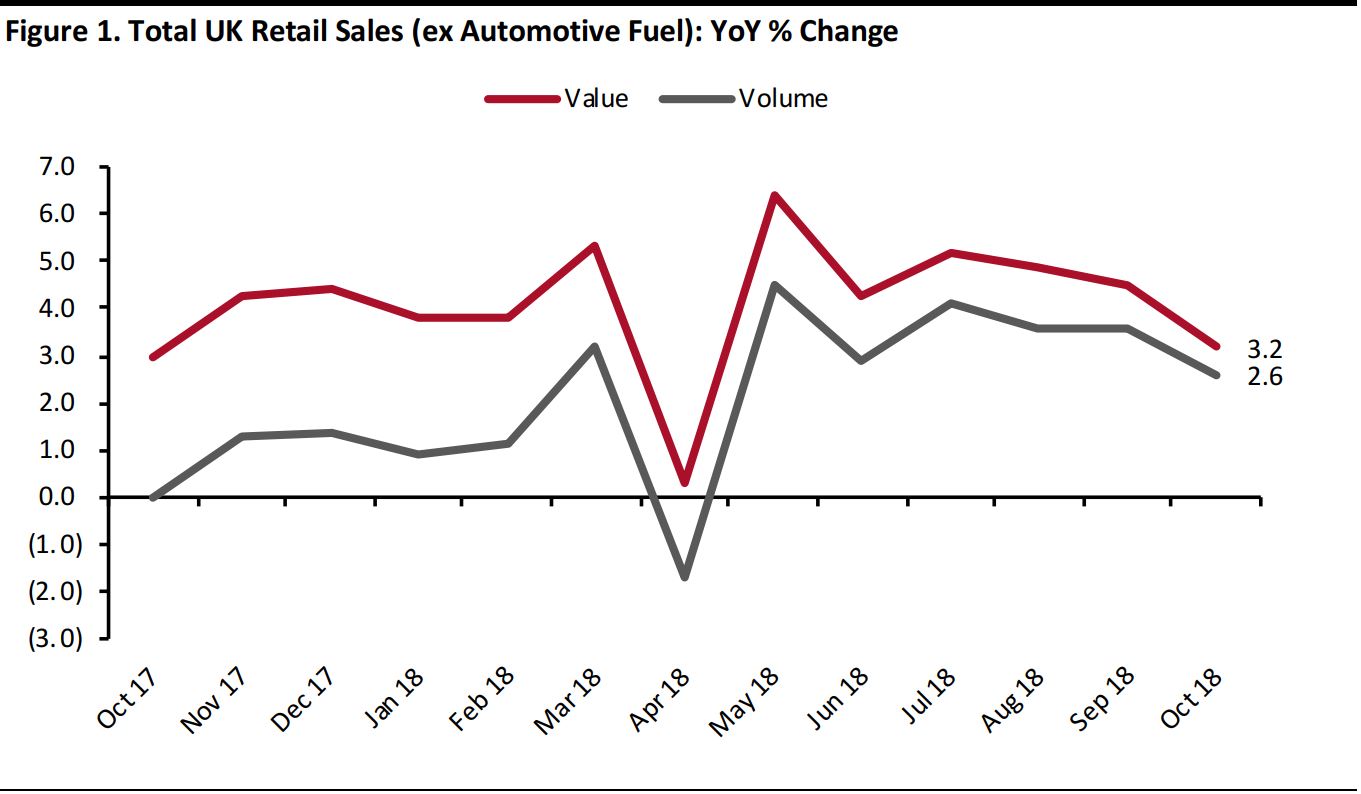

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

Source: ONS/Coresight Research

Source: ONS/Coresight Research

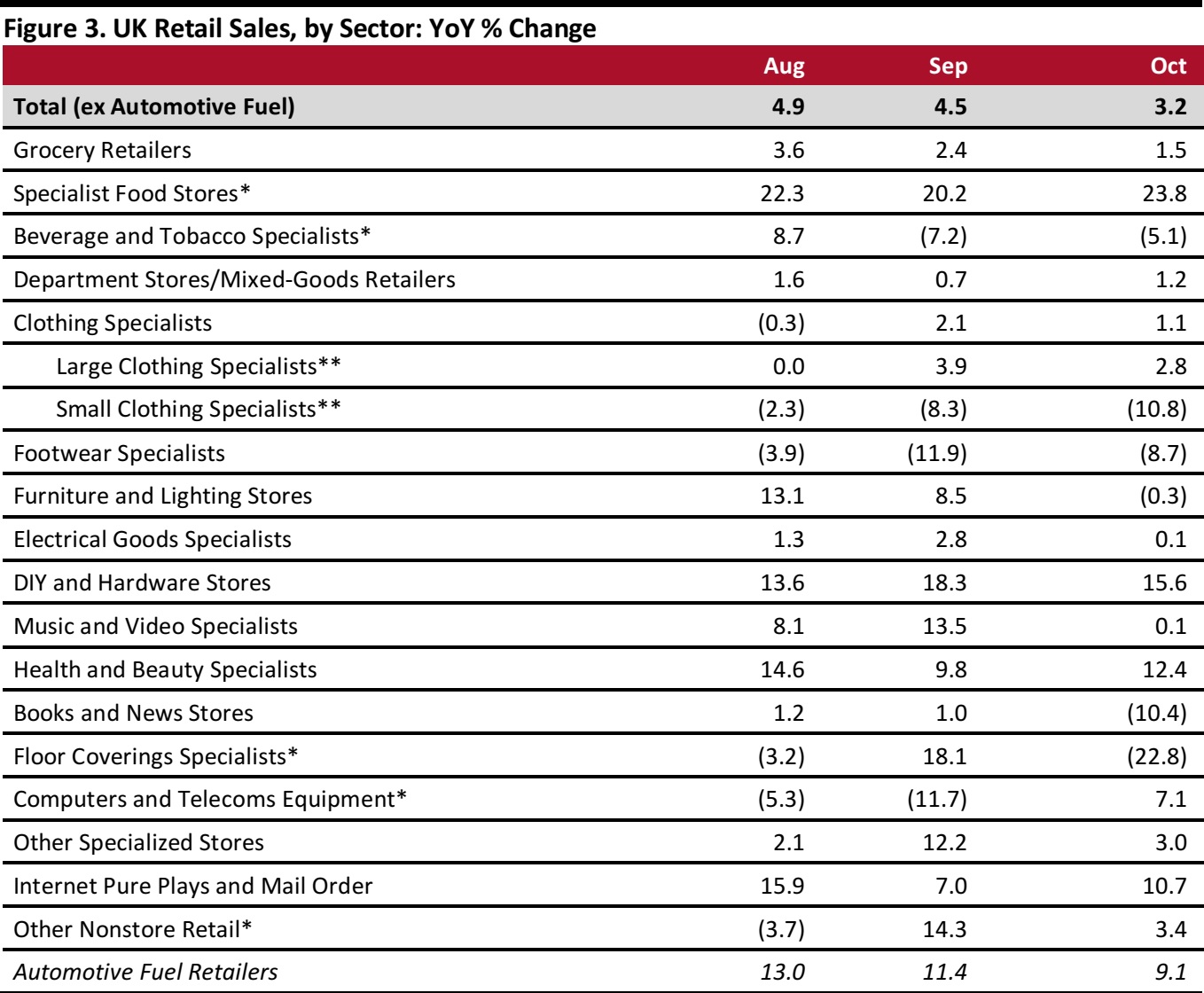

RETAIL SALES GROWTH BY SECTOR

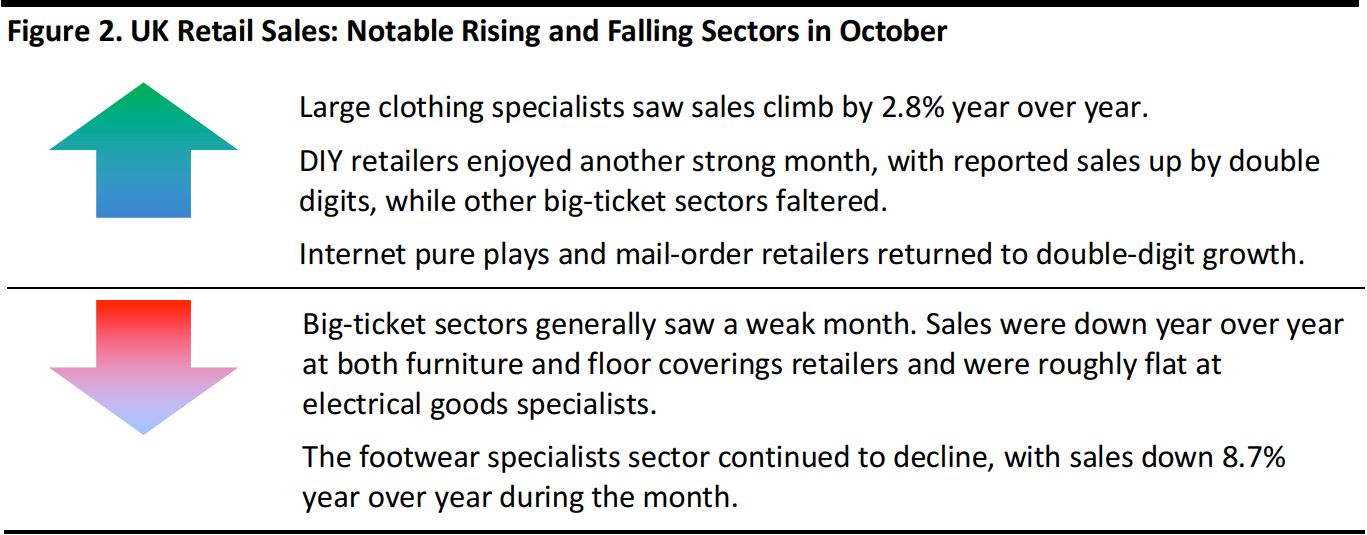

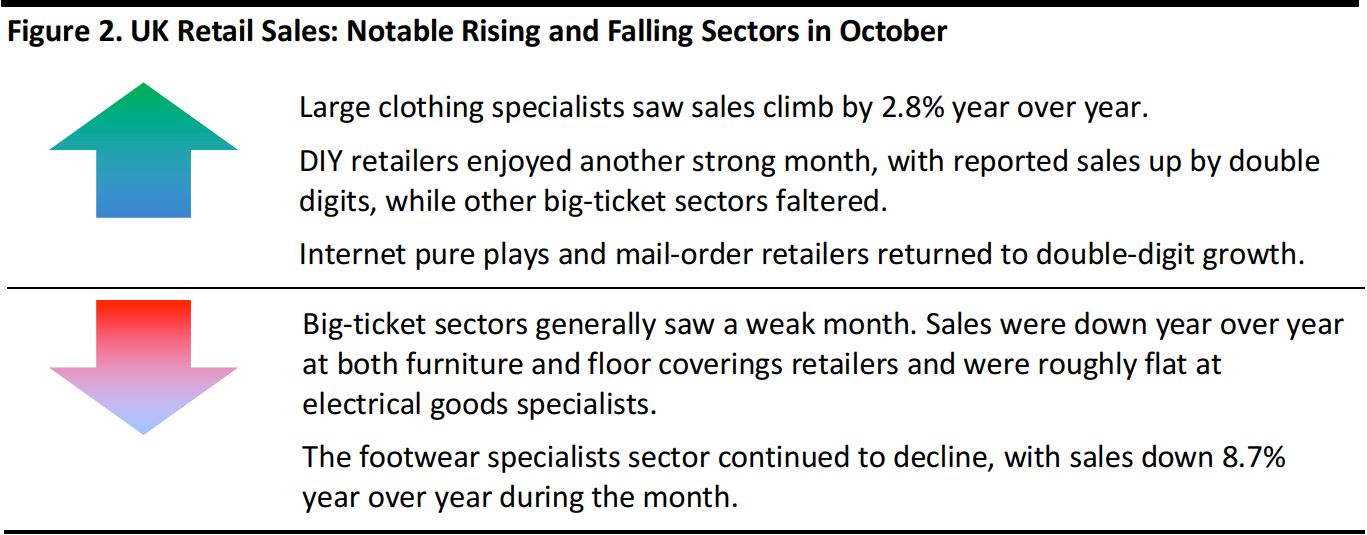

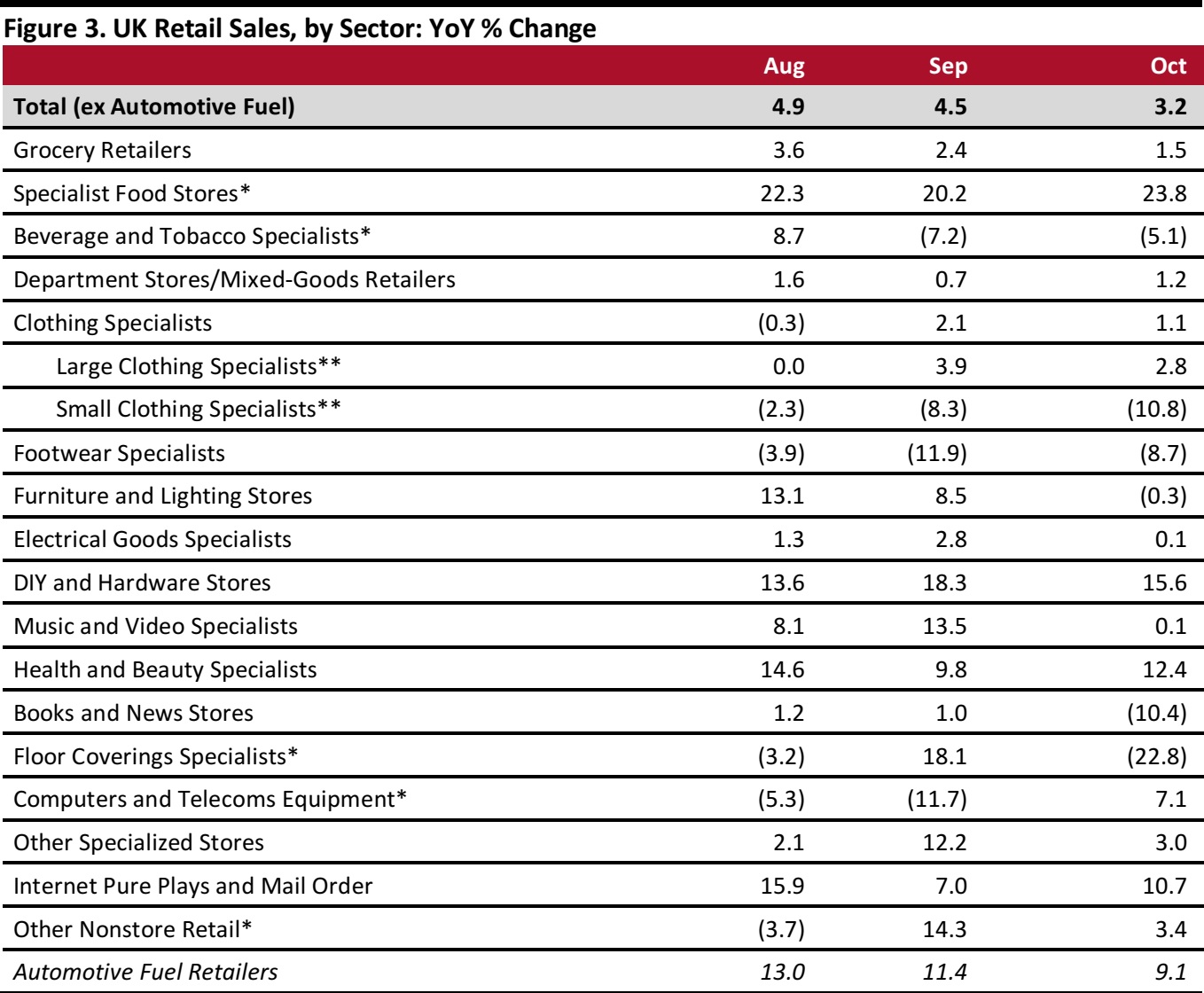

The ONS frequently reports volatile growth figures for some fragmented sectors, but the volatility was unusually widespread in October. The ONS recorded inexplicably sharp swings in performance at books and news retailers, floor coverings retailers, and computers and telecoms retailers. Beyond methodological issues, it is hard to account for such sudden shifts—and also for the strong growth recorded for DIY stores and health and beauty retailers.

DIY retailers aside, one apparent trend in October was a softening in big-ticket demand, as represented by sequential changes in the growth rates for furniture retailers, floor coverings retailers (volatility notwithstanding) and electrical goods retailers.

Large clothing retailers enjoyed moderate growth in spite of unseasonably warm October weather. Grocery retailers saw softer growth, although this was in the context of easing sector inflation: year-over-year inflation in the food retail sector eased to 1.0% in October from 1.5% in September. At nonfood retailers, inflation stood at 0.1% in October versus 0.2% in September.

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

ONLINE RETAIL SALES GROWTH

Total Internet retail sales were up 12.8% year over year in October, versus 10.7% growth in September. In October, Internet sales grew by 2.0% at food retailers, by 19.7% at nonfood retailers and by 11.1% at nonstore retailers.

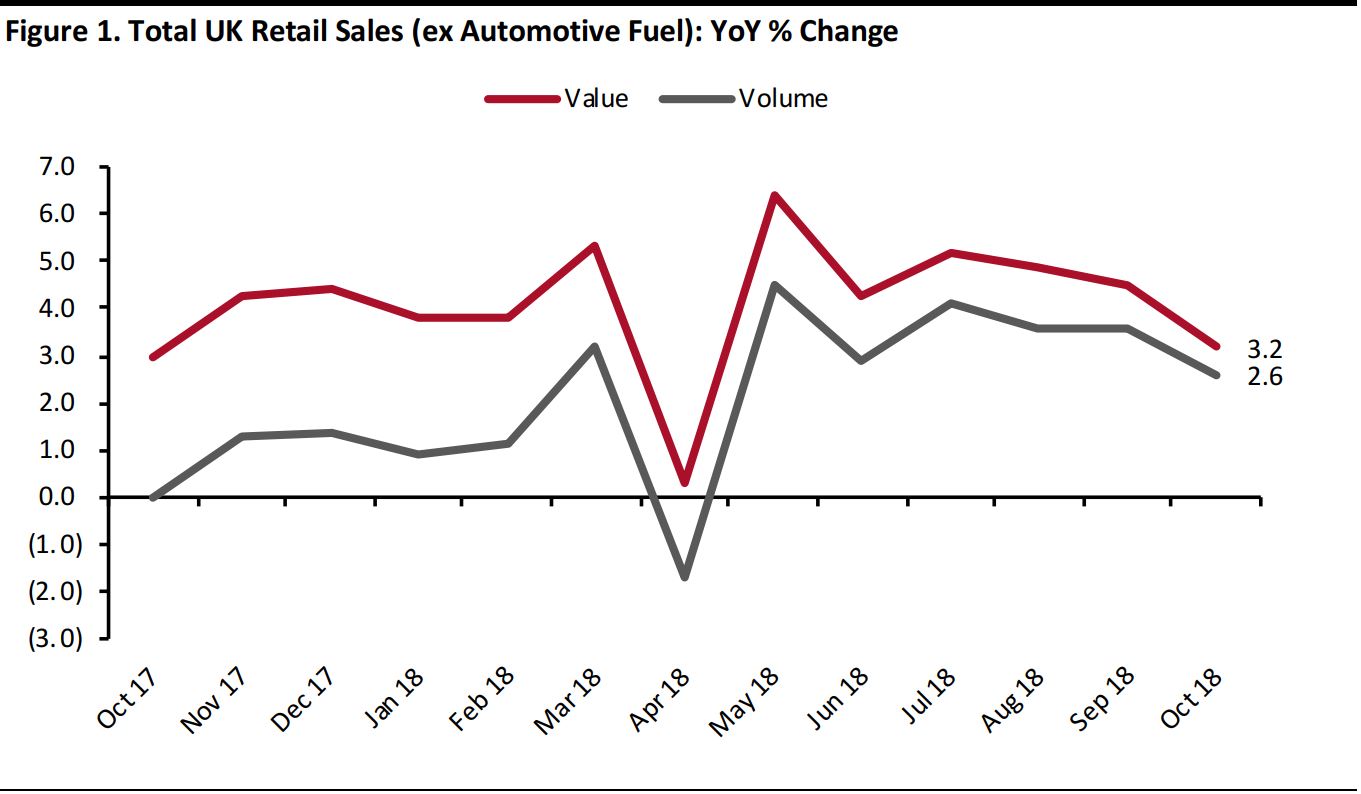

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research Source: ONS/Coresight Research

Source: ONS/Coresight Research *A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS