DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

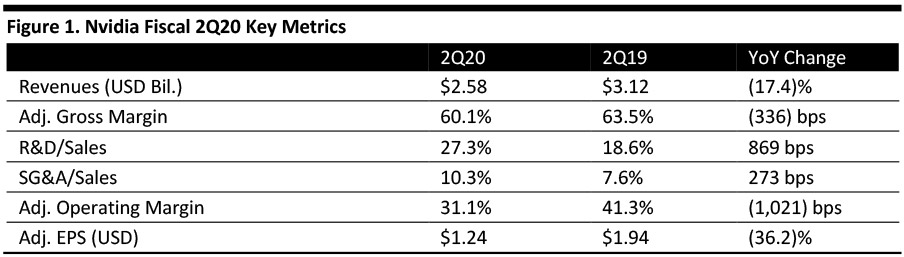

Fiscal 2Q20 Results

Nvidia reported fiscal 2Q20 revenues of $2.58 billion, down 17.4% year over year and slightly ahead of the $2.55 billion consensus estimate.

Adjusted gross margins declined 336 bps year over year due to lower gaming and data-center margins driven primarily by product costs.

Adjusted EPS was $1.24, down 36.2% year over year and beating the $1.15 consensus estimate. GAAP EPS was $0.90, down from $1.76 in the year-ago quarter.

Results by Segment

- GPU revenues were $2.1 billion, down 20.8% year over year.

- Tegra processor revenues, which include automotive, system-on-a-chip (SOC) modules for gaming platforms and embedded edge-AI platforms, were $475 million, up 1.7% year over year .

Results by Application

- Gaming revenues were $1.3 billion, down 27.3% year over year, due to a decline in shipments of gaming desktop graphics processing units (GPUs) and system-on-a-chip (SOC) modules for gaming platforms, partially offset by growth in gaming notebook GPUs.

- Professional visualization revenues were $291 million, up 3.6% year over year due to strength across mobile-workstation products.

- Data center revenues were $655 million, down 13.8% year over year, due to lower hyperscale revenue.

- Automotive revenues were $209 million, up 29.8% year over year, due to a development services agreement signed in the quarter.

- OEM and other revenues were $111 million, down 4.3% year over year. Revenues grew 12% sequentially due to due to growth in shipments of embedded edge AI products.

Details from the Quarter

Management commented that the company achieved sequential growth across its platforms. In addition, that real-time ray tracing is the most important graphics innovation in a decade, and adoption has reached a tipping point. Further, the industry is racing to enable the next frontier in artificial intelligence, conversational AI, as well as autonomous systems such as self-driving vehicles and delivery robots.

The acquisition of Mellanox is expected to close by the end of the calendar year.

Data Center- Announced breakthroughs in language understanding to enable real-time conversational AI, with record-setting performance in running training and inference.

- The company’s DGX SuperPOD, which provides the AI infrastructure for autonomous-vehicle development program, was ranked the world's 22nd fastest supercomputer and that its reference architecture is available commercially.

- Set eight records in AI training performance in the latest MLPerf benchmarking tests.

- Announced support for ARM CPUs, for building energy-efficient, AI-enabled exascale supercomputers.

- Upgraded the GPU product line with GeForce RTX 2060 SUPER, GeForce RTX 2070 SUPER and GeForce RTX 2080 SUPER, for enhanced gaming performance and real-time ray tracing.

- Unveiled the new Nvidia Studio platform for online and studio-based creatives.

- Rolled out a range of Turing architecture-based Quadro GPUs for mobile workstations with global system providers.

- Volvo Group announced that it is using the Nvidia Drive autonomous driving platform to train, test and deploy networks in self-driving vehicles, targeting freight transport, refuse and recycling collection, public transport, construction, mining, forestry and other applications.

Implications for Retail

During the quarter, the company announced several AI-related announcements to advance conversational AI and autonomous vehicles, which can be used for delivery and customer service in retail.

Nvidia’s enterprise and edge computing servers enable companies in manufacturing, retail and healthcare to bring intelligence to the edge of the network where customers operate. In addition, robotics represents one of Nvidia’s three growth strategies, and the company envisions retailers using robots for pick-and-place in warehouses, delivery drones and in smart stores.

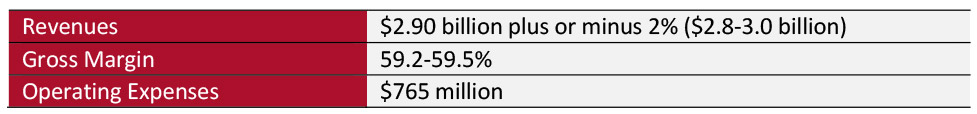

Outlook Nvidia offered the following guidance (using adjusted figures) for fiscal 2Q20: Based on these figures, adjusted EPS should fall within $1.48-1.64, in line with the $1.52 consensus estimate.

Based on these figures, adjusted EPS should fall within $1.48-1.64, in line with the $1.52 consensus estimate.