Source: Company reports/Fung Global Retail & Technology

FY16 Results

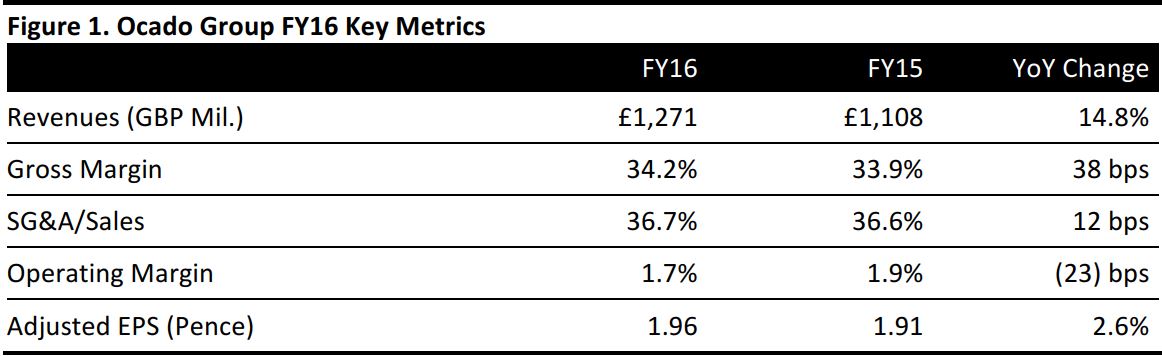

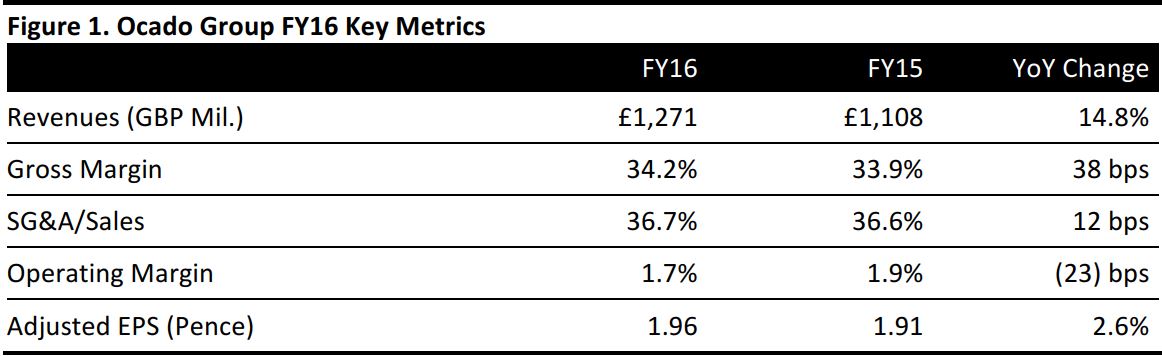

Ocado Group announced another year of strong top-line growth. Revenues for the year came in at £1,271 million versus consensus of £1,275 million.

Revenue growth of 14.8% reflected an out performance versus the online grocery market: the Office for National Statistics recorded average (non-weighted) year-over-year growth of 13.7% in online sales by food stores in the 12 months through November 2016; Euro monitor says that online sales of food and drink grew by 10.7% in calendar 2016.

Operating margins contracted in spite of the rapid top-line growth. Ocado noted SG&A impacts from the deflationary grocery market, the introduction of the National Living Wage and investments to grow its business.

Profit before tax crept up by 1.7% to £12.1 million. Diluted EPS rose by 2.6% to 1.96 pence, which was marginally ahead of the 1.94 pence expected by analysts.

Among the non financial metrics reported by Ocado were:

- Active customer numbers rose by 13.9% to 580,000.

- Order volumes grew by 17.9% to an average of 230,000 per week.

- The average grocery basket value declined by 2.7% to £108, impacted by grocery-market deflation and increased uptake of Ocado’s Smart Pass, which encourages more frequent shopping.

- Its own-label sales were up by “over 10%,” though we note this lags its overall 14.8% revenue growth.

Ocado’s long-anticipated tie-up to provide technology services to international retailers again failed to materialize; the company noted that it continues to “engage and develop discussions with multiple international retailers.” The company reiterated that it is “confident” that it will sign “multiple deals in multiple territories in the medium term.”

Outlook

Ocado noted that it expects to continue to outperform the online grocery market in the year ahead. It expects capital expenditure to total approximately £175 million in FY17.

The opening of a new Customer Fulfillment Center in And over in November 2016 will impact on depreciation costs in FY17; depreciation totaled £47 million in FY16. Further CFCs are set to open in FY18.

For FY17, analysts expect Ocado to grow revenues by 13.7%, EBIT by 31% and pre tax profit by 38%. Diluted EPS is expected to rise to 2.7 pence.