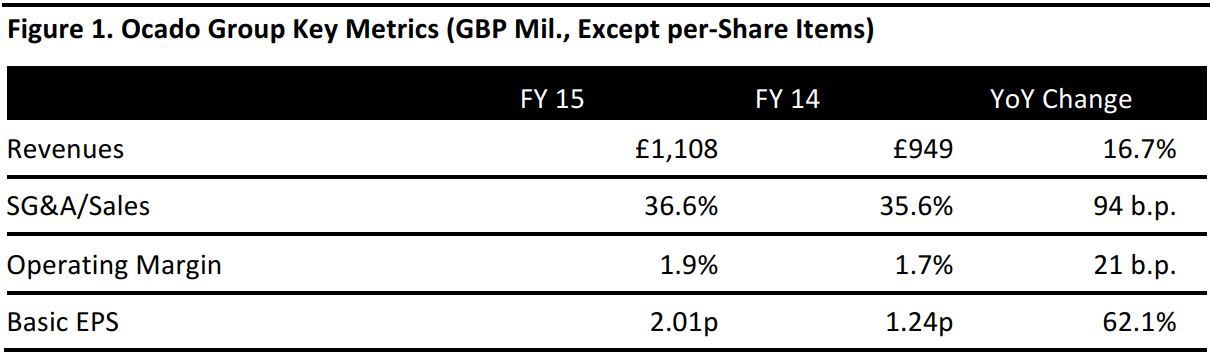

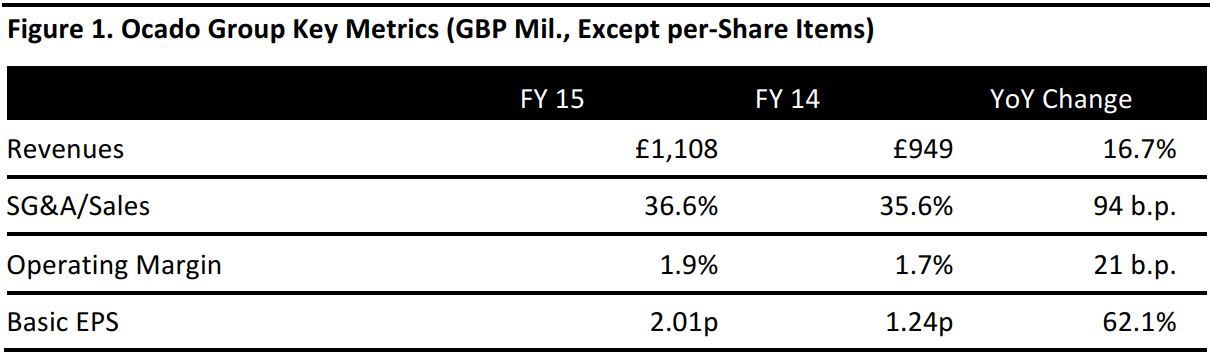

Source: Company reports

Ocado Group posted another year of solid top-line growth, with revenues up 16.7%, which CFO Duncan Tatton-Brown said was “ahead of the online grocery market.”Total revenues for the year ending November 2015 were in line with consensus estimates reported by S&P Capital IQ.

The company reported its second annual positive net profit, of £11.8 million, versus £7.3 million for fiscal 2014.

Active customer numbers were up 12.4% year over year, with new customer acquisitions up more than 20%. Order volumes grew by 16.8%, but average basket values fell by 2.1% in a deflationary UK grocery market.

Total distribution and administrative expenses (SG&A) grew by 19.8% year over year, driven higher by costs recharged to Morrisons, for which Ocado operates an online grocery service. Excluding Morrisons, SG&A grew by 12.9%.

Ocado Group’s revenues include the recharge of costs and fees charged to Morrisons.

Increasing Capacity

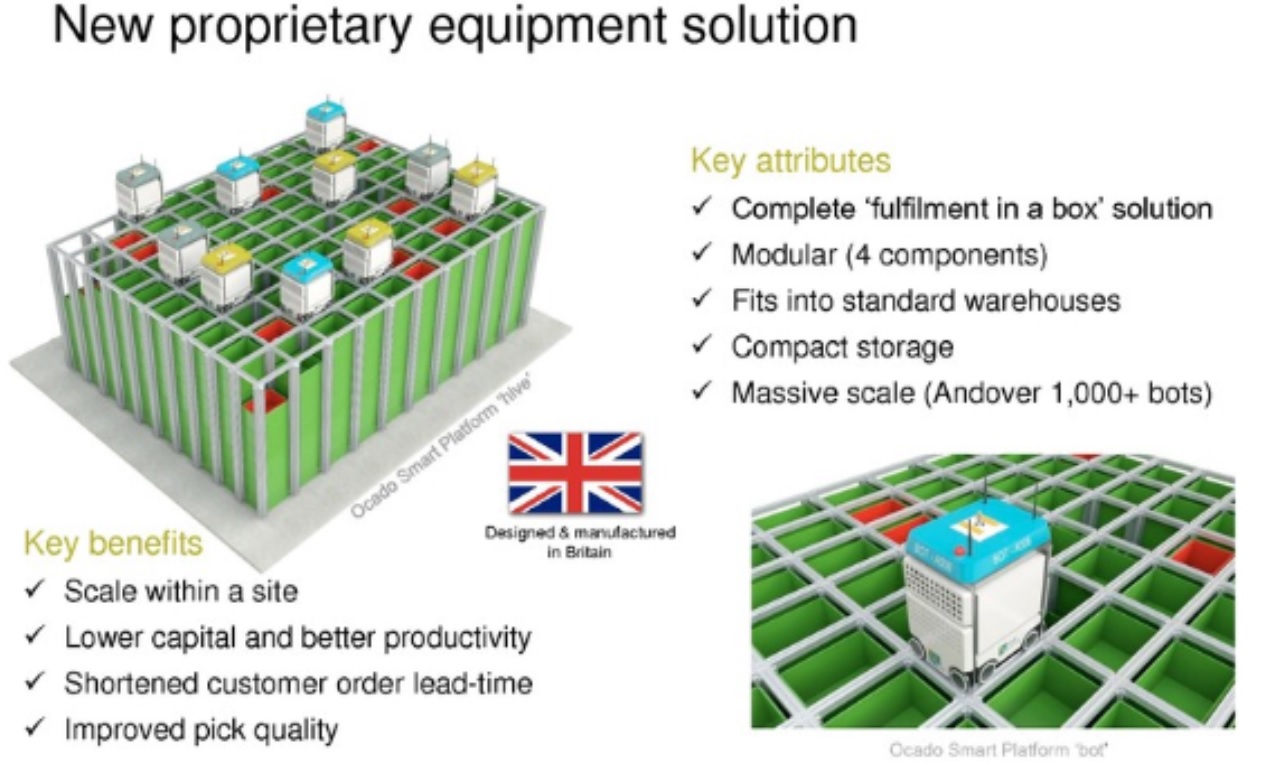

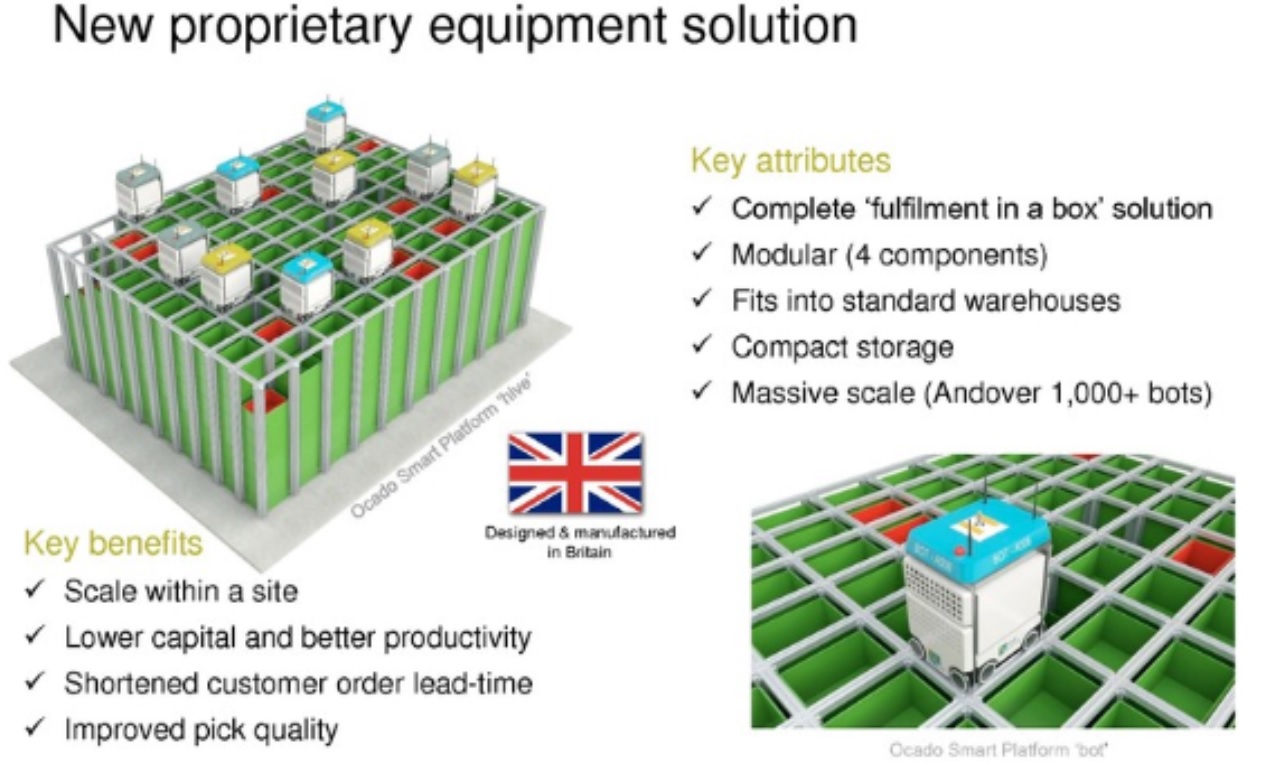

The company is boosting its capacity with a focus on Southeastern England. It has two new automated fulfillment centers in the pipeline, one at Andover, in Hampshire, and one at Erith in Outer London. Both deploy new robotic technology that allows the company to maximize space through automation. The Andover site will have around 1,000 robots and the Erith site three times as many.

Source: Ocado

Third-Party Agreements

Ocado said sales through Morrisons.com had reached around £200 million after 12 months of trading. We recently heard from Morrisons that its online sales were up by “nearly 100%” in the nine weeks to January 9. Ocado Group CEO Tim Steiner said that was the “fastest ramp-up of any online grocery service in the world.”

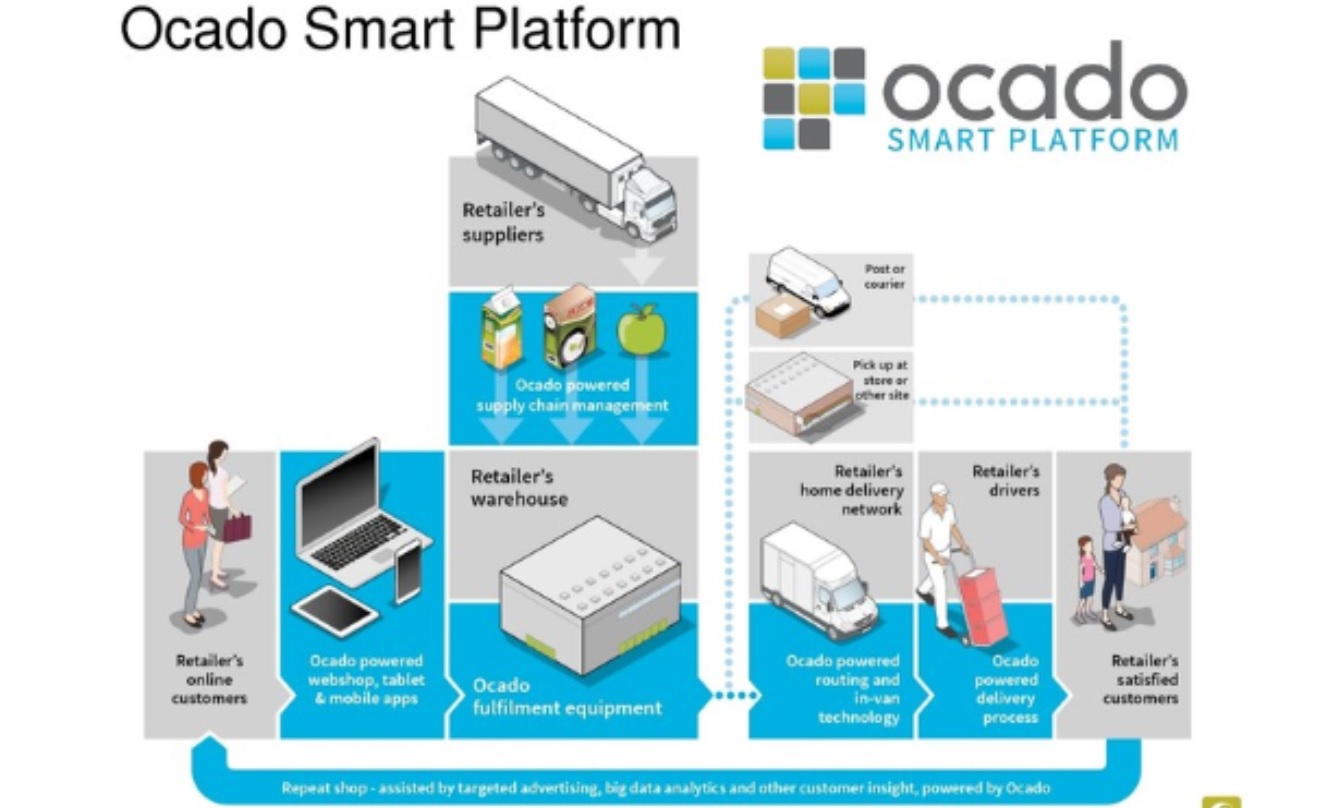

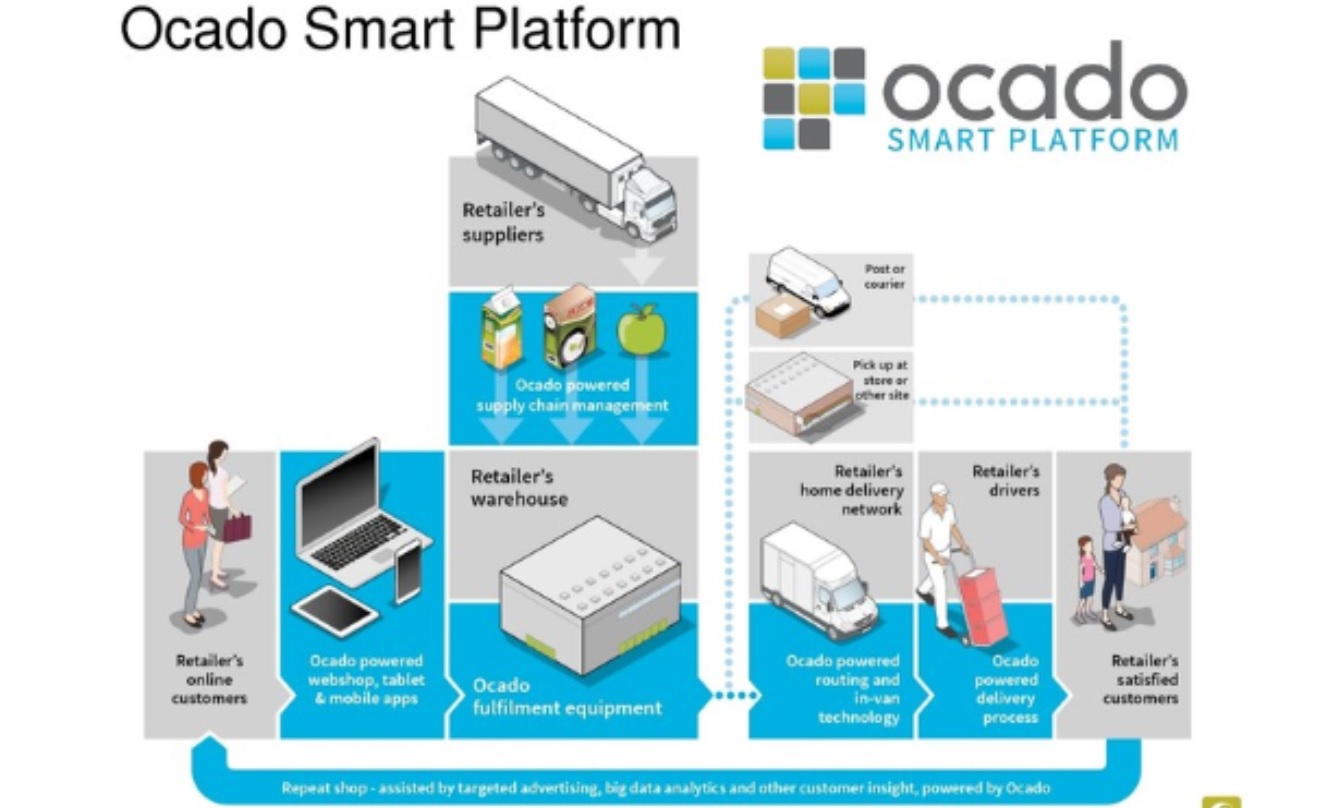

Ocado Group had aimed to sign a deal to license its “Smart Platform” technology to an international retail partner before fiscal year-end. The company did not meet its goal, and today said, “Discussions with multiple potential international partners…continue and our confidence in signing a deal remains high.” Steiner said the company maintains a medium-term target to sign multiple deals in multiple territories.

Source: Ocado

In today’s Q&A, management would not comment on reports that the company had failed to secure a deal with US retailer Sprouts Farmers Market, which in December 2015 launched sales trials via Amazon Prime Now.

The Morrisons deal is frequently cited as indicating Ocado Group’s potential in terms of licensing its know-how. However, the agreement is fundamentally different from any likely future agreement: the Morrisons deal was based on leveraging Ocado’s physical assets (its fulfillment centers) to ramp up capability rapidly, rather than licensing its intellectual property to build an operation from scratch.

Amazon Fresh?

Recurring rumors that an Amazon Fresh launch in the UK is imminent have weighed on Ocado’s share price in the recent past, but Steiner noted that Amazon Fresh may help expand the total UK e-grocery market, and said, “We welcome that.”