Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

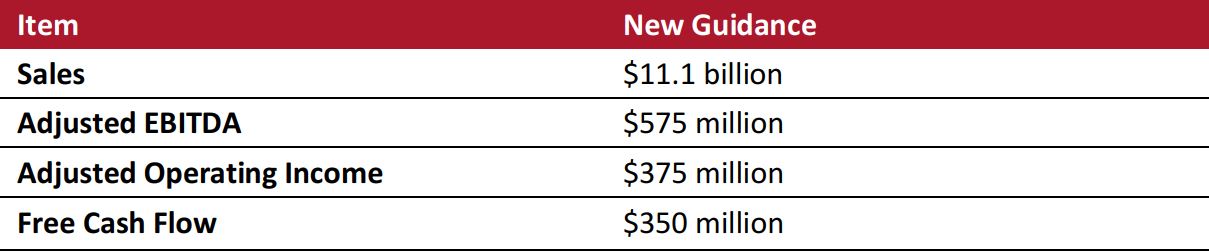

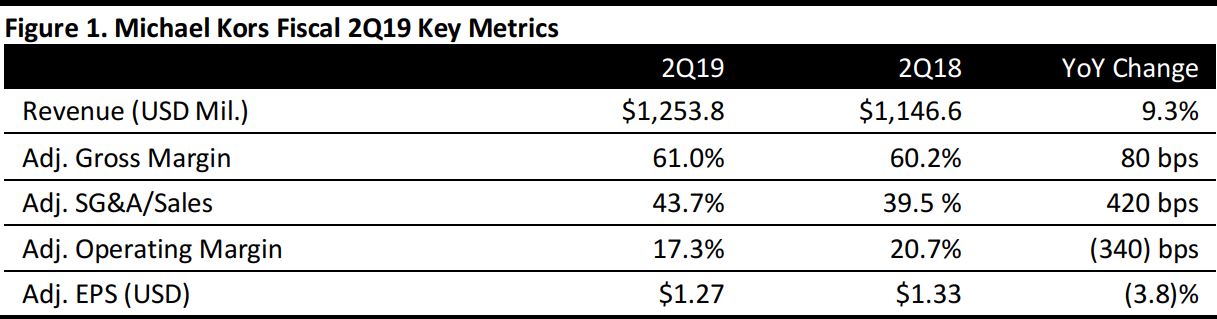

3Q18 Results

Office Depot reported 3Q18 revenues of $2.89 billion, up 10.2% year over year and beating the consensus estimate of $2.83 billion.

Sales increased by 6% as reported and by 1% organically in the Business Solutions division. Services revenues increased by 28% in that division and by 11% in the Retail division. Retail sales declined by 6% as reported and by 5% according to a new revenue recognition standard.

Adjusted EPS was $0.13, beating the consensus estimate by a penny.

Results by Segment

- Business Solutions: Sales totaled $1.4 billion in 3Q18, up 6% year over year. The growth reflects the impact of acquisitions and e-commerce growth. Sales were up by approximately 1% organically year over year, with the improvement primarily driven by growth in adjacency products, core supplies and services. Product sales in the quarter increased by 5%, while services revenue increased by 28% year over year.

- Retail: Sales totaled $1.3 billion in the quarter, down 6% year over year. Planned store closures and adoption of a new revenue recognition standard contributed to the reported decline. Sales declined by 5% excluding the change in revenue recognition. Product sales declined by 7%, while services revenue increased by 11% year over year, primarily due to fewer transactions in the quarter.

- CompuCom: Office Depot had not yet acquired CompuCom in the year-ago period. Reported sales for CompuCom were $268 million in the quarter, down 4% from $280 million a year ago, primarily related to lower sales from one of the division’s largest customers, which is currently undergoing a reorganization. Excluding this customer’s impact, sales were approximately flat year over year.

Details from the Quarter

Management commented that it is making progress on its strategy and that a primary focus during this phase of the company’s transformation is to recapture top-line sales growth and strengthen its core. The Business Solutions division delivered its best quarter in over a decade, with sales up 6% as reported and up 1% organically. Investments in building services capabilities are also continuing to pay off, as services revenues grew by double digits again in both the Business Solutions and Retail divisions. Management believes that it is pursuing the right strategy to drive sustainable, profitable growth in the future.

Other key points:

- In the quarter, the company strengthened its core business and drove strong results in the Business Solutions division, with sales growing on both an organic and total basis. The company continues to grow high-margin services businesses, driving double-digit sales increases in services in both the Business Solutions and Retail segments.

- The company continues to invest in the expansion of its distribution and supply chain network capabilities, the backbone of its business and one of its key assets.

- The acquisition of CompuCom played a major role in overall year-over-year growth, and management saw improving trends in its core business.

- The growing B2B business continues to be the largest segment, representing approximately 60% of total revenue.

- Retail sales trends improved by 500 basis points, as sales were down 5% year to date versus down 10% during the same year-to-date period a year ago. These improvements helped offset lower revenue at CompuCom.

- Total services revenue more than doubled from a year ago. While much of this increase came from the CompuCom acquisition, services revenue growth accelerated across the Business Solutions and Retail divisions, which grew by a combined 17% in the quarter. This performance is a result of the traction in the enhanced services and subscription-based offerings that the company began rolling out earlier this year.

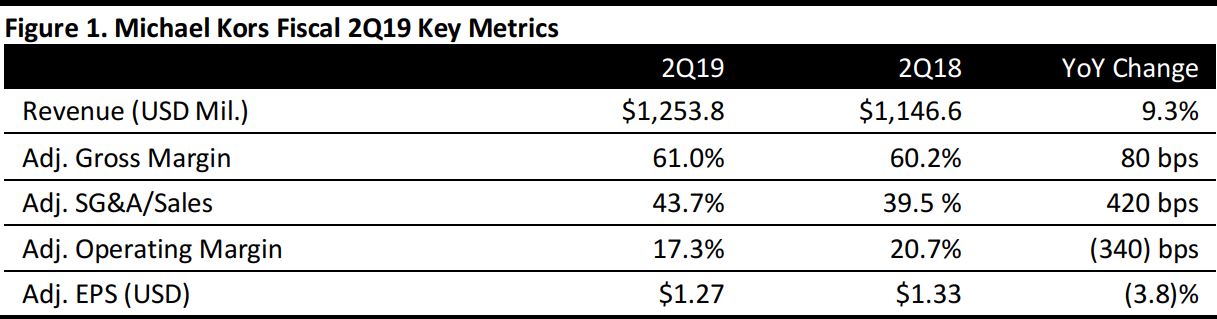

Outlook

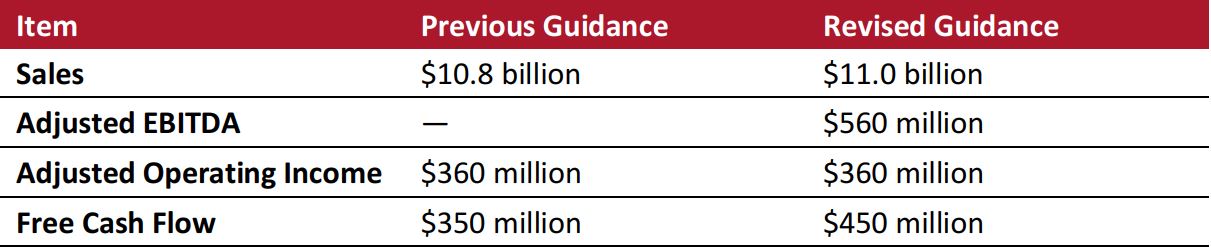

Office Depot updated and raised its FY18 guidance as follows (figures are approximate):

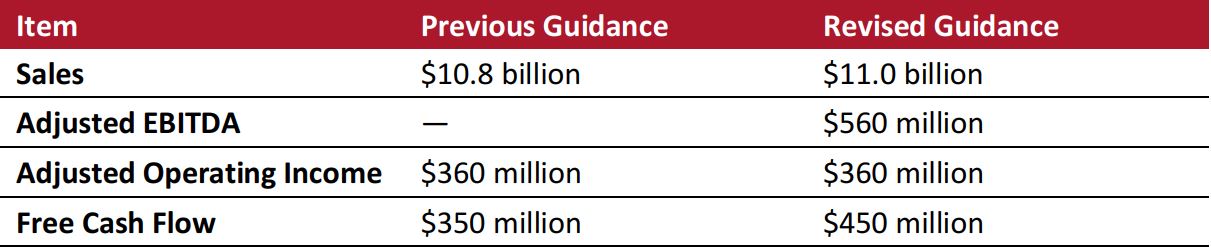

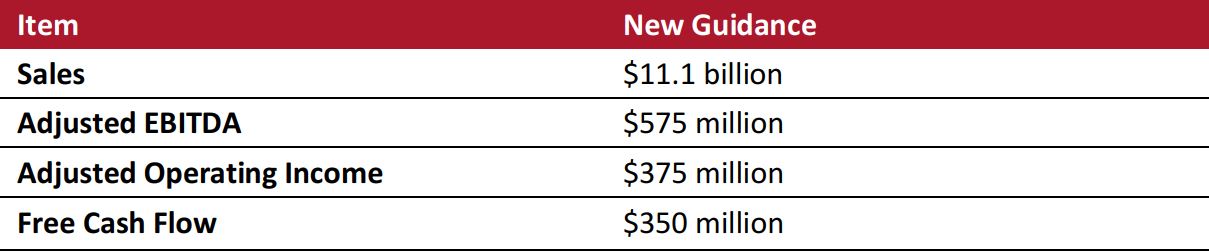

For FY19, the company introduced the following guidance:

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research For FY19, the company introduced the following guidance:

For FY19, the company introduced the following guidance: