albert Chan

China Retail Sales: October 2021

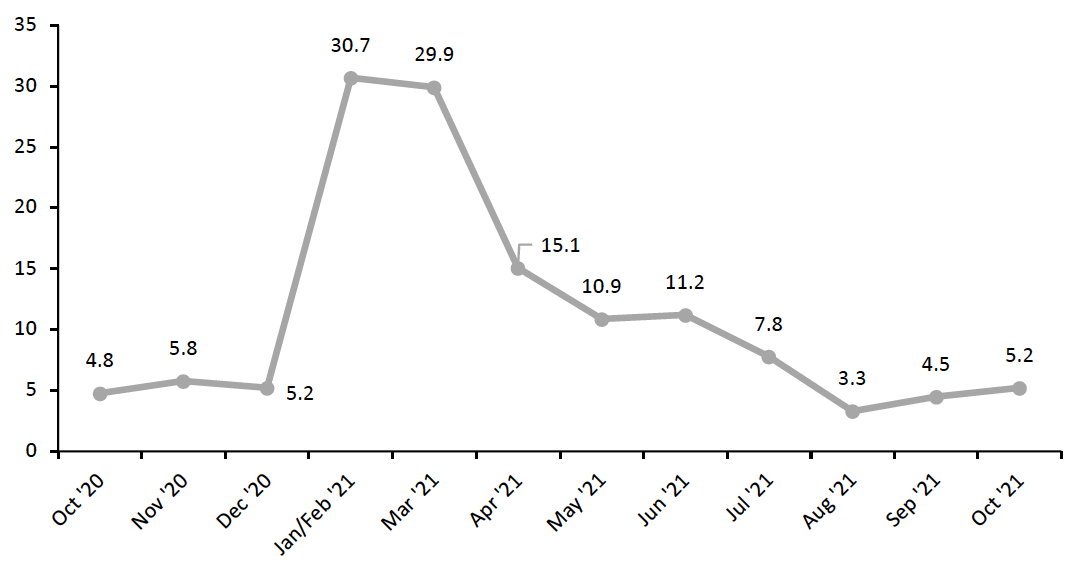

In October, China’s total retail sales growth (excluding food service, including automobiles and gasoline) increased 5.2% year-over-year. October’s retail sales growth marks the second consecutive month of sales acceleration. However, the persistent low-mid single digit growth rate indicates that China’s economic recovery is facing challenges.

Alibaba and JD.com both kicked off their Singles’ Day campaigns in October this year, with their first pre-sale periods beginning on October 20 and likely supporting total retail demand during the month (even if not amplifying the year-over-year pace of change; Alibaba extended its Singles’ Day event into October in 2020). Meanwhile, the number of Covid-19 cases in China ticked back up in October, likely dampening household consumption during the month. The government’s zero-tolerance approach to Covid-19 infections, in addition to supply chain bottlenecks caused by natural disasters and earlier Covid-19 outbreaks, poses headwinds to future retail growth. We anticipate that retail sales will continue to grow by single digits in the coming months, as growth momentum in China has slowed.

Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_136441" align="aligncenter" width="550"]

January and February figures are reported together

January and February figures are reported togetherSource: National Bureau of Statistics/Coresight Research[/caption] Retail Sales Growth by Sector

In October, five sectors saw double-digit year-over-year growth, as overall retail sales slightly accelerated for the second consecutive month. However, some notable sectors did see declines.

- Communication equipment posted a second consecutive strong month in October, growing 34.8% year-over-year—its second straight month of growth exceeding 20%, after a year-over-year decline in August.

- Although school supplies, office supplies and computers saw sales growth decelerate in October, sales increases remained in the double digits, growing by 11.5% year over year or 29.9% on a two-year basis.

- The apparel and footwear sector posted a sales decline for the third consecutive month. In October, the sector saw sales decline by 3.3% year over year. However, it did post 6.4% growth from 2019 pre-pandemic values.

- Furniture sales growth has decelerated for the fourth consecutive month, while remaining positive against weak year-over-year comparatives. Furniture sales increased by 2.4% year over year, but were down 14.6% compared to the same period in 2019.

- The food sector performed strongly in October, accelerating slightly from September and exhibiting 9.9% year-over-year growth. On a two-year basis, food retail sales increased by 14.0%.

- The beauty sector appears to be picking up speed as we head towards the end of 2021. After a flat August, the beauty sector has seen sales growth accelerate for two consecutive months, up to 7.2% year-over-year growth in October. On a two-year basis, the sector saw sales increase by a strong 32.6%.

- Household appliance purchases also appear to be gaining speed. After seeing sales decline in August, this sector has seen solid single-digit growth for two consecutive months. In October, household appliance purchases increased 9.5% compared to October 2020 and 8.4% compared to October 2019.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY % Change and Two-Year % Change [wpdatatable id=1456 table_view=regular]

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics

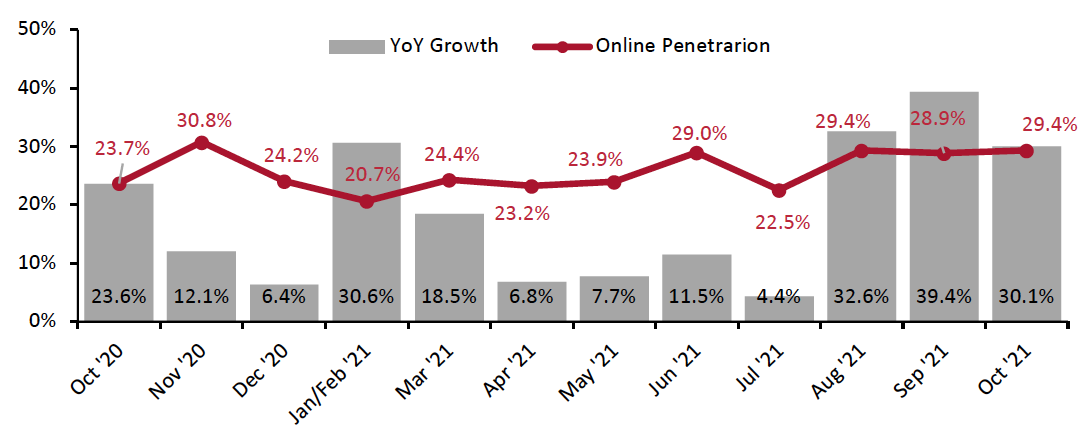

Online Retail Sales Account for 29.4% of All Retail Sales

E-commerce has been the bright spot in recent months, even as total retail growth has proved underwhelming. In October, online retail sales growth in China remained strong, although it fell from last month’s peak. Online retail sales grew by 30.1% year over year, down from September’s 39.4% year-over-year growth. The channel accounted for 29.4% of total retail sales in the period, remaining in line with August and September, and maintaining some of the highest levels of online sales penetration seen in 2021. The kick-off of Singles’ Day in October will have supported this raised penetration rate and strict Covid restrictions enforced by the government to control infections are likely to have contributed, too.

Online retail sales include food service, as the National Bureau of Statistics does not provide online data that exclude food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales (YoY % Change) as a Proportion of Total Retail Sales (%) (incl. Automobiles, Gas and Food Service) [caption id="attachment_136442" align="aligncenter" width="550"]

Online retail sales include food service

Online retail sales include food serviceJanuary and February figures are reported together

Source: National Bureau of Statistics[/caption]