Web Developers

EXECUTIVE SUMMARY

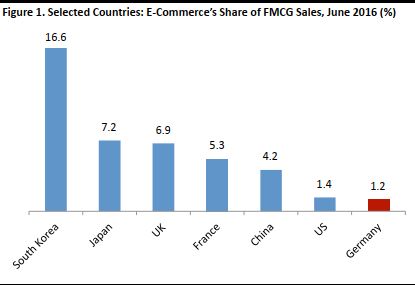

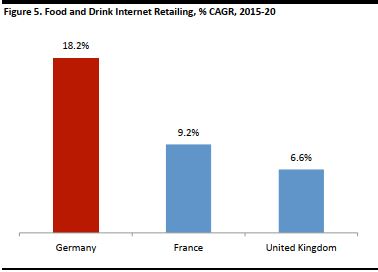

Germany lags other markets in grocery e-commerce despite having one of the largest grocery sectors in Europe as well as an advanced nonfood e-commerce market. Online sales accounted for only 1.2% of total grocery sales in Germany as of June 2016, according to Kantar Worldpanel, much lower than in France and the UK. The strong presence of discounters in the market, which traditionally do not sell online, the high density of smaller food stores and the reluctance of German shoppers to pay by credit card are the main factors that have slowed down the development of grocery e-commerce in Germany. Despite the relative inactivity of the main German grocery retailers in e-commerce in the past few years, the number of shoppers buying groceries online is increasing. According to a survey conducted by research institution IfD Allensbach, the number of people that purchased food or beverage online in Germany increased by 1.2 million over 2013 through 2015. According to a survey by research firm Fittkau & Maaß, German consumers tend to be infrequent online grocery shoppers; they usually buy items that are difficult to find in brick-and-mortar stores locally and when they do buy online, they tend to buy mainly from Amazon and US-based marketplace eBay. In other words, German consumers do not undertake the same kind of big-basket shops that typically drive in-store shopping. Amazon is expanding rapidly into grocery e-commerce in Germany. At the end of 2015, the pure player launched Amazon Pantry, and, while it has yet to be confirmed by the company, many industry observers expect a launch of AmazonFresh in the near future. The Amazon threat is forcing domestic players to respond rapidly with their own e-commerce initiatives. Major domestic brick-and-mortar grocery retailers have started expanding into the online realm. In most cases, the initiatives are very recent and motivated by the need to play catch-up with Amazon and German grocery competitors. As a result of the recent dynamism in the market, grocery e-commerce in Germany is expected to grow much faster than that of the more mature markets in neighboring countries. Euromonitor International expects online sales of food and drink in Germany to grow at a compound annual growth rate (CAGR) of 18.2% between 2015 and 2020. This compares with the single-digit growth rates in France and the UK. [caption id="attachment_90489" align="aligncenter" width="411"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

INTRODUCTION

This is the fourth report in our Online Grocery series. Previous reports, covering the UK, the US and France, can be found on FungGlobalRetailTech.com. Germany lags other markets in grocery e-commerce, despite having one of the largest grocery sectors in Europe as well as an advanced non-food e-commerce market. The dominance of discounters has slowed the development of grocery e-commerce within the country. However, the threat from rapid expansion of US-based online retail giant Amazon into grocery e-commerce has forced domestic players to respond quickly by expanding their own e-commerce initiatives. In this report, we give an overview of the online grocery sector in Germany, illustrating the main characteristics of the market and how consumers buy groceries online, and analyze the main initiatives that the industry players are undertaking to expand their share of this market. A broader overview of the German retail sector, including its e-commerce market, is provided in our report Germany Retail Overview: Characteristics, Developments and Prospects. [caption id="attachment_90490" align="aligncenter" width="412"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

GERMANY: LAGGING OTHER MARKETS IN GROCERY E-COMMERCE

Germany lags other markets in grocery e-commerce, despite the size of its e-commerce and grocery retail sectors:- As of 2015, Germany had the second largest e-commerce and third-largest grocery retail sector in Europe, with total retail sales of €36 billion and €196 billion, respectively, according to Euromonitor International.

- There is a strong non-food e-commerce sector in the country. In 2015, 13.6% of nonfood sales were made online, compared to 12% in France and 21.9% in the UK, according our analysis of Euromonitor International data. Based on data from the German market research firm IFH, consumer electronics and fashion are the two sectors with the highest online penetration.

- However, as the following chart shows, only 1.2% of fast-moving consumer goods (FMCG) sales are made online in Germany, much lower than in either France or the UK.

GERMANY: LAGGING OTHER MARKETS IN GROCERY E-COMMERCE

Germany lags other markets in grocery e-commerce, despite the size of its e-commerce and grocery retail sectors:- As of 2015, Germany had the second largest e-commerce and third-largest grocery retail sector in Europe, with total retail sales of €36 billion and €196 billion, respectively, according to Euromonitor International.

- There is a strong non-food e-commerce sector in the country. In 2015, 13.6% of nonfood sales were made online, compared to 12% in France and 21.9% in the UK, according our analysis of Euromonitor International data. Based on data from the German market research firm IFH, consumer electronics and fashion are the two sectors with the highest online penetration.

- However, as the following chart shows, only 1.2% of fast-moving consumer goods (FMCG) sales are made online in Germany, much lower than in either France or the UK.

Source: Kantar Worldpanel[/caption]

The structure of the grocery retailing sector—i.e. the strong presence of discounters and easy access to brick-and-mortar stores—as well as consumer preferences in terms of payment methods, have slowed the expansion of grocery e-commerce in Germany:

Source: Kantar Worldpanel[/caption]

The structure of the grocery retailing sector—i.e. the strong presence of discounters and easy access to brick-and-mortar stores—as well as consumer preferences in terms of payment methods, have slowed the expansion of grocery e-commerce in Germany:

- Strong presence of discounters: Discounters, a channel that typically does not sell online, accounted for 40% of sales by modern grocery formats in Germany in 2015, according to Euromonitor International, compared to only a single-digit share in the UK and France. Historically, discounters had little incentive to enter grocery e-commerce because of their no-frills retailing model, and the high costs associated with picking and delivering grocery orders do not fit well with this model. Moreover, German consumers are traditionally price sensitive when it comes to groceries. This factor, while it has contributed to the success of discounters, has discouraged the expansion of online grocery shopping, which incurs extra costs such as delivery fees.

- Easy access to brick-and-mortar stores: There is a high density of food stores in Germany. This is in part due to the strong presence of discounters, which tend to have smaller outlets located in urban and suburban areas, rather than big out-of-town stores. This high density of smaller stores partially meets consumers’ demands for convenience, which, in other markets—notably France, where the hypermarket model is more prevalent—is met by grocery e-commerce.

- German shoppers dislike credit-cards payments: The payment method preferences of German consumers have slowed the development of online grocery shopping. Credit-card payment is preferred by only 18% of consumers buying online, according to postal company PostNord. Many German consumers would rather be invoiced rather than pay in advance, according to Kantar Worldpanel. Invoicing is less of an issue with big-ticket items such as consumer electronics, which are purchased infrequently, but is arguably less practical for more frequent, smaller payment purchases such as grocery shopping.

Figures extrapolated from a survey of 7,000-8,000 of consumers aged 14+ in each year.

Figures extrapolated from a survey of 7,000-8,000 of consumers aged 14+ in each year.Source: IfD Allensbach[/caption]

HOW GERMAN CONSUMERS SHOP ONLINE: INFREQUENT SHOPPERS OF SPECIALTY PRODUCTS

So, if regular supermarkets have been slow to expand online, and at the same time, consumers have shown an increased propensity to buy groceries online, then the question remains what type of grocery shopping do Germans undertake online and where do they buy from? A 2014 survey by research firm Fittkau & Maaß investigated the behavior of German consumers when buying online. Their main findings are a follows:- German consumers tend to be infrequent online grocery buyers: Only 6.8% of the respondents said they do their regular weekly food shopping online.

- German consumers tend to search for specialty products or foreign products not available in their grocery stores locally: Some 5% of the respondents said they buy online products that are difficult to find in stores locally. Almost one-third of respondents searched for foreign products online.

- German consumers buy grocery products online from Amazon and eBay: Among the respondents, about 45% had bought food at least once from Amazon and 25.5% from eBay. This was followed by online delicatessen shop Gourmondo and multi-channel retailer REWE.

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

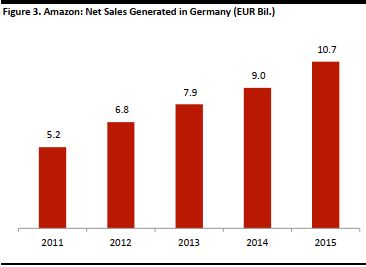

THE THREAT OF AMAZON’S EXPANSION INTO GROCERY

We have seen that Amazon is already the main destination for grocery shopping in Germany, according to Fittkau & Maaß, despite the fact that Amazon has only recently started to expand its grocery-specific service, Amazon Pantry, in Germany—as we show later in this section. Given the position of strength that the Seattle-based company already holds in online grocery, the prospect of a more structured market penetration, through further expansion of Amazon Pantry and the introduction of AmazonFresh, is seen as a genuine threat by domestic grocery retailers. Germany is Amazon’s biggest market outside the US. As shown in the following chart, Amazon’s revenue in Germany expanded rapidly during 2011-15, growing at a CAGR of 19.7%. [caption id="attachment_90498" align="aligncenter" width="366"] Source: Company Reports/Fung Global Retail & Technology[/caption]

As we noted earlier, Germans tend to buy grocery products from Amazon that are difficult to find in regular supermarkets and grocery stores. This suggests that German shoppers do not yet do their regular grocery shopping on Amazon. Nevertheless, this could soon change, as Amazon expands its grocery shopping services in Germany:

Source: Company Reports/Fung Global Retail & Technology[/caption]

As we noted earlier, Germans tend to buy grocery products from Amazon that are difficult to find in regular supermarkets and grocery stores. This suggests that German shoppers do not yet do their regular grocery shopping on Amazon. Nevertheless, this could soon change, as Amazon expands its grocery shopping services in Germany:

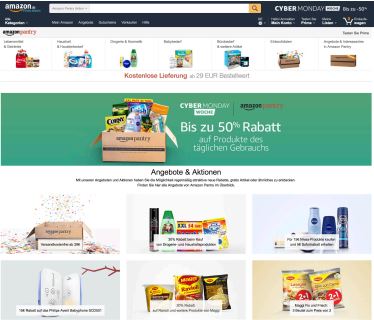

- Amazon Pantry: Amazon launched Amazon Pantry in Germany in October 2015. The service enables Prime members to buy a 20KG box filled with ambient grocery items and household products.

- AmazonFresh: Although a German launch of AmazonFresh has yet to be confirmed by the company, it is possible following the recent launches in the UK (London) and Italy (Milan) in the first half of 2016. According to a Reuters report, Alain Caparros, CEO of Rewe Group, said that Amazon had already secured logistics in Germany to expand AmazonFresh in the market.

Source: Amazon[/caption]

Source: Amazon[/caption]

DOMESTIC RETAILERS REACT TO AMAZON’S EXPANSION INTO GROCERY

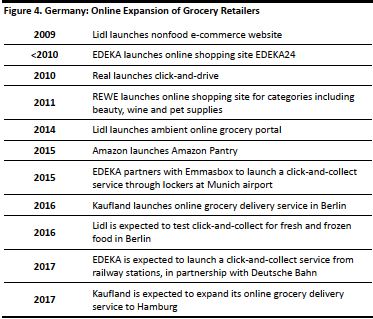

The prospect of Amazon’s expansion into the German grocery market is forcing domestic brick-and-mortar retailers to reconsider their grocery e-commerce strategy (or the lack thereof) and to start offering serious online grocery retailing services in order to avoid leaving the first-mover advantage to the Seattle-based company. All the main grocery retailers in Germany have started to put together some kind of grocery e-commerce strategy. However, the recurring theme among industry players is that their expansion into online has occurred only relatively recently, and was mainly in response to the threat posed by Amazon. Below, we discuss how the main domestic players are expanding into grocery e-commerce. We begin with a timeline of key developments. [caption id="attachment_90501" align="aligncenter" width="373"] Source: Company reports[/caption]

Source: Company reports[/caption]

REWE

Rewe launched its online shopping service in March 2011. Initially, the focus was on categories including beauty products, wine and pet supplies. The service includes in-store click-and-collect and home delivery. In March 2015, REWE stated:

REWE

Rewe launched its online shopping service in March 2011. Initially, the focus was on categories including beauty products, wine and pet supplies. The service includes in-store click-and-collect and home delivery. In March 2015, REWE stated:

- It offers a pick-up service from 13 drive pick-up stores throughout Germany.

- Its Delivery Service (home delivery of online grocery purchases) is available in 57 cities throughout Germany.

Source: REWE[/caption]

Source: REWE[/caption]

Real

The German hypermarket, which is part of Metro Group, offers its customers home delivery, collection from Deutsche Post parcel stations and collection from local stores. Moreover, the retailer offers click-and-drive—a service that enables shoppers to pick up their groceries from drive-through pick-up points—from two of its locations, Isernhagen-Altwarmbüchen near Hanover, and Cologne-Porz. Real’s drive-through service was launched in November 2010. The retailer plans to expand its click-and-drive model to other metropolitan areas in Germany.

[caption id="attachment_90507" align="aligncenter" width="376"]

Real

The German hypermarket, which is part of Metro Group, offers its customers home delivery, collection from Deutsche Post parcel stations and collection from local stores. Moreover, the retailer offers click-and-drive—a service that enables shoppers to pick up their groceries from drive-through pick-up points—from two of its locations, Isernhagen-Altwarmbüchen near Hanover, and Cologne-Porz. Real’s drive-through service was launched in November 2010. The retailer plans to expand its click-and-drive model to other metropolitan areas in Germany.

[caption id="attachment_90507" align="aligncenter" width="376"] Source: Metro Group[/caption]

Source: Metro Group[/caption]

Kaufland

This discount-hypermarket retailer started its delivery service on October 6, 2016. At the time of writing, the service is only available in the Berlin area. The minimum order for delivery is €40, website Gabot.de reports. Expansion in other regions is planned, and the service will be available in Hamburg by spring 2017, according to economic publication Manager Magazin. Kaufland is planning to launch a click-and-collect service in the future, according to IGD. Kaufland is owned by Schwartz Group, which also owns Lidl.

[caption id="attachment_90509" align="aligncenter" width="379"]

Kaufland

This discount-hypermarket retailer started its delivery service on October 6, 2016. At the time of writing, the service is only available in the Berlin area. The minimum order for delivery is €40, website Gabot.de reports. Expansion in other regions is planned, and the service will be available in Hamburg by spring 2017, according to economic publication Manager Magazin. Kaufland is planning to launch a click-and-collect service in the future, according to IGD. Kaufland is owned by Schwartz Group, which also owns Lidl.

[caption id="attachment_90509" align="aligncenter" width="379"] Source: Kaufland[/caption]

Source: Kaufland[/caption]

Lidl

Lidl Germany launched its nonfood e-commerce site in 2009 and its ambient grocery e-commerce site in 2014. By December 2016, the retailer will test click-and-collect on fresh and frozen foods in Berlin, according to Manager Magazin. The retailer is expected to expand the service to other cities in Germany. Lidl Germany will offer in-store collection, although it remains unclear whether home delivery is on the retailer’s plate, according to British trade publication The Grocer.

[caption id="attachment_90513" align="aligncenter" width="378"]

Lidl

Lidl Germany launched its nonfood e-commerce site in 2009 and its ambient grocery e-commerce site in 2014. By December 2016, the retailer will test click-and-collect on fresh and frozen foods in Berlin, according to Manager Magazin. The retailer is expected to expand the service to other cities in Germany. Lidl Germany will offer in-store collection, although it remains unclear whether home delivery is on the retailer’s plate, according to British trade publication The Grocer.

[caption id="attachment_90513" align="aligncenter" width="378"] Source: Lidl[/caption]

Expanding into grocery e-commerce is particularly challenging for discounters. Aldi, the leading discounter in Germany, according to Euromonitor International, does not operate a transactional website in Germany at the time of writing. The focus of discounters is on no-frills retailing and low prices. The high costs required by offering grocery e-commerce, including picking and delivering orders, present a poor fit with the business model at the root of the discounters’ success. These retailers usually operate on thin margins, making it difficult to absorb the extra costs involved in e-commerce. Moreover, discounters’ outlets are normally relatively small, with little space to be used for e-commerce operations such as picking orders and click-and-collect. All these challenges raise questions about whether offering grocery e-commerce will be viable for discounters in the long term.

Source: Lidl[/caption]

Expanding into grocery e-commerce is particularly challenging for discounters. Aldi, the leading discounter in Germany, according to Euromonitor International, does not operate a transactional website in Germany at the time of writing. The focus of discounters is on no-frills retailing and low prices. The high costs required by offering grocery e-commerce, including picking and delivering orders, present a poor fit with the business model at the root of the discounters’ success. These retailers usually operate on thin margins, making it difficult to absorb the extra costs involved in e-commerce. Moreover, discounters’ outlets are normally relatively small, with little space to be used for e-commerce operations such as picking orders and click-and-collect. All these challenges raise questions about whether offering grocery e-commerce will be viable for discounters in the long term.

EDEKA

Edeka is Germany’s biggest food retailer by revenues, operating a network that spans small local stores to hypermarkets. Through the portal EDEKA24, consumers can buy ambient packaged food, while another website, EDEKA Lebensmittel, also offers fresh food. EDEKA was one of the first grocery retailers in Germany to sell online: a 2010 report produced by The Irish Food Board, Bord Bia, stated that “EDEKA would appear to be the most advanced [online grocery retailer] with a system called EDEKA24.”

EDEKA is experimenting with innovative solutions for online grocery shopping fulfillment:

EDEKA

Edeka is Germany’s biggest food retailer by revenues, operating a network that spans small local stores to hypermarkets. Through the portal EDEKA24, consumers can buy ambient packaged food, while another website, EDEKA Lebensmittel, also offers fresh food. EDEKA was one of the first grocery retailers in Germany to sell online: a 2010 report produced by The Irish Food Board, Bord Bia, stated that “EDEKA would appear to be the most advanced [online grocery retailer] with a system called EDEKA24.”

EDEKA is experimenting with innovative solutions for online grocery shopping fulfillment:

- In 2015, the retailer partnered with Emmasbox—a company specialized in click-and-collect solutions for retail and logistics—to launch a click-and-collect service through lockers at Munich airport.

- EDEKA partnered with railroad operator Deutsche Bahn to pilot a click-and-collect service from train stations, IGD reports. The first trial is expected to be launched in February 2017 in Berlin, where shoppers will be able to collect groceries they purchased online from station lockers. The lockers will be equipped with chilled boxes to guarantee freshness.

Source: EDEKA[/caption]

Source: EDEKA[/caption]

GERMAN GROCERY E-COMMERCE IS EXPECTED TO GROW FAST

The expansion of Amazon and of domestic players into grocery e-commerce raises the prospect of rapid growth in the channel in the next few years. Euromonitor International forecasts that food and drink Internet retailing in Germany will grow much faster than in France and in the UK, where the online grocery market is more mature, as shown in the chart below. [caption id="attachment_90517" align="aligncenter" width="378"] Source: Euromonitor International[/caption]

Despite the strong projected growth, Germany is not expected to catch up with its more mature neighboring markets. Euromonitor forecasts that the value of the food and drink e-commerce market in Germany will be €2.2 billion by 2020, compared to €6.3 billion in France. The prevalence of discounters in Germany, for which, the roll out of grocery e-commerce is particularly challenging, should limit the scope of the expansion of grocery e-commerce in the market.

[caption id="attachment_90519" align="aligncenter" width="373"]

Source: Euromonitor International[/caption]

Despite the strong projected growth, Germany is not expected to catch up with its more mature neighboring markets. Euromonitor forecasts that the value of the food and drink e-commerce market in Germany will be €2.2 billion by 2020, compared to €6.3 billion in France. The prevalence of discounters in Germany, for which, the roll out of grocery e-commerce is particularly challenging, should limit the scope of the expansion of grocery e-commerce in the market.

[caption id="attachment_90519" align="aligncenter" width="373"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

KEY TAKEAWAYS

Although grocery e-commerce in Germany still lags other markets in comparable countries, the rapid expansion of the main industry players in the segment points to significant growth potential in the near future. Our key takeaways from the German online grocery market are:- Germany lags other markets in grocery e-commerce. Online grocery sales in Germany accounted for only 1.2% of total grocery sales as of June 2016, according to Kantar Worldpanel, much lower than in both France and the UK.

- The strong presence of discounters in the market, which traditionally do not sell online, the high density of smaller food stores and the reluctance of German shoppers to pay by credit card are the main factors that have slowed down the penetration of grocery e-commerce in the country.

- The number of shoppers buying groceries online has been increasing. According to an IfD Allensbach survey, the number of respondents that claim to have purchased food or beverage online increased by 1.2 million over 2013-15.

- Amazon is expanding rapidly into grocery e-commerce in Germany. Amazon Pantry was launched at the end of 2015, and many industry observers believe AmazonFresh will also enter the market soon, although this has yet to be confirmed by the company.

- Domestic players are responding rapidly to Amazon’s expansion into grocery with their own e-commerce initiatives. All the main domestic brick-and-mortar grocery retailers have started selling online.

- As a result of the recent dynamism in the market, the online grocery sector in Germany is expected to grow much faster than that of its more mature neighboring countries in the next few years.