DIpil Das

What’s the Story?

Singles’ Day, also known by Alibaba as the 11.11 Global Shopping Festival, has become China’s most important online shopping festival—with consumers flocking to major Chinese e-commerce platforms such as Alibaba’s Taobao and Tmall, and JD.com to take advantage of promotions. Now that the coronavirus lockdown has lifted, many brands and retailers are looking for the event to help them hit revenue targets. This year, we continue to see a variety of platforms joining the event, including short video platforms Douyin and Kuaishou, which have both announced plans to host shopping festivals in November to compete with e-commerce giants. In this report, we look at the rules for the events and the plans set out by each platform—including measures taken to better help brands and retailers capitalize on the biggest shopping extravaganza of the year.Alibaba’s Taobao and Tmall

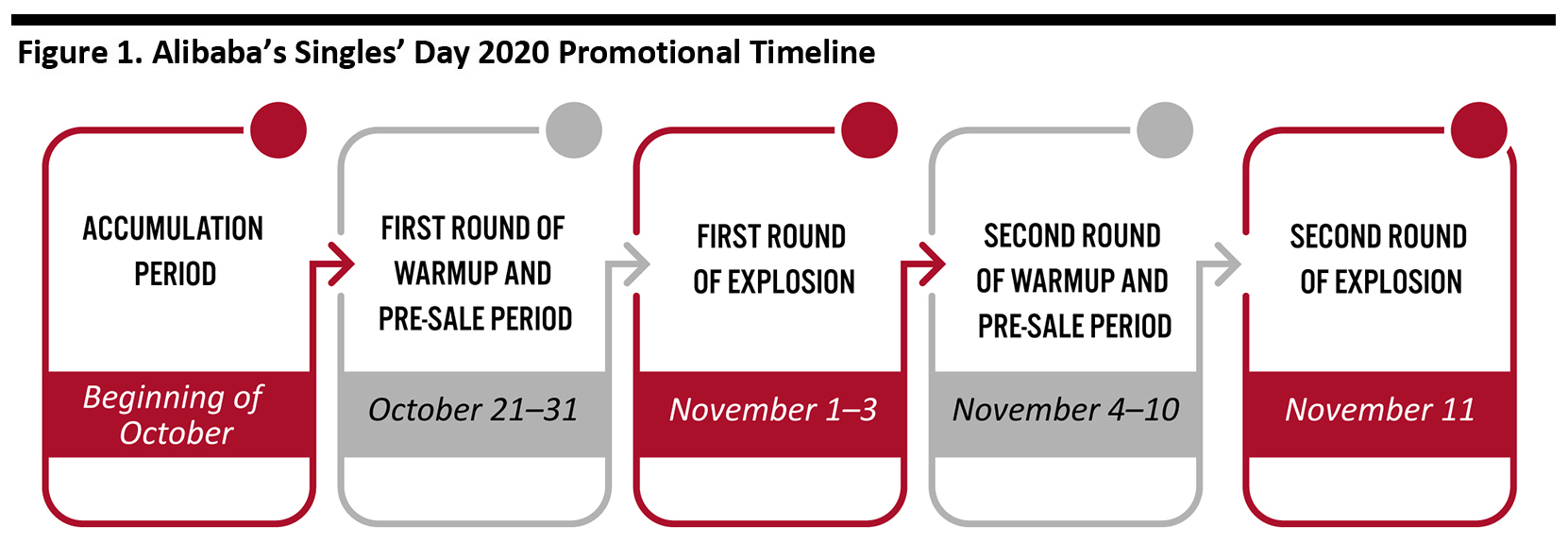

In the previous countdown report, we noted that Alibaba has changed the timeline for its 11.11 Global Shopping Festival this year to include two “explosion” periods for the official sale, with the first round taking place from November 1–3 and the second round starting on November 11. As a result, there will be two pre-sale periods, when consumers can preview promotions that will be offered, then put down deposits before completing purchases. We summarize the complete timeline in Figure 1. [caption id="attachment_117435" align="aligncenter" width="700"] Source: Alibaba/Coresight Research[/caption]

Alibaba opened applications for participation in its 11.11 Global Shopping Festival and unveiled its participation rule for merchants on September 18. Participating merchants need to keep in mind the registration deadline for both pre-sale products and regular products. Because of the timeline change for this year’s event, there are three different product registration periods:

Source: Alibaba/Coresight Research[/caption]

Alibaba opened applications for participation in its 11.11 Global Shopping Festival and unveiled its participation rule for merchants on September 18. Participating merchants need to keep in mind the registration deadline for both pre-sale products and regular products. Because of the timeline change for this year’s event, there are three different product registration periods:

- September 27 to October 13—products featured during the first round of pre-sale period

- October 13 to 23—products featured in the first round of explosion

- October 13 to 28—products featured in the second round of pre-sale and explosion.

- For transactions completed between November 1–3, brands and retailers must ship products within 48 hours

- For transactions completed on November 11, brands and retailers must ship products no later than 11:59pm on November 17

- The top horizontal banner is now vertical and has been moved down.

- The “guess you like it” product recommendation feed section has been moved up and expanded. Content can now be displayed as pictures or short videos.

- The Mini detail page (discussed in the previous countdown report) after clicking products displayed in the “guess you like it” section.

Main page of Taobao app before the upgrade (left); main page of Taobao app after the upgrade (right)

Main page of Taobao app before the upgrade (left); main page of Taobao app after the upgrade (right) Source: Taobao [/caption]

JD.com

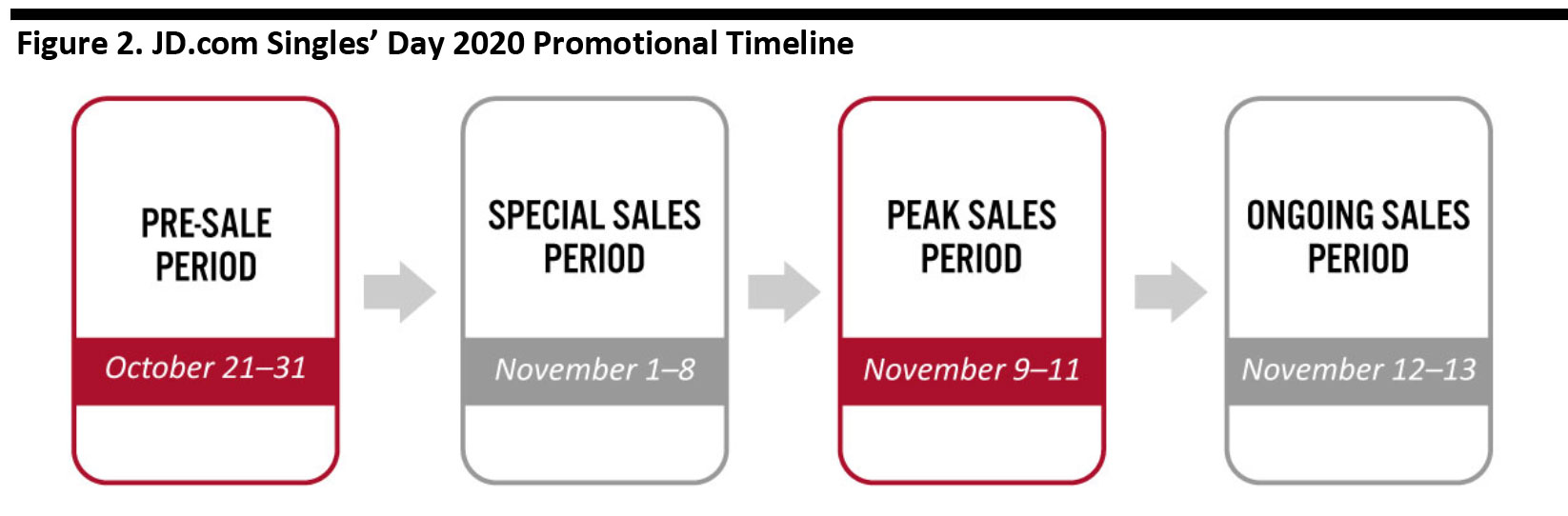

On September 14, JD.com announced the plans for and rules of its Double 11 shopping festival. The timeline of the event, which lasts for almost a month, is similar to last year. JD.com will kick off the event on October 21 with pre-sale. The official sale will begin on November 1 and end on November 13, with a special sales period focusing on specific product categories for each day up to the sales peak on November 9–11. In 2019, the official sale lasted from November 1–15. The company will provide merchant support for finance, logistics, marketing, subsidies and technology tools. Some of the announced measures include:- 10 free visual design tools offered for merchants to better present their brands and products to consumers

- Reduced commission fee on cost per sales (CPS) advertising on short video platform Kuaishou, online Q&A forum Zhihu, Weibo, and JD livestreaming

- ¥1 billion (around $147 million) in financial support to over 10,000 qualified merchants to help them increase return on investment

Source: JD.com/Coresight Research [/caption]

Source: JD.com/Coresight Research [/caption]

Suning.com

Suning.com unexpectedly announced the launch of its Singles’ Day promotion on September 28. To boost the consumption and leverage the Golden Week Holiday, which is considered to be one of the biggest holidays in China for consumer spending, Suning set September 28–October 8 as the launch period for its Singles’ Day. The company has unleashed shopping subsidies worth ¥5 billion ($733 billion) on over 100 million products including accessories, beauty, clothing, electronics, food, home and jewelry. For example, an iPhone 11 (128GB) costs ¥4,649 after the discount, down ¥350 from the original price of ¥4,999. Airpods Pro costs ¥1,399, down ¥200 from the original price of ¥1,599. For products purchased during this promotional period, Suning offered its longest best-price guarantee—it will pay back the difference if the price drops up to November 12. Suning.com will start its pre-sale period for Singles’ Day on October 20. The official sale will be taking place from November 1–12, following the same as the timeline as last year. [caption id="attachment_117438" align="aligncenter" width="700"] Early Singles’ Day promotions on Suning.com app

Early Singles’ Day promotions on Suning.com app Source: Coresight Research [/caption]