Introduction

British online grocery and technology firm Ocado announced that it has signed a deal with French supermarket company Group Casino to bring its Ocado Smart Platform technology to France. The platform is an end-to-end online grocery system that includes an automated warehouse and accompanying software applications. It will support Casino’s grocery e-commerce business.

This is Ocado’s long-awaited first agreement to provide its Smart Platform service to an international retailer. In June 2017, Ocado signed a software and technology licensing deal with an unnamed regional European grocer, but the deal did not include the adoption of Ocado’s automated fulfillment technology.

Partnership to Help Push Casino’s Online Proposition

The agreement between the retailers lays out plans for Ocado to develop a customer fulfillment center using its proprietary mechanical handling equipment. Ocado will build an advanced, automated, robot-supported warehouse and provide front-end website support, last-mile routing management and real-time implementation of the complete offering.

Below are some of the details we gathered from the companies’ press releases and a conference call held by Ocado.

New Fulfillment Center Is Similar to Ocado’s And over Facility

Ocado CFO Duncan Tatton-Brown said on an analyst call that the service Ocado will develop is similar to that offered in its robot-equipped warehouse facility that began operating at the end of last year in And over, in southwest England.Casino will decide the size of the fulfillment center in France closer to the time of development, “but the building could be potentially bigger than the And over facility,” Tatton-Brown said.

The warehouse in And over spans 240,000 square feet spread over five stories and has an operating capacity of 70,000 orders per week. Groceries and other products are stacked in hive-like shelves that run many levels deep. Overhead robots that hang from roof beams pick and move products across the facility. The warehouse uses machine learning to operate functions, store thousands of kinds of products across several temperature systems,and move products across the floor or give them to a human picker fulfilling orders. Tatton-Brown stated that the And over warehouse was launched with 50 robots and can be scaled to utilize 1,100 robots if necessary.

Timescale and Deployment of the E-Commerce Solution

The building and launch of the e-commerce solution is expected to take at least two years, according to press releases from both retailers. Tatton-Brown clarified that, according to the agreement, Casino has to identify a suitable property and carry out specific work before Ocado can begin building the solution.

What Will Casino Start With?

Casino will first deploy the solution for its convenience banner, Monoprix.fr, and serve customers in the Greater Paris area and the Normandy and Hauts-de-France regions. In the first stage of the deployment, 50,000 food items will be offered for home delivery to shoppers in the Greater Paris area, according to Casino CEO Jean-Charles Naouri’s statement in the press release.A service focused on home delivery will prove distinct in a grocery e-commerce sector that is dominated by drive-through collection.

Tatton-Brown mentioned that Ocado’s solution is capable of supporting online sales of food and general merchandise and offering home delivery as well as click-and-collect service.He added that it is Casino’s decision to choose the services it will offer, and that he could not comment further on the French retailer’s strategy.

Fees and Length of the Contract

Casino paid Ocado upfront fees upon signing the agreement and will continue to pay Ocado while the customer fulfillment facility is developed. After that, Ocado will charge Casino based on utilization of the capacity within the facility.

Tatton-Brown did not state the specific length of the contract, but said that it is a shorter-term agreement than Ocado’s contract with UK grocer Morrisons. Ocado and Morrisons signed that agreement in 2013, and it spans 25 years. The fees Ocado will receive from this agreement also differ from those under the Morrisons deal, Tatton-Brown said. This is because a large part of the cost of operations that Ocado offers as part of its technology and service agreement with Morrisons—such as employing people to pick and move goods and drive delivery vehicles—is absent in the Casino deal.

Both retailers are willing to consider the development of further fulfillment centers close to other large urban areas in France. Tatton-Brown indicated the possibility of an exclusivity agreement between the retailers should Casino wish to develop more fulfillment facilities in France.

Financial Impact for Ocado

Ocado conveyed that it expects this deal to bring significant value to the business in the long run, but to have minimal impact on earnings this fiscal year, which ends on December 3, 2017. In order to provide better clarity on the split between Ocado’s retail business (Ocado Retail) and its online retailing, logistics and distribution technology business (Ocado Solutions), the retailer will introduce segmental reporting of sales and EBITDA in its full-year 2017 results.

In fiscal 2018, Ocado anticipates that the Casino transaction will be earnings neutral, with the costs of establishing the partnership offsetting the initial fees it will receive. The company expects to incur additional capital expenditure of £15 million in fiscal 2018 and further capital expenditure in future years as a result of this partnership.

Ocado expects the profitability of Ocado Solutions to grow in fiscal 2019 as fees from this transaction increase and in anticipation of signing other deals.

Implications for Casino’s E-Commerce Proposition

In our

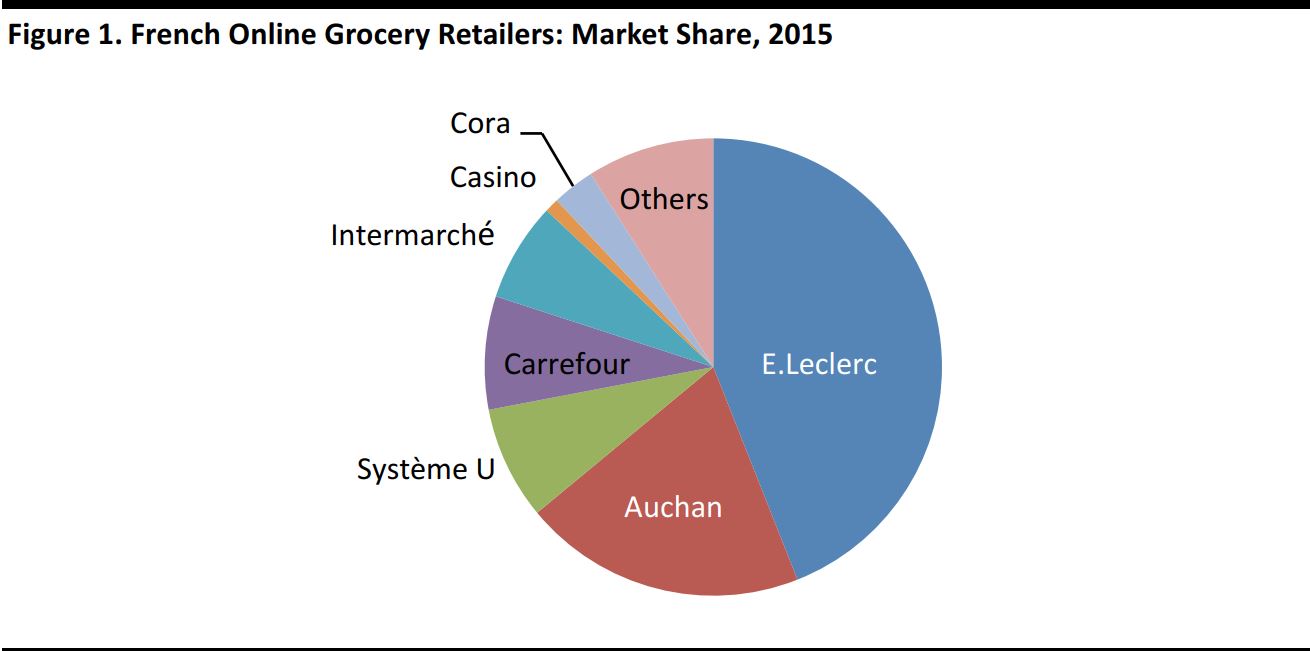

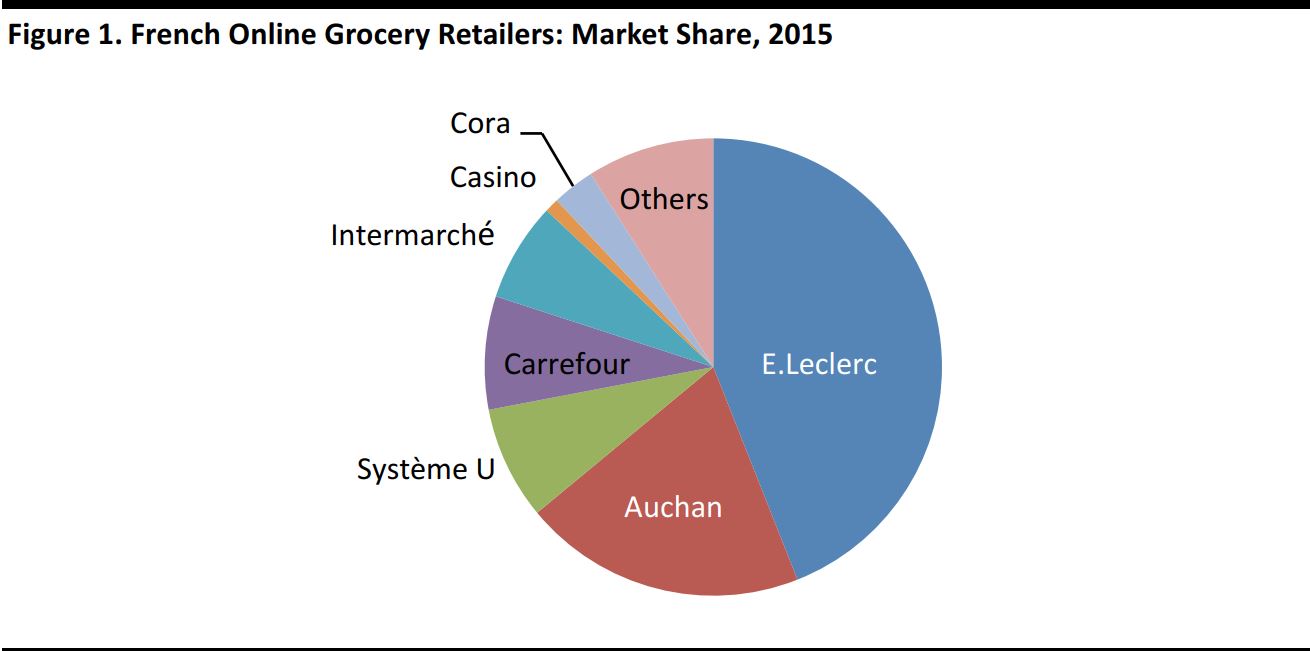

Deep Dive: Online Grocery Series: France—Where Click-and-Drive Is King report, we discussed how the French online grocery sector is one of the most advanced in the world. France’s online grocery market is led by E.Leclerc, based on 2015 Kantar Worldpanel data, with Casino accounting for only a very small share.

Source: Kantar Worldpanel/FGRT

The deal with Ocado will likely help Casino push its e-commerce proposition further and advance its online grocery business. Should Casino realize significant value from the partnership and commission Ocado to develop further fulfillment facilities, it could well be the exclusive user of Ocado’s state-of-the-art solution in France, which would likely help it push further ahead of its competition.