Nitheesh NH

On Tuesday, February 5, 2019, a fire started in the ambient grid section of Ocado Group’s automated customer fulfillment center (CFC) in Andover, England — and only on Friday, February 8 was the fire extinguished, by which time the CFC had been destroyed.

The Andover CFC

The Andover CFC was Ocado’s first to feature its robot-focused “Hive” format. The center launched a new approach to automation, shifting from the conveyor-belt system used in previous Ocado sites to one centered around a dense 3D grid dubbed the Hive, in which layers of crates containing grocery products are stacked. The grids provide 250,000 storage locations.

Swarms of robots — which communicate with each other using a proprietary 4G-based protocol — move across the grid to collect crates and take them to picking stations where (human) employees select the individual items needed to fill customer orders. The Andover CFC was designed to operate with up to 1,100 robots, according to Ocado.

Source: Ocado Technology/Coresight Research[/caption]

Source: Ocado Technology/Coresight Research[/caption]

- For more details on Ocado’s technology, see our November 2018 report Ocado’s Robot-Staffed Distribution Centers: Automating Grocery E-Commerce

- Reduced Capacity: Although Ocado has only four CFCs in the U.K., the company said the Andover CFC accounted for only 10% of its total capacity. The company had previously noted that it was ramping up capacity at its fourth CFC, in Erith, London. This CFC opened in the first half of 2018 and is an Andover-style automated center. This center may help replace some of the lost capacity.

- Knock-On Hit to Sales: On February 6, the company acknowledged sales growth would slow until it can increase capacity elsewhere. In its full-year results released on the day the fire started, Ocado had guided for 10%–15% growth in retail revenues in fiscal 2019.

- Possible Regulatory Changes: Given the reported difficulties in tackling the blaze, there could be pressure to update safety regulations for the era of robotics.

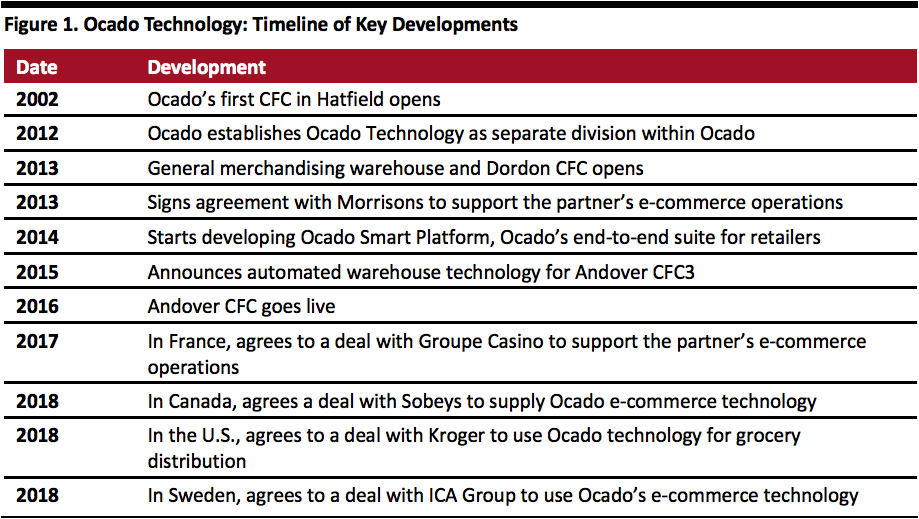

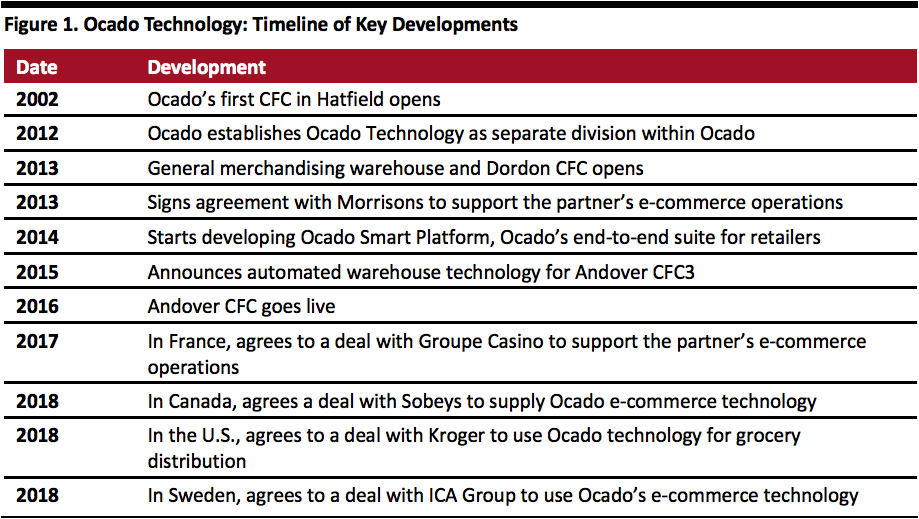

- Renewed Caution Among Possible Partners: Ocado enjoyed a strong 2018, signing agreements to provide technology, including robotic CFCs, to Sobeys in Canada, ICA Group in Sweden and, most notably, Kroger in the U.S. (see timeline below). The fire — and the commentary from those who fought it — may spur renewed caution among potential retail partners, though we see little probability of it scuppering future deals.

- Implementation of Existing Partnerships May Slow: Ocado’s existing retail partners are likely to seek reassurances. Designs for ongoing CFC construction, such as the 335,000-square-foot center that Kroger is building in Cincinnati, could be reviewed, suggesting the possibility of disruption for Ocado and its partners. However, these projects already have relatively long lead times, with Kroger’s Cincinnati CFC set to open in 2021 and ICA’s in 2022. Recent media reports state that Ocado won a “gold safety award” for the sprinkler system at its Andover CFC in June 2018. Existing assurances such as this will likely be insufficient to those buying Ocado’s technology.

- Investor Confidence Hit: The fire highlights the risk of the centralized distribution model, which is virtually unique to Ocado in the U.K. online grocery space. Most of Ocado’s online grocery rivals in the U.K. rely on in-store picking, dispersing the risk of disruption among hundreds of local stores. Ocado’s share price fell 15.5% between February 5 and February 7, though it bounced back by 3.5% on February 8.

Source: Ocado Technology/Coresight Research[/caption]

Source: Ocado Technology/Coresight Research[/caption]