Nitheesh NH

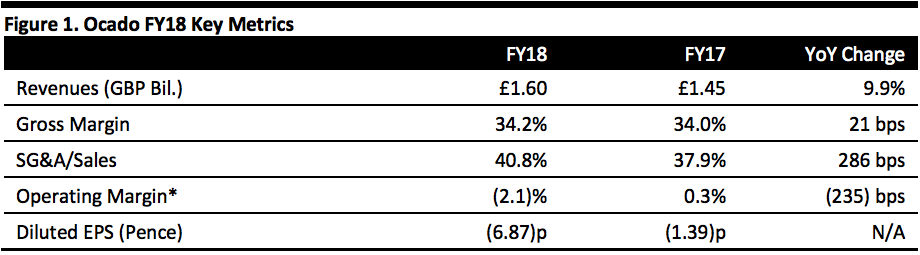

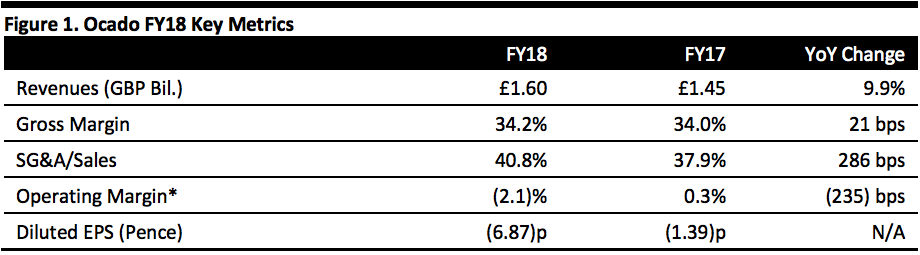

[caption id="attachment_70831" align="aligncenter" width="640"] FY17 was 53 weeks

FY17 was 53 weeks

*Before results from joint venture and exceptional items.

Source: Company reports/Coresight Research[/caption] FY18 Results Ocado reported its FY18 results for the 52 weeks ended December 2, 2018. Unless specified, growth figures below compare the 52-week FY18 to the 53-week FY17.

FY17 was 53 weeks

FY17 was 53 weeks*Before results from joint venture and exceptional items.

Source: Company reports/Coresight Research[/caption] FY18 Results Ocado reported its FY18 results for the 52 weeks ended December 2, 2018. Unless specified, growth figures below compare the 52-week FY18 to the 53-week FY17.

- Net sales were up 9.9% year over year to £1.60 billion, driven by increases in the average number of orders per week and fees earned from the partnerships. However, the company missed the consensus of £1.62 billion.

- On a 52-week basis, total revenues were up 12.3% year over year, while the company grew retail revenues 12% year over year, and solutions revenues by 15.8% year over year.

- Gross margin expanded 21 basis points to 34.2%.

- Operating margin contracted 235 basis points, due to higher distribution and administrative costs. Customer fulfillment center (CFC) costs grew 17.8% year over year, while trunking and delivery costs grew 8.5%.

- Non-GAAP EBITDA decreased 22.4% year over year to £59.5 million, below the consensus estimate of £73.8 million. Management attributed the decline in EBITDA to increased resources devoted to further develop its technology platform, the opening of a new CFC, and increased technology headcount to support ongoing development.

- The company reported a loss per share of 6.87 pence, compared to loss per share of 1.39 pence in the previous year and below the consensus estimate of a 3.8 pence loss per share by StreetAccount.

- Cash fees from solutions partners in 2018 were £200.1 million, compared with £146.1 million in 2017.

- The company grew its active customers 11.8% year over year to 721,000.

- Total order volume increased 12.1% to an average of 296,000 orders per week.

- Ocado saw a slight decline in its average basket value, to £106.85 in FY18, from £107.28 in 2017, on the back of an increase in the average price per item offset by a decrease in the average basket size.

- Retail revenue for fiscal 2019 to increase in the range of 10%–15%, as it ramps up its fulfillment capacity. It expects to grow market share in the U.K.

- Retail EBITDA to grow further, led by increased capacity utilization at new CFCs.

- EBITDA to decline in the solutions segment, due to an additional £15–£20 million in CFC build cost.

- Capital expenditure of £350 million in fiscal 2019, with additional capital directed towards its solutions business.

- In FY19, according to consensus estimates recorded by StreetAccount, analysts expect Ocado to report revenues of £1.83 billion, up 14.5% year over year, and a loss per share of 1.8 pence.