Nitheesh NH

Ocado has announced that Australian supermarket retailer Coles Group is the latest international retailer to sign up to its Ocado Smart Platform (OSP). The agreement will see the construction of two robotic customer fulfillment centers (CFCs), one in Sydney the other in Melbourne, to serve customers in Australia’s larger urban areas. The companies expect these centers to go live within four years. Coles will adopt Ocado’s proprietary store-pick software to allow it to serve online grocery shoppers in less-populated areas. Ocado stated:

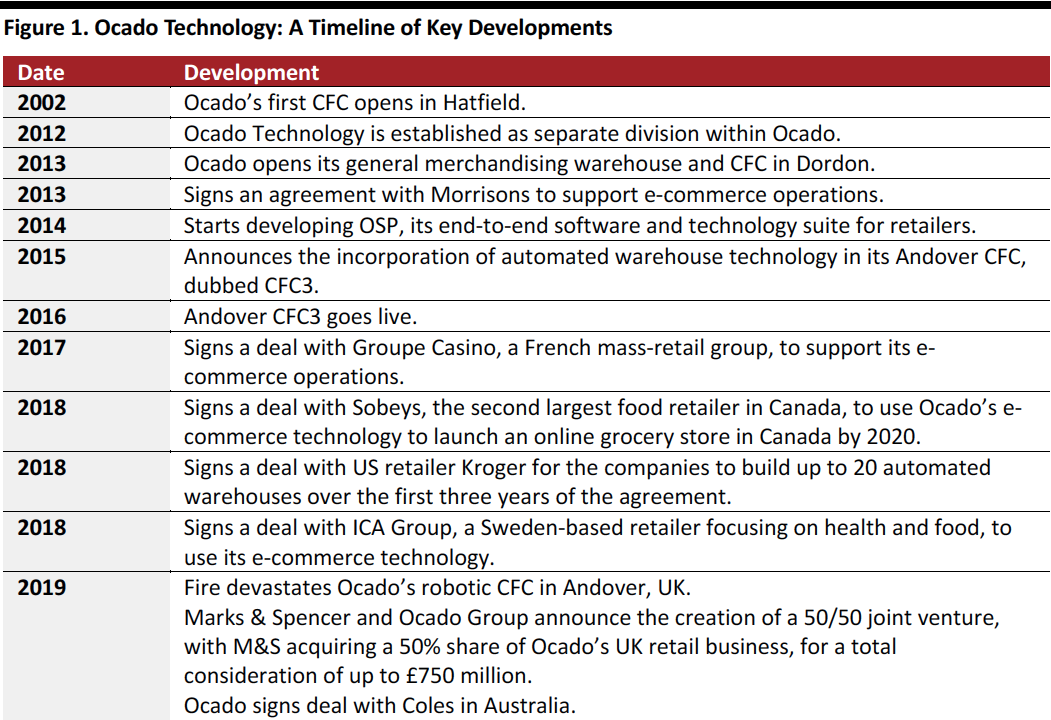

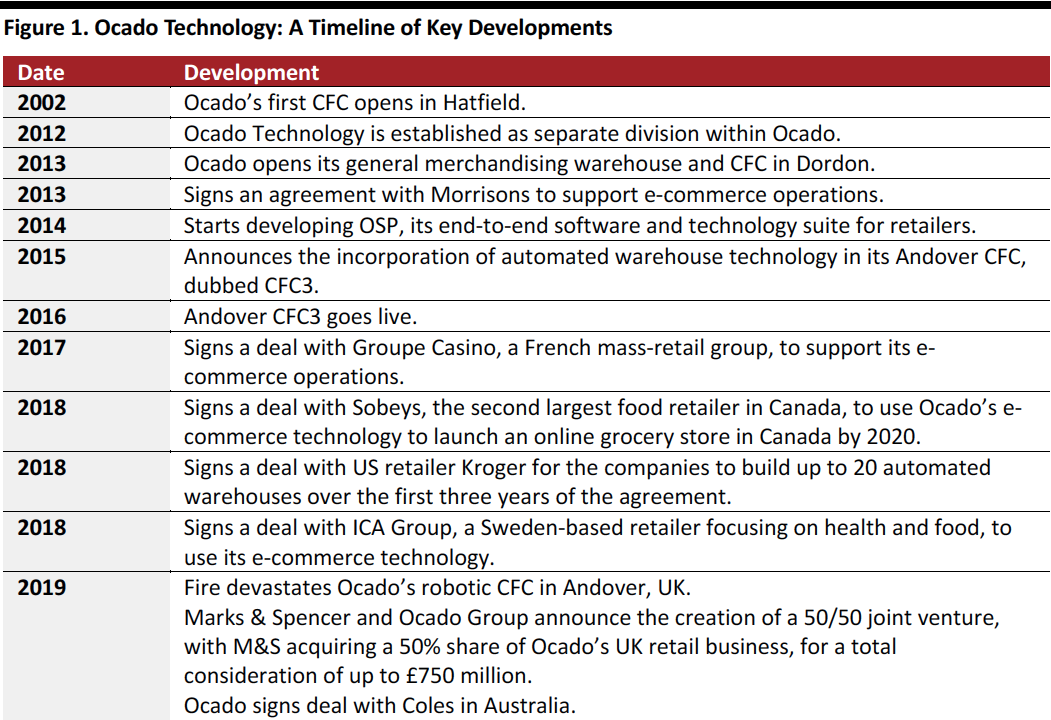

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

As is now standard in OSP partnerships, Ocado will provide a comprehensive and customized suite of support and engineering services to enable a smooth launch and sustainable e-commerce operations.

Coles will pay Ocado upfront fees on signing the contract and during the development phase, and ongoing fees linked to sales, installed capacity and service criteria. Coles will enjoy exclusive access to OSP in Australia, as long as certain (undisclosed) conditions are maintained. Ocado stated it expects the deal “to create significant long-term value to the business.” Management said:The impact of this transaction should be earnings negative in the current financial year as no cash fees will be recognized in revenue until operations commence. Ocado expects minimal additional capex in FY19 with the majority of additional capex in the 18 months prior to the opening of the CFCs.

Coles is one of Australia's largest retailers: It trades from 818 supermarkets, 911 liquor stores, and 712 Coles Express petrol stations, and generated sales of A$39.4 billion (£22 billion) in the year ended June 30, 2018. According to Ocado’s statement, Coles is a market leader in online grocery retailing in Australia, with more than A$1 billion of sales on an annualized basis. This is a large share of the country’s total 2018 Internet sales of food and drink of A$3.5 billion, according to Euromonitor International. Ocado’s deal with Coles follows similar agreements with retailers such as Kroger in the US, Sobeys in Canada and Groupe Casino in France. It also follows Ocado’s recent announcement of a joint venture with Marks & Spencer in the UK, whereby Marks & Spencer will acquire a 50% share of Ocado’s UK online grocery business (which excludes its business suppling technology to other retailers). [caption id="attachment_81837" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]