albert Chan

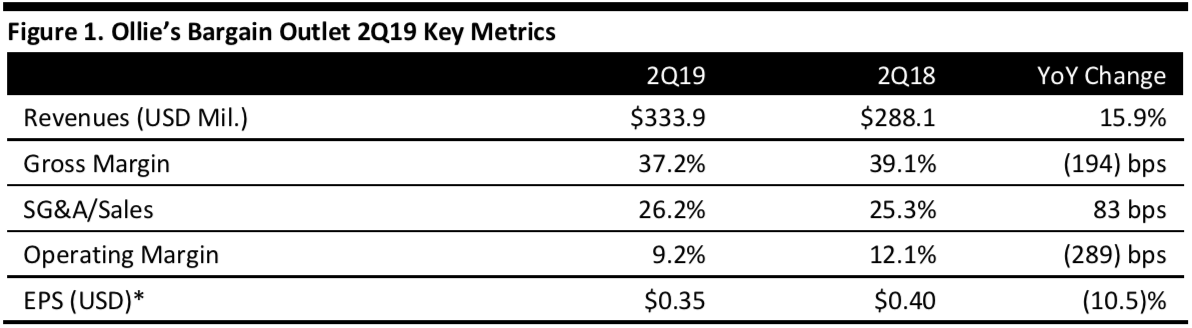

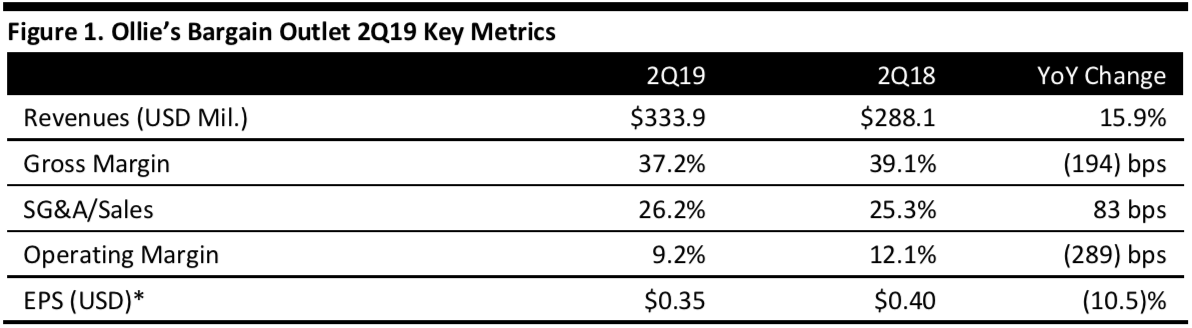

[caption id="attachment_95459" align="aligncenter" width="700"] *EPS is adjusted for tax benefits pertaining to stock-based compensation Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ollie’s reported 2Q19 revenues of $333.9 million, up 15.9% but missing the $339.8 million consensus estimate. The sales increase was driven by strong performance in new stores.

Gross margin was 37.2%, down 194 basis points versus the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales compared unfavorably to last year.

Comps decreased 1.7%, compared to a 4.4% increase in the year-ago quarter and short of the 1.9% consensus estimate.

Adjusted EPS was $0.35, down 10.5% and missing the consensus estimate by 11 cents, excluding tax benefits pertaining to stock-based compensation. GAAP EPS was $0.38, down 16.2% from $0.45 in the year-ago quarter.

Details from the Quarter

*EPS is adjusted for tax benefits pertaining to stock-based compensation Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ollie’s reported 2Q19 revenues of $333.9 million, up 15.9% but missing the $339.8 million consensus estimate. The sales increase was driven by strong performance in new stores.

Gross margin was 37.2%, down 194 basis points versus the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales compared unfavorably to last year.

Comps decreased 1.7%, compared to a 4.4% increase in the year-ago quarter and short of the 1.9% consensus estimate.

Adjusted EPS was $0.35, down 10.5% and missing the consensus estimate by 11 cents, excluding tax benefits pertaining to stock-based compensation. GAAP EPS was $0.38, down 16.2% from $0.45 in the year-ago quarter.

Details from the Quarter

*EPS is adjusted for tax benefits pertaining to stock-based compensation Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ollie’s reported 2Q19 revenues of $333.9 million, up 15.9% but missing the $339.8 million consensus estimate. The sales increase was driven by strong performance in new stores.

Gross margin was 37.2%, down 194 basis points versus the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales compared unfavorably to last year.

Comps decreased 1.7%, compared to a 4.4% increase in the year-ago quarter and short of the 1.9% consensus estimate.

Adjusted EPS was $0.35, down 10.5% and missing the consensus estimate by 11 cents, excluding tax benefits pertaining to stock-based compensation. GAAP EPS was $0.38, down 16.2% from $0.45 in the year-ago quarter.

Details from the Quarter

*EPS is adjusted for tax benefits pertaining to stock-based compensation Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ollie’s reported 2Q19 revenues of $333.9 million, up 15.9% but missing the $339.8 million consensus estimate. The sales increase was driven by strong performance in new stores.

Gross margin was 37.2%, down 194 basis points versus the year-ago quarter as both merchandise margin and supply chain costs as a percentage of net sales compared unfavorably to last year.

Comps decreased 1.7%, compared to a 4.4% increase in the year-ago quarter and short of the 1.9% consensus estimate.

Adjusted EPS was $0.35, down 10.5% and missing the consensus estimate by 11 cents, excluding tax benefits pertaining to stock-based compensation. GAAP EPS was $0.38, down 16.2% from $0.45 in the year-ago quarter.

Details from the Quarter

- Management commented that comparable sales in the quarter were impacted considerably by cannibalization of sales by Toys “R” Us locations that the company acquired last year; the normalization of some store classes that reported strong productivity last year as they entered the comp store base; and, reduced comp store inventory levels through most of the quarter.

- Ollie’s opened eight stores during the quarter, ending the quarter with 332 stores in 23 states, an increase of 17.7% year on year.

- Operating margin declined 289 basis points to 9.2% in the quarter, compared to 12.1% in the year-ago quarter, owing to a decline in gross margin and the deleveraging of SG&A.

- Inventory increased 23.4% at the end of the quarter compared to the year-ago quarter, mainly attributed to growth in new stores and the timing of deal flow.

- Capital expenditure grew to $20.2 million in the quarter, compared to $5.5 million in the same quarter last year, due mainly to investments in the company’s third distribution center, new stores and maintenance capital.

- Revenues of $1.42-1.43 billion, up 14-15% and in line with the $1.43 billion consensus, down from the $1.44-1.45 billion guidance provided in 1Q19.

- Opening 42 new stores and no planned relocations or closures.

- Comps to decrease 0.5-1.5%, revised down from previous guidance of an increase of 1-2%.

- Adjusted EPS of $1.95-2.00, up 7-9% and below the $2.05 consensus estimate; down from previous guidance of $2.13-2.17.

- Capital expenditure of $75-80 million.