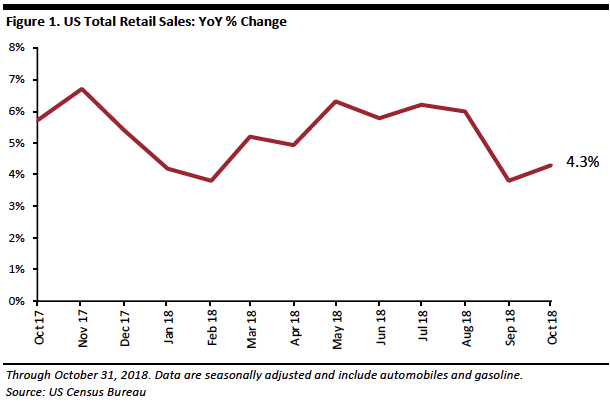

Total seasonally adjusted retail sales including automobiles and gasoline grew more quickly in October year over year at 4.3%, faster than the 3.8% rate seen in September (revised substantially from the advance estimate published last month), according to the US Census Bureau.

Year over year in October, sales increased 4.7% at clothing and clothing accessories stores, 3.0% at grocery stores and 3.5% at general merchandise stores, with a 0.3% decline in department store sales. Non-store retailers registered year-over-year sales growth of 12.1%.

On a month-over-month basis and seasonally adjusted, retail sales increased by 0.9% in October.

In-Store Metrics

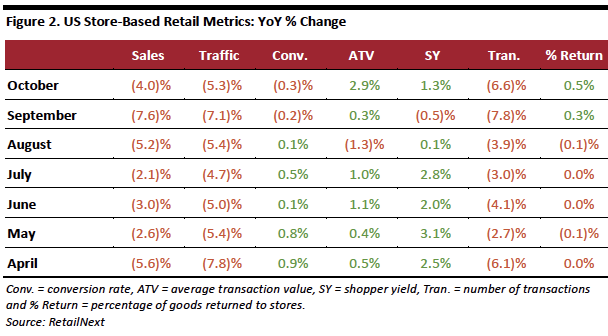

Store-based sales and traffic declined in October, while the conversion rate declined by 0.3%, according to RetailNext. This was the second consecutive monthly decline in the conversion rate. Average transaction value recorded its strongest growth in the past year at 2.9% and the rate of product returns climbed 0.5%, its biggest increase since November 2017.

- Retail traffic declined 5.3% year over year in October, following a steep 7.1% decline in September.

- Shopper yield (sales divided by traffic) increased 1.3% year over year in October following a 0.5% decline last month, the number of transactions declined 6.6%.

All geographic regions posted sales and traffic declines in October compared to the same period last year. The South experienced the largest year-over-year in-store sales decline among all regions, with sales down 10.0%, whereas the Midwest reported the smallest decline, with sales down 3.0%.

Total seasonally adjusted retail sales including automobiles and gasoline grew more quickly in October year over year at 4.3%, faster than the 3.8% rate seen in September (revised substantially from the advance estimate published last month), according to the US Census Bureau.

Year over year in October, sales increased 4.7% at clothing and clothing accessories stores, 3.0% at grocery stores and 3.5% at general merchandise stores, with a 0.3% decline in department store sales. Non-store retailers registered year-over-year sales growth of 12.1%.

On a month-over-month basis and seasonally adjusted, retail sales increased by 0.9% in October.

In-Store Metrics

Total seasonally adjusted retail sales including automobiles and gasoline grew more quickly in October year over year at 4.3%, faster than the 3.8% rate seen in September (revised substantially from the advance estimate published last month), according to the US Census Bureau.

Year over year in October, sales increased 4.7% at clothing and clothing accessories stores, 3.0% at grocery stores and 3.5% at general merchandise stores, with a 0.3% decline in department store sales. Non-store retailers registered year-over-year sales growth of 12.1%.

On a month-over-month basis and seasonally adjusted, retail sales increased by 0.9% in October.

In-Store Metrics

Store-based sales and traffic declined in October, while the conversion rate declined by 0.3%, according to RetailNext. This was the second consecutive monthly decline in the conversion rate. Average transaction value recorded its strongest growth in the past year at 2.9% and the rate of product returns climbed 0.5%, its biggest increase since November 2017.

Store-based sales and traffic declined in October, while the conversion rate declined by 0.3%, according to RetailNext. This was the second consecutive monthly decline in the conversion rate. Average transaction value recorded its strongest growth in the past year at 2.9% and the rate of product returns climbed 0.5%, its biggest increase since November 2017.