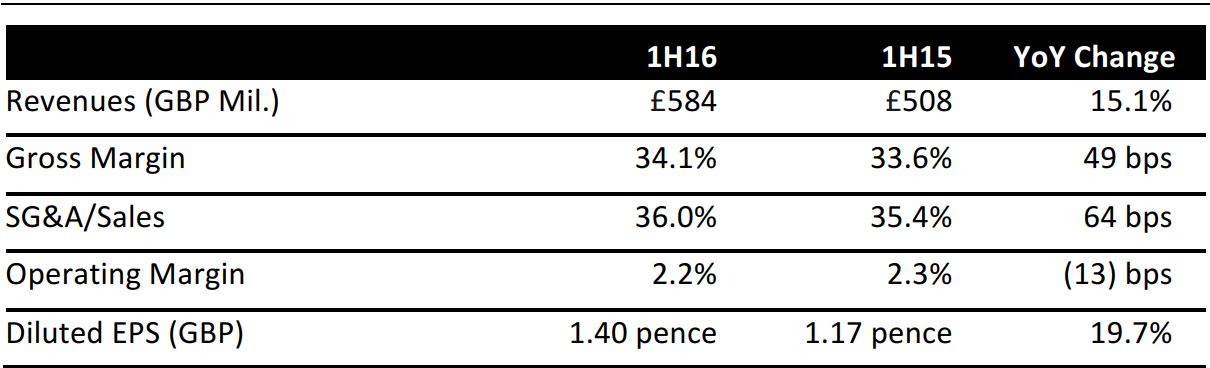

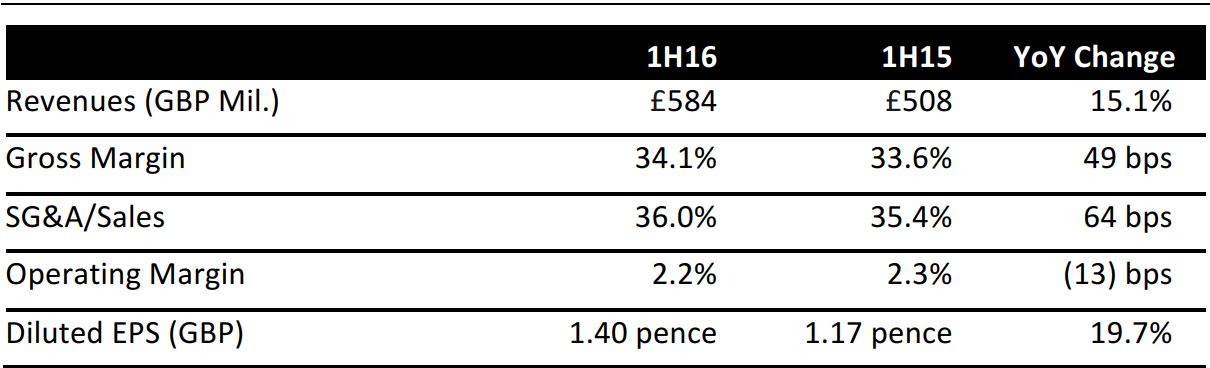

1H16 ended May 15, 2016; 1H15 ended May 17, 2015.

Source: Company reports/Fung Global Retail & Technology

1H16 RESULTS

British online grocery retailer Ocado Group reported that revenues grew by 15.1%, to £584 million, in 1H16. This was fractionally behind the consensus estimate of £588 million.

Ocado said the agreement to provide the online service for brick-and-mortar grocer Morrisons bolstered its gross margin. SG&A grew by 17.1% year over year, also driven up by the Morrisons agreement; excluding costs associated with Morrisons, SG&A grew by 12.3%.

Net profit climbed by 19.4%, to £8.6 million. This fed through to EPS climbing 19.7%, to 1.40 pence, versus consensus of 1.19 pence.

SELECTED METRICS: PRODUCTIVITY UP, BASKET SIZE DOWN

Nonfinancial metrics reported by Ocado for 1H16 include the following:

- Order volumes grew by 17.8%, to an average of 225,000 orders per week.

- Active customer numbers were up 14.9%, to 541,000.

- The average Ocado.com basket value declined by 2.2%, to £110.10, impacted by price deflation.

- Ocado own-label sales were up 11%.

- Delivery efficiency improved to 175 deliveries per van per week, up from 162 in the year-ago period.

- Productivity in Ocado’s mature fulfillment centers grew to 159 units per labor hour, up from 153 a year ago.

- On-time delivery stood at 94.9%, down from 95.6% a year ago. Order accuracy was 99.1% versus 99.3% a year ago.

The company reiterated that it is engaged with international retailers on their potential adoption of its “Smart Platform” technology.

GUIDANCE

Ocado said it expects to continue to grow faster than the online market. It anticipates average order values will continue to decline in the context of a competitive market. The company expects to open and start depreciating its third fulfillment center in 2H16. Capital expenditures are expected to be £150 million across FY16.

For the full year, analysts expect Ocado to post revenue growth of 14.7% and for GAAP EPS to climb by 36.6%.