DIpil Das

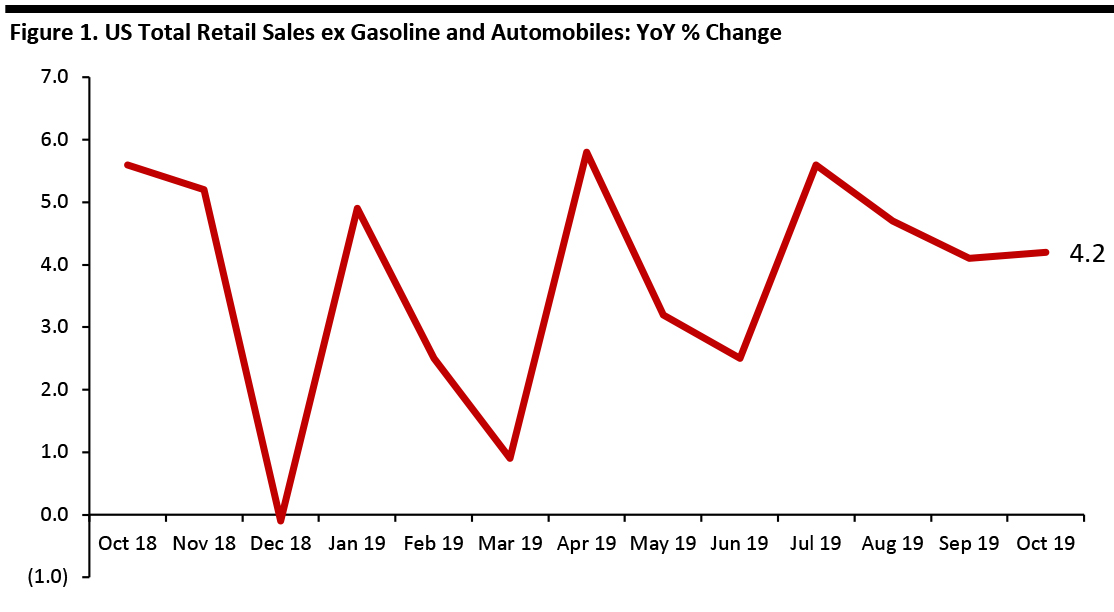

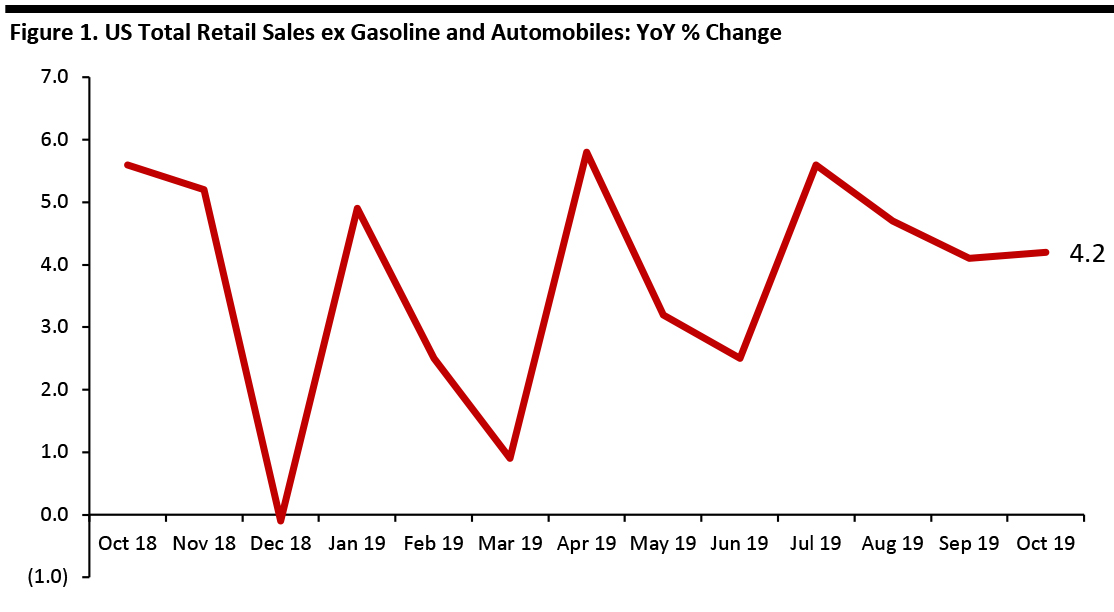

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric stood at 4.2% in October, versus 4.1% in September. October’s solid growth supports our estimate of around 4% growth for the holiday period.

[caption id="attachment_99798" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

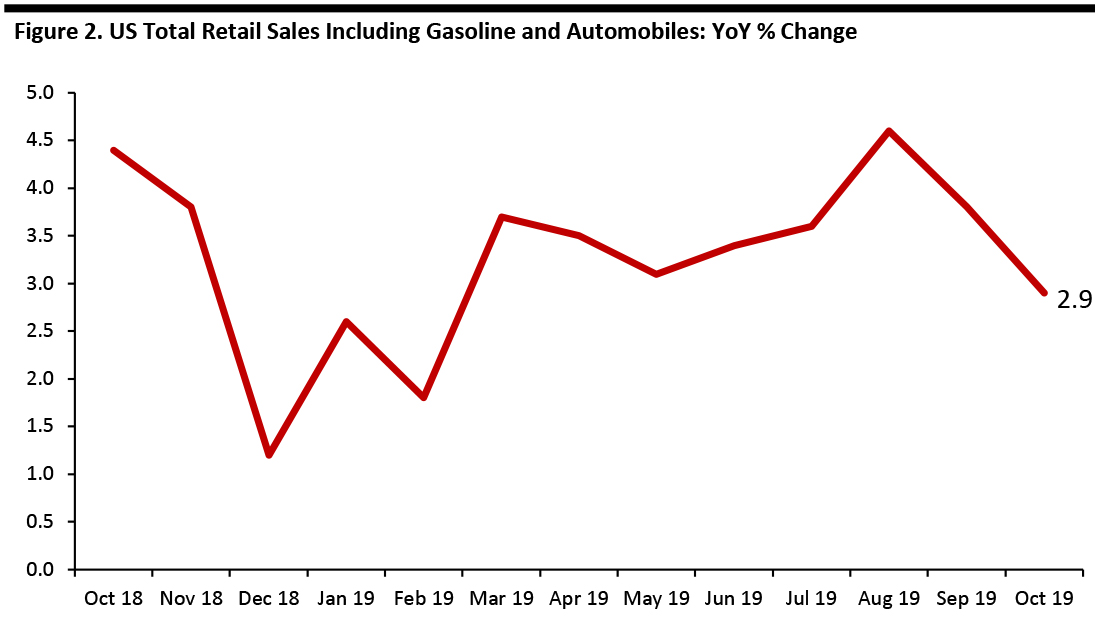

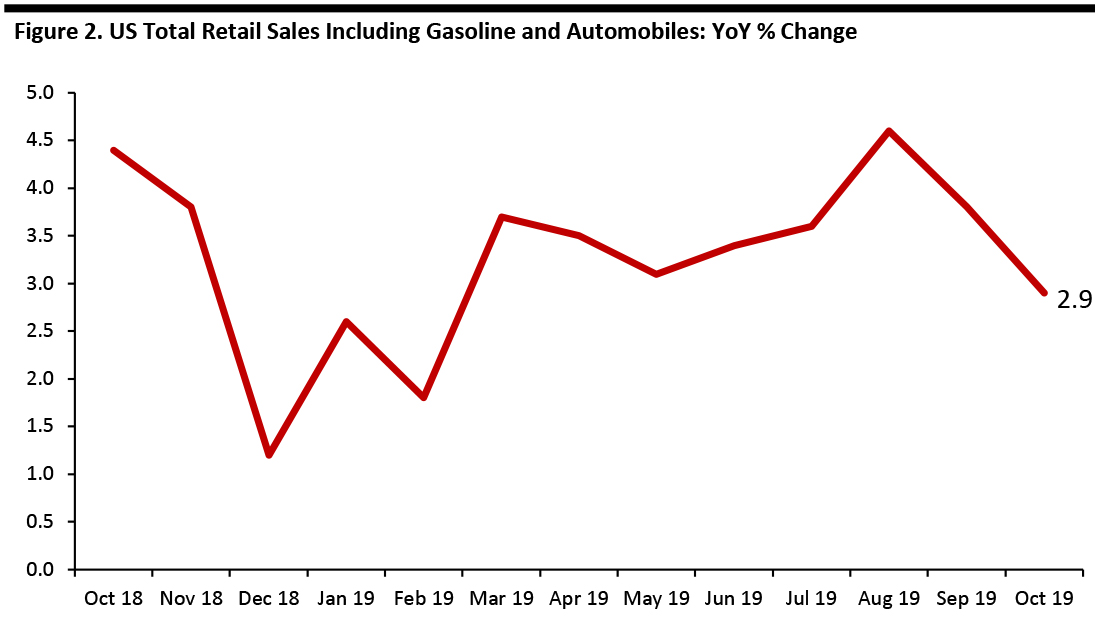

Source: US Census Bureau/Coresight Research [/caption] Retail Sales Decline Month Over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure grew 2.9% year over year in October, slower than the 3.8% growth seen in September. On a month-over-month basis and seasonally adjusted, retail sales declined 0.3% in October. [caption id="attachment_99800" align="aligncenter" width="700"] Data is seasonally adjusted

Data is seasonally adjusted

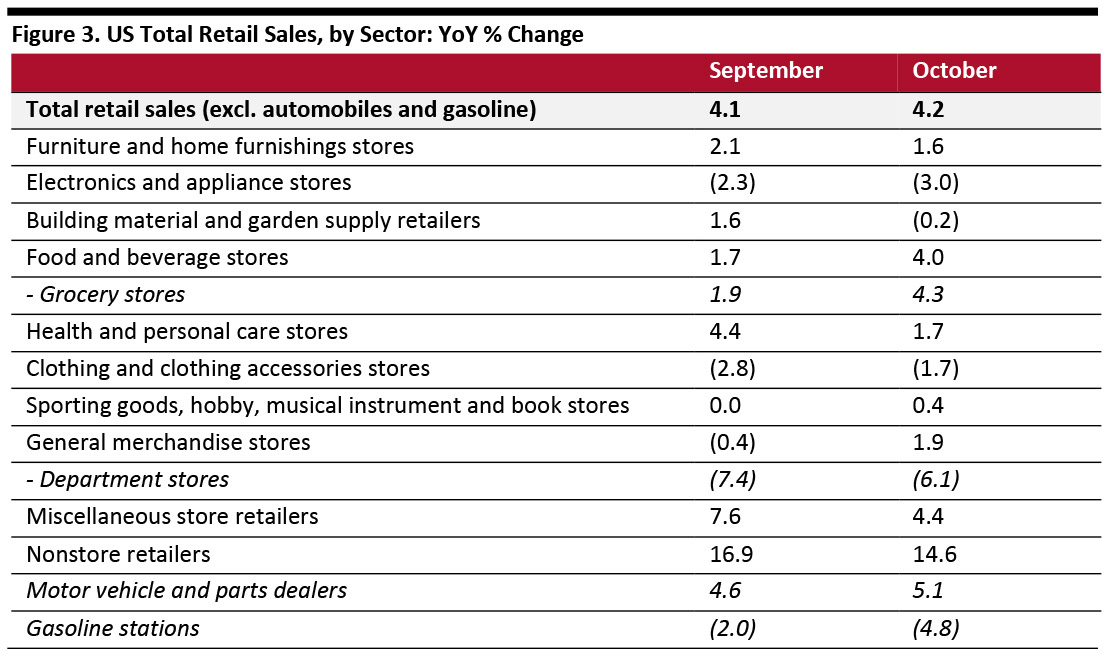

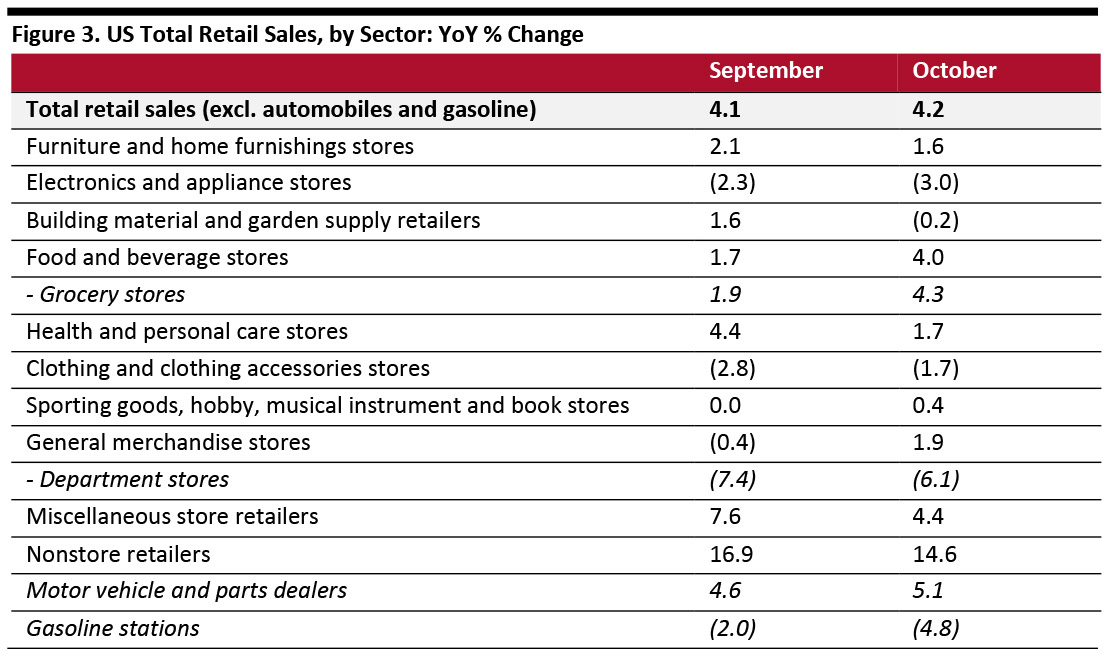

Source: US Census Bureau [/caption] Retail Sales Growth by Sector Several sectors saw sequentially slower growth in October, including furniture and home furnishings stores, health and personal care stores and miscellaneous store retailers. Sales growth accelerated in food and beverage stores; general merchandise stores; and, motor vehicle and parts dealers. Sales at department stores (a sub-set of general-merchandise stores) declined 6.7% in October, slower than the 7.4% fall in September. Clothing and accessories stores posted slower declines: a decline of 1.7% in October compared to a 2.8% decrease in September. After posting growth in September, sales fell slightly in October at building material and garden supply retailers. Nonstore retailers continued to post double-digit growth, of 14.6% versus 16.9% in September. [caption id="attachment_99842" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

Source: US Census Bureau/Coresight Research [/caption]

Data is not seasonally adjusted

Data is not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Decline Month Over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure grew 2.9% year over year in October, slower than the 3.8% growth seen in September. On a month-over-month basis and seasonally adjusted, retail sales declined 0.3% in October. [caption id="attachment_99800" align="aligncenter" width="700"]

Data is seasonally adjusted

Data is seasonally adjusted Source: US Census Bureau [/caption] Retail Sales Growth by Sector Several sectors saw sequentially slower growth in October, including furniture and home furnishings stores, health and personal care stores and miscellaneous store retailers. Sales growth accelerated in food and beverage stores; general merchandise stores; and, motor vehicle and parts dealers. Sales at department stores (a sub-set of general-merchandise stores) declined 6.7% in October, slower than the 7.4% fall in September. Clothing and accessories stores posted slower declines: a decline of 1.7% in October compared to a 2.8% decrease in September. After posting growth in September, sales fell slightly in October at building material and garden supply retailers. Nonstore retailers continued to post double-digit growth, of 14.6% versus 16.9% in September. [caption id="attachment_99842" align="aligncenter" width="700"]

Data is not seasonally adjusted

Data is not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption]