Nitheesh NH

What’s the Story?

On November 24, 2021, South Africa reported the identification of a new coronavirus variant to the World Health Organization (WHO). The new variant, Omicron, contains mutations that would “strongly suggest that it would be more transmissible,” Dr. Fauci told ABC News. The US has since reported its first confirmed case of the Omicron variant in California, and its eventual spread to other states has immediate and far-sighted implications for retail.Why It Matters

The introduction of a new coronavirus variant that could be more transmissible than previous variants will further complicate an already complex retail situation. Brands and retailers must be prepared for the potential impacts of the spread of Omicron in both the short and medium term.Potential Impacts of Omicron on US Retail: Coresight Research Analysis

Immediate-Term Implications Much about the new variant of Covid-19 is still to be determined—and that uncertainty is likely to be a driver of some shifts in consumer behavior in the near term. US President Biden announced on November 29, 2021, that his administration expects to learn more about Omicron in the next two weeks. In the meantime, the reigning uncertainty has heightened consumer concern surrounding the winter wave of Covid-19 infections.- Coresight Research’s latest weekly US Consumer Tracker survey, undertaken on November 29, recorded significant week-over-week declines in consumer visits to restaurants and coffee shops, which could indicate an immediate consumer reaction to pull back from public places with a negative impact on services spending.

- Any slowdown in service spending during the remainder of the holiday season would prove a net benefit to retail as consumers redirect spending toward goods. This would largely benefit discretionary categories, but grocery would also get a boost from any pullback on dining out. Restaurants and bars saw sales of $74 billion in October 2021, per the Census Bureau, so even a relatively modest percentage decline across December would likely inject a few billion dollars extra into grocery spend (even allowing for food being cheaper at retail than in restaurants).

- Any widespread consumer caution about visiting public places should bolster e-commerce growth in the immediate future, including online sales of groceries, where demand has proved solid this year.

- In the immediate future, some travel plans are likely to be postponed or canceled as at least some international travel restrictions have been reintroduced. The US has implemented a temporary closing of its borders to flights arriving from Southern Africa, while countries such as Japan and Israel have closed their borders entirely. Given international travel tends to be booked and paid for well in advance, we do not see a meaningful near-term boost to retail from any such reduction in travel.

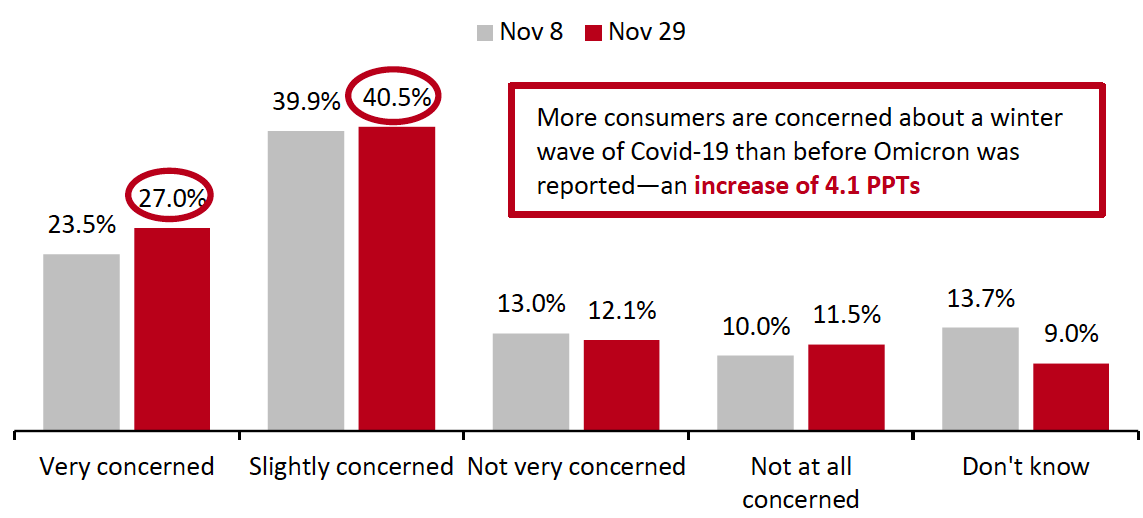

- Increased consumer avoidance of public places: After the news broke about the Omicron variant, Coresight Research surveyed US consumers about whether they are concerned about a winter wave of Covid-19 infections. Our November 29, 2021, survey found that 67.5% of respondents are slightly or very concerned, compared to 63.4% before news of the Omicron variant broke (in our November 8, 2021, survey)—see Figure 1. One way for consumers to act on these concerns is to increase their avoidance of public spaces. Our consumer surveys found a 4.4-percentage-point (PPT) rise in the proportion of respondents who expect to increase their avoidance of public places this winter. See next week’s US Consumer Tracker report for full details of anticipated avoidance.

Figure 1: Whether US Consumers Are Concerned About a Winter Wave of Covid-19 Infections (% of Respondents) [caption id="attachment_137236" align="aligncenter" width="700"]

Base: 469 US respondents aged 18+, surveyed on November 8, 2021; 445 US respondents aged 18+, surveyed on November 29, 2021

Base: 469 US respondents aged 18+, surveyed on November 8, 2021; 445 US respondents aged 18+, surveyed on November 29, 2021Source: Coresight Research[/caption]

- Sustained e-commerce growth: Should the Omicron variant lead to another consumer retreat from public spaces, we expect any such behavior to contribute to sustained e-commerce growth, specifically in the online grocery and instant-needs sector. Another shift to online grocery from consumers that had ventured back into stores could signal a more permanent change for the sector.

- Global supply chain shortages: Omicron could further complicate global supply chain challenges. In 2021, we have already witnessed lockdowns in key ports in China and Vietnam due to Covid-19 outbreaks in those countries. The introduction of a new, even more transmissible variant increases the likelihood that we could see more port closures in the coming months, leading to further backlogs, shipping delays and product shortages.

What We Think

There is still much to be determined about the new Omicron coronavirus variant, including the effectiveness of vaccines and booster shots and whether it will cause more severe illness. More clear answers to these questions will likely affect the retail picture moving forward. Uncertainty is typically a meaningful drag on total consumer discretionary spending. However, this time any near-term shifts in consumer behavior, such as avoidance of public places, will be well-rehearsed—consumers may roll their eyes, seek to reduce their exposure to public places and otherwise carry on much like they have so far. In addition, US consumers still have massive firepower in the form of savings banked during the crisis: From BEA data, Coresight Research calculates that US consumers accrued an additional $2.7 trillion in savings between the start of 2020 and September 2021. That is over and above typical precrisis net savings, and it represents a huge store of potential discretionary spending—and is likely to be a major buttress against a softening in spending. Still, the presence of Omicron will likely have implications for retail moving forward.- With consumers likely to be more cautious in service spending and traveling during the holidays, retail could benefit from increased spending on goods.

- A consumer retreat from public spaces—even short-term—could see shoppers avoid shops and malls, damaging physical store traffic but providing a renewed boost to e-commerce—particularly in the grocery and instant-needs space.

- Should the health risk prove elevated, those consumer shifts are likely to endure through the winter. Added to them could be further challenges in the global supply chain, as port closures and air freight delays may occur due to new outbreaks.