Ocado

Sector: Online retailer

Countries of operation: Australia, Canada, France, Japan, Poland, Spain, Sweden, the UK and the US

Key product categories: Clothing, food and beverages, and general merchandise

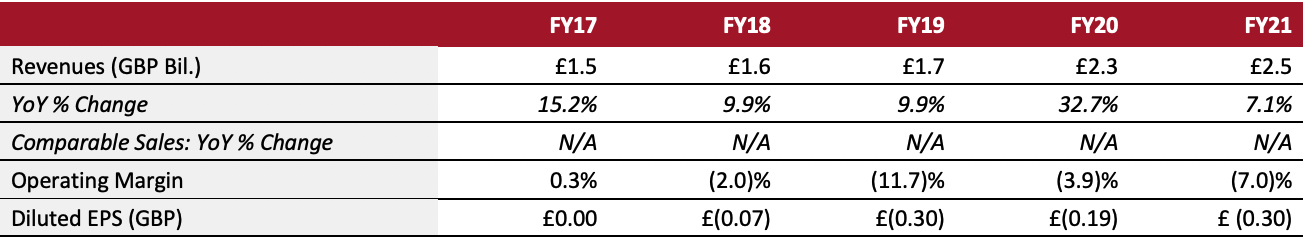

Annual Metrics

[caption id="attachment_151460" align="aligncenter" width="700"]

Fiscal year ends close to November 30 of the same calendar year

Fiscal year ends close to November 30 of the same calendar year[/caption]

Summary

Ocado is a UK-based online grocery retailer and technology provider. The company provides grocers around the world with technology solutions powered by the Ocado Smart Platform (OSP): these include delivery and in-van technology, supply chain, warehouse fulfillment and website solutions (as well as for tablet and mobile apps). OSP’s global clients include Aeon (Japan), Alcampo (Spain), Auchan Retail (Poland), Bon Preu (Spain), Casino (France), Coles (Australia), ICA (Sweden), Kroger (US), M&S (UK), Sobey’s (Canada). Ocado also operates a separate retail business in a 50:50 joint venture with M&S.

Company Analysis

Coresight Research insight: In recent years, Ocado has pivoted away from being a pure-play online grocer operating in the UK to being a global technology-led software and robotics platform business, providing end-to-end online grocery solutions to retailers worldwide. The pandemic-induced surge in online orders has galvanized many grocers to accelerate entry into the automated e-commerce fulfillment space, in order to increase supply chain efficiency and speed up delivery. Ocado is well-positioned to leverage its experience, both in grocery retail and technology solutions, to form partnerships with leading grocery retailers on a global scale.

Although Ocado has signed up various sizeable international grocery retailers in recent years, the OSP is a capital-intensive solution with a long lead time of 18 months or more. This can be an off-putting factor for many potential customers looking to accelerate their online business. Additionally, Ocado faces tough competition from rival technology providers that gained prominence during the pandemic, which do not involve a long-term commitment or significant capital investment—including grocery delivery platforms (DoorDash, Instacart and Shipt) and micro-fulfillment centers.

| Tailwinds |

Headwinds |

- Pandemic-induced growth in the online grocery market will increase demand for the OSP from current and prospective partners.

- The operating model bypasses the store fulfillment process and is therefore unaffected by out-of-stock situations at stores.

- Recent acquisitions of robotic startups Myrmex, Kindred Systems and Haddington Dynamics will enhance material handling efficiency.

- The switchover from Waitrose to M&S has increased the range of food and clothing product lines.

- There are opportunities for sustained international expansion by partnering with grocery retailers in emerging markets.

|

- There is heightened competition from other online grocery fulfillment channels, including micro-fulfillment technologies and delivery platforms.

- The OSP requires high initial investment of $50–55 million to construct fulfillment centers and a long lead time of more than 18 months to become operational.

- Last-mile delivery costs are high.

- Volumes are relatively fixed in fulfillment centers and cannot scale as rapidly as low-tech solutions, such as in-store picking.

|

Strategy

In 2021, the company introduced a new strategy focused on five priorities:

1. Grow revenue

- Develop, build, acquire and diversify its revenue streams

2. Optimise OSP economics

- Ensure the technology, implementation and services delivery industry-leading returns and low-cost operations

3. Deliver transformational technology

- Innovate continuously ahead of the market by identifying, developing and protecting its digital ecosystem

4. Delivery on client commitments

- Provide efficient and scalable solutions and delivery a best in-class customer service

5. Develop global scale-up capabilities

- Build the foundations to continue scaling and growing at pace

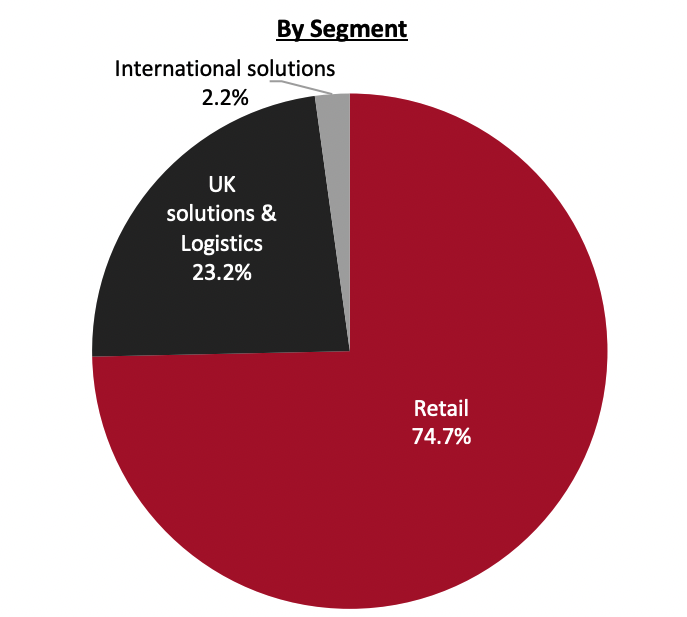

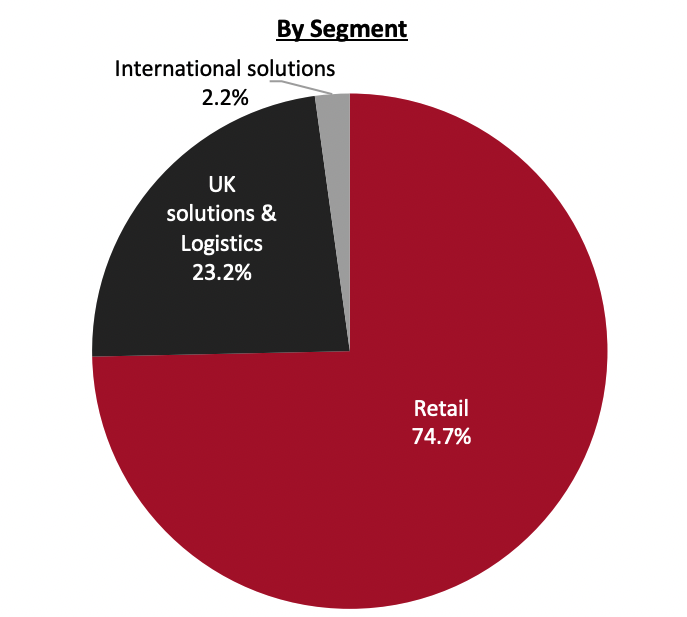

Revenue Breakdown (FY21)

Company Developments

Company Developments

| Date |

Development |

| May 23, 2022 |

Ocado acquires Athens-based material handling robotic startup Myrmex for €10.2 million ($11.0 million). |

| January 26, 2022 |

Ocado introduces a suite of innovations including lightweight robots, robotic arms for order picking and warehouse grids. |

| October 6, 2021 |

Ocado invests £10 million ($13.6 million) in self-driving technology startup Wayve |

| April 21, 2021 |

Ocado announces that it has partnered with Oxbotica, a UK-based startup that develops autonomous delivery systems. |

| March 1, 2021 |

Ocado opens its first mini customer fulfillment center, spanning 150,000 square feet in Bristol, England. |

| January 7, 2021 |

Ocado sells its online pet accessories store to Paw Holdings, which runs Pet-Supermarket.co.uk and Petmeds. |

| November 24, 2020 |

Ocado announces plans to construct a 200,000 square feet customer fulfillment center in the US, and roll out its in-store fulfillment technology across Kroger stores from 2021. |

| November 9, 2020 |

Ocado acquires two robotic startups, Kindred Systems and Haddington Dynamics, enhancing its robotic manipulation capabilities. |

| October 15, 2020 |

Ocado acquires a minority stake in material handling robotics startup Myrmex. |

| April 28, 2020 |

Ocado announces that its first customer fulfillment center in North America is up and running for online grocery home delivery service Violà by Sobeys. |

| March 26, 2020 |

Ocado announces the live launch of its operations for Groupe Casino’s fulfillment center in Paris. |

| August 5, 2019 |

Ocado announces that it has completed the £750 million deal to turn its online grocery business into a joint venture with M&S. |

Management Team

- Rick Haythornthwaite—Chairman

- Tim Steiner—CEO

- Luke Jensen—CEO Ocado Solutions

- Stephen Daintith—CFO

- Mark Richardson—COO

Source: Company reports

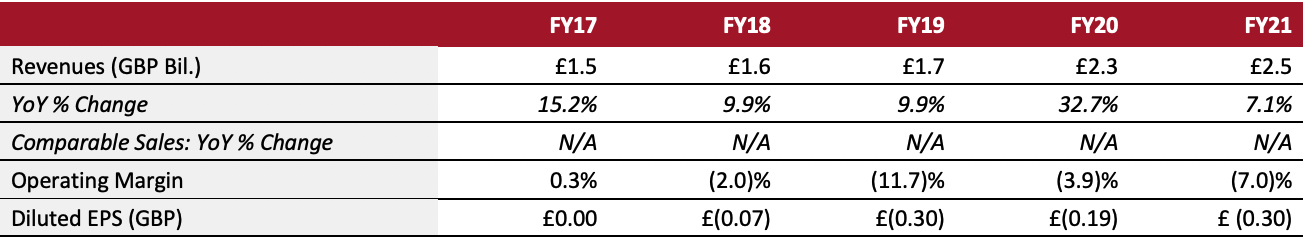

Fiscal year ends close to November 30 of the same calendar year[/caption]

Summary

Ocado is a UK-based online grocery retailer and technology provider. The company provides grocers around the world with technology solutions powered by the Ocado Smart Platform (OSP): these include delivery and in-van technology, supply chain, warehouse fulfillment and website solutions (as well as for tablet and mobile apps). OSP’s global clients include Aeon (Japan), Alcampo (Spain), Auchan Retail (Poland), Bon Preu (Spain), Casino (France), Coles (Australia), ICA (Sweden), Kroger (US), M&S (UK), Sobey’s (Canada). Ocado also operates a separate retail business in a 50:50 joint venture with M&S.

Company Analysis

Coresight Research insight: In recent years, Ocado has pivoted away from being a pure-play online grocer operating in the UK to being a global technology-led software and robotics platform business, providing end-to-end online grocery solutions to retailers worldwide. The pandemic-induced surge in online orders has galvanized many grocers to accelerate entry into the automated e-commerce fulfillment space, in order to increase supply chain efficiency and speed up delivery. Ocado is well-positioned to leverage its experience, both in grocery retail and technology solutions, to form partnerships with leading grocery retailers on a global scale.

Although Ocado has signed up various sizeable international grocery retailers in recent years, the OSP is a capital-intensive solution with a long lead time of 18 months or more. This can be an off-putting factor for many potential customers looking to accelerate their online business. Additionally, Ocado faces tough competition from rival technology providers that gained prominence during the pandemic, which do not involve a long-term commitment or significant capital investment—including grocery delivery platforms (DoorDash, Instacart and Shipt) and micro-fulfillment centers.

Fiscal year ends close to November 30 of the same calendar year[/caption]

Summary

Ocado is a UK-based online grocery retailer and technology provider. The company provides grocers around the world with technology solutions powered by the Ocado Smart Platform (OSP): these include delivery and in-van technology, supply chain, warehouse fulfillment and website solutions (as well as for tablet and mobile apps). OSP’s global clients include Aeon (Japan), Alcampo (Spain), Auchan Retail (Poland), Bon Preu (Spain), Casino (France), Coles (Australia), ICA (Sweden), Kroger (US), M&S (UK), Sobey’s (Canada). Ocado also operates a separate retail business in a 50:50 joint venture with M&S.

Company Analysis

Coresight Research insight: In recent years, Ocado has pivoted away from being a pure-play online grocer operating in the UK to being a global technology-led software and robotics platform business, providing end-to-end online grocery solutions to retailers worldwide. The pandemic-induced surge in online orders has galvanized many grocers to accelerate entry into the automated e-commerce fulfillment space, in order to increase supply chain efficiency and speed up delivery. Ocado is well-positioned to leverage its experience, both in grocery retail and technology solutions, to form partnerships with leading grocery retailers on a global scale.

Although Ocado has signed up various sizeable international grocery retailers in recent years, the OSP is a capital-intensive solution with a long lead time of 18 months or more. This can be an off-putting factor for many potential customers looking to accelerate their online business. Additionally, Ocado faces tough competition from rival technology providers that gained prominence during the pandemic, which do not involve a long-term commitment or significant capital investment—including grocery delivery platforms (DoorDash, Instacart and Shipt) and micro-fulfillment centers.

Company Developments

Company Developments