Online Marketplaces for Handcrafted and Vintage Merchandise

Online marketplaces for handcrafted merchandise sell unique goods that are not manufactured by large-scale factories; rather, they are made by individuals or microbusinesses. Some of these platforms also sell vintage merchandise, which must be older than 20 years and owned by the seller. These marketplaces have emerged amid a wider set of trends in developed markets, including structural changes in the labor market—such as a reduction in manufacturing jobs and an increase in self- and part-time employment—and changing consumer tastes, hallmarked by the rising prominence of the arts and crafts and maker movements and thrift shopping.

The first part of this report provides an overview of handcrafted and vintage goods online businesses and the current market landscape. The second part of the report examines the business models of these platforms, with a focus on Etsy and how it compares with the larger e-commerce platforms, eBay and Amazon, and Amazon’s own handcrafted goods marketplace, Handmade at Amazon.

HANDCRAFTED GOODS: MARKET LANDSCAPE

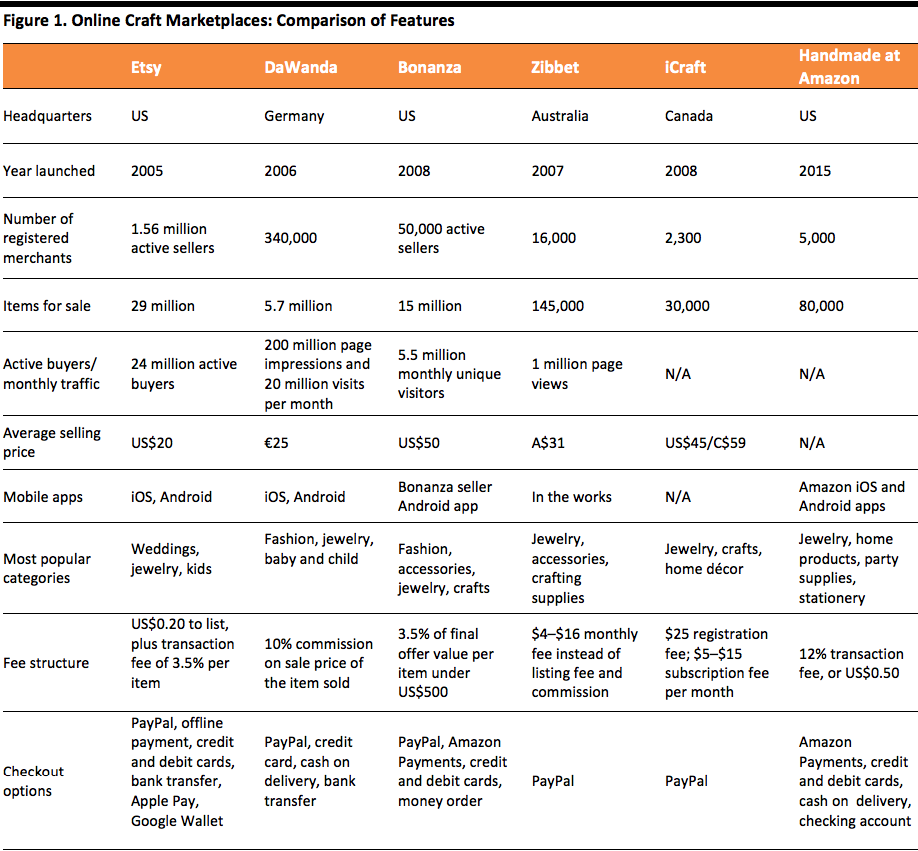

While the more established online marketplaces, eBay and Amazon, were founded in the 1990s, the archetypical online craft marketplace, Etsy, did not appear until 2005. With gross merchandise sales of $2.39 billion, an active seller count of 1.56 million and 24 million active buyers, the company completed an initial public offering in 2015. Etsy’s success in growing its business over the past decade has spurred other players to enter the online market for handmade goods, including e-commerce giant Amazon, which launched Handmade at Amazon in 2015.

[caption id="attachment_86905" align="aligncenter" width="720"]

Source: Forbes

Source: Forbes[/caption]

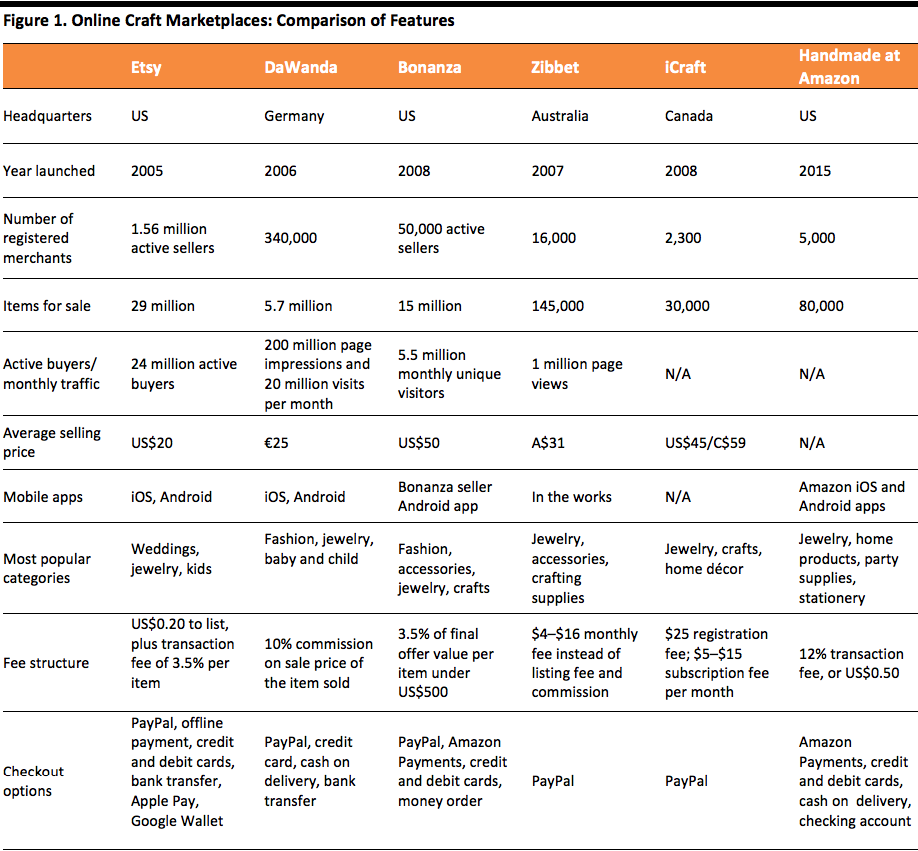

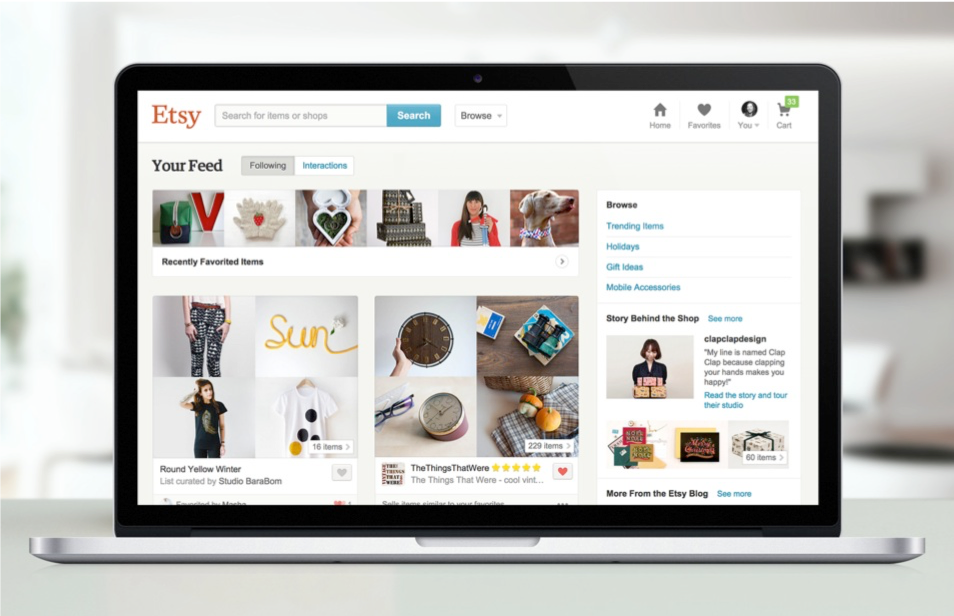

[caption id="attachment_86906" align="aligncenter" width="720"]

Source: Etsy/DaWanda/Bonanza/Zibbet/iCraft/Amazon/PCWorld/WhereToSellOnline

Source: Etsy/DaWanda/Bonanza/Zibbet/iCraft/Amazon/PCWorld/WhereToSellOnline[/caption]

Lower prices are one factor attracting buyers to the handmade goods platforms. In general, the prices of goods sold on Etsy are lower than those of similar products sold on retailers’ online outlets (such as department store websites). Low overhead costs for sellers allow them to charge less for their creations. The equation results in value being passed directly to the consumer, although it is important to note that these handmade goods marketplaces operate solely online and bear no manufacturing or distribution costs related to the items sold.

Who Sells on Etsy?

As niche markets, online craft and vintage marketplaces look small compared to eBay and Amazon, but they provide valuable distribution platforms for self-employed microbusiness entrepreneurs, much like eBay enables the existence of self-employed eBay merchants who source goods to sell on that platform. Handcrafted goods marketplaces have also built communities as a core part of their business model. This differs from conventional business models, but aligns with emerging consumer trends such as social shopping and supporting socially driven enterprises.

Typical sellers on Etsy include self-employed jewelry and furniture makers, artists and designers. Etsy’s figures showed that in 2014, 51% of its sellers were independent workers, 36% had full-time employment and 11% were unemployed. Among Etsy sellers that year, 86% were women, 95% were running their online shops from home and 79% had started their online shop as a creative outlet.

A 2014 study on Etsy users in the UK by the Royal Society for the Encouragement of Arts, Manufactures and Commerce (RSA) also found that many sellers were running their online business on a part-time basis, as an extra source of income, and that the sellers tended to be female and young, with little capital to start their online shops. The RSA study identified the following patterns among Etsy sellers in the UK:

- 65% were doing business on Etsy part-time; only 20% were full-time.

- 22% were employed in a full-time job on top of their Etsy business; 15% were in a part-time job and 15% were at home looking after dependents.

- 31% used their earnings from the online business to cover household expenses, while 26% used the income to buy things they otherwise would not.

- 91% of the sellers were female.

- 40% required no funding to get their business started.

Etsy’s published statistics and the RSA survey both indicate that a large number of sellers on the platform are female and working part-time. We project that sellers with a similar profile are likely active on the other handcrafted goods platforms. This is noteworthy because platforms like Etsy have essentially brought a new type of merchant to the market, thereby disrupting traditional online retail and creating more competition for the consumer’s share of wallet.

What is Being Sold on Etsy?

According to Etsy’s policy, three types of goods can be sold on the platform: handmade, vintage and craft supplies. Handmade items refer to items made or designed by the seller. Vintage items must be at least 20 years old. Craft supplies refer to tools or materials to be used in the creation of a new handmade item, and commercially produced materials ready for use as finished goods cannot be sold as craft supplies. Etsy also states in its policy that it does not allow reselling, which means selling an item in the handmade category when the seller was not involved in the creation process.

A number of drivers have facilitated the growth of online craft marketplaces: a self-employment boom in developed economies over the past decade; new technology that has enabled easier online content creation and facilitated interaction via social media; the growing popularity of custom-made goods; thrift shopping; and the values of the “sharing economy,” which have helped enhance loyalty among sellers and buyers.

The Self-Employment Boom

The number of microbusinesses run by self-employed, part-time workers and the number of online platforms they rely on have both increased in conjunction with the economic downturn in developed economies, especially since 2008. A 2012 Pew Research Center survey of middle-class households in the US found that 85% of respondents claimed it was more difficult to maintain their living standard than it had been 10 years earlier, and more people said they were supplementing their incomes and supporting their families by becoming freelancers. A study commissioned by Freelancers Union and Elance-oDesk in 2014 estimated that 53 million Americans, or 34% of the US workforce, were working as freelancers, and that freelancers added $715 billion to the US economy every year. The study also found that millennials (workers under age 35) have been a source of growth in the freelancer cohort in the US, with 38% of millennials freelancing, and 62% of them saying they were more likely to look for work that has “a positive impact on the world” or is “exciting.”

[caption id="attachment_86908" align="aligncenter" width="720"]

Source: etsy

Source: etsy[/caption]

A similar trend has been seen in the UK. UK government figures show that the number of firms with fewer than 10 employees increased by 40% between 2000 and 2014, while the number of people working for themselves increased by 30% in the same period.

The Labour Force Survey, conducted by the UK Office for National Statistics, found that, between 2000 and 2013, there was a much bigger increase in part-time self-employment than in full-time self-employment. The number of people working for themselves for less than 30 hours a week grew by over 60% during the period, whereas the number of self-employed full-time workers grew by only about 20%.

In addition, the number of self-made handcrafts businesses has risen in conjunction with a reduction in manufacturing jobs in both the US and the UK over the past decade. In the US, there were 14.3 million manufacturing jobs in 2004; the number fell to 12.2 million in 2014. In the UK, manufacturing employment fell from around 4 million in the fourth quarter of 2000 to around 3 million in the fourth quarter of 2015.

The economic downturn in the developed world also led to increase in thrift shopping, which underpinned the supply and demand of vintage items sold online. The Association of Resale Professionals (NARTS), a trade association of resale stores in the US, said the resale industry in the US thrived during the economic downturn. Its members had reported significant increase in sales as consumers looked for more value for money and became more interested in secondhand goods sold at low prices. Incoming inventory of secondhand goods also increased significantly as people looked for extra sources of income, according to NARTS. Its operating survey shows strong growth in resale for the five years between 2010 and 2014. Net sales increased by 5% in 2014 over 2013, compared to the 3.7% growth in overall retail sales in the US in 2014.

Lower Barriers to Entry and Increased Demand for Custom-Made Goods

New technology that enables easier content creation on the Internet and facilitates interaction via social media has helped online handmade goods platforms proliferate, as has the growing popularity of custom-made goods. Online platforms have reduced the risks inherent to starting a business and have provided entrepreneurs with a channel through which they can try their ideas without the need for a substantial investment up front. The 2014 RSA study found that 36% of the sellers surveyed said they would not have been able to start their business were it not for a platform like Etsy.

[caption id="attachment_86909" align="aligncenter" width="720"]

Source: etsy

Source: etsy[/caption]

Technology has also allowed customers to provide immediate feedback that can be seen by other customers and to share their comments on products more easily. One-third of UK Etsy sellers surveyed by the RSA said that buyers had helped them by suggesting ideas for new products, and 72% said buyers had helped them by spreading the word about their goods.

Demand for customized products has also benefited online craft marketplaces. Customers have become more actively involved in the production process, and 71% of Etsy sellers surveyed in the UK said that providing customized products is an important part of their business.

The Sharing Economy

Online craft marketplaces are a part of the sharing economy. Chad Dickerson, CEO of Etsy, said in the company’s IPO prospectus that Etsy’s mission is to “reimagine commerce in ways that build a more fulfilling and lasting world.” Dickerson said the “Etsy Economy” is characterized by values that differ from conventional ways of making, selling and buying goods:

- It relies on a people-centered, humane business model. Artisans can preserve the spirit of craftsmanship, emphasizing the person behind the products and transactions.

- Authenticity is important. The handmade nature of the goods sold on Etsy ensures they are unique, something that mass production cannot provide. Intellectual property rights are important.

- Business should be fun. Profit generation is not the only purpose of a business; passion, personal fulfillment and sense of purpose are also important. Many Etsy sellers sell arts and crafts as a creative outlet.

- Building community and connection through business is key. Sellers on the platform help each other, providing emotional support and building friendships.

By upholding these values, Etsy earned B Corp certification, which is an assessment of for-profit companies meeting standards of social and environmental performance, accountability and transparency. These values are one way that Etsy differentiates itself from competitors such as Handmade at Amazon.

Online craft marketplaces also represent a new mode of doing business, according to the RSA report:

- Sellers emphasize creating experiences for buyers, which can be enhanced through interaction via social media.

- Through the global reach enabled by the Internet, highly niche products can reach a critical mass of buyers.

- Custom-made products foster a lean business model, and encourage business owners to adhere to a “just in time” model of production, which helps keep costs low.

Etsy launched a pilot crowdfunding program called Fund on Etsy in the US in 2015. It allows sellers to raise the funds they need to create new products from buyers; the program allows buyers to become investors in the new products. By creating this program, Etsy not only brought sellers more financial support, but also blurred the boundary between consumers and investors.

HANDCRAFTED GOODS: MARKET POTENTIAL

Online platforms for handcrafted goods depend on growth in both online retail and demand for crafted and vintage items. Euromonitor International estimates that the global Internet retail market was worth $990.6 billion in 2015, and that it will grow to $1.5 trillion by 2018. In the US, growth rates for e-commerce continue to outpace those of physical retail in general, and by 2020, e-commerce is forecast to account for 14.8% of total US retail sales, up from 9.1% in 2015.

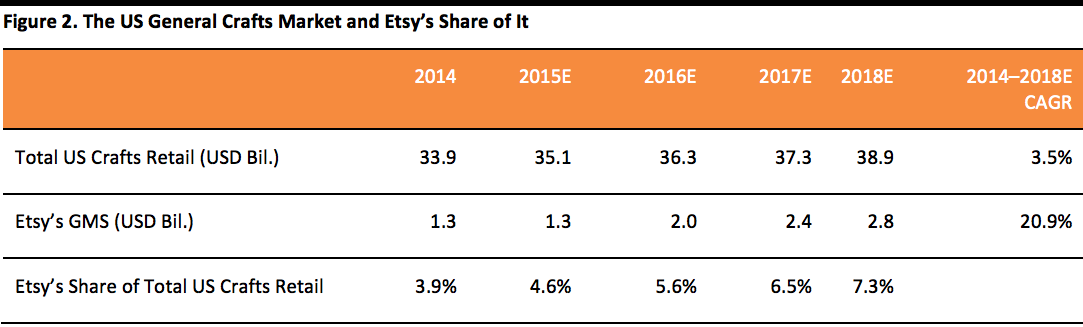

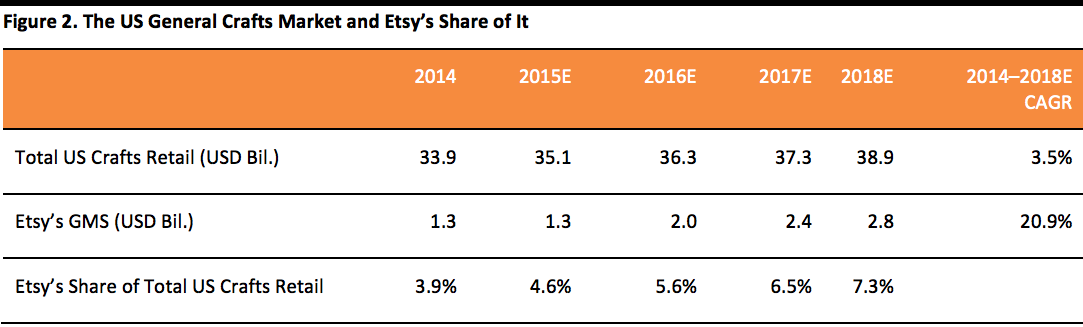

Currently, online sales of handmade goods account for only a small portion of total online retailing. However, as economies undergo structural changes and shift toward more self-employment, handmade goods’ share of online sales may increase. Morgan Stanley noted that about $34 billion was spent on general crafts, fine arts, jewelry and bead crafts in the US in 2014, and that Etsy’s US general merchandise sales in the same year made up only 3.9% of this addressable market. That means there is plenty of room for online craft marketplaces to grow their sales if they can convince more craftspeople to use their platforms. According to Morgan Stanley, Etsy’s share of the addressable market will reach 7.3% by 2018.

[caption id="attachment_86910" align="aligncenter" width="718"]

Source: forbes

Source: forbes[/caption]

[caption id="attachment_86911" align="aligncenter" width="720"]

Source: Craft & Hobby Association/Morgan Stanley

Source: Craft & Hobby Association/Morgan Stanley[/caption]

HANDCRAFTED GOODS: CHALLENGES

While there is plenty of room for future growth, online craft marketplaces and the artisans selling on them face a number of challenges:

- Strict handmade and vintage requirements have made it difficult for online businesses to scale up.

- The category is maturing and there is more competition from new entrants, such as Handmade at Amazon.

- As more sellers join these marketplaces, it takes more time and effort for shops to get noticed by customers.

- There is increasing competition between sellers who list similar items.

- Sellers who list counterfeit merchandise must be controlled.

As the front-runner in the space, Etsy launched a new program called Etsy Manufacturing in 2015 that allows sellers to use approved manufacturers. The idea is to help sellers scale up their businesses and to broaden the range of categories sold on the platform. However, this move has created some backlash, as the manufacturing program risks alienating some of Etsy’s artisan sellers who produce strictly handmade goods. Finding the right balance will be both a challenge and necessity for Etsy.

To mitigate the effect of increasing competition, Etsy is working to build a sustainable competitive advantage for its member community. For example, it aims to create an environment where sellers collaborate and support each other by referring customers to other sellers, so that their relationship is not purely competitive.

Finally, Etsy and similar platforms need to address the issue of sellers listing counterfeit merchandise. It was widely reported that Etsy’s stock was downgraded on fears related to litigation resulting from the sale of counterfeit items in 2015, and some analysts estimate that as much as 5% of listed items fall in the counterfeit category. That being said, other businesses, such as eBay, have gone through similar challenges in the past, and we believe handcrafted goods platforms will be able to successfully fight counterfeiting by dedicating more resources to vetting and monitoring listed items.

ETSY VS. AMAZON VS. EBAY

Conventional online marketplaces such as eBay and Amazon sell a wide range of products, most of them mass-produced. In contrast, online craft marketplaces such as Etsy position themselves as alternative marketplaces devoted to the sale of handmade and vintage items, and they usually require that the products sold on them be designed and made by the artisan sellers themselves.

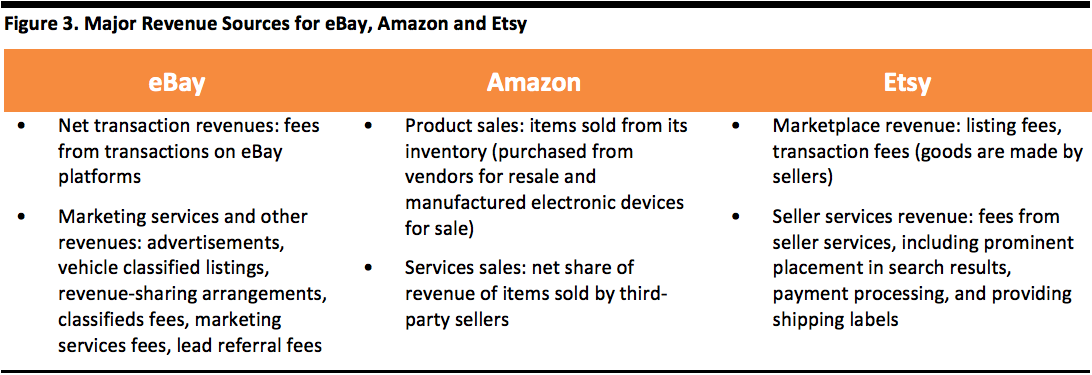

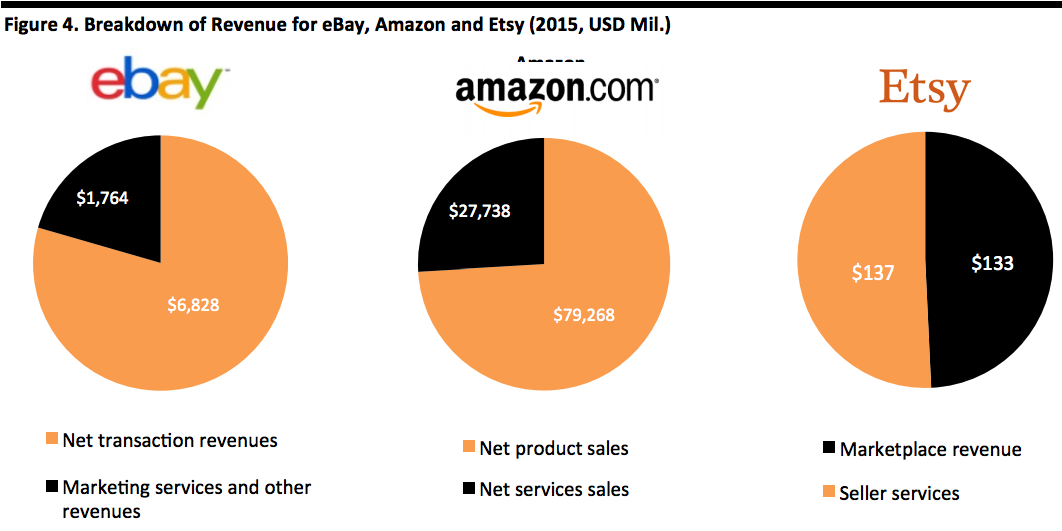

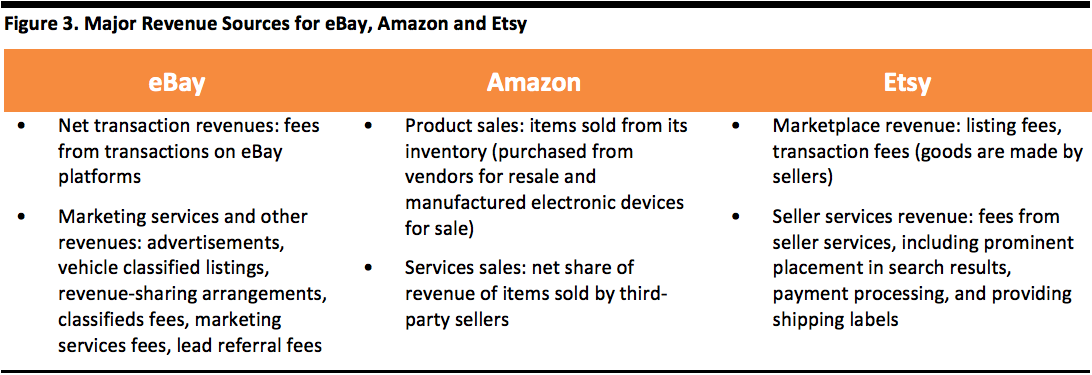

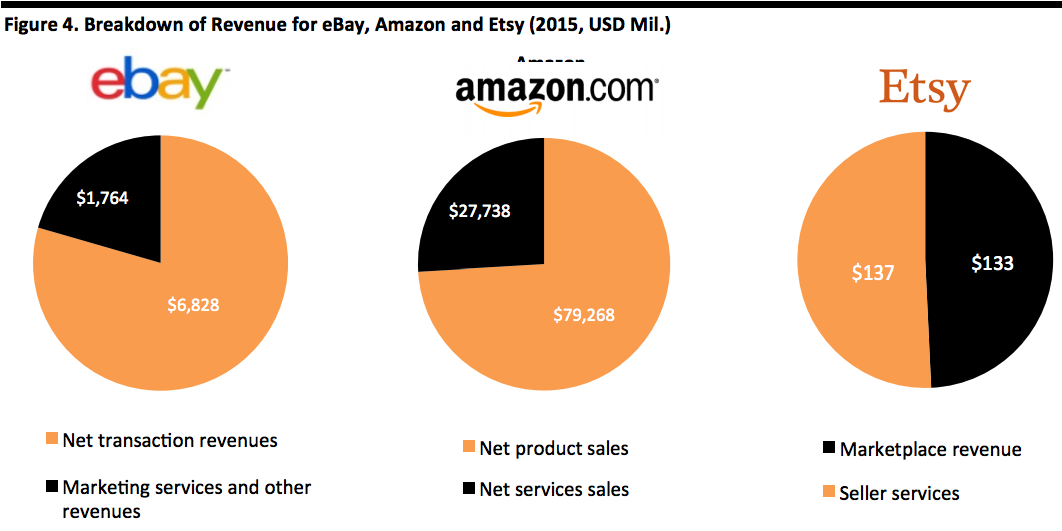

While the sources of revenue are similar among online platforms, Etsy’s revenue is noticeably lower than Amazon’s and eBay’s, as handcrafted goods are a niche product category. However, Etsy has leveraged the scalability of a platform business model to grow quickly and become the major player in its market niche. In addition, when compared to the bigger e-commerce platforms, Etsy is generating a disproportionate amount of revenue through its seller services offering The company’s seller services revenue grew by 65.6% year over year in 2015, showing much higher growth momentum than its marketplace revenue, which grew by 22% in the same year. Seller services revenue also surpassed marketplace revenue to become the company’s biggest revenue contributor in 2015.

[caption id="attachment_86912" align="aligncenter" width="720"]

Source: eBay/Amazon/Etsy

Source: eBay/Amazon/Etsy[/caption]

[caption id="attachment_86913" align="aligncenter" width="720"]

Source: eBay/Amazon/Etsy

Source: eBay/Amazon/Etsy[/caption]

ETSY VS. HANDMADE AT AMAZON

When Amazon launched its handmade goods platform in 2015, it was seen as a big threat to Etsy. But a comparison of the two platforms shows a number of differences in terms of purpose, strategy and execution.

Handmade at Amazon and Etsy define “handmade” in different ways, and Amazon has a stricter definition. On Etsy, everything listed as handmade must be made or designed by the seller. Sellers may hire employees to help run the business or use outside help to assist in making the designs, but if they do, they have to disclose it. Outside help must be approved through Etsy’s outside-manufacturing-review process. But Handmade at Amazon requires that all products sold be made entirely by hand, hand altered or hand assembled (not from a kit). Products must be handmade by the artisan, by a company with 20 or fewer employees or by a collective with fewer than 100 people.

Handmade at Amazon also has a different fee scale. It charges no listing fee, but charges a transaction fee of 12% of the item price or $0.50, whichever is higher. This fee includes payment processing and access to discounted shipping and Amazon’s Sponsored Products service. In addition, Handmade at Amazon sellers must have a Professional Seller account and may have to pay a monthly fee of $39.99 under some circumstances.

[caption id="attachment_86914" align="aligncenter" width="720"]

Source: geekwire

Source: geekwire[/caption]

Shortly after Handmade at Amazon was launched in 2015, it listed 80,000 items from 5,000 sellers. By comparison, Etsy had 29 million listed items in 2014. Over 70% of Amazon’s revenue comes from sales of items from its inventory (product sales), so its handmade marketplace is not the company’s major source of income. It launched Handmade at Amazon to attract buyers interested in handmade crafts and custom-made products in order to drive traffic. It remains to be seen whether Amazon can build an online community of artisans with strong loyalty, and we think it has a different purpose than Etsy. Since qualified artisans can sell on Etsy and Handmade at Amazon at the same time, and since Amazon has stricter rules regarding the handmade qualification, it is unlikely that many sellers will be diverted from Etsy. But buyers may switch to Handmade at Amazon if they find that prices are lower there.

CONCLUSION

Growing demand for personalized and custom-made goods, new technologies and increasing numbers of self-employed workers in the developed economies have fostered growth of online craft marketplaces over the past decade. Though a number of such platforms have been established in the developed economies—particularly in North America and Europe— the market is currently underdeveloped in Asia. Also, in the US, online craft marketplaces currently make up only a small portion of the total general crafts market. Accordingly, there is much room for further growth in the sector, both in the US and across the globe.

Source: Forbes[/caption]

[caption id="attachment_86906" align="aligncenter" width="720"]

Source: Forbes[/caption]

[caption id="attachment_86906" align="aligncenter" width="720"] Source: Etsy/DaWanda/Bonanza/Zibbet/iCraft/Amazon/PCWorld/WhereToSellOnline[/caption]

Lower prices are one factor attracting buyers to the handmade goods platforms. In general, the prices of goods sold on Etsy are lower than those of similar products sold on retailers’ online outlets (such as department store websites). Low overhead costs for sellers allow them to charge less for their creations. The equation results in value being passed directly to the consumer, although it is important to note that these handmade goods marketplaces operate solely online and bear no manufacturing or distribution costs related to the items sold.

Who Sells on Etsy?

As niche markets, online craft and vintage marketplaces look small compared to eBay and Amazon, but they provide valuable distribution platforms for self-employed microbusiness entrepreneurs, much like eBay enables the existence of self-employed eBay merchants who source goods to sell on that platform. Handcrafted goods marketplaces have also built communities as a core part of their business model. This differs from conventional business models, but aligns with emerging consumer trends such as social shopping and supporting socially driven enterprises.

Typical sellers on Etsy include self-employed jewelry and furniture makers, artists and designers. Etsy’s figures showed that in 2014, 51% of its sellers were independent workers, 36% had full-time employment and 11% were unemployed. Among Etsy sellers that year, 86% were women, 95% were running their online shops from home and 79% had started their online shop as a creative outlet.

A 2014 study on Etsy users in the UK by the Royal Society for the Encouragement of Arts, Manufactures and Commerce (RSA) also found that many sellers were running their online business on a part-time basis, as an extra source of income, and that the sellers tended to be female and young, with little capital to start their online shops. The RSA study identified the following patterns among Etsy sellers in the UK:

Source: Etsy/DaWanda/Bonanza/Zibbet/iCraft/Amazon/PCWorld/WhereToSellOnline[/caption]

Lower prices are one factor attracting buyers to the handmade goods platforms. In general, the prices of goods sold on Etsy are lower than those of similar products sold on retailers’ online outlets (such as department store websites). Low overhead costs for sellers allow them to charge less for their creations. The equation results in value being passed directly to the consumer, although it is important to note that these handmade goods marketplaces operate solely online and bear no manufacturing or distribution costs related to the items sold.

Who Sells on Etsy?

As niche markets, online craft and vintage marketplaces look small compared to eBay and Amazon, but they provide valuable distribution platforms for self-employed microbusiness entrepreneurs, much like eBay enables the existence of self-employed eBay merchants who source goods to sell on that platform. Handcrafted goods marketplaces have also built communities as a core part of their business model. This differs from conventional business models, but aligns with emerging consumer trends such as social shopping and supporting socially driven enterprises.

Typical sellers on Etsy include self-employed jewelry and furniture makers, artists and designers. Etsy’s figures showed that in 2014, 51% of its sellers were independent workers, 36% had full-time employment and 11% were unemployed. Among Etsy sellers that year, 86% were women, 95% were running their online shops from home and 79% had started their online shop as a creative outlet.

A 2014 study on Etsy users in the UK by the Royal Society for the Encouragement of Arts, Manufactures and Commerce (RSA) also found that many sellers were running their online business on a part-time basis, as an extra source of income, and that the sellers tended to be female and young, with little capital to start their online shops. The RSA study identified the following patterns among Etsy sellers in the UK:

A number of drivers have facilitated the growth of online craft marketplaces: a self-employment boom in developed economies over the past decade; new technology that has enabled easier online content creation and facilitated interaction via social media; the growing popularity of custom-made goods; thrift shopping; and the values of the “sharing economy,” which have helped enhance loyalty among sellers and buyers.

The Self-Employment Boom

The number of microbusinesses run by self-employed, part-time workers and the number of online platforms they rely on have both increased in conjunction with the economic downturn in developed economies, especially since 2008. A 2012 Pew Research Center survey of middle-class households in the US found that 85% of respondents claimed it was more difficult to maintain their living standard than it had been 10 years earlier, and more people said they were supplementing their incomes and supporting their families by becoming freelancers. A study commissioned by Freelancers Union and Elance-oDesk in 2014 estimated that 53 million Americans, or 34% of the US workforce, were working as freelancers, and that freelancers added $715 billion to the US economy every year. The study also found that millennials (workers under age 35) have been a source of growth in the freelancer cohort in the US, with 38% of millennials freelancing, and 62% of them saying they were more likely to look for work that has “a positive impact on the world” or is “exciting.”

[caption id="attachment_86908" align="aligncenter" width="720"]

A number of drivers have facilitated the growth of online craft marketplaces: a self-employment boom in developed economies over the past decade; new technology that has enabled easier online content creation and facilitated interaction via social media; the growing popularity of custom-made goods; thrift shopping; and the values of the “sharing economy,” which have helped enhance loyalty among sellers and buyers.

The Self-Employment Boom

The number of microbusinesses run by self-employed, part-time workers and the number of online platforms they rely on have both increased in conjunction with the economic downturn in developed economies, especially since 2008. A 2012 Pew Research Center survey of middle-class households in the US found that 85% of respondents claimed it was more difficult to maintain their living standard than it had been 10 years earlier, and more people said they were supplementing their incomes and supporting their families by becoming freelancers. A study commissioned by Freelancers Union and Elance-oDesk in 2014 estimated that 53 million Americans, or 34% of the US workforce, were working as freelancers, and that freelancers added $715 billion to the US economy every year. The study also found that millennials (workers under age 35) have been a source of growth in the freelancer cohort in the US, with 38% of millennials freelancing, and 62% of them saying they were more likely to look for work that has “a positive impact on the world” or is “exciting.”

[caption id="attachment_86908" align="aligncenter" width="720"] Source: etsy[/caption]

A similar trend has been seen in the UK. UK government figures show that the number of firms with fewer than 10 employees increased by 40% between 2000 and 2014, while the number of people working for themselves increased by 30% in the same period. The Labour Force Survey, conducted by the UK Office for National Statistics, found that, between 2000 and 2013, there was a much bigger increase in part-time self-employment than in full-time self-employment. The number of people working for themselves for less than 30 hours a week grew by over 60% during the period, whereas the number of self-employed full-time workers grew by only about 20%.

In addition, the number of self-made handcrafts businesses has risen in conjunction with a reduction in manufacturing jobs in both the US and the UK over the past decade. In the US, there were 14.3 million manufacturing jobs in 2004; the number fell to 12.2 million in 2014. In the UK, manufacturing employment fell from around 4 million in the fourth quarter of 2000 to around 3 million in the fourth quarter of 2015.

The economic downturn in the developed world also led to increase in thrift shopping, which underpinned the supply and demand of vintage items sold online. The Association of Resale Professionals (NARTS), a trade association of resale stores in the US, said the resale industry in the US thrived during the economic downturn. Its members had reported significant increase in sales as consumers looked for more value for money and became more interested in secondhand goods sold at low prices. Incoming inventory of secondhand goods also increased significantly as people looked for extra sources of income, according to NARTS. Its operating survey shows strong growth in resale for the five years between 2010 and 2014. Net sales increased by 5% in 2014 over 2013, compared to the 3.7% growth in overall retail sales in the US in 2014.

Lower Barriers to Entry and Increased Demand for Custom-Made Goods

New technology that enables easier content creation on the Internet and facilitates interaction via social media has helped online handmade goods platforms proliferate, as has the growing popularity of custom-made goods. Online platforms have reduced the risks inherent to starting a business and have provided entrepreneurs with a channel through which they can try their ideas without the need for a substantial investment up front. The 2014 RSA study found that 36% of the sellers surveyed said they would not have been able to start their business were it not for a platform like Etsy.

[caption id="attachment_86909" align="aligncenter" width="720"]

Source: etsy[/caption]

A similar trend has been seen in the UK. UK government figures show that the number of firms with fewer than 10 employees increased by 40% between 2000 and 2014, while the number of people working for themselves increased by 30% in the same period. The Labour Force Survey, conducted by the UK Office for National Statistics, found that, between 2000 and 2013, there was a much bigger increase in part-time self-employment than in full-time self-employment. The number of people working for themselves for less than 30 hours a week grew by over 60% during the period, whereas the number of self-employed full-time workers grew by only about 20%.

In addition, the number of self-made handcrafts businesses has risen in conjunction with a reduction in manufacturing jobs in both the US and the UK over the past decade. In the US, there were 14.3 million manufacturing jobs in 2004; the number fell to 12.2 million in 2014. In the UK, manufacturing employment fell from around 4 million in the fourth quarter of 2000 to around 3 million in the fourth quarter of 2015.

The economic downturn in the developed world also led to increase in thrift shopping, which underpinned the supply and demand of vintage items sold online. The Association of Resale Professionals (NARTS), a trade association of resale stores in the US, said the resale industry in the US thrived during the economic downturn. Its members had reported significant increase in sales as consumers looked for more value for money and became more interested in secondhand goods sold at low prices. Incoming inventory of secondhand goods also increased significantly as people looked for extra sources of income, according to NARTS. Its operating survey shows strong growth in resale for the five years between 2010 and 2014. Net sales increased by 5% in 2014 over 2013, compared to the 3.7% growth in overall retail sales in the US in 2014.

Lower Barriers to Entry and Increased Demand for Custom-Made Goods

New technology that enables easier content creation on the Internet and facilitates interaction via social media has helped online handmade goods platforms proliferate, as has the growing popularity of custom-made goods. Online platforms have reduced the risks inherent to starting a business and have provided entrepreneurs with a channel through which they can try their ideas without the need for a substantial investment up front. The 2014 RSA study found that 36% of the sellers surveyed said they would not have been able to start their business were it not for a platform like Etsy.

[caption id="attachment_86909" align="aligncenter" width="720"] Source: etsy[/caption]

Technology has also allowed customers to provide immediate feedback that can be seen by other customers and to share their comments on products more easily. One-third of UK Etsy sellers surveyed by the RSA said that buyers had helped them by suggesting ideas for new products, and 72% said buyers had helped them by spreading the word about their goods.

Demand for customized products has also benefited online craft marketplaces. Customers have become more actively involved in the production process, and 71% of Etsy sellers surveyed in the UK said that providing customized products is an important part of their business.

The Sharing Economy

Online craft marketplaces are a part of the sharing economy. Chad Dickerson, CEO of Etsy, said in the company’s IPO prospectus that Etsy’s mission is to “reimagine commerce in ways that build a more fulfilling and lasting world.” Dickerson said the “Etsy Economy” is characterized by values that differ from conventional ways of making, selling and buying goods:

Source: etsy[/caption]

Technology has also allowed customers to provide immediate feedback that can be seen by other customers and to share their comments on products more easily. One-third of UK Etsy sellers surveyed by the RSA said that buyers had helped them by suggesting ideas for new products, and 72% said buyers had helped them by spreading the word about their goods.

Demand for customized products has also benefited online craft marketplaces. Customers have become more actively involved in the production process, and 71% of Etsy sellers surveyed in the UK said that providing customized products is an important part of their business.

The Sharing Economy

Online craft marketplaces are a part of the sharing economy. Chad Dickerson, CEO of Etsy, said in the company’s IPO prospectus that Etsy’s mission is to “reimagine commerce in ways that build a more fulfilling and lasting world.” Dickerson said the “Etsy Economy” is characterized by values that differ from conventional ways of making, selling and buying goods:

Source: forbes[/caption]

[caption id="attachment_86911" align="aligncenter" width="720"]

Source: forbes[/caption]

[caption id="attachment_86911" align="aligncenter" width="720"] Source: Craft & Hobby Association/Morgan Stanley[/caption]

HANDCRAFTED GOODS: CHALLENGES

While there is plenty of room for future growth, online craft marketplaces and the artisans selling on them face a number of challenges:

Source: Craft & Hobby Association/Morgan Stanley[/caption]

HANDCRAFTED GOODS: CHALLENGES

While there is plenty of room for future growth, online craft marketplaces and the artisans selling on them face a number of challenges:

Source: eBay/Amazon/Etsy[/caption]

[caption id="attachment_86913" align="aligncenter" width="720"]

Source: eBay/Amazon/Etsy[/caption]

[caption id="attachment_86913" align="aligncenter" width="720"] Source: eBay/Amazon/Etsy[/caption]

ETSY VS. HANDMADE AT AMAZON

When Amazon launched its handmade goods platform in 2015, it was seen as a big threat to Etsy. But a comparison of the two platforms shows a number of differences in terms of purpose, strategy and execution.

Handmade at Amazon and Etsy define “handmade” in different ways, and Amazon has a stricter definition. On Etsy, everything listed as handmade must be made or designed by the seller. Sellers may hire employees to help run the business or use outside help to assist in making the designs, but if they do, they have to disclose it. Outside help must be approved through Etsy’s outside-manufacturing-review process. But Handmade at Amazon requires that all products sold be made entirely by hand, hand altered or hand assembled (not from a kit). Products must be handmade by the artisan, by a company with 20 or fewer employees or by a collective with fewer than 100 people.

Handmade at Amazon also has a different fee scale. It charges no listing fee, but charges a transaction fee of 12% of the item price or $0.50, whichever is higher. This fee includes payment processing and access to discounted shipping and Amazon’s Sponsored Products service. In addition, Handmade at Amazon sellers must have a Professional Seller account and may have to pay a monthly fee of $39.99 under some circumstances.

[caption id="attachment_86914" align="aligncenter" width="720"]

Source: eBay/Amazon/Etsy[/caption]

ETSY VS. HANDMADE AT AMAZON

When Amazon launched its handmade goods platform in 2015, it was seen as a big threat to Etsy. But a comparison of the two platforms shows a number of differences in terms of purpose, strategy and execution.

Handmade at Amazon and Etsy define “handmade” in different ways, and Amazon has a stricter definition. On Etsy, everything listed as handmade must be made or designed by the seller. Sellers may hire employees to help run the business or use outside help to assist in making the designs, but if they do, they have to disclose it. Outside help must be approved through Etsy’s outside-manufacturing-review process. But Handmade at Amazon requires that all products sold be made entirely by hand, hand altered or hand assembled (not from a kit). Products must be handmade by the artisan, by a company with 20 or fewer employees or by a collective with fewer than 100 people.

Handmade at Amazon also has a different fee scale. It charges no listing fee, but charges a transaction fee of 12% of the item price or $0.50, whichever is higher. This fee includes payment processing and access to discounted shipping and Amazon’s Sponsored Products service. In addition, Handmade at Amazon sellers must have a Professional Seller account and may have to pay a monthly fee of $39.99 under some circumstances.

[caption id="attachment_86914" align="aligncenter" width="720"] Source: geekwire[/caption]

Shortly after Handmade at Amazon was launched in 2015, it listed 80,000 items from 5,000 sellers. By comparison, Etsy had 29 million listed items in 2014. Over 70% of Amazon’s revenue comes from sales of items from its inventory (product sales), so its handmade marketplace is not the company’s major source of income. It launched Handmade at Amazon to attract buyers interested in handmade crafts and custom-made products in order to drive traffic. It remains to be seen whether Amazon can build an online community of artisans with strong loyalty, and we think it has a different purpose than Etsy. Since qualified artisans can sell on Etsy and Handmade at Amazon at the same time, and since Amazon has stricter rules regarding the handmade qualification, it is unlikely that many sellers will be diverted from Etsy. But buyers may switch to Handmade at Amazon if they find that prices are lower there.

CONCLUSION

Growing demand for personalized and custom-made goods, new technologies and increasing numbers of self-employed workers in the developed economies have fostered growth of online craft marketplaces over the past decade. Though a number of such platforms have been established in the developed economies—particularly in North America and Europe— the market is currently underdeveloped in Asia. Also, in the US, online craft marketplaces currently make up only a small portion of the total general crafts market. Accordingly, there is much room for further growth in the sector, both in the US and across the globe.

Source: geekwire[/caption]

Shortly after Handmade at Amazon was launched in 2015, it listed 80,000 items from 5,000 sellers. By comparison, Etsy had 29 million listed items in 2014. Over 70% of Amazon’s revenue comes from sales of items from its inventory (product sales), so its handmade marketplace is not the company’s major source of income. It launched Handmade at Amazon to attract buyers interested in handmade crafts and custom-made products in order to drive traffic. It remains to be seen whether Amazon can build an online community of artisans with strong loyalty, and we think it has a different purpose than Etsy. Since qualified artisans can sell on Etsy and Handmade at Amazon at the same time, and since Amazon has stricter rules regarding the handmade qualification, it is unlikely that many sellers will be diverted from Etsy. But buyers may switch to Handmade at Amazon if they find that prices are lower there.

CONCLUSION

Growing demand for personalized and custom-made goods, new technologies and increasing numbers of self-employed workers in the developed economies have fostered growth of online craft marketplaces over the past decade. Though a number of such platforms have been established in the developed economies—particularly in North America and Europe— the market is currently underdeveloped in Asia. Also, in the US, online craft marketplaces currently make up only a small portion of the total general crafts market. Accordingly, there is much room for further growth in the sector, both in the US and across the globe.