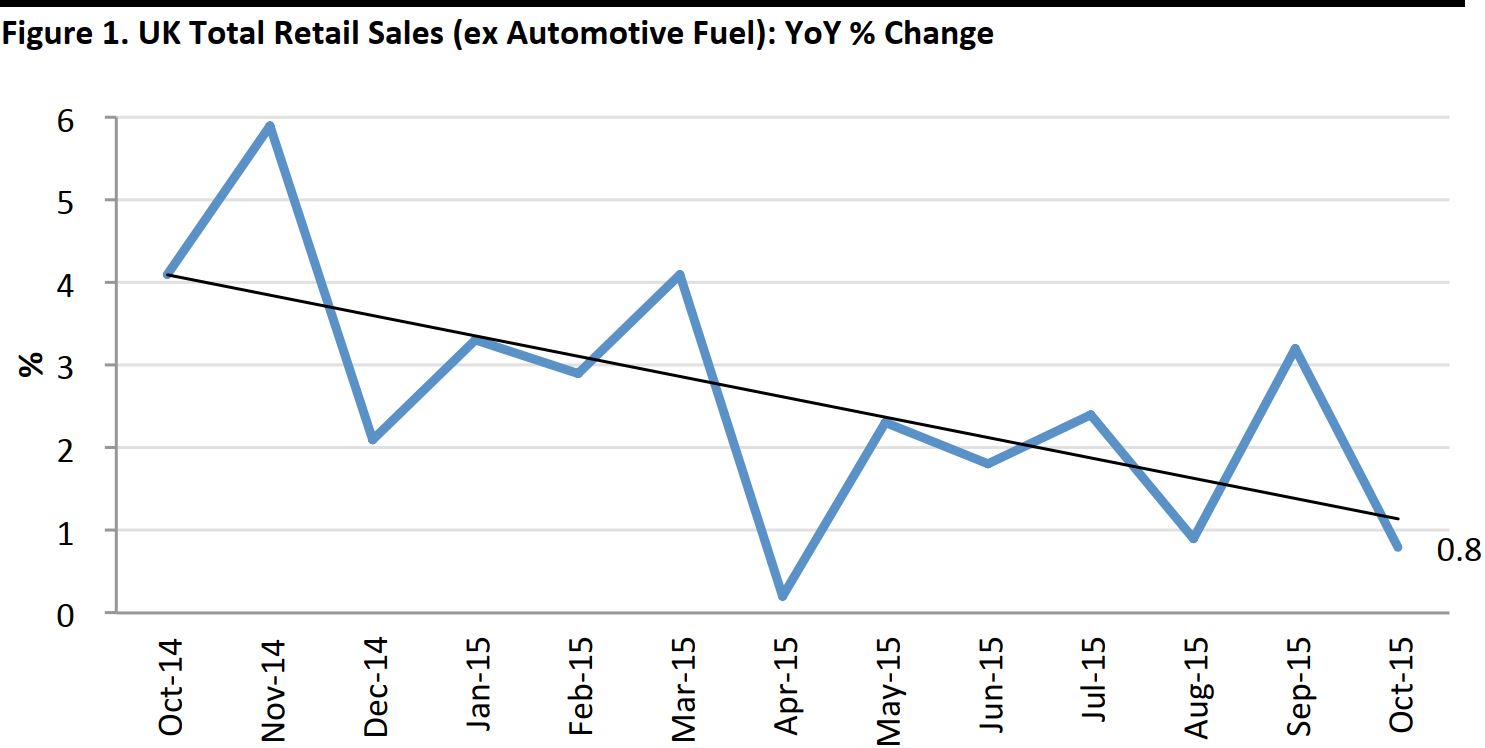

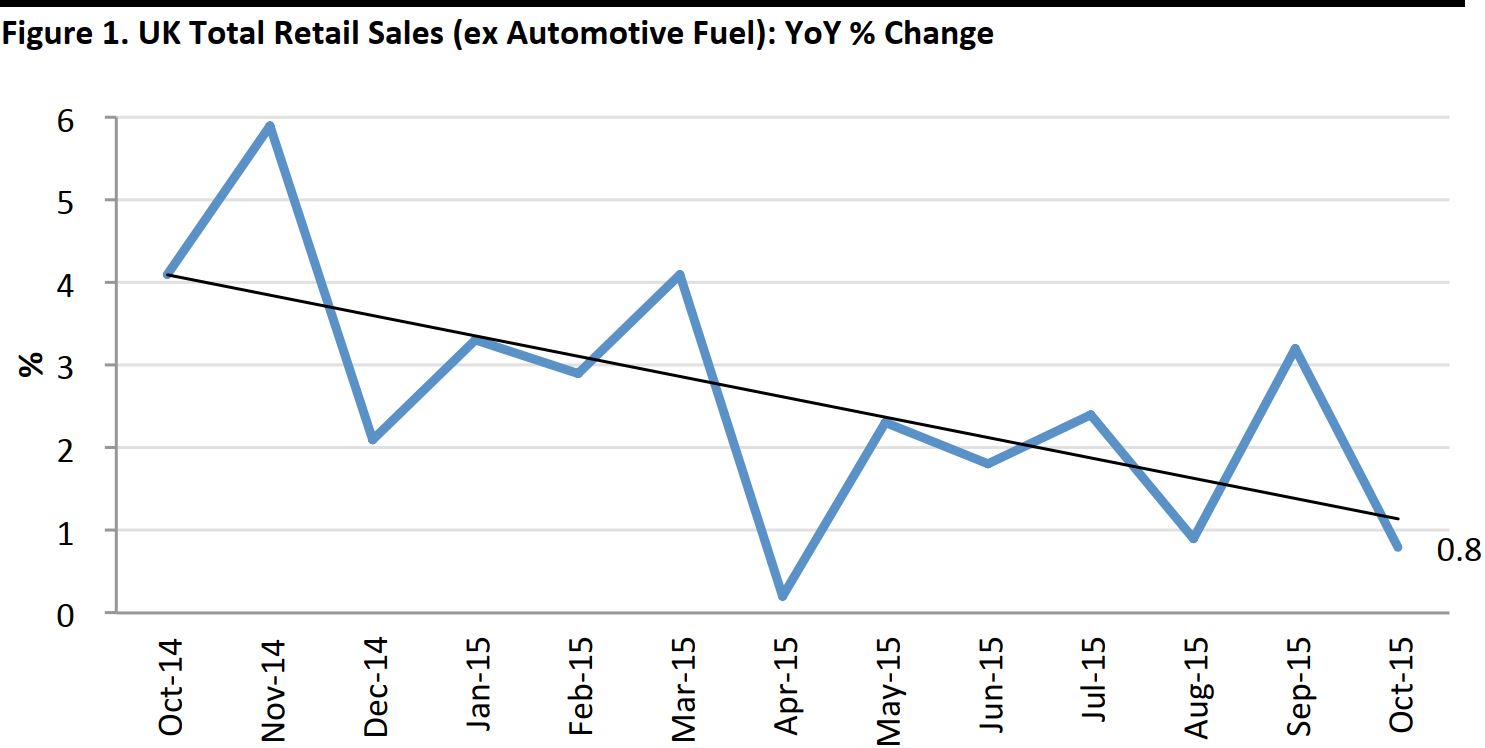

OCTOBER 2015: GROWTH WEAKENS AGAIN

TOTAL RETAIL SALES TURNS DOWN

All data in this report are nonseasonally adjusted.

Source: Office for National Statistics (ONS)

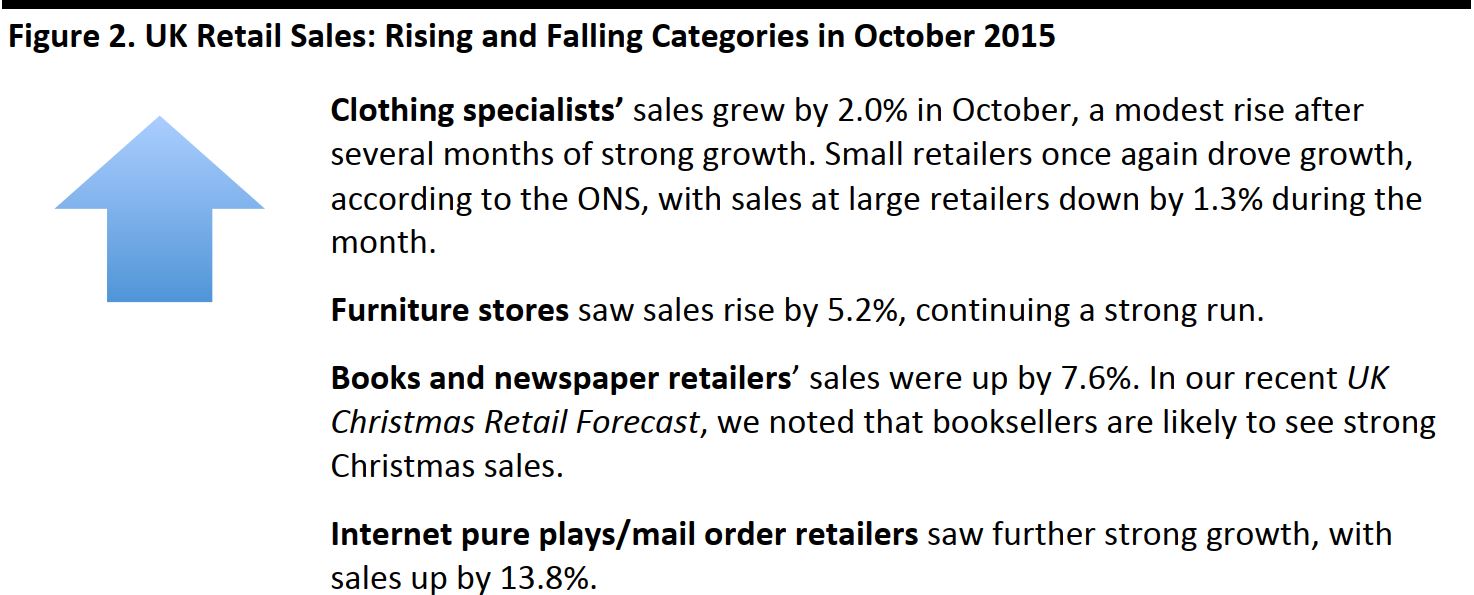

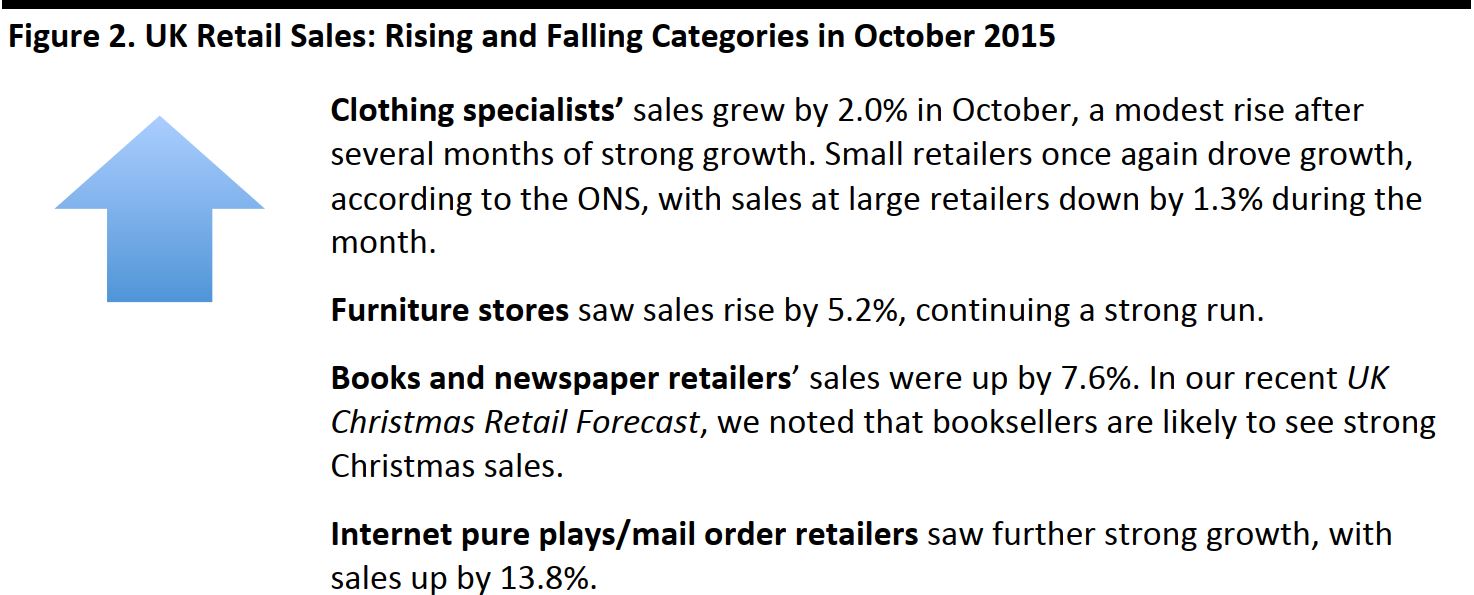

WINNERS AND LOSERS

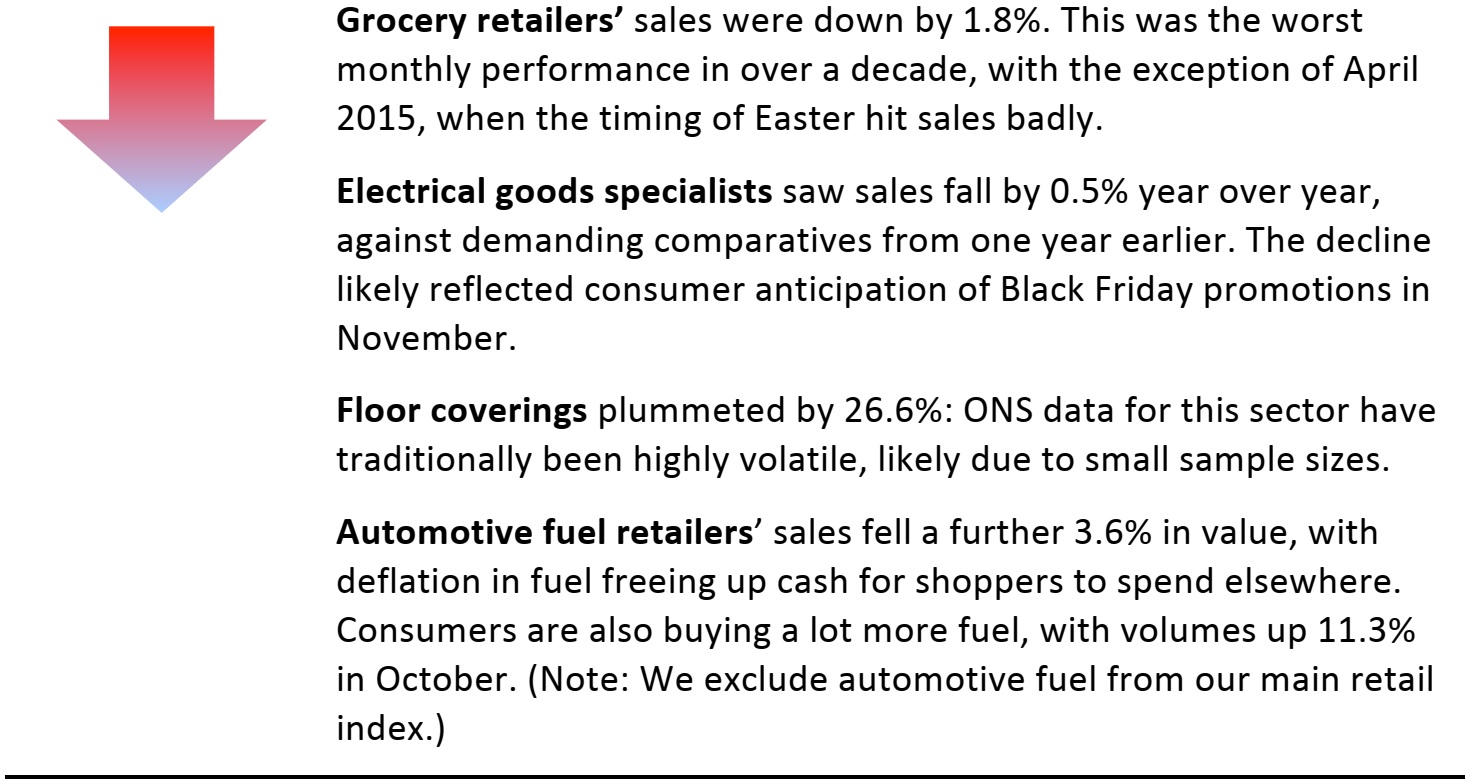

Source: ONS/FBIC Global Retail & Technology

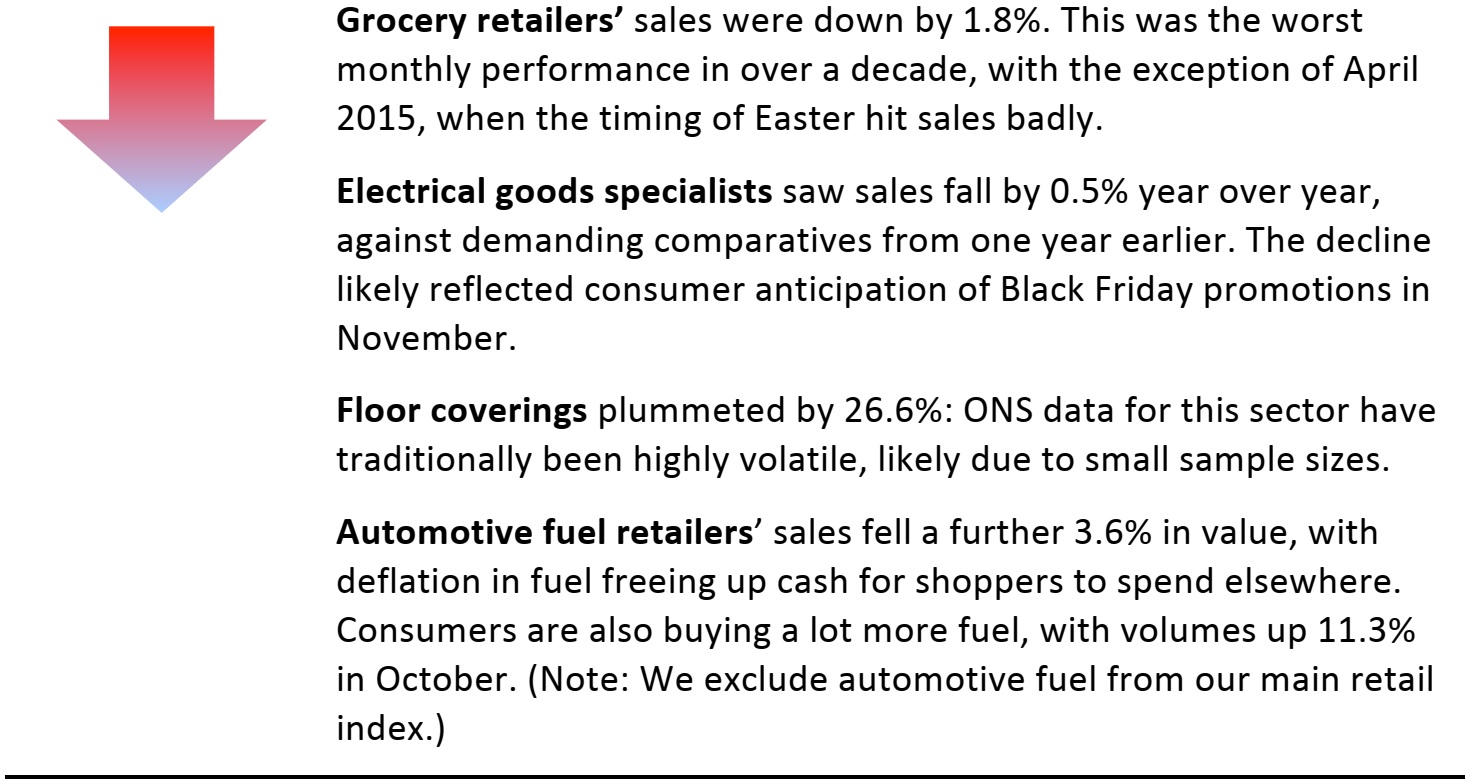

RETAIL IN DETAIL

Grocery retailers returned to negative growth in October—and some decline it was. At (1.8)%, this was the worst monthly sales performance in well over a decade (with the exception of April 2015, when the timing of Easter distorted performance). This figure cements our expectations of negative sales growth this Christmas, even against undemanding comparatives from 2014. In volume terms, grocery retailers’ sales rose by 0.7% in October.

The rise in grocery retailers’ sales in September had been due to a combination of the Rugby World Cup boosting demand and the inclusion of the August Bank Holidayin the ONS data set for the month.

Clothing specialists have tended to enjoy a strong run across 2015, but demand softened in October—which is of little surprise, given the unusually warm autumn weather the UK has experienced. As with grocery, the figures for September had likely been boosted by the inclusion of the Bank Holiday in that month’s data. Since November has continued to be unusually warm, we expect many apparel retailers to be carrying excess winter stock—and, so, we would not be surprised to see a glut of discounting before Christmas, including on Black Friday (see our separate preview report for more on Black Friday).

Once again, small retailers drove clothing salesin October, with big retailers down by 1.3%. A small retailer is defined as onewith fewer than 100 employees or with turnover of £60 million or less per year.

Bookstores were up, and we tipped them as a growth sector for Christmas 2015, as shoppers appear to be returning to tradition by buying physical books in physical stores.

Electrical goods specialists were down against last year’s strong comparatives (the category grew by 7.5% in October 2014), and shopper anticipation of forthcoming Black Friday bargains likely contributed to the decline.

Source: ONS

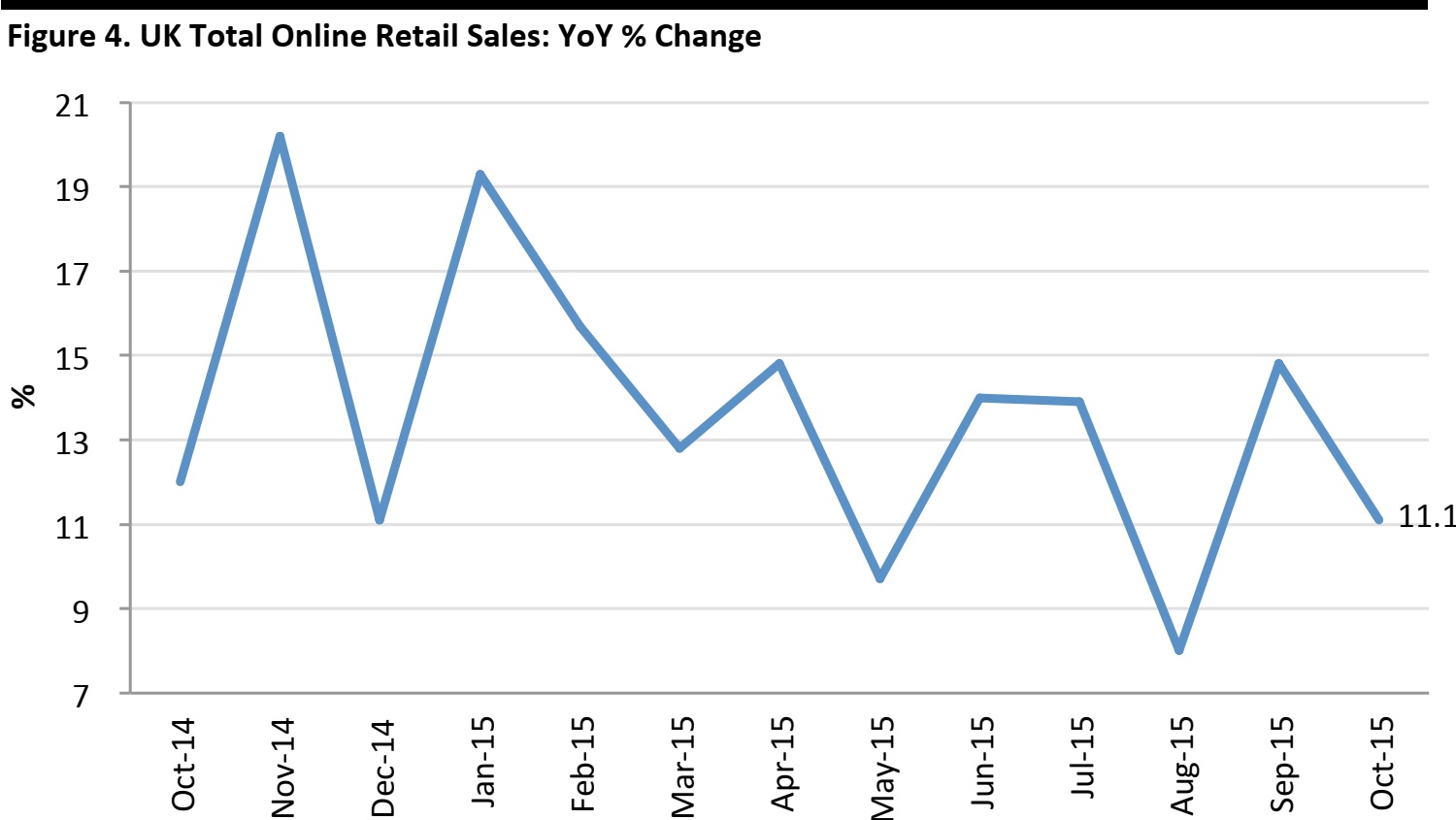

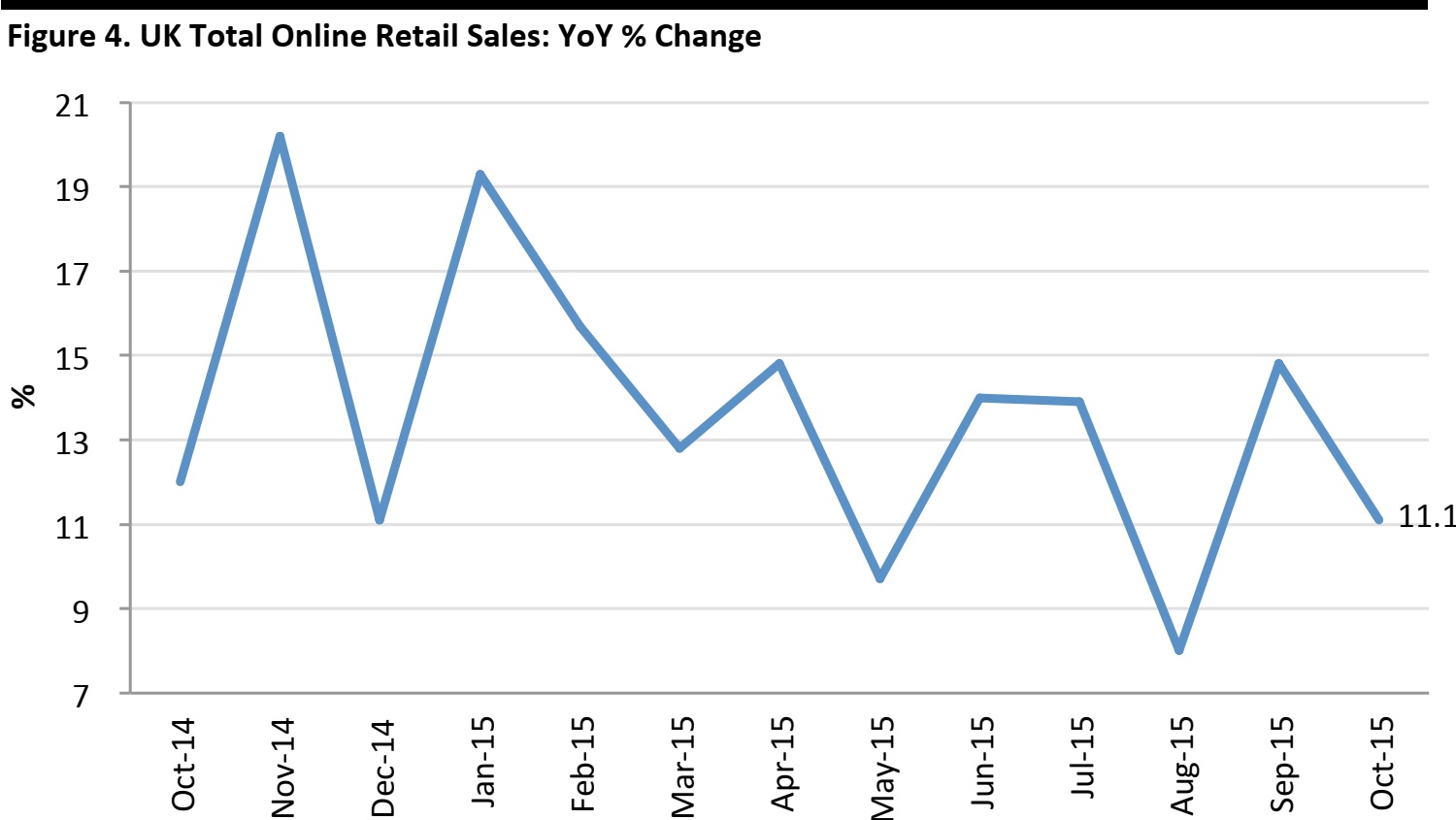

E-‐COMMERCE MAINTAINS DOUBLE-‐DIGIT GROWTH

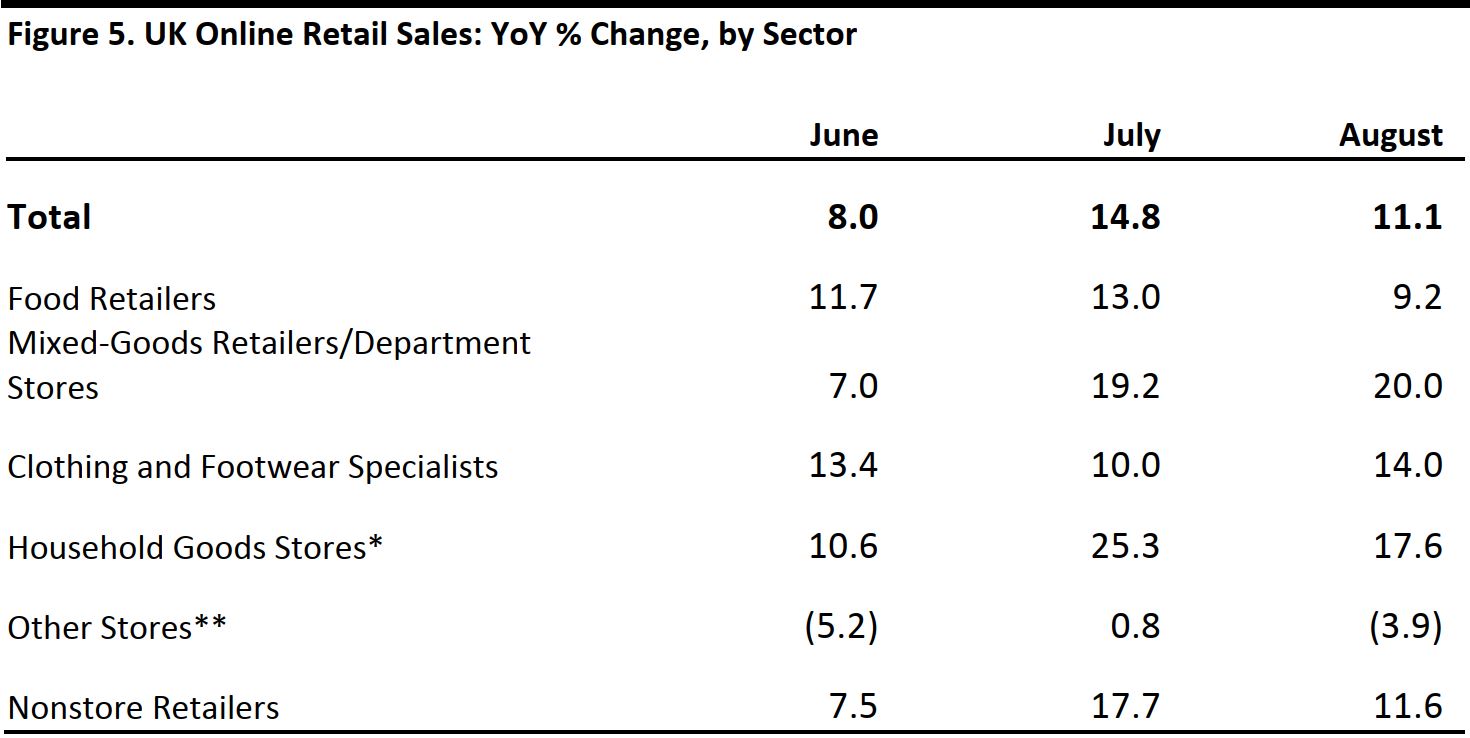

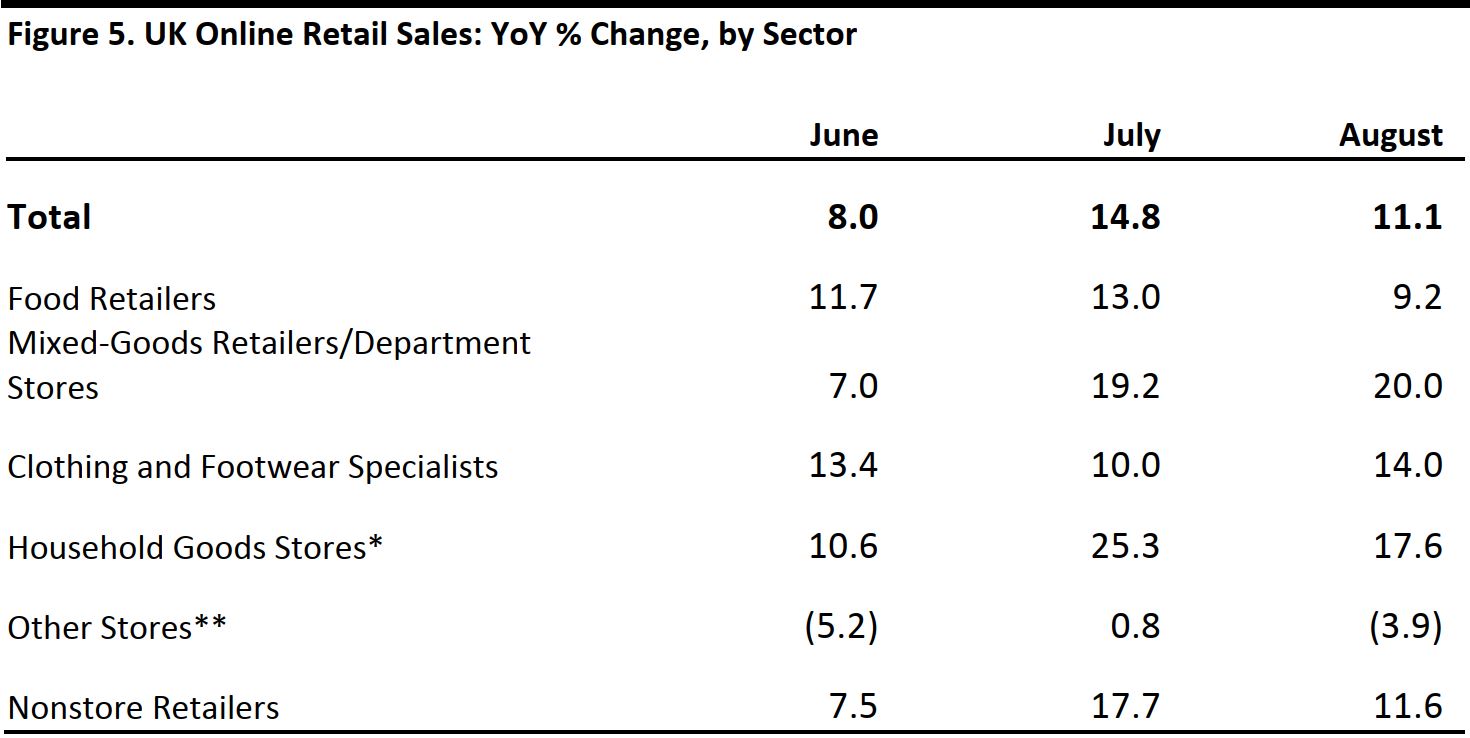

Given the overall weakness in retail in October,total Internet sales growth held up well, at just over 11%. Mixed-‐goods retailers/department stores and household goods stores (furniture, DIY and electrical goods) drove growth.

Source: ONS

*Household goods stores is comprised of furniture and lighting specialists, electrical goods retailers, DIY and hardware stores, and music and video retailers.

**Other stores include health and beauty, books and news, floor coverings, computers and telecoms, and other specialized stores.

Source: ONS

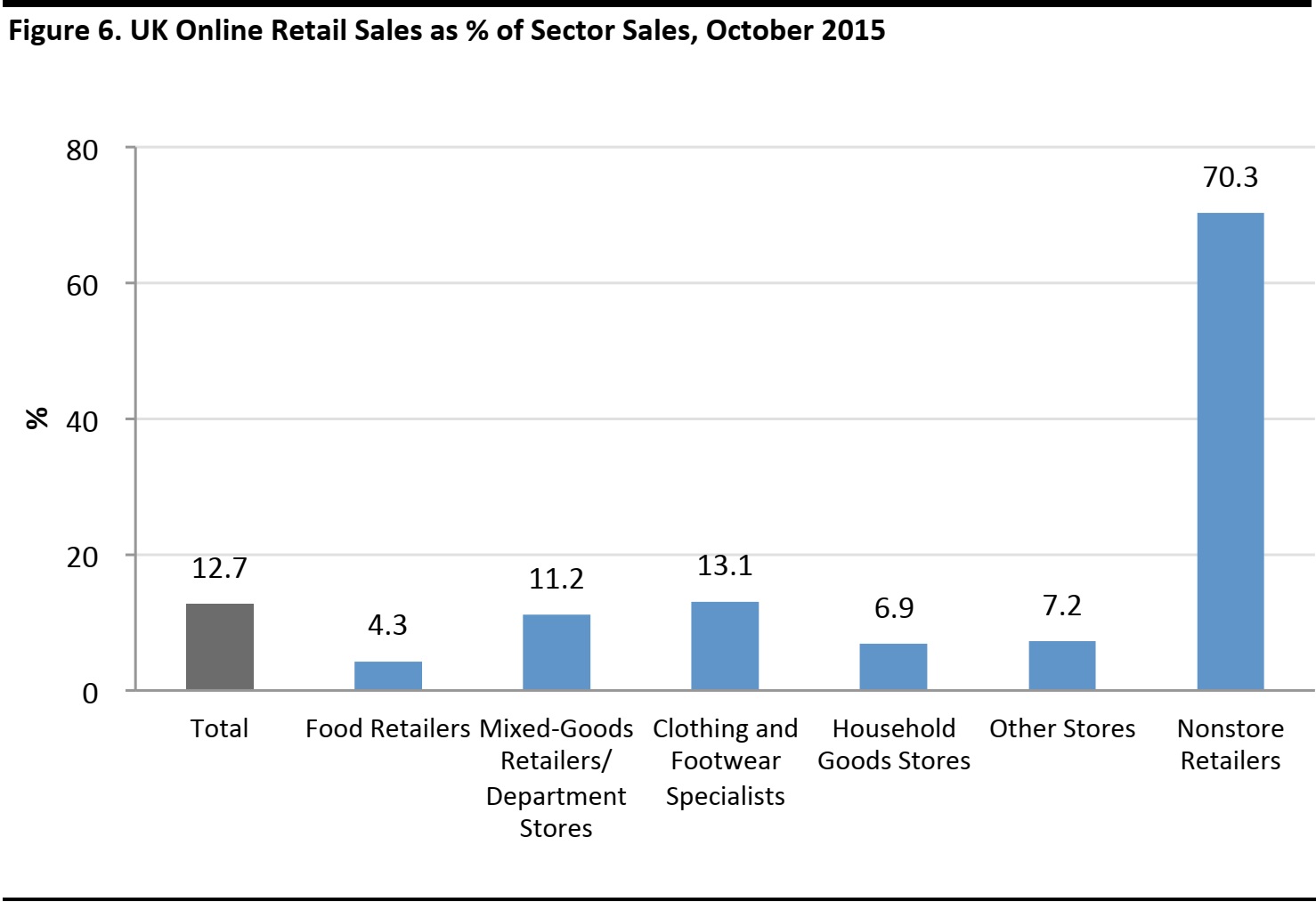

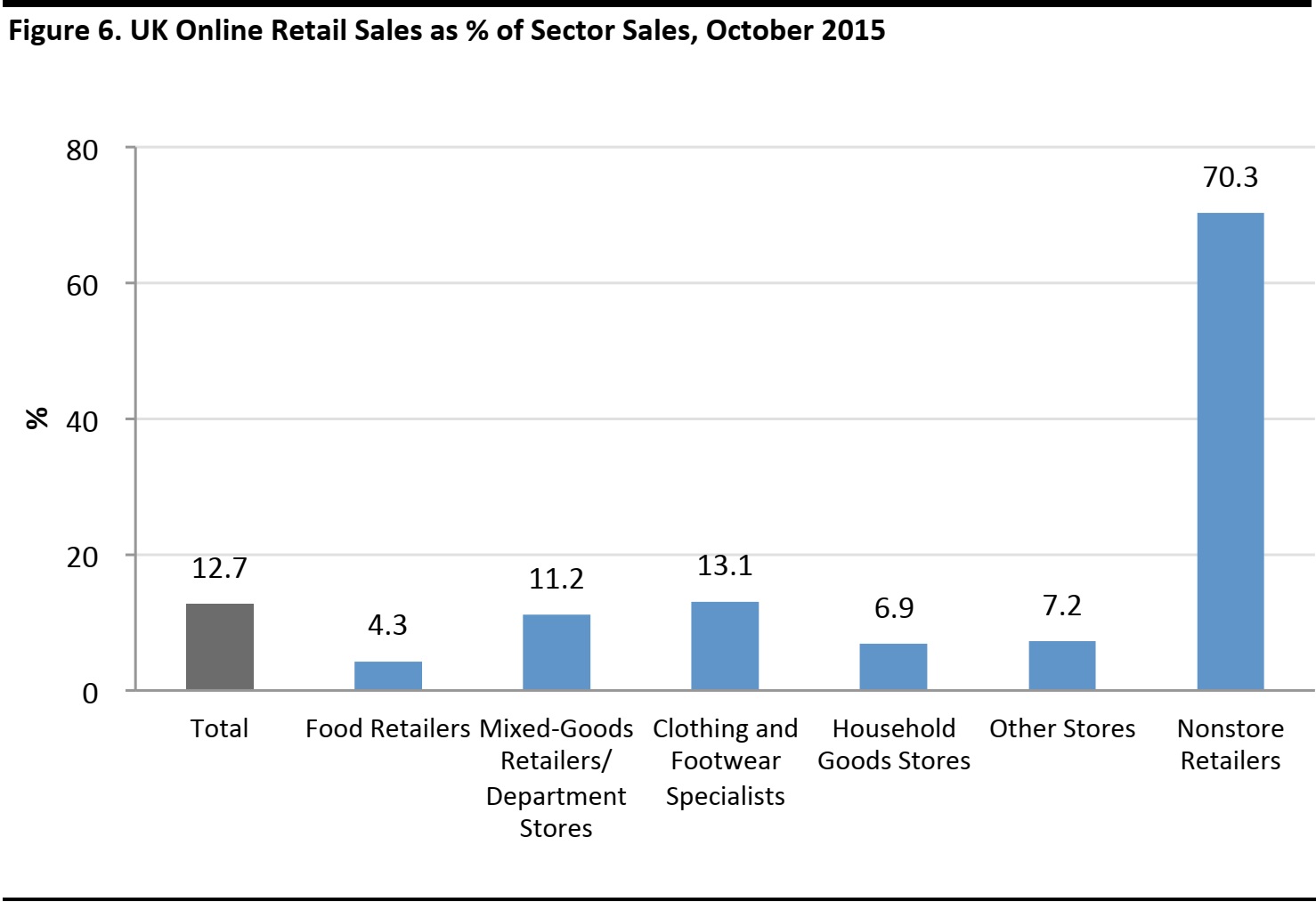

E-‐COMMERCE’S SHARE OF TOTAL RETAIL

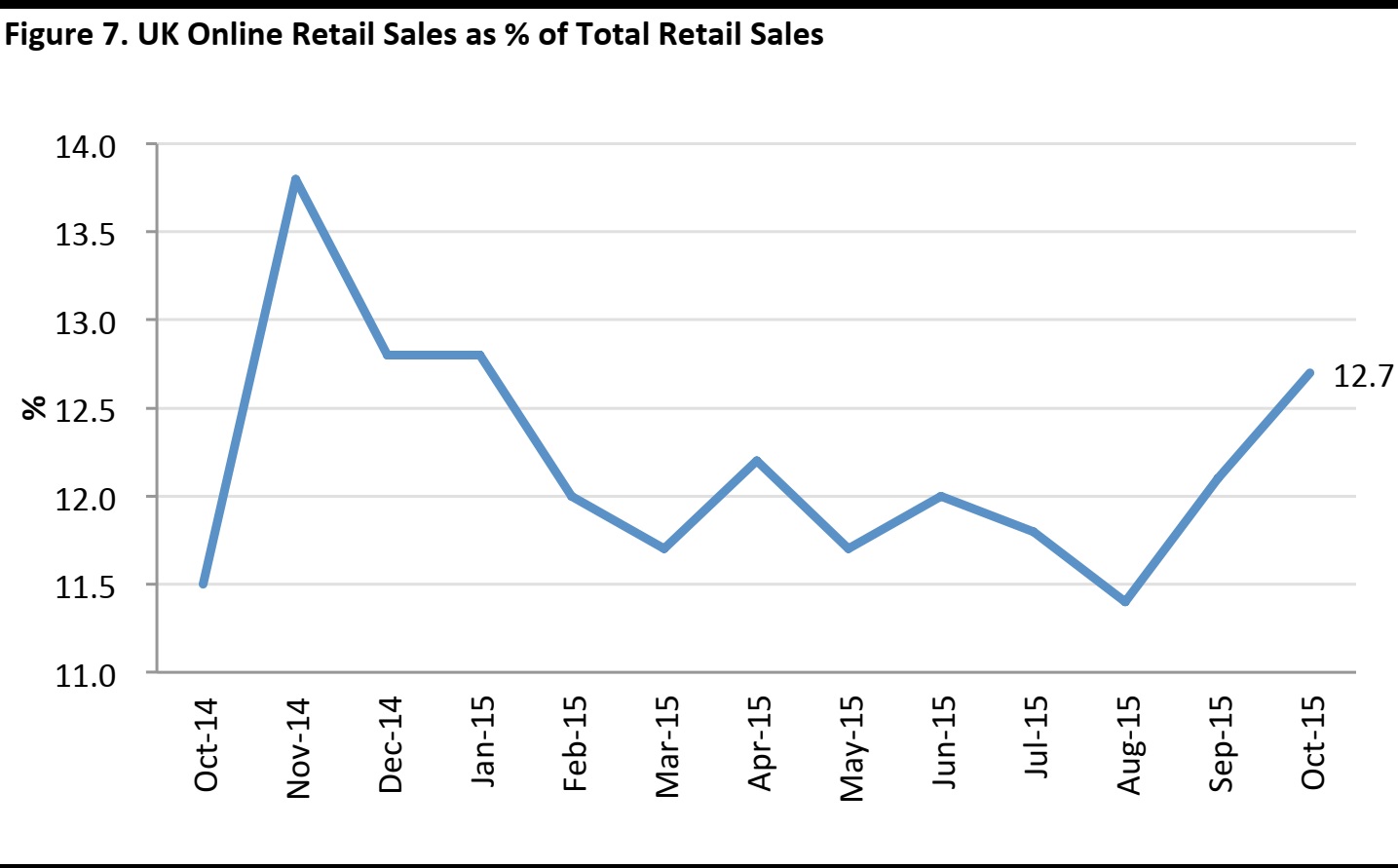

The online channel accounted for almost 13% of total retail sales in October, with clothing and footwear specialists among the leading store-‐based sectors by this measure.

Only 4.3% of total food retailers’ sales were made online in October, according to the ONS—a lower share of grocery retail sales than those quoted by research companies such as Kantar World panel and IGD.

Source: ONS

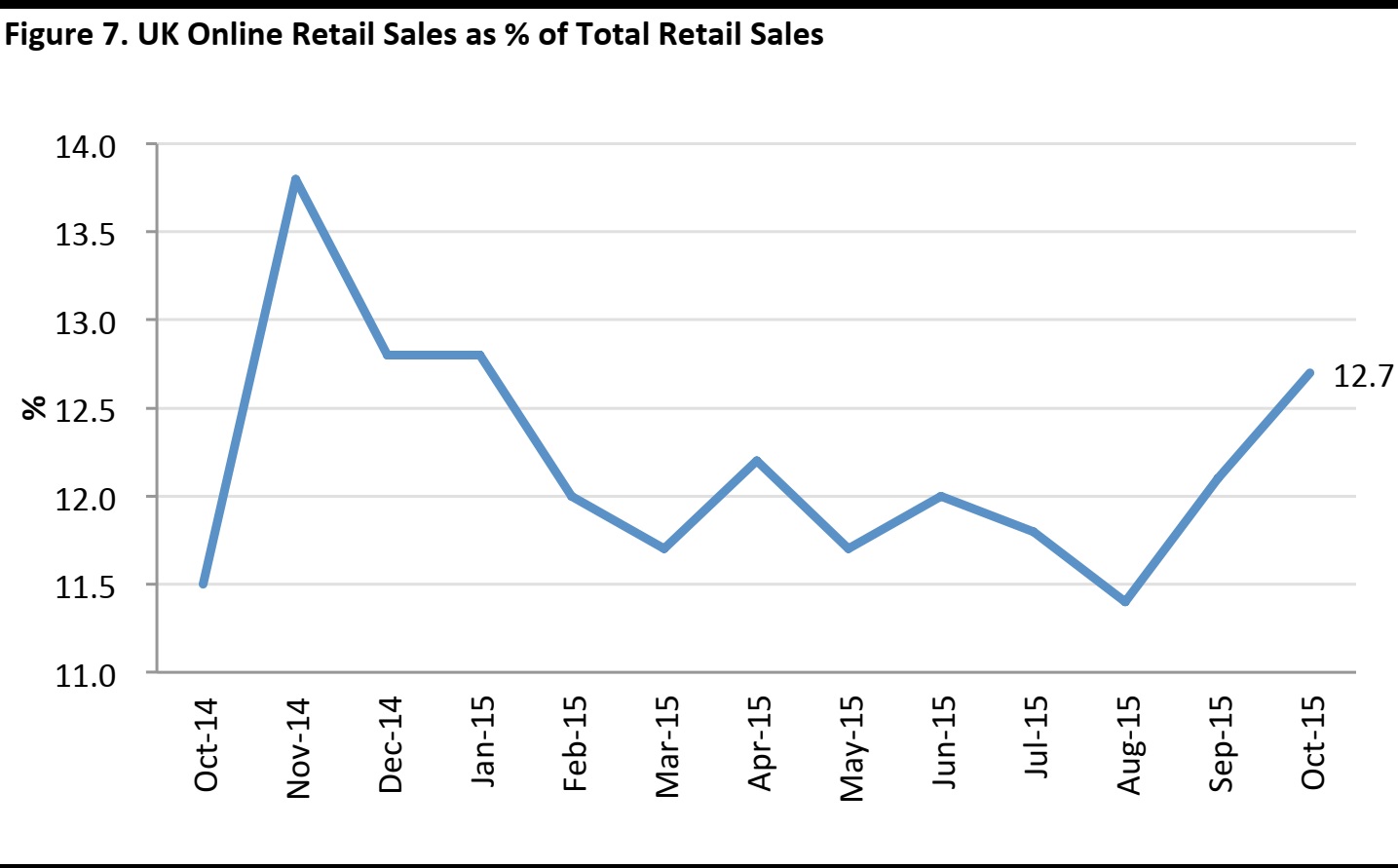

As a share of total retail, online sales tend to peak ahead of Christmas and fall back during the summer. So, we are now approaching the Internet’s peak share period for the year.

Source: ONS