albert Chan

Introduction: European Shoppers Demand Omnichannel Experiences

Today’s shopper is virtually always connected. Switching between channels and devices – and even speaking aloud to those devices – is second nature for digital enthusiasts. In fact, 67% of European consumers use multiple channels to complete a single transaction, according to a 2019 Salesforce report State of the Connected Customer.

Customers expect retailers and brands to keep pace by providing omnichannel service. “Omnichannel” describes a strategy of delivering a unified customer experience across all points of contact. While the term has been floating around the industry for years, many retail organizations still haven’t implemented omnichannel fully – even though the strategy is more critical today than it ever has been.

For European retailers and brands, serving up omnichannel experiences is particularly challenging because there are multiple languages, currencies, cultural preferences and regulations to contend with. That said, retailers should prioritize the strategy: 40% of customers will not do business with a company if they can’t use their preferred channels, according to the same Salesforce study.

This report provides a view of the current state of omnichannel in Europe by evaluating executives’ key challenges and priorities in executing a successful omnichannel strategy in Europe. We also highlight valuable lessons from top-performing retailers and brands in the region.

A collaboration between Coresight Research and Salesforce, the report is based on a survey of 470 senior retail executives based in France, Germany, Italy, Netherlands, the Nordic countries, Spain and the UK, as well as interviews with senior executives from leading European retailers.

Our thanks go to the following executives for their time and insights during the in-depth interviews (listed alphabetically):

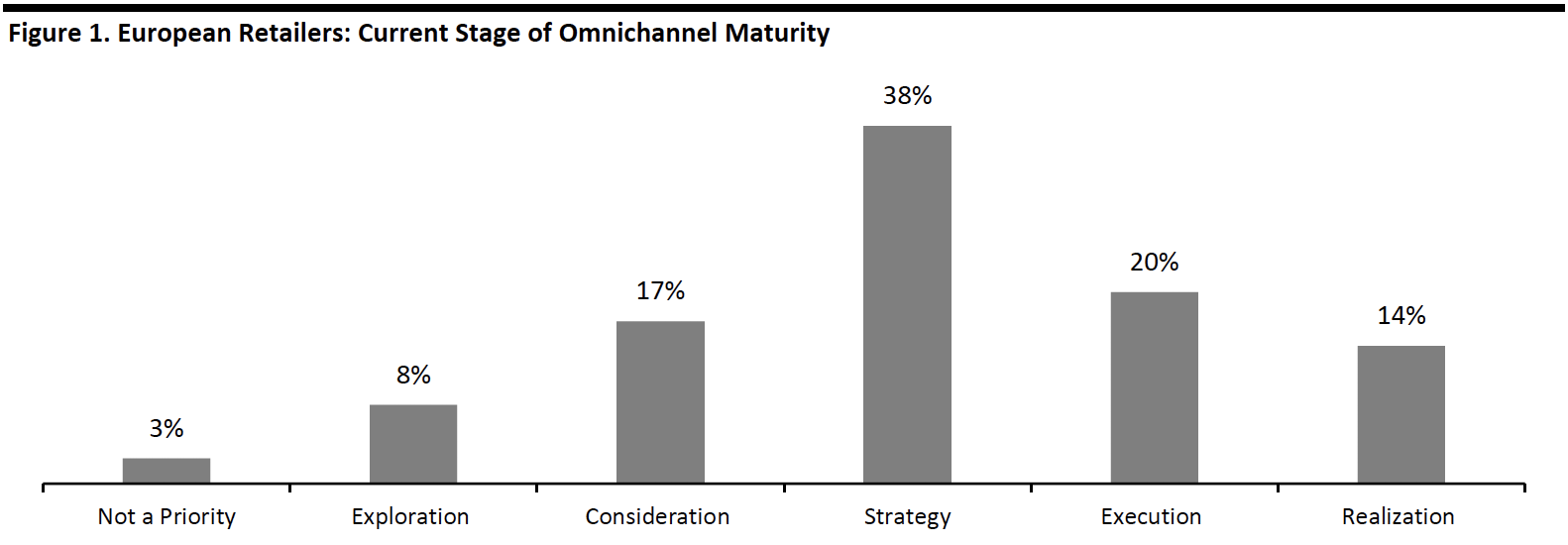

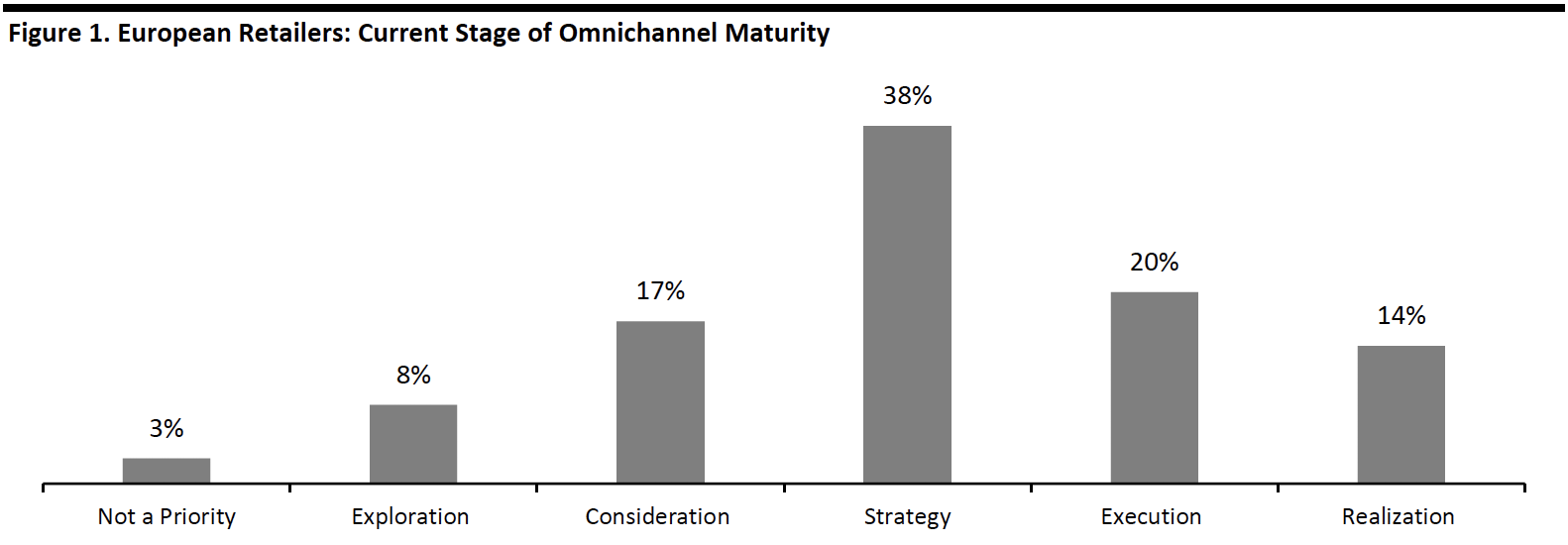

Survey question summary: “How would you categorize your organization’s maturity in adopting omnichannel offerings?” Respondents could select one option only. Responses ranged from “Not a Priority” (least advanced state of adoption) to “Realization” (most advanced state of adoption).

Survey question summary: “How would you categorize your organization’s maturity in adopting omnichannel offerings?” Respondents could select one option only. Responses ranged from “Not a Priority” (least advanced state of adoption) to “Realization” (most advanced state of adoption).

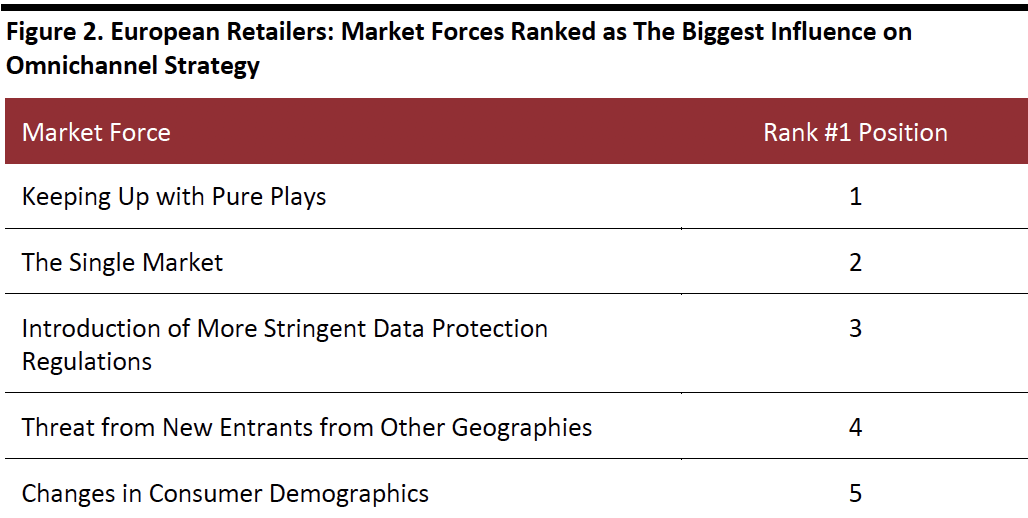

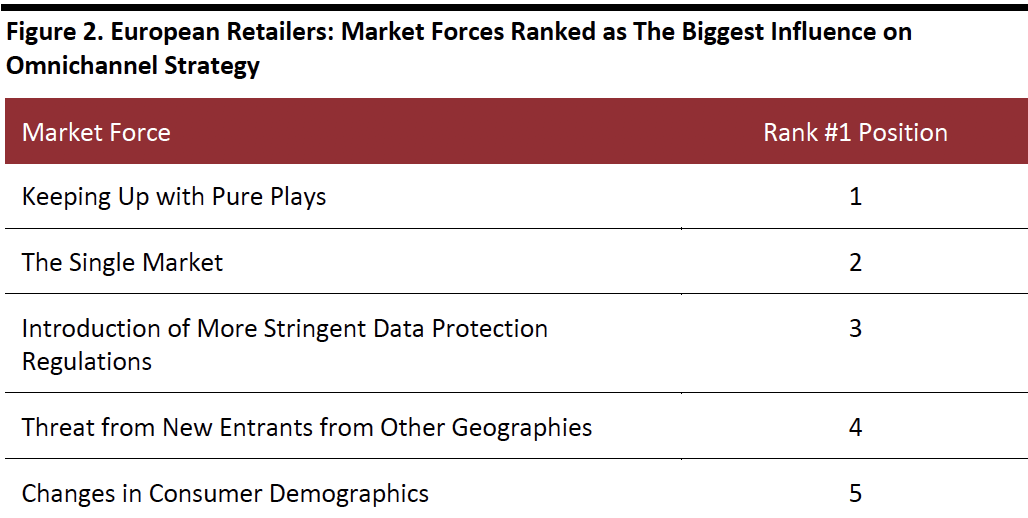

Source: Salesforce/Coresight Research[/caption] Further distinctions emerge when analyzing maturity by country. Only a quarter of UK retailers in our study have started implementing their omnichannel strategies. Countries such as the Netherlands and the Nordics struggled the most to make their omnichannel strategies operational: over 30% had yet to secure any type of budget. This can be attributed in part to their priorities: Nearly a tenth (8%) of Nordic decision-makers stated that omnichannel was not even on their agenda. Market and Organizational Dynamics Create Barriers to Maturity Why are so few European retailers (14%) realizing the benefits of an omnichannel strategy? European retailers and brands face the complexity of operating across distinct European countries, in addition to the same omnichannel challenges they share with their overseas counterparts. “Europe is complicated. Imagine how complex it would be if every state in America had different languages, different customs, different payments and different service providers. There’s the cultural element, then there’s the different perception of your brand in every country – and you have to manage that.” - David Williams, Senior Director, Ecommerce and Retail at Deckers Brands. Market Forces Affecting European Retailers Retailers and brands are influenced by external factors that could have an impact on their omnichannel strategies. Keeping pace with pure plays is a major factor the respondents (16%) consider when devising omnichannel strategies, possibly pressured by the disruption in the retail industry caused – in part – by pure plays and their ability to move quickly, unencumbered by legacy systems and processes. Dutch eyewear brand Ace & Tate is one such company that amassed a dedicated customer base online and, after experimenting with pop-up shops, expanded to nearly 50 physical stores across Europe. Yet the threat of agile, digitally native companies like Ace & Tate is felt by companies worldwide. Many market forces specifically impact European retailers and brands such as: Top five ranked #1 to the survey question “What macro factors are impacting your omnichannel strategy, either positively or negatively?” Respondents could select up to three options and rank these by importance.

Top five ranked #1 to the survey question “What macro factors are impacting your omnichannel strategy, either positively or negatively?” Respondents could select up to three options and rank these by importance.

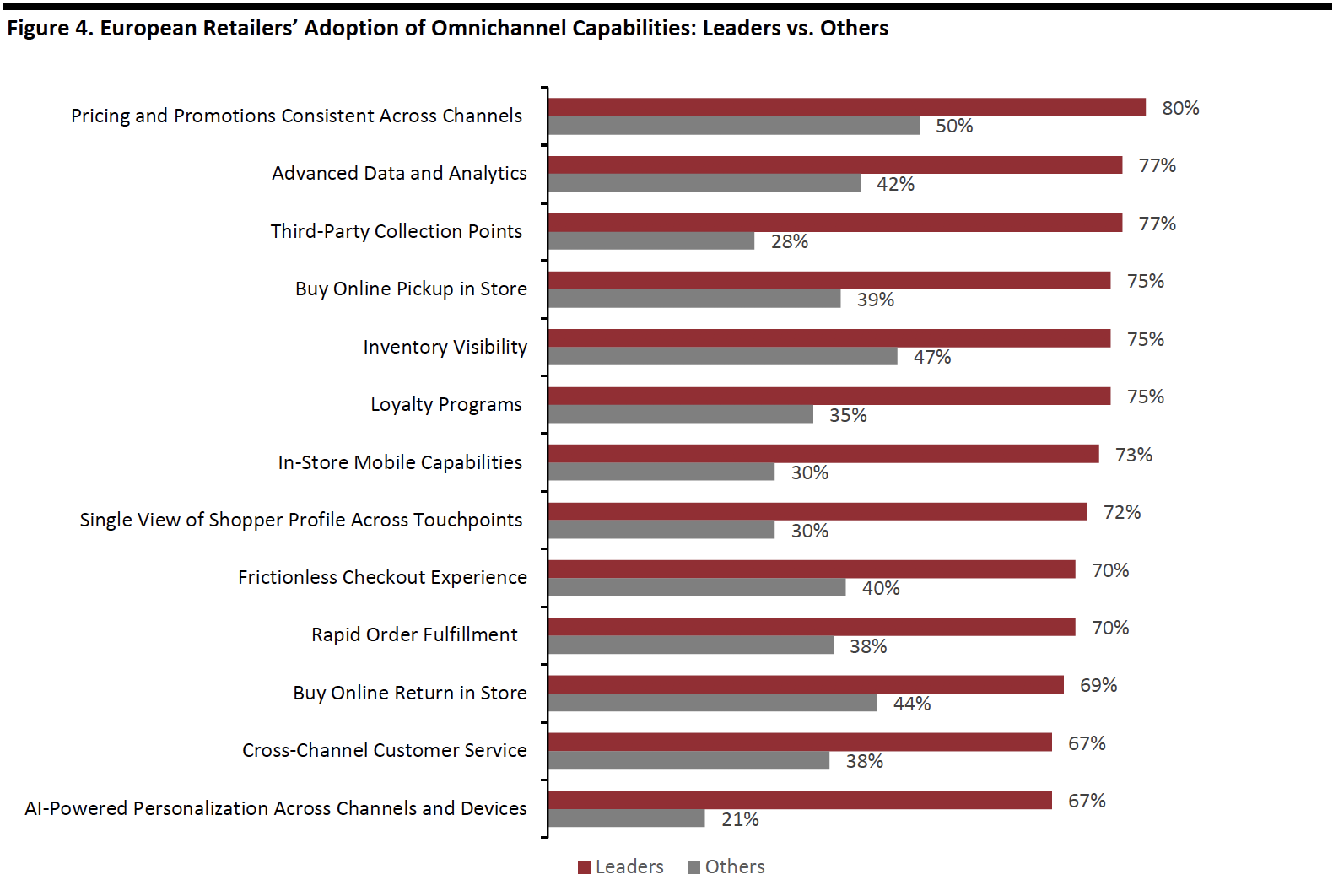

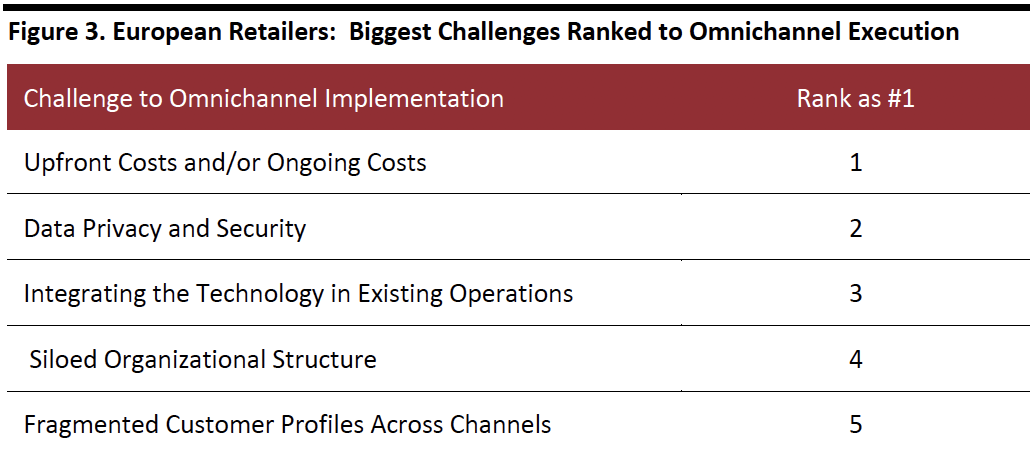

Source: Salesforce/Coresight Research[/caption] Data, Cost and Integration Challenges Getting omnichannel right is complex and costs money. As new channels emerge and consumer expectations continue to evolve, European retailers and brands are tasked with selecting, paying for and implementing the right technology. The survey revealed the following key challenges: Percentage of participants who responded “Implemented across all store networks” for each omnichannel capability listed as options in response to the question “Which, if any, of the following omnichannel capabilities does your company currently have?”

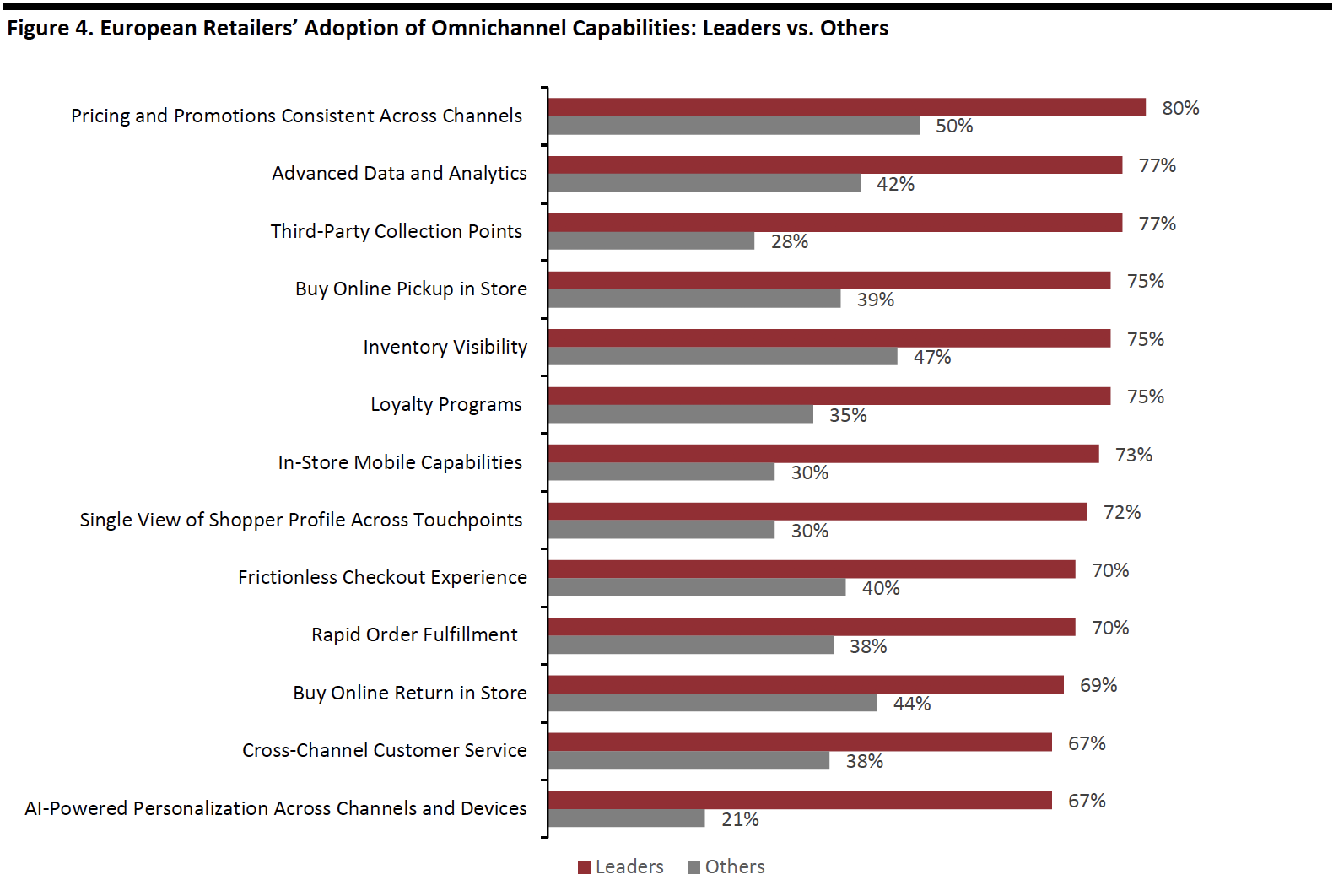

Percentage of participants who responded “Implemented across all store networks” for each omnichannel capability listed as options in response to the question “Which, if any, of the following omnichannel capabilities does your company currently have?”

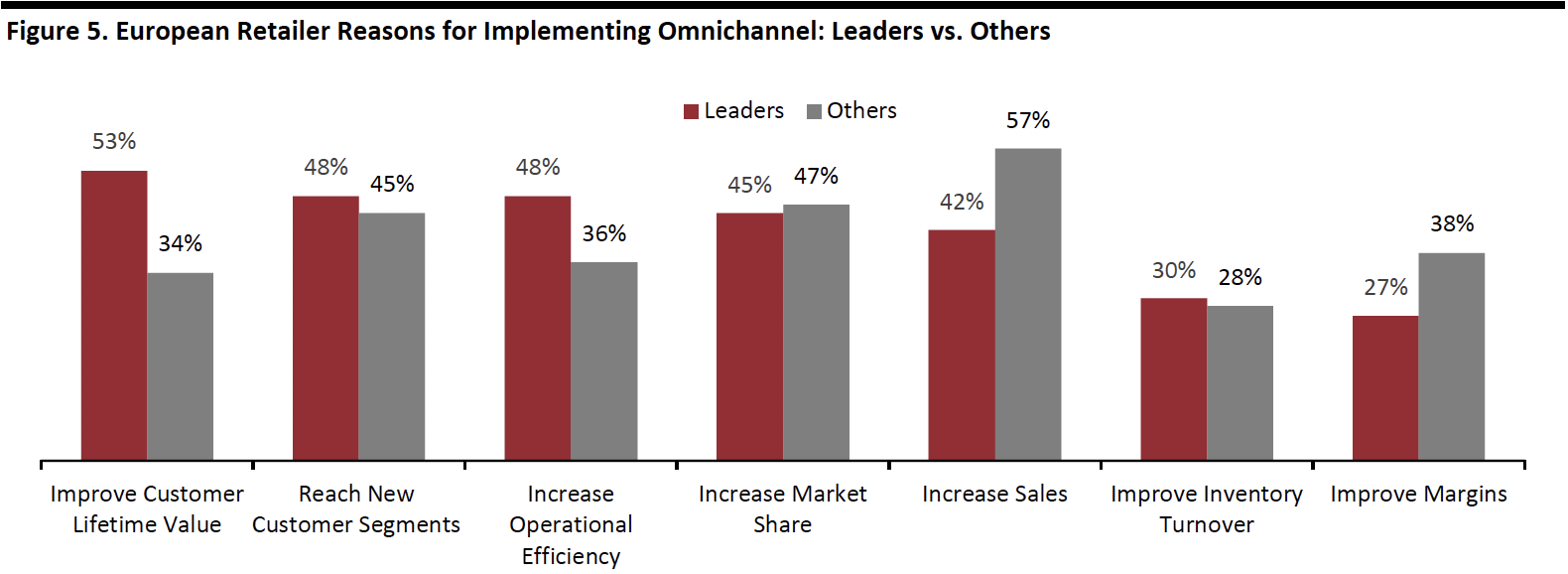

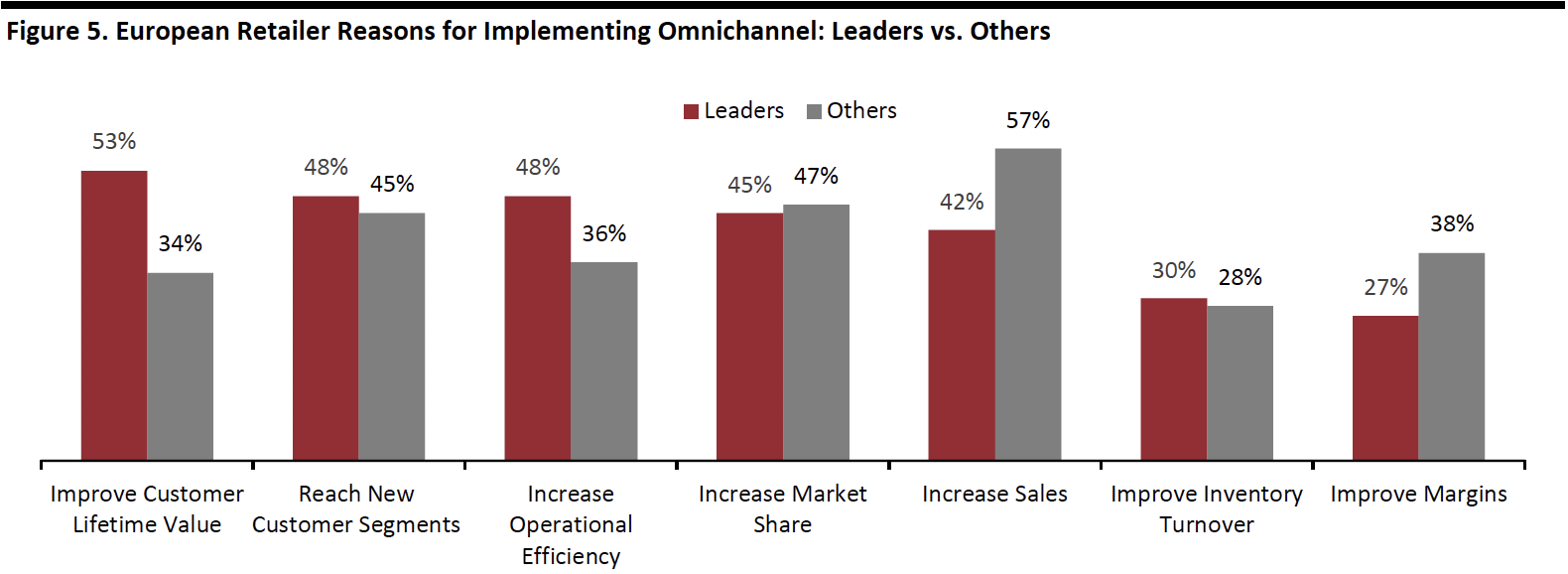

Source: Salesforce/Coresight Research[/caption] The adoption rate of these capabilities by leaders is no surprise, as it is one of our definitions of an omnichannel leader. More interesting are the capabilities for which the “others” have relatively low adoption rates, and “artificial intelligence (AI)-powered personalization across channels and devices” stands out. The need to provide personalized shopping experiences across channels, and its corresponding impact on revenue, has been discussed for some time. For context, in the first quarter of 2019, 16% of global shoppers engaged with AI-powered product recommendations during visits, and those who acted on the recommendations spent 26% more than shoppers who didn’t, according to the Salesforce Shopping Index, which analyses the activity of more than 500 million shoppers. Omnichannel leaders realize that AI is no longer a nice-to-have, it is a must. Leaders Prioritize Long-Term Goals Over Short-Term Sales Increases “[Executing omnichannel] is never just money-driven. There’s always an element of being as efficient as possible. But I think for Deckers, offering more omnichannel capabilities came down to the recognition that we needed to be more consumer-centric. And to do that, we needed to have a more holistic, less siloed view of how business is done.'' - David Williams, Senior Director, Ecommerce and Retail at Deckers Brands. Short-term objectives such as increasing sales certainly remain important, but leaders see the benefits of omnichannel as more structural, strategic and long-term. Figure 5 shows leaders are mostly driven by long-term goals such as reaching new customer segments, including digital natives via social media, increasing customer lifetime value and improving operational efficiency. [caption id="attachment_96404" align="aligncenter" width="700"] Response to the question “What are the biggest benefits you hope to receive from omnichannel retail?” Respondents could select up to three options and rank these by importance

Response to the question “What are the biggest benefits you hope to receive from omnichannel retail?” Respondents could select up to three options and rank these by importance

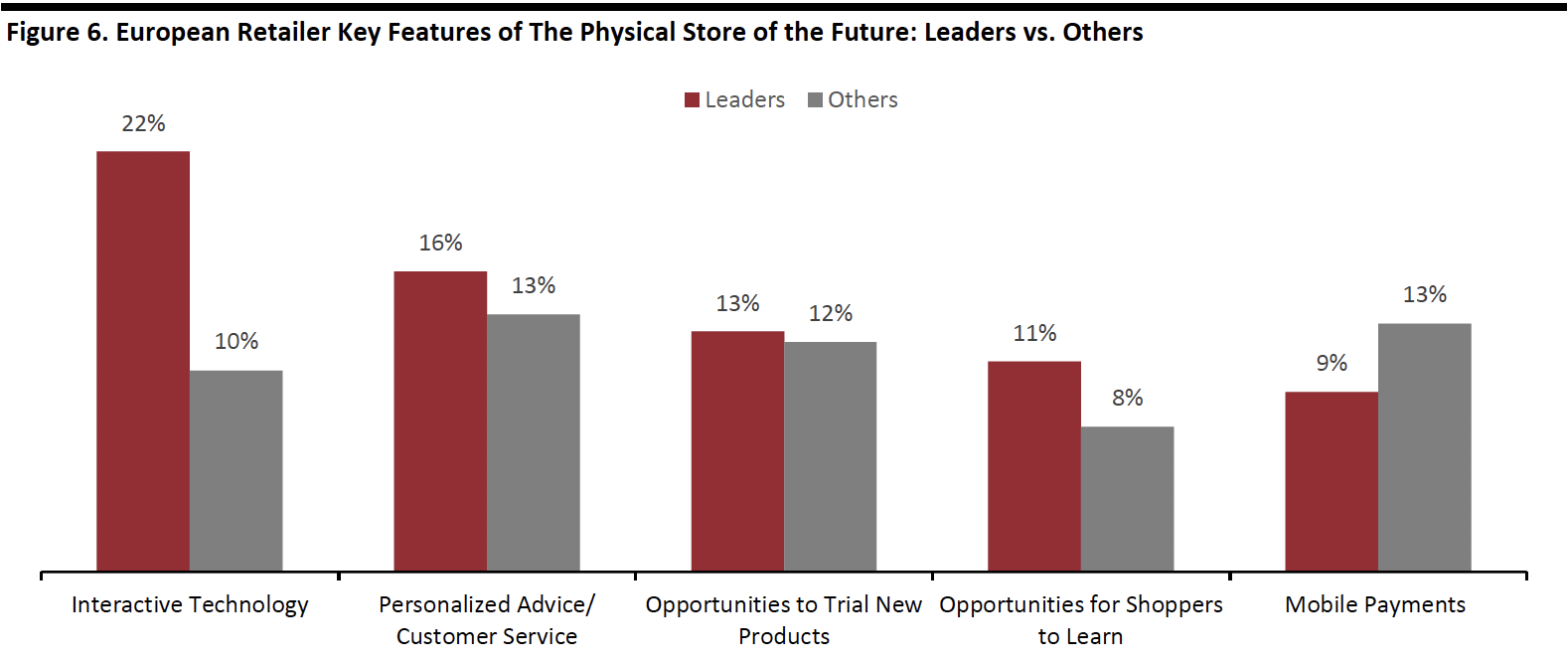

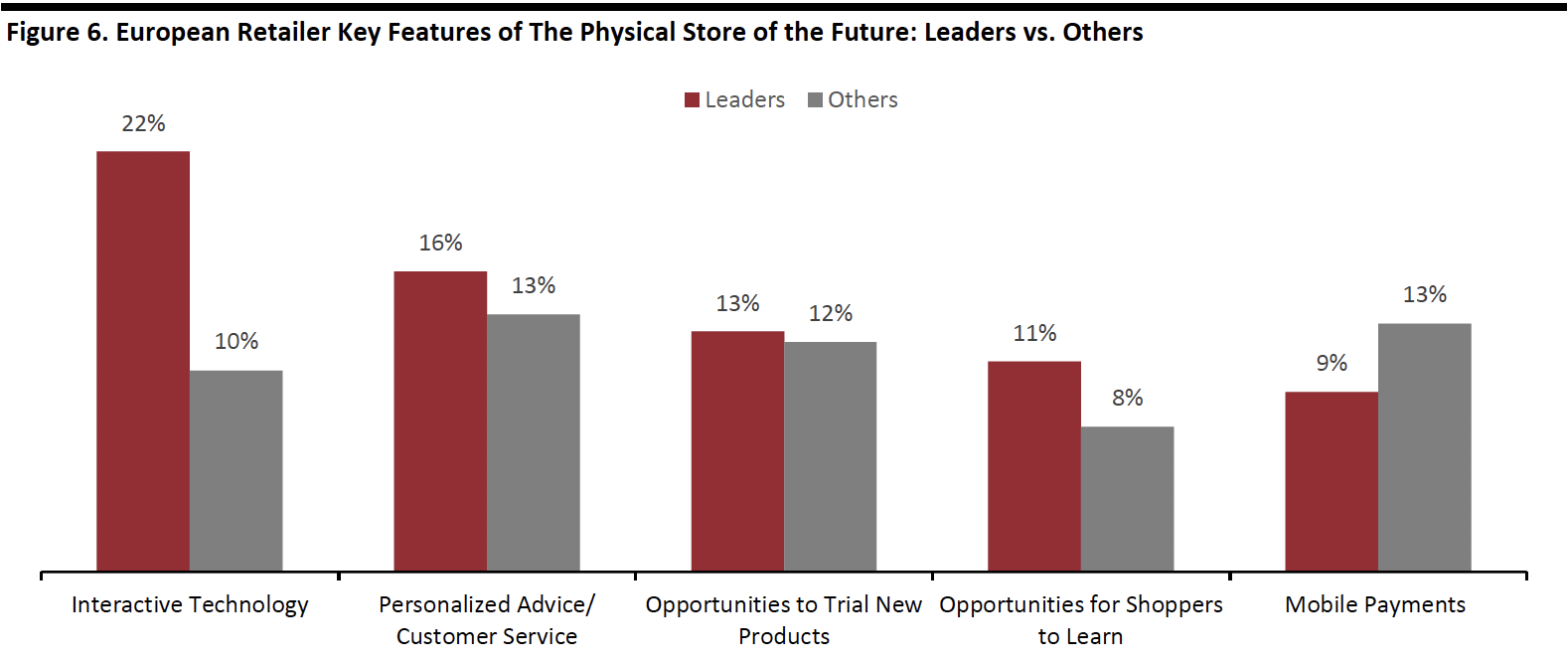

Source: Salesforce/Coresight Research[/caption] Leaders Say Stores Will Be Interactive and Service Oriented “We are sure that brick-and-mortar stores are not going to disappear. But the future is a store where the digital and offline businesses are merged." - Almudena Cárdenas, Strategic Projects Director, Tendam f.k.a. Grupo Cortefiel. The interviews with senior executives confirmed that physical stores will continue to play a key role in the future of omnichannel retailing, but they expect the role of that store to shift. In some cases, the store will evolve from a leading sales channel to a place of shopper engagement that complements digital touchpoints. Survey respondents agree, and leaders have a much clearer idea of the future role of physical stores: Response to survey question “When you think about brick-and-mortar stores in five years, what will be their most important features?” Respondents could select up to three options and rank them by importance.

Response to survey question “When you think about brick-and-mortar stores in five years, what will be their most important features?” Respondents could select up to three options and rank them by importance.

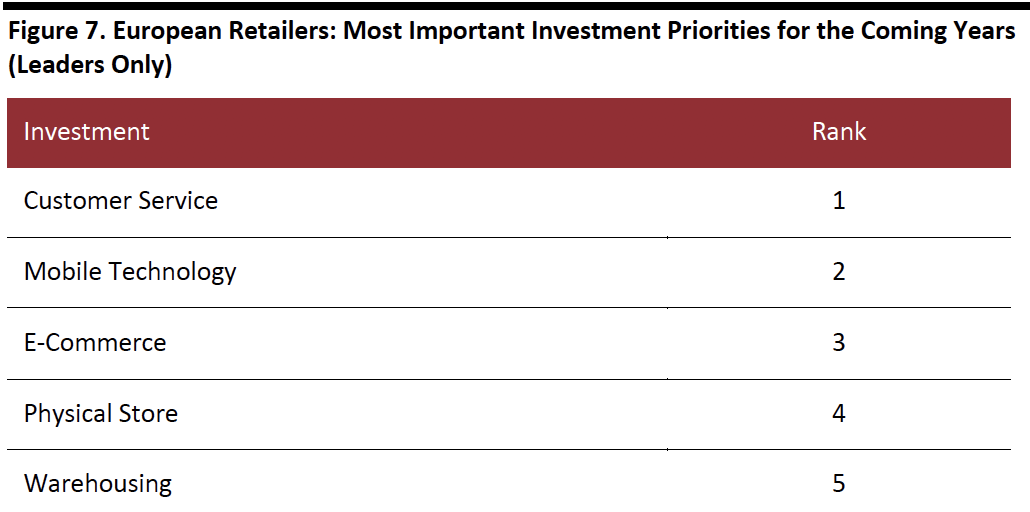

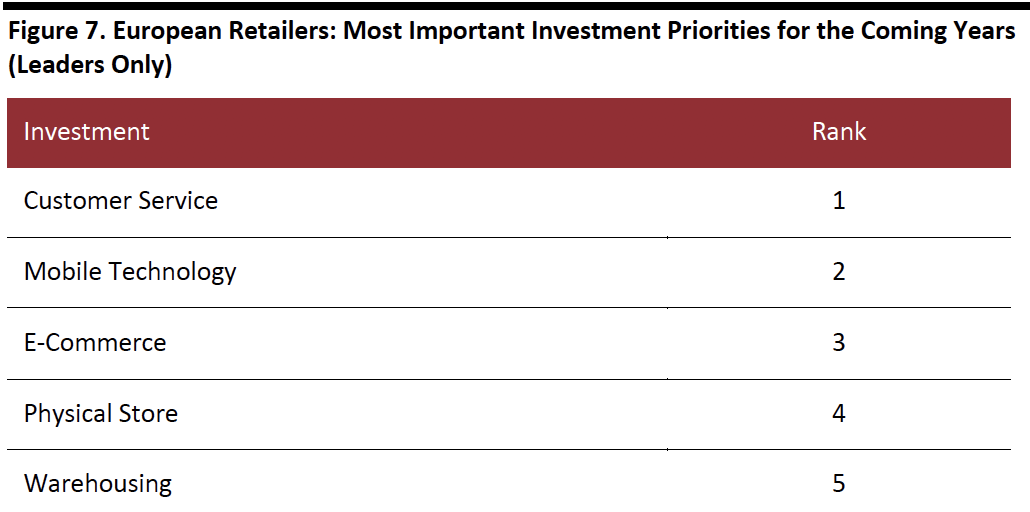

Source: Salesforce/Coresight Research[/caption] Leaders Invest in Digital Transformation to Get Closer to Customers When it comes to investment priorities over the next year, figure 7 suggests that leaders have already implemented the foundations of omnichannel: their focus now is on optimizing execution and enhancing the customer experience. “As long as you have the foundations in place – a strong platform and an easy way to manage the complexity of Europe – you can then start attacking other areas a bit more holistically, that could be by implementing the right personalization technology, or doing more user testing.” - David Williams, Senior Director, Ecommerce and Retail at Deckers Brands. Omnichannel leaders, it has been established, are customer-centric and strive to establish long-term relationships with customers, so it is not surprising that for the coming year, they have prioritized customer service as an area in which they plan to invest. Similarly, leaders seem set to continue to optimize customer-facing technologies, having chosen e-commerce as another key area of investment. According to Salesforce’s Shopping Index, growth in European online traffic overall came overwhelmingly from mobile devices in the first quarter of the year. Interestingly, UK consumers have for a long time placed more orders via mobile phone than computer, but in the quarter purchases via mobile eclipsed computers for the first time in the Netherlands, Spain, as well as the Nordics. This shows why adopting a mobile-first approach online is an increasingly critical piece of e-commerce strategies. [caption id="attachment_96400" align="aligncenter" width="500"] Response to the survey question “What are your company’s top investment areas for the coming year?” Respondents could select up to three options and rank these by importance.

Response to the survey question “What are your company’s top investment areas for the coming year?” Respondents could select up to three options and rank these by importance.

Source: Salesforce/Coresight Research[/caption] Key Considerations: Top Three Questions to Guide Your Omnichannel Journey European omnichannel leaders, despite challenges, have moved beyond implementing an omnichannel foundation and are now focused on deepening customer relationships. Leaders’ customer-centric focus in implementing omnichannel and future investment priorities suggests they are set not only to keep up with ever-changing consumer preferences but also to maintain an edge over their peers. So how does one follow the path of these omnichannel leaders? Here are three questions to help guide the journey.

1. Are your frontline staff empowered to provide personalized customer service? 25% of omnichannel leaders plan to invest in frontline training and development in the coming year. Insights from Jason Schiess, Global Ecommerce Director at Stokke AS Stokke is a Norwegian brand manufacturer of children’s furniture and accessories which provides global distribution through selected retailers in around 50 countries. Empowering Store Staff A key element to omnichannel success is ensuring the entire organization understands the importance of and buys into the strategy. For store staff, it is important that the strategy is broken down into clear functions, and that they are empowered to execute these functions and are rewarded accordingly. Jason Schiess embodies that ethos: “I think empowering the store staff is very important and you need to ensure that you take into account the complex nature of the commissions. I’ve seen it happen many times where omnichannel projects have failed because individual store staff don’t get commissions – why would they sell if they’re not incentivized?” Channel conflicts are easy to resolve as long as functions and incentives are set up in an integrated way to ensure alignment across departments and channels, according to Schiess. “Service is very important, when you go into a store you expect the store staff to be able to support you, for example, you walk in with a product and want to get an accessory, it’s not in stock but the store staff can order it online and have it delivered to you – that’s partly sales but it’s service at the end of the day.” When it comes to customer service, Schiess acknowledges it can be difficult to find service-oriented staff but empowering them with the right tools enables them to provide the level of service shoppers expect: “Having those tools to support new starters so they can be an expert with relatively little onboarding is very important,'' he said.

2. How are you monitoring consumers’ ever-changing expectations? 31% of omnichannel leaders will invest in consumer insights over the coming year. Case Study | Deckers Brands Deckers — a global footwear, apparel and accessories company — sells products in over 50 countries through select department and specialty stores, company-owned and operated retail stores and select online stores, including company-owned websites. Capturing Customer Needs and Expectations The ability to capture data about consumers and turn it into insights is an important aspect to offering a seamless omnichannel experience and keeping up with consumers’ ever-changing expectations. David Williams from Deckers agrees: “Looking to the future, retailers and brands will need to leverage consumer data better, that’s going to be the key to success. Consumer data can help inform the rest of the business where there are potential growth opportunities with new products and types of consumer.” Deckers underwent a major shift a few years ago, with the aim of putting its customers at the heart of the organization, irrespective of channel. One element to facilitating that shift was using data and insights – and those insights can come from anywhere, both inside and out of the organization: “What you can learn from the consumer. What you can learn from your staff. How can you leverage that a lot more? How can you harness that last three feet, as they call it, to really change your business? If you can utilize the outputs from store staff consumer interactions more, there are definitely opportunities there to get one over on the competition.” Of course, there are concerns around capturing customer data following the introduction of GDPR, but according to Williams, the GDPR challenges are surmountable. “GDPR didn’t make any difference to our strategy, you just have to be very vigilant about what it entails. With all these new legislations that come, we get used to it after a while and it’s really important to be cognizant to ensure that you’re on top of it all the time. The reason you collect consumer data isn’t to spy on them, it’s to try and give them as good a brand experience as possible, a personalized experience. And that hasn’t changed.”

3. What are you doing to bring customers to your stores? Own company websites, physical stores and partners are the three most common channels European retailers use, according to the survey. Case Study | Tendam f.k.a. Grupo Cortefiel Tendam is a Spanish fashion retailer that operates in over 90 markets with a footprint of 1,300 stores, 700 franchises and 2,000 points of sale. Digitizing the Store A clear point of view on the evolving retail landscape defines the omnichannel strategy for Tendam: the need to reinforce the bridge between online and offline. “People are buying more online, but those who buy online and in stores buy more.” Almudena Cárdenas and Pedro Esquivias from Tendam said. Omnichannel shoppers are said to spend more because they buy more frequently, so Tendam has been digitizing some of its stores using a clienteling approach: “One of the priorities we’re working on is piloting in certain stores how to take omnichannel into the store. How do we equip our store personnel with omnichannel tools to leverage the power that we have built for our e-commerce platform, to allow them to do more things with the customer, like provide more information on a product?” Cárdenas and Esquivias added. This enables store staff to provide better, more personalized customer service, a strategy ultimately aimed at deepening relationships with customers. “Reinforcing the bridge between the store and the e-commerce business has enormous potential and gives us a competitive advantage over online pure plays, who can’t offer a lot of the things that we offer in our physical stores. The future is a store where the digital and offline businesses are merged.” All of this is driven, in part, by the need for immediacy today’s connected shopper exhibits: “Customers want their product immediately and I think this is something that is going to get bigger,” according to Cárdenas and Esquivias.

Methodology This report is based on a survey we undertook among 470 retail and branded manufacturers (B2B and B2C) executives in retail categories excluding grocery and based in seven European geographies (the Netherlands, Germany, France, the UK, Spain, Italy and the Nordics — which include Denmark, Sweden and Norway). The survey was conducted in August 2019. We identified as “Leaders” those respondents from companies with advanced omnichannel implementation: respondents who said their company has implemented all (13) of the main omnichannel capabilities listed in the question “Which, if any, of the following omnichannel capabilities does your company currently have?” and with company turnover growth of 4% or more in the latest fiscal year. The survey data from the Salesforce study cited in Introduction: European Shoppers Demand Omnichannel Experiences was taken from the Salesforce report State of the Connected Customer - 3rd Edition (2019). These are the specific questions asked: “I have used multiple methods of communication to start and complete a single transaction (e.g., browsed for products online and purchased in-store).” Some 67% of respondents in Europe (France, Germany, Italy, Spain, Switzerland, the UK and Ireland) answered: “I won't do business with a company if I can't use my preferred method of communication.” Some 40% of respondents in Europe (France, Germany, Italy, Spain, Switzerland, the UK and Ireland) said “agree” or “strongly agree.” The survey also cited data taken from the Salesforce Q1 2019 Shopping Index.

- Almudena Cárdenas, Strategic Projects Director, Tendam f.k.a. Grupo Cortefiel.

- Pedro Esquivias, Chief Customer Officer, Tendam f.k.a. Grupo Cortefiel.

- Jason Schiess, Global E-Commerce Director, Stokke.

- David Williams, Senior Director - DTC (Ecommerce and Retail), Deckers.

Survey question summary: “How would you categorize your organization’s maturity in adopting omnichannel offerings?” Respondents could select one option only. Responses ranged from “Not a Priority” (least advanced state of adoption) to “Realization” (most advanced state of adoption).

Survey question summary: “How would you categorize your organization’s maturity in adopting omnichannel offerings?” Respondents could select one option only. Responses ranged from “Not a Priority” (least advanced state of adoption) to “Realization” (most advanced state of adoption).Source: Salesforce/Coresight Research[/caption] Further distinctions emerge when analyzing maturity by country. Only a quarter of UK retailers in our study have started implementing their omnichannel strategies. Countries such as the Netherlands and the Nordics struggled the most to make their omnichannel strategies operational: over 30% had yet to secure any type of budget. This can be attributed in part to their priorities: Nearly a tenth (8%) of Nordic decision-makers stated that omnichannel was not even on their agenda. Market and Organizational Dynamics Create Barriers to Maturity Why are so few European retailers (14%) realizing the benefits of an omnichannel strategy? European retailers and brands face the complexity of operating across distinct European countries, in addition to the same omnichannel challenges they share with their overseas counterparts. “Europe is complicated. Imagine how complex it would be if every state in America had different languages, different customs, different payments and different service providers. There’s the cultural element, then there’s the different perception of your brand in every country – and you have to manage that.” - David Williams, Senior Director, Ecommerce and Retail at Deckers Brands. Market Forces Affecting European Retailers Retailers and brands are influenced by external factors that could have an impact on their omnichannel strategies. Keeping pace with pure plays is a major factor the respondents (16%) consider when devising omnichannel strategies, possibly pressured by the disruption in the retail industry caused – in part – by pure plays and their ability to move quickly, unencumbered by legacy systems and processes. Dutch eyewear brand Ace & Tate is one such company that amassed a dedicated customer base online and, after experimenting with pop-up shops, expanded to nearly 50 physical stores across Europe. Yet the threat of agile, digitally native companies like Ace & Tate is felt by companies worldwide. Many market forces specifically impact European retailers and brands such as:

- The single market, which is the most important factor for 14% of respondents. Open trade within the European Union (EU) is designed to lead to a more efficient supply chain for retailers in the region. Interestingly, at the time of survey, UK retailers and brands, which may soon face the prospect of trading restrictions with partners in continental Europe, cited this as an important factor. Unsurprisingly, almost half (46%) of all UK respondents said a potential no-deal Brexit impacts their omnichannel strategies.

“You’re already seeing the effects of Brexit. It has affected consumer confidence – online growth is at its lowest ever. I think it would be tough for UK retailers if the majority of their business is in the UK because until it’s resolved, consumer confidence is going to remain hit.” - David Williams, Senior Director - DTC (Ecommerce and Retail), Deckers.

- The introduction of stringent data protection laws was an important market force for 13% of respondents. Data is vital to delivering seamless omnichannel experiences. Yet laws such as the General Data Protection Regulation (GDPR) have raised concerns around data capture processes and its effects on capture rates. It may be more difficult for retailers operating in the EU to leverage the data to the same extent as retailers not subject to the regulation.

“As GDPR tightens its grip, we’re introducing little hurdles that affect our customers. On the one hand, it defends their privacy. On the other, it adds annoyances. It's the little things. There’s no one big experience killer, but the combination of all these small moments that increase friction for customers.” - Pedro Esquivias, Chief Customer Officer, Tendam (f.k.a Grupo Cortefiel).

- New entrants from other geographies is the number one external pressure influencing omnichannel according to 13% of respondents. The aggressive expansion over recent years into some of Europe’s largest markets by retailers from other regions, notably Amazon, undoubtedly gives European retailers cause for concern. In 2018, for example, Amazon UK’s sales growth expressed in British pounds outpaced the country’s total Internet sales growth rate by nine percentage points, according to company reports and data from the Office for National Statistics (ONS).

Top five ranked #1 to the survey question “What macro factors are impacting your omnichannel strategy, either positively or negatively?” Respondents could select up to three options and rank these by importance.

Top five ranked #1 to the survey question “What macro factors are impacting your omnichannel strategy, either positively or negatively?” Respondents could select up to three options and rank these by importance.Source: Salesforce/Coresight Research[/caption] Data, Cost and Integration Challenges Getting omnichannel right is complex and costs money. As new channels emerge and consumer expectations continue to evolve, European retailers and brands are tasked with selecting, paying for and implementing the right technology. The survey revealed the following key challenges:

- The financial implications of implementing omnichannel are a key concern for 41% of respondents. “[Omnichannel implementation] is a huge investment. Plus, things change so fast nowadays, so the right partner today might not be the right partner in two years. Finding a partner who takes care of enough of your company’s needs to make the investment worthwhile is difficult.” - Jason Schiess, Global E-Commerce Director at Stokke.

- Capturing data about consumers is key to offering a seamless omnichannel experience and keeping up with rising expectations. However, consumers’ attitudes towards data privacy can differ across countries: retailers and brands must manage those nuances. In addition, they need to comply with European regulations, such as the GDPR. It is therefore unsurprising that data privacy and security was the top concern around omnichannel execution.

- For 38% of respondents, the complexity of integrating new technology into existing operations is a top barrier to successfully executing an omnichannel strategy.

[caption id="attachment_96396" align="aligncenter" width="500"]

Top five responses to the survey question “What are the biggest challenges to executing your omnichannel strategy?” Respondents could select up to five options and rank these by importance.

Top five responses to the survey question “What are the biggest challenges to executing your omnichannel strategy?” Respondents could select up to five options and rank these by importance.

Source: Salesforce/Coresight Research[/caption]

Percentage of participants who responded “Implemented across all store networks” for each omnichannel capability listed as options in response to the question “Which, if any, of the following omnichannel capabilities does your company currently have?”

Percentage of participants who responded “Implemented across all store networks” for each omnichannel capability listed as options in response to the question “Which, if any, of the following omnichannel capabilities does your company currently have?”Source: Salesforce/Coresight Research[/caption] The adoption rate of these capabilities by leaders is no surprise, as it is one of our definitions of an omnichannel leader. More interesting are the capabilities for which the “others” have relatively low adoption rates, and “artificial intelligence (AI)-powered personalization across channels and devices” stands out. The need to provide personalized shopping experiences across channels, and its corresponding impact on revenue, has been discussed for some time. For context, in the first quarter of 2019, 16% of global shoppers engaged with AI-powered product recommendations during visits, and those who acted on the recommendations spent 26% more than shoppers who didn’t, according to the Salesforce Shopping Index, which analyses the activity of more than 500 million shoppers. Omnichannel leaders realize that AI is no longer a nice-to-have, it is a must. Leaders Prioritize Long-Term Goals Over Short-Term Sales Increases “[Executing omnichannel] is never just money-driven. There’s always an element of being as efficient as possible. But I think for Deckers, offering more omnichannel capabilities came down to the recognition that we needed to be more consumer-centric. And to do that, we needed to have a more holistic, less siloed view of how business is done.'' - David Williams, Senior Director, Ecommerce and Retail at Deckers Brands. Short-term objectives such as increasing sales certainly remain important, but leaders see the benefits of omnichannel as more structural, strategic and long-term. Figure 5 shows leaders are mostly driven by long-term goals such as reaching new customer segments, including digital natives via social media, increasing customer lifetime value and improving operational efficiency. [caption id="attachment_96404" align="aligncenter" width="700"]

Response to the question “What are the biggest benefits you hope to receive from omnichannel retail?” Respondents could select up to three options and rank these by importance

Response to the question “What are the biggest benefits you hope to receive from omnichannel retail?” Respondents could select up to three options and rank these by importanceSource: Salesforce/Coresight Research[/caption] Leaders Say Stores Will Be Interactive and Service Oriented “We are sure that brick-and-mortar stores are not going to disappear. But the future is a store where the digital and offline businesses are merged." - Almudena Cárdenas, Strategic Projects Director, Tendam f.k.a. Grupo Cortefiel. The interviews with senior executives confirmed that physical stores will continue to play a key role in the future of omnichannel retailing, but they expect the role of that store to shift. In some cases, the store will evolve from a leading sales channel to a place of shopper engagement that complements digital touchpoints. Survey respondents agree, and leaders have a much clearer idea of the future role of physical stores:

- Interactive technology will play an important role in stores by providing information to shoppers and facilitating shopper engagement. Some 22% of leaders chose the use of interactive technology such as smart screens using AI, augmented reality (AR) and virtual reality (VR) as the most important means to engage shoppers. Mobile payments are also set to remain important, helping to deliver frictionless shopping experiences.

- Personalized customer service will shape shopping experiences in the store. Equipped with the right tools, store staff will better understand each shopper’s preferences, based on their shopping behavior, including previous browsing history. This, in turn, should enable store staff to provide more value-added services, such as one-to-one customer advice and customized assistance.

- Shoppers will visit stores for the experience, such as the opportunity to try new products or to learn more about a product. Of course, one size doesn’t fit all sectors, but luxury brands, for example, are increasingly using stores as venues for events. Some examples of retailers turning retail floor space into experience hubs include:

- Luxury retailer MatchesFashion.com has a dedicated hub in London’s Mayfair for private shopping and events.

- French beauty retailer L’Occitane drives traffic to its New York store via VR technology, making it an “immersive destination” in which shoppers can do a variety of things such as taking a virtual hot air balloon ride.

Response to survey question “When you think about brick-and-mortar stores in five years, what will be their most important features?” Respondents could select up to three options and rank them by importance.

Response to survey question “When you think about brick-and-mortar stores in five years, what will be their most important features?” Respondents could select up to three options and rank them by importance.Source: Salesforce/Coresight Research[/caption] Leaders Invest in Digital Transformation to Get Closer to Customers When it comes to investment priorities over the next year, figure 7 suggests that leaders have already implemented the foundations of omnichannel: their focus now is on optimizing execution and enhancing the customer experience. “As long as you have the foundations in place – a strong platform and an easy way to manage the complexity of Europe – you can then start attacking other areas a bit more holistically, that could be by implementing the right personalization technology, or doing more user testing.” - David Williams, Senior Director, Ecommerce and Retail at Deckers Brands. Omnichannel leaders, it has been established, are customer-centric and strive to establish long-term relationships with customers, so it is not surprising that for the coming year, they have prioritized customer service as an area in which they plan to invest. Similarly, leaders seem set to continue to optimize customer-facing technologies, having chosen e-commerce as another key area of investment. According to Salesforce’s Shopping Index, growth in European online traffic overall came overwhelmingly from mobile devices in the first quarter of the year. Interestingly, UK consumers have for a long time placed more orders via mobile phone than computer, but in the quarter purchases via mobile eclipsed computers for the first time in the Netherlands, Spain, as well as the Nordics. This shows why adopting a mobile-first approach online is an increasingly critical piece of e-commerce strategies. [caption id="attachment_96400" align="aligncenter" width="500"]

Response to the survey question “What are your company’s top investment areas for the coming year?” Respondents could select up to three options and rank these by importance.

Response to the survey question “What are your company’s top investment areas for the coming year?” Respondents could select up to three options and rank these by importance.Source: Salesforce/Coresight Research[/caption] Key Considerations: Top Three Questions to Guide Your Omnichannel Journey European omnichannel leaders, despite challenges, have moved beyond implementing an omnichannel foundation and are now focused on deepening customer relationships. Leaders’ customer-centric focus in implementing omnichannel and future investment priorities suggests they are set not only to keep up with ever-changing consumer preferences but also to maintain an edge over their peers. So how does one follow the path of these omnichannel leaders? Here are three questions to help guide the journey.

1. Are your frontline staff empowered to provide personalized customer service? 25% of omnichannel leaders plan to invest in frontline training and development in the coming year. Insights from Jason Schiess, Global Ecommerce Director at Stokke AS Stokke is a Norwegian brand manufacturer of children’s furniture and accessories which provides global distribution through selected retailers in around 50 countries. Empowering Store Staff A key element to omnichannel success is ensuring the entire organization understands the importance of and buys into the strategy. For store staff, it is important that the strategy is broken down into clear functions, and that they are empowered to execute these functions and are rewarded accordingly. Jason Schiess embodies that ethos: “I think empowering the store staff is very important and you need to ensure that you take into account the complex nature of the commissions. I’ve seen it happen many times where omnichannel projects have failed because individual store staff don’t get commissions – why would they sell if they’re not incentivized?” Channel conflicts are easy to resolve as long as functions and incentives are set up in an integrated way to ensure alignment across departments and channels, according to Schiess. “Service is very important, when you go into a store you expect the store staff to be able to support you, for example, you walk in with a product and want to get an accessory, it’s not in stock but the store staff can order it online and have it delivered to you – that’s partly sales but it’s service at the end of the day.” When it comes to customer service, Schiess acknowledges it can be difficult to find service-oriented staff but empowering them with the right tools enables them to provide the level of service shoppers expect: “Having those tools to support new starters so they can be an expert with relatively little onboarding is very important,'' he said.

2. How are you monitoring consumers’ ever-changing expectations? 31% of omnichannel leaders will invest in consumer insights over the coming year. Case Study | Deckers Brands Deckers — a global footwear, apparel and accessories company — sells products in over 50 countries through select department and specialty stores, company-owned and operated retail stores and select online stores, including company-owned websites. Capturing Customer Needs and Expectations The ability to capture data about consumers and turn it into insights is an important aspect to offering a seamless omnichannel experience and keeping up with consumers’ ever-changing expectations. David Williams from Deckers agrees: “Looking to the future, retailers and brands will need to leverage consumer data better, that’s going to be the key to success. Consumer data can help inform the rest of the business where there are potential growth opportunities with new products and types of consumer.” Deckers underwent a major shift a few years ago, with the aim of putting its customers at the heart of the organization, irrespective of channel. One element to facilitating that shift was using data and insights – and those insights can come from anywhere, both inside and out of the organization: “What you can learn from the consumer. What you can learn from your staff. How can you leverage that a lot more? How can you harness that last three feet, as they call it, to really change your business? If you can utilize the outputs from store staff consumer interactions more, there are definitely opportunities there to get one over on the competition.” Of course, there are concerns around capturing customer data following the introduction of GDPR, but according to Williams, the GDPR challenges are surmountable. “GDPR didn’t make any difference to our strategy, you just have to be very vigilant about what it entails. With all these new legislations that come, we get used to it after a while and it’s really important to be cognizant to ensure that you’re on top of it all the time. The reason you collect consumer data isn’t to spy on them, it’s to try and give them as good a brand experience as possible, a personalized experience. And that hasn’t changed.”

3. What are you doing to bring customers to your stores? Own company websites, physical stores and partners are the three most common channels European retailers use, according to the survey. Case Study | Tendam f.k.a. Grupo Cortefiel Tendam is a Spanish fashion retailer that operates in over 90 markets with a footprint of 1,300 stores, 700 franchises and 2,000 points of sale. Digitizing the Store A clear point of view on the evolving retail landscape defines the omnichannel strategy for Tendam: the need to reinforce the bridge between online and offline. “People are buying more online, but those who buy online and in stores buy more.” Almudena Cárdenas and Pedro Esquivias from Tendam said. Omnichannel shoppers are said to spend more because they buy more frequently, so Tendam has been digitizing some of its stores using a clienteling approach: “One of the priorities we’re working on is piloting in certain stores how to take omnichannel into the store. How do we equip our store personnel with omnichannel tools to leverage the power that we have built for our e-commerce platform, to allow them to do more things with the customer, like provide more information on a product?” Cárdenas and Esquivias added. This enables store staff to provide better, more personalized customer service, a strategy ultimately aimed at deepening relationships with customers. “Reinforcing the bridge between the store and the e-commerce business has enormous potential and gives us a competitive advantage over online pure plays, who can’t offer a lot of the things that we offer in our physical stores. The future is a store where the digital and offline businesses are merged.” All of this is driven, in part, by the need for immediacy today’s connected shopper exhibits: “Customers want their product immediately and I think this is something that is going to get bigger,” according to Cárdenas and Esquivias.

Methodology This report is based on a survey we undertook among 470 retail and branded manufacturers (B2B and B2C) executives in retail categories excluding grocery and based in seven European geographies (the Netherlands, Germany, France, the UK, Spain, Italy and the Nordics — which include Denmark, Sweden and Norway). The survey was conducted in August 2019. We identified as “Leaders” those respondents from companies with advanced omnichannel implementation: respondents who said their company has implemented all (13) of the main omnichannel capabilities listed in the question “Which, if any, of the following omnichannel capabilities does your company currently have?” and with company turnover growth of 4% or more in the latest fiscal year. The survey data from the Salesforce study cited in Introduction: European Shoppers Demand Omnichannel Experiences was taken from the Salesforce report State of the Connected Customer - 3rd Edition (2019). These are the specific questions asked: “I have used multiple methods of communication to start and complete a single transaction (e.g., browsed for products online and purchased in-store).” Some 67% of respondents in Europe (France, Germany, Italy, Spain, Switzerland, the UK and Ireland) answered: “I won't do business with a company if I can't use my preferred method of communication.” Some 40% of respondents in Europe (France, Germany, Italy, Spain, Switzerland, the UK and Ireland) said “agree” or “strongly agree.” The survey also cited data taken from the Salesforce Q1 2019 Shopping Index.