DIpil Das

US Retail Sales: October 2021

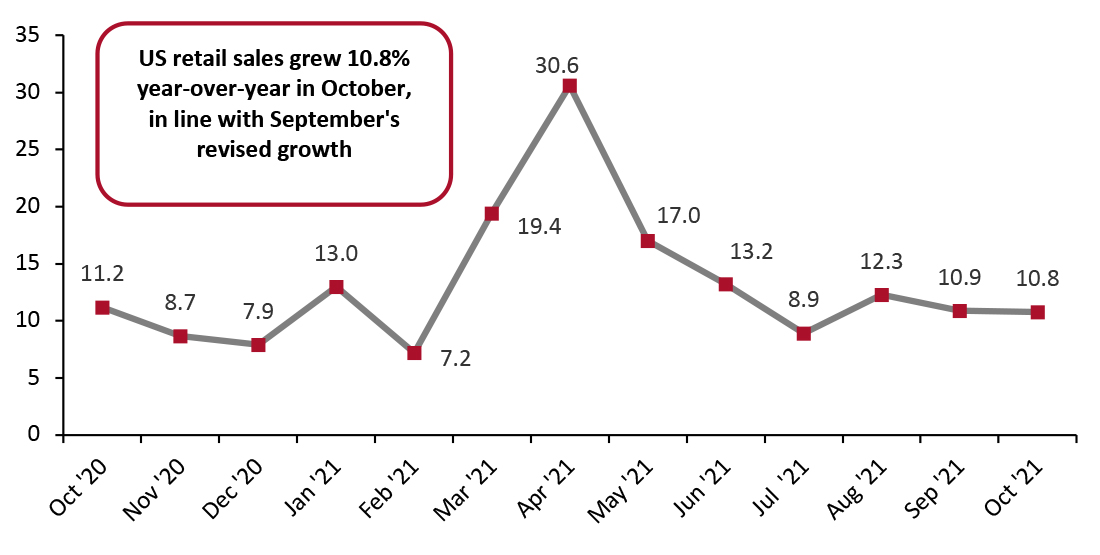

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric remained healthy at 10.8% in October, approximately in line with last month’s 10.9% revised growth, as reported by the US Census Bureau on November 16, 2021. Retail sales growth was strong in October, despite the month also seeing declining consumer sentiment and the largest increase in consumer prices in 30 years. Retail sales figures in October were likely boosted by an earlier start to the holiday shopping season, as our weekly consumer survey data in October showed an increase in respondents expecting to start holiday shopping earlier this year. Sales growth this month was led by strong year-over-year increases at department stores, miscellaneous store retailers, clothing and clothing accessory stores, and electronics and appliance stores.Figure 1. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change [caption id="attachment_136404" align="aligncenter" width="725"]

Data are not seasonally adjusted

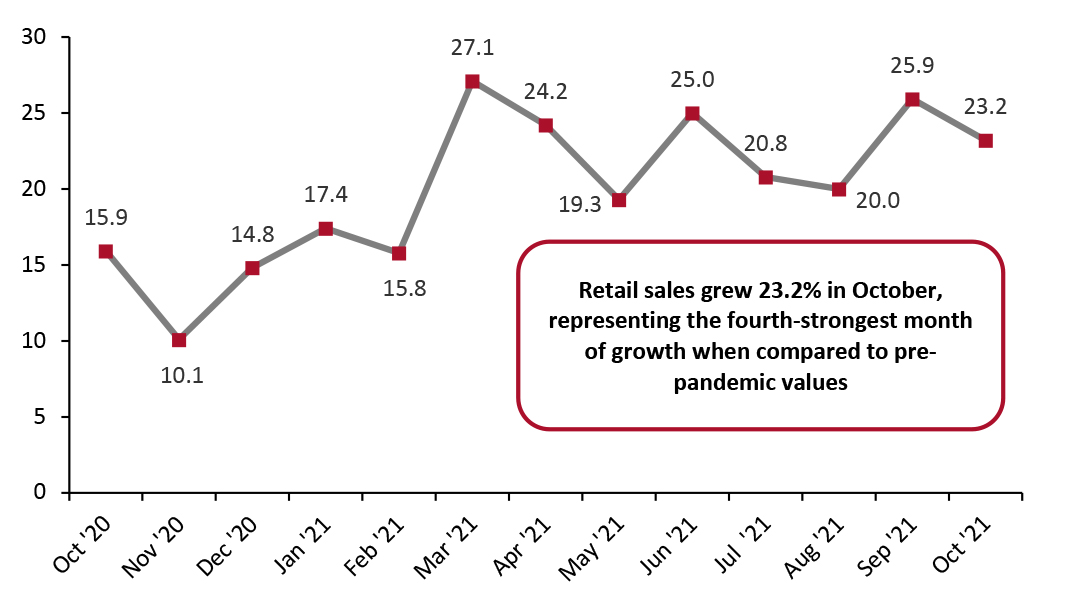

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Against the more consistent comparatives of 2019, October retail sales maintained momentum from September. Retail sales grew 23.2% from 2019 values in October, slightly down from September’s 25.9% revised two-year growth. On a two-year basis, October represents the fourth-strongest month of growth compared to pre-pandemic values.

Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: % Change from Two Years Prior [caption id="attachment_136406" align="aligncenter" width="726"]

Source: US Census Bureau/Coresight Research[/caption]

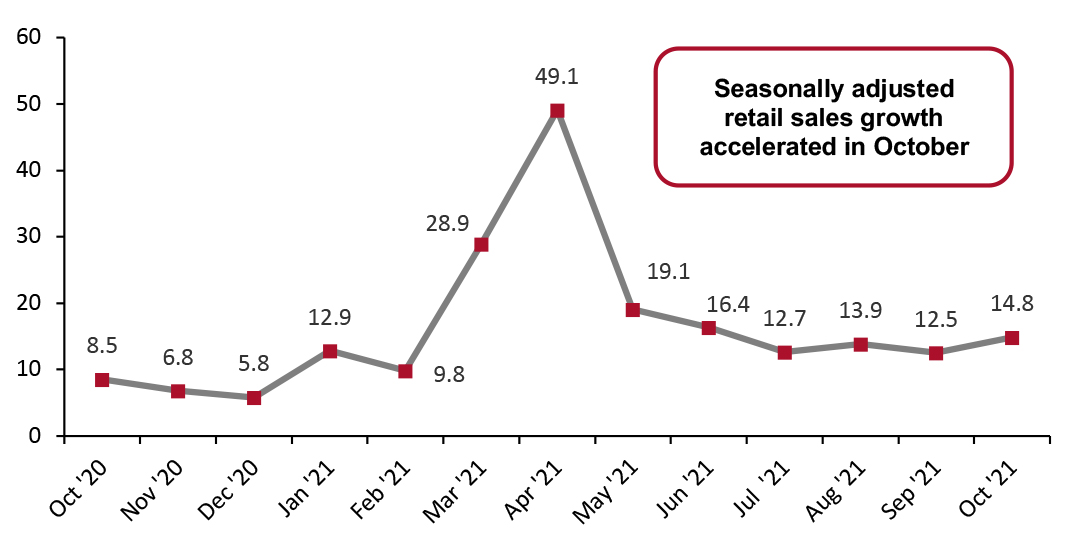

Seasonally adjusted retail sales, including automobiles and gasoline, grew 14.8% year over year, picking up speed from September’s 12.5% growth. In October, the sales of motor vehicles increased from September, even amid the global semiconductor shortage, pointing to high demand for second-hand vehicles.

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusted retail sales, including automobiles and gasoline, grew 14.8% year over year, picking up speed from September’s 12.5% growth. In October, the sales of motor vehicles increased from September, even amid the global semiconductor shortage, pointing to high demand for second-hand vehicles.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: Seasonally Adjusted YoY % Change [caption id="attachment_136407" align="aligncenter" width="725"]

Data are seasonally adjusted

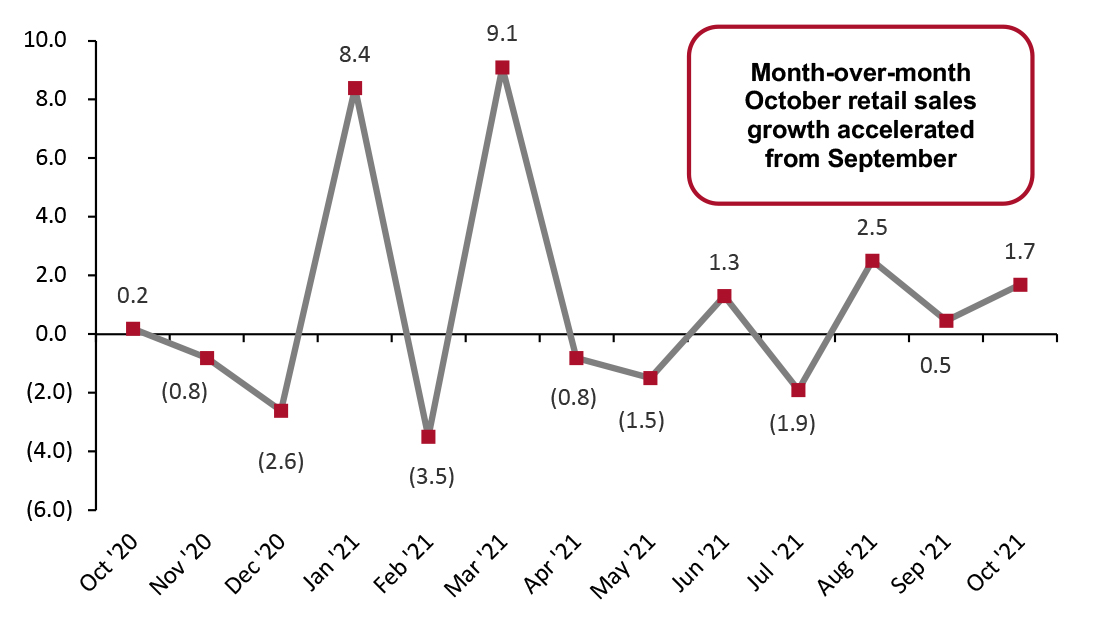

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Sales Slightly Increase Month over Month On a month-over-month basis, seasonally adjusted sales (excluding automobiles and gas) increased by 1.7% in October, gaining speed from the 0.5% revised September figure. October’s strong retail sales continue the overall positive trend of high retail sales as we push into the peak of what we expect to be a very strong holiday season, with sales increases of 9%–10% versus 2020.

Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_136408" align="aligncenter" width="725"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Although overall retail sales saw double-digit sales growth from October 2020, the spread of Covid-19 through the US last spring hit some sectors much harder than others. To control for the effects of the pandemic in 2020’s retail sales figures, we largely compare October 2021 sales to pre-pandemic October 2019 sales in this section. In a very strong month, several sectors saw sales growth of 15% or more from 2019 levels:

- Sporting goods and hobby store sales rose 38.7% from 2019 values. Compared to 2020 values, the sector saw growth of 16.5% year over year.

- Nonstore retailers continued to thrive in October, with sales growing 34.1% from 2019 values. This sector saw sales growth of 7.4% from 2020, against stronger comparatives from a period when pandemic restrictions forced many people to make purchases online. Continued surges in this sector, even as stores across the country are now open without restrictions, indicate that e-commerce is continuing to grow in 2021.

- Miscellaneous store retailers saw solid sales growth of 31.2% from 2019, a slowdown from September’s 35.3% two-year growth.

- Furniture and home-furnishings stores—which did not perform nearly as well as home-improvement retailers amid the Covid-19 outbreak—continued their strong performance, recording growth of 18.5%in October 2021 compared to October 2019.

- General merchandise stores saw sales growth of 24.2% on a two-year basis. The department stores subsector showed strong growth of 17.6% compared to pre-pandemic values. As more workers return to the office, it is likely they are stopping in stores to browse and purchase items.

- Food and beverage stores continued to see elevated sales, rising 19.3% from 2019 levels while year-over-year growth stood at 7.6%. Grocery stores saw 19.2% growth from 2019 and8.3% growth from 2020.

- Clothing and clothing accessories stores saw solid sales growth of 15.2% from 2019 levels and 22.7% growth compared to weaker 2020 comparatives. This supports our expectation of strong recovery in the overall US apparel and footwear market in 2021.

- Electronics and appliance stores saw sales rise 13.6% in October from 2019 values, a substantial increase from September’s 7.1% two-year growth. Consumers have spent well on electronics throughout the pandemic. For much of 2020, they directed their spending away from specialty electronics retailers to online-only rivals. The increase in the two-year growth rates may be related to the earlier-than-usual holiday demand.

Figure 5. US Total Retail Sales, by Sector: YoY % Change from 2020 (Top) and 2019 (Bottom) [wpdatatable id=1446 table_view=regular] [wpdatatable id=1447 table_view=regular]

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research