Web Developers

Source: Company reports

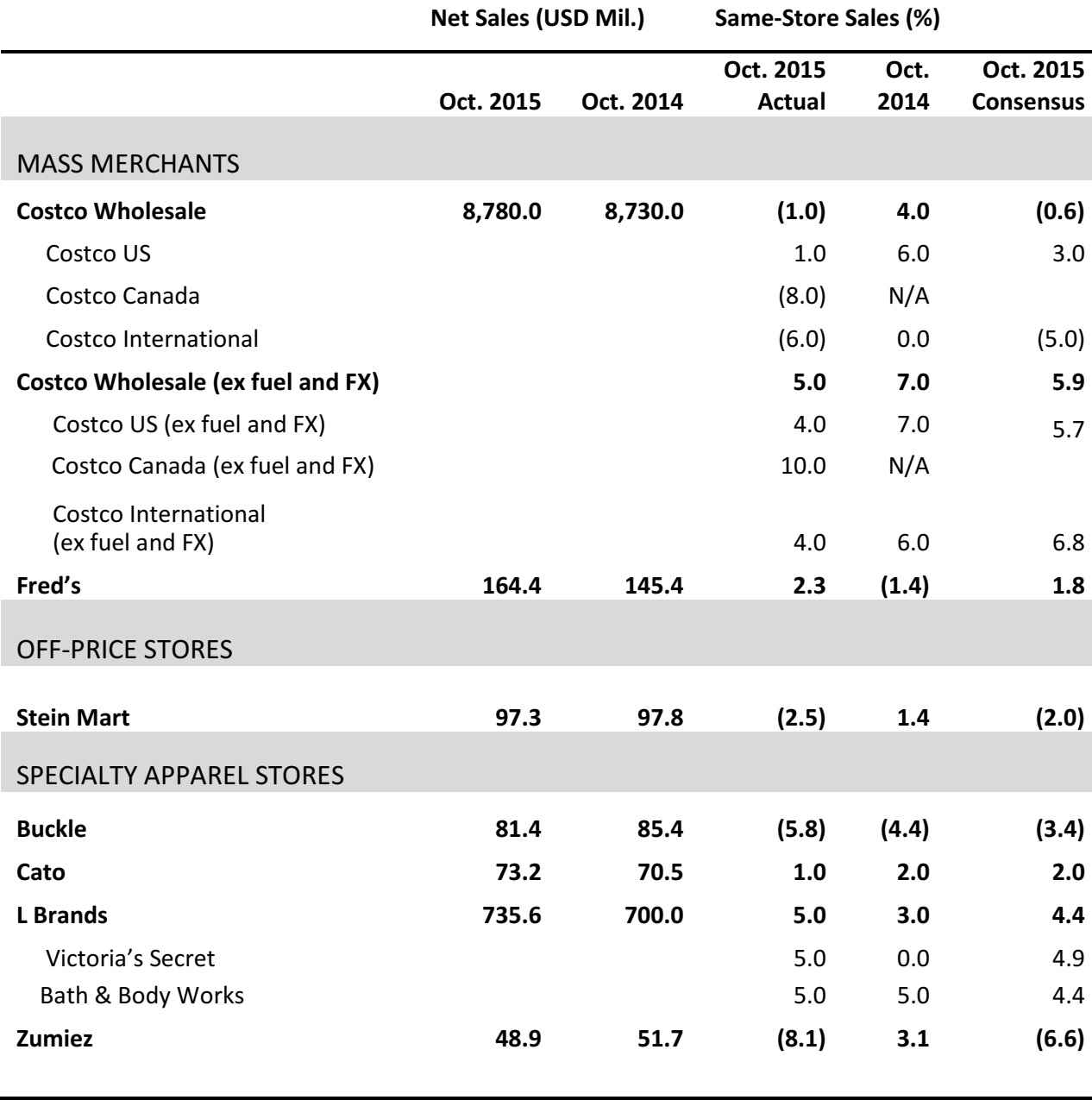

Costco Comps Miss Estimates As Traffic Decelerated

- The four-week October period had 28 selling days both this year and last year.

- Costco’s (1)% comparable sales growth in October slightly missed analysts’ consensus of (0.6)%.

- Within the US, the strongest sales regions were the Midwest and California. Internationally, Australia, Canada, Taiwan, and Japan posted strong sales, as in recent months.

- Food and sundries saw comparable sales for the month up in the mid-single-digit range. Within food and sundries, the categories with the strongest results were sundries, cooler, liquor and candy.

- In the hardline category, garden, sporting goods and office supply were the top performers, posting positive low-single-digit comps. Consumer electronics comps were negative mid-single digits.

- Better-performing softline goods included women’s apparel, domestics and media. Fresh foods were up mid-single digits for the month, which include produce, meat and service deli.

- Gasoline comps were negative in the high teens versus last year, with the average price per gallon down 25%, to $2.33 a gallon from $3.11 per gallon in October 2014. Gas price deflation caused overall comps to decline by roughly 2.8% and by roughly 3.5% in the US.

- Average transactions were down 4.0%, including a negative impact from foreign exchange and gas deflation of more than 6.5%. Comp traffic was up 2.75%, a slight decrease versus the previous several months. The first two weeks of the month were softer than the last two weeks.

- Overall, the foreign exchange impact was roughly (3.75)%.

Momentum Continues at L Brands

- October comps were up 5% at Victoria Secret, driven by continued strength in core lingerie and PINK. Comps were up 5% at Bath & Body Works, driven by seasonal collections.

- Overall inventory per square foot was up 7% at the end of the month.

- Merchandise margins were down compared to last year. The decrease was primarily driven by planned promotional activity, including the Angel Card-issue and an unfavorable FX impact in the Canadian business.

- The company expects November comps to be up in the low-single-digit range.

Fred’s Benefited from Pharmacy Sales and Halloween

- Total sales for Fred’s increased by 13%, to $164.4 million in October, up from $145.4 million in of October last year. Total sales growth would have been 17%, excluding $4.5 million from last year’s 47 closed stores.

- Same-store sales for the month increased by 2.3%

- Both total sales and comps tracked with the company’s plan, driven by strength in retail and specialty pharmacy. Halloween sales were a key driver of general merchandise performance in October.

Cato October Comp Sales Up 1%, Missing Expectations

- Cato reported sales of $73.2 million for the four weeks ended October 31, 2015, up 4% from $70.5 million, in 2014. Comp sales were up 1%.

- October same-store sales exceeded company guidance. With recent positive trends and a favorable tax benefit of $0.06 per share, Cato estimates 3Q diluted EPS of $0.24 to $0.28 versus $0.20 last year and up from our previous guidance of $0.18 to $0.22.

Zumiez Same-Store Sales Drop by 8.1% in October

- October comps for Zumiez were driven by a decline in comp transactions that was partially offset by an increase in dollars per transaction.

- The increase in dollars per transaction was driven by increases in both units per transaction and average unit retail.

- The categories, hard goods, men’s, accessories and juniors comps were negative, while footwear comps were positive.

- Foreign exchange negatively impacted the month’s total sales, however the impact was not quantified.

Stein Mart Comps Miss Expectations, Driven by Unseasonably Warm Weather

- Total reported sales were $97.3 million, a (0.5)% decline from last year. Comp sales decreased by 2.5%

- October sales were hurt by unseasonably warm weather and ladies’ apparel and accessories performed lower than the chain.

- Florida and North Carolina posted the strongest sales, with solid positive comps, while Texas and the West underperformed.

- The company reported a positive outlook due to holiday sales which will include incremental sales from six new stores opened through the third quarter plus four more new stores opening in November.

Buckle Misses Expectations with Comps Down 5.8%

- Teen retailer Buckle saw overall comps decline by 5.8%

- The women’s section accounted for 57.0% of sales versus 50.5% last October. Men’s categories increased to 43.0% from 41.5% last year.

- Accessories sales were up slightly and footwear was up 11.5%

- Strong women’s categories included woven tops and footwear, while the men’s side was led by knit shirts and accessories.