DIpil Das

[caption id="attachment_90098" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

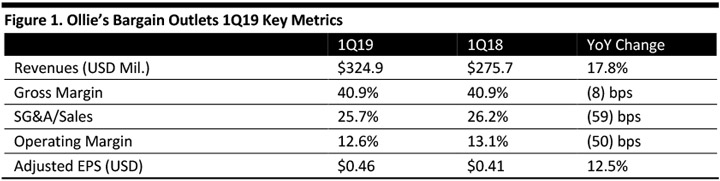

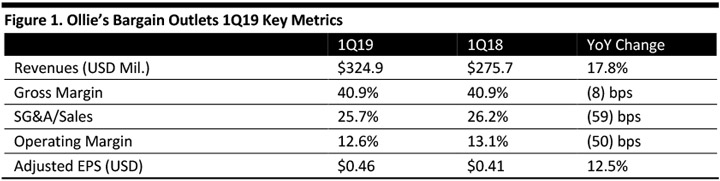

Ollie’s reported 1Q19 revenues of $324.9 million, up 17.8% and beating the $319.2 million consensus estimate. The sales increase was driven by a 17.4% increase in the store count and a 0.8% increase in comparable sales.

Gross margin was 40.9%, consistent with the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales remained flat compared to last year.

Comps increased 0.8%, down from 1.9% in the year-ago quarter and missing the 1.2% consensus estimate.

Adjusted EPS was $0.46, up 12.5% and beating the consensus estimate by 2 cents, excluding insurance settlement gain, non-cash stock-based compensation expense and non-cash purchase accounting items. GAAP EPS was $0.59, up 27.2% from $0.46 in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ollie’s reported 1Q19 revenues of $324.9 million, up 17.8% and beating the $319.2 million consensus estimate. The sales increase was driven by a 17.4% increase in the store count and a 0.8% increase in comparable sales.

Gross margin was 40.9%, consistent with the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales remained flat compared to last year.

Comps increased 0.8%, down from 1.9% in the year-ago quarter and missing the 1.2% consensus estimate.

Adjusted EPS was $0.46, up 12.5% and beating the consensus estimate by 2 cents, excluding insurance settlement gain, non-cash stock-based compensation expense and non-cash purchase accounting items. GAAP EPS was $0.59, up 27.2% from $0.46 in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ollie’s reported 1Q19 revenues of $324.9 million, up 17.8% and beating the $319.2 million consensus estimate. The sales increase was driven by a 17.4% increase in the store count and a 0.8% increase in comparable sales.

Gross margin was 40.9%, consistent with the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales remained flat compared to last year.

Comps increased 0.8%, down from 1.9% in the year-ago quarter and missing the 1.2% consensus estimate.

Adjusted EPS was $0.46, up 12.5% and beating the consensus estimate by 2 cents, excluding insurance settlement gain, non-cash stock-based compensation expense and non-cash purchase accounting items. GAAP EPS was $0.59, up 27.2% from $0.46 in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ollie’s reported 1Q19 revenues of $324.9 million, up 17.8% and beating the $319.2 million consensus estimate. The sales increase was driven by a 17.4% increase in the store count and a 0.8% increase in comparable sales.

Gross margin was 40.9%, consistent with the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales remained flat compared to last year.

Comps increased 0.8%, down from 1.9% in the year-ago quarter and missing the 1.2% consensus estimate.

Adjusted EPS was $0.46, up 12.5% and beating the consensus estimate by 2 cents, excluding insurance settlement gain, non-cash stock-based compensation expense and non-cash purchase accounting items. GAAP EPS was $0.59, up 27.2% from $0.46 in the year-ago quarter.

Details from the Quarter

- Management commented this was the 20th consecutive quarter of positive comps, and claimed broad-based strength across its merchandise categories.

- Ollie’s opened 21 stores during the quarter, ending the quarter with 324 stores in 23 states, an increase of 17.4% year over year.

- Operating margin declined 50 basis points to 12.6% in the quarter, compared to 13.1% in the year-ago quarter. Adjusted operating margin was 12.4%, down 70 basis points, after adjusting for an insurance settlement gain of $565,000.

- Inventory increased 19.2% at the end of the quarter compared to the year-ago quarter, mainly attributed to growth in new stores and the timing of deal flow.

- Capital expenditure rose to $20.1 million in the quarter, compared to $4.7 million in the same quarter last year, due mainly to investments in a third distribution center, new stores and maintenance capital.

- Revenues of $1.44-1.45 billion, up 16-17% and in line with the $1.45 billion consensus.

- Opening 42-44 new stores and no planned relocations or closures.

- Comps to increase 1-2%.

- Adjusted EPS of $2.13-2.17, up 16-19% and in line with the $2.15 consensus estimate.

- Capital expenditure of $75-80 million.