DIpil Das

*Restated due to adoption of IFRS 15 in the second half of 2018

*Restated due to adoption of IFRS 15 in the second half of 2018 **Not meaningful

All items are statutory

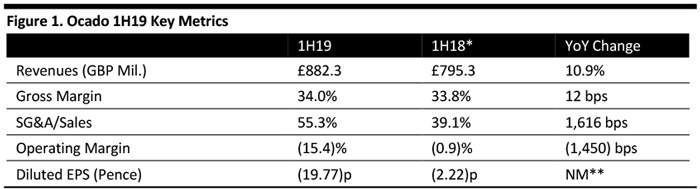

Source: Company reports/Coresight Research[/caption] 1H19 Results Ocado reported 1H19 results with strong growth in revenues. However, the company posted a net loss due to higher CFC costs and other distribution and administration expenses. The highlights are as follows:

- Ocado posted total revenues of £882.3 million, up 10.9% year over year. The growth was driven by an increase in the average number of orders per week.

- By segment, retail increased 10.2% to £811.5 million and solutions 20.6% to £70.8 million, year over year. Retail revenues include revenues from Ocado.com, Fetch, Fabled and wholesale partnerships.

- A fire at its CFC3 in Andover in February resulted lost revenues equivalent to 2% of sales in the first half.

- Total EBITDA was down drastically, 47.2% year over year to £18.1 million. Retail EBITDA fell 4.6% to £43.4 million; solutions EBITDA was (16.2) million in the current quarter compared to (6.6) million in the same quarter of the previous year.

- Operating margin contracted 1,450 bps year over year to (15.4)%, due to higher CFC costs related to its new Erith CFC, increases in marketing costs related to online acquisition and an offline media campaign, and head office cost led by technology expenses incurred due to the transition of Ocado.com onto a new platform, additional headcount partly to support operations at warehouses opened in the last 12 months and higher share incentive costs due to the increase in the share price.

- CFC costs increased mainly due to the annualized impact of the Erith CFC (which started operating in July 2018) which carries higher than the normal engineering costs per order.

- Ocado reported a diluted loss per share of 19.77 pence compared to a loss per share of 2.22 pence in the same period of the previous year.

- Due to capacity constraints caused by the Andover fire, Ocado reached an agreement with Morrisons to suspend Morrisons right to 30% of the capacity at Erith (CFC4) until February 2021.

- The company’s active customers increased 9.7% to 745,000.

- Total order volumes from Ocado.com and Fetch were 318,000 orders per week, up 10.4% year over year.

- Average hypermarket basket value was stable at £108.04 compared to £108.18 in 1H18, as the trend to smaller baskets due to ordering on mobile was offset by price inflation.

In the last six months, the center of gravity at Ocado Group has shifted. Our exciting new joint venture with M&S creates further growth opportunities for both parties in the UK and allows Ocado Group to increase focus on growing our Ocado Solutions business and innovating for our partners. At the same time, we are beginning to apply our technology skills and expertise to other related activities which we expect to be of benefit to our solutions partners as well as to other Ocado Group stakeholders. The innovation factory we have created is founded on a near twenty-year heritage of constant re-examination and reinvention of technology to provide the best customer experience. As we look to successfully scale our business and deliver outstanding execution to our partners, our challenge will be to select and prioritize the most attractive of these opportunities.

Other Major Highlights:- Ocado previously announced a 50:50 joint venture with Marks & Spencer (M&S) to automate fulfilment, driven by Ocado Smart Platform (OSP). Ocado said the inflow of £562.5 million from the M&S deal in August will give the company financial flexibility to execute its current commitments and to take full advantage of opportunities to grow Ocado Solutions and other platforms.

- Ocado sold its remaining retail business, Fabled, to Next.

- Ocado signed its sixth international partnership with Coles to develop the OSP in Australia.

- The company extended its partnership with Sobeys with the announcement of a second customer fulfilment center (CFC) in Montreal.

- The first CFCs for Groupe Casino and Sobeys are set to open in the first half of 2020.

- Kroger has broken ground on the first Kroger CFC, in Monroe, Ohio, with two other CFC locations announced recently.

- Ocado expects retail revenue growth of 10-15% in 2H19, despite the impact of the Andover fire, driven by demand growth and the company’s ability to use additional capacity in its CFC4.

- As CFC4 ramps up, Ocado expects to find efficiency and further growth in the underlying EBITDA contribution of Ocado Retail.

- Due to the loss of fees resulting from Morrisons not using Erith CFC capacity, Ocado expects solutions revenue to grow more slowly than retail. In line with the previous guidance at FY18 results, Ocado continues to expect £15-20 million additional operating costs towards CFCs and to provide features on the platform.

- The company kept its capital expenditure guidance unchanged at £350 million for FY19.

- Ocado expects a £15 million impact on Group EBITDA from Andover-related business disruption: £8 million related to reduced fees in solutions and higher fixed costs due to Morrisons not using capacity at Erith, with the remaining retail sales lost due to the Andover fire. Ocado expects insurance payments to cover the losses related to the Andover fire for business disruption that will be experienced over the next few years, including lost sales and cost inefficiencies.