DIpil Das

Source: Company reports

Source: Company reports

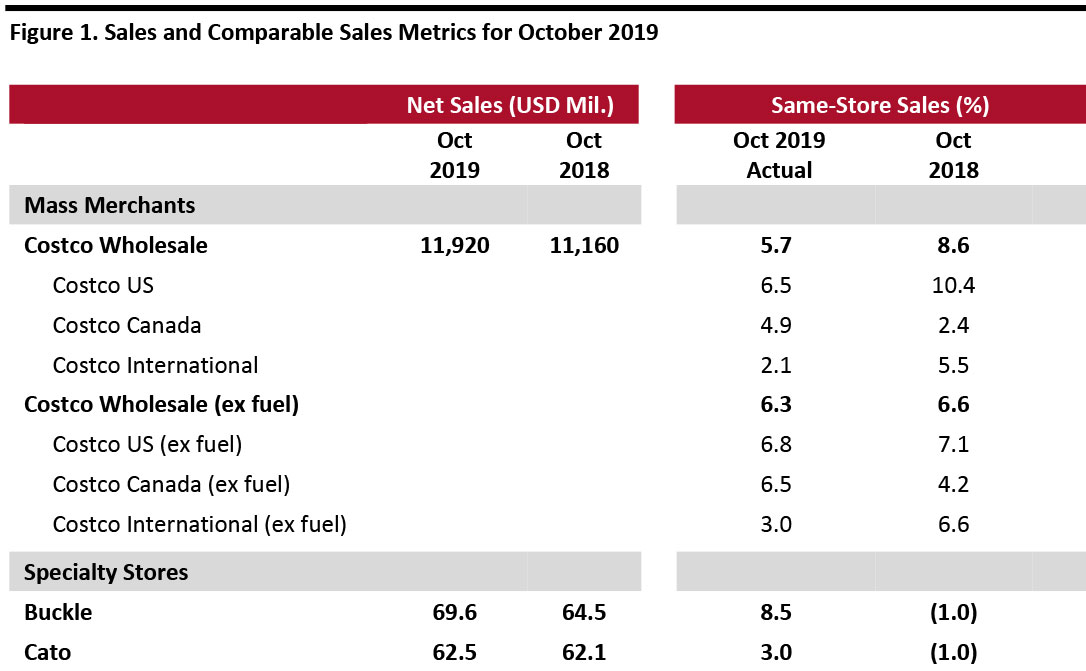

Costco comps growth accelerates, online comps growth slows

- In October, Costco grew global same-store sales 5.7% year over year, versus 4.2% growth in September. Ex fuel, global comps were up 6.3% in October.

- Costco’s e-commerce comparable sales growth was 16.5% in October, decelerating from September’s 17.8%.

- Ex fuel, Costco US comps were up 6.8% in October, faster than 5.7% in September. Results were strongest in the San Francisco Bay Area, San Diego and Los Angeles. Internationally, Costco saw strong sales growth in Spain, Taiwan and Mexico.

- Currency fluctuations negatively impacted international comps by about 20 basis points (bps) overall: Canada same-store sales growth by about 80 bps, while other international comp growth was negatively impacted approximately 50 bps.

- Cannibalization negatively impacted US comps by about 20 bps and other international segments by 140 bps. Overall, cannibalization negatively impacted comparable sales by 40 bps.

- In the merchandise segment, excluding currency effects, comps for food and sundries were positive mid-single digits: Departments that showed the strongest results were candy, liquor and deli. Hardlines posted comps in the positive mid-single digits: Departments with strong performance included toys and seasonal, sporting goods, hardware and majors. Softlines grew mid-single digits: Departments that showed stronger performance were home furnishings, apparel and housewares.

- Fresh-food comparable sales were up mid to high single digits, with service deli and meat performing better than other departments.

- In the ancillary businesses, gas, hearing aids and optical saw the strongest comp sales increases.

- Gasoline price deflation negatively impacted total comps by about 40 bps, with the overall average selling price decreasing to $2.97 per gallon this year from $3.05 last year.

Buckle’s sales growth accelerates: Men’s segment outperforms women’s

- Buckle’s comparable sales increased 8.5% year over year in October, following a 3.0% increase in September. In October, net sales increased 8.0% year over year following a 2.5% rise in September.

- By business segment, total sales in men’s were up 8.5% year over year. The men’s segment accounted for approximately 51.0% of total sales in October 2019 versus 50.5% in October 2018. In October 2019, price points were down by about 1.0% in the men’s segment.

- Total sales in the women’s segment were up 4.5% year over year. The women’s segment accounted for 49.0% of total monthly sales in October 2019 versus 50.5% in October 2018. Price points in women’s were down about 1.5% in October 2019.

- By product type, accessories sales were up 9.5% year over year in October and accounted for 7.5% of total sales. Footwear sales were up 23.5% year over year and represented 9.0% of total sales. Average accessory price points decreased about 5.0% and average footwear price points were down about 7.5%.

- In October, units per transaction decreased about 0.5%.

Cato same-store sales growth decelerates: Management remains cautiously optimistic

- Cato’s comparable sales increased 3.0% year over year in October, decelerating from a 5.0% increase in September. Cato’s sales increased 1.0% year over year to $62.5 million in October, slightly slower than the 1.6% increase in September.

- CEO John Cato commented that “October same-store sales continued our positive trend. However, we remain cautiously optimistic as we continue to evaluate the potential impact of current and future tariffs.”

- As of November 2, 2019, the company operated 1,298 stores in 31 states, down from 1,350 stores in 33 states as of November 3, 2018.