DIpil Das

[caption id="attachment_88260" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

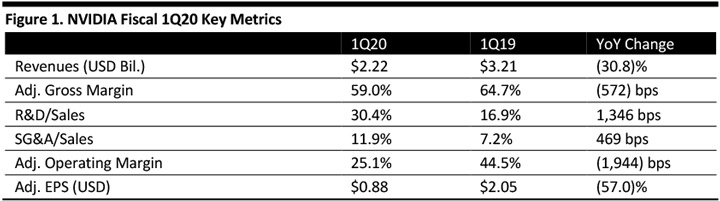

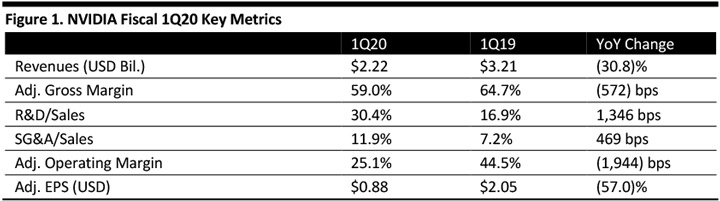

NVIDIA reported fiscal 1Q20 revenues of $2.22 billion, down 30.8% year over year and slightly ahead of the $2.20 billion consensus estimate.

Adjusted EPS was $0.88, down 57.0% year over year and beating the $0.57 consensus estimate. GAAP EPS was $0.64, down from $1.98 in the year-ago quarter.

Results by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

NVIDIA reported fiscal 1Q20 revenues of $2.22 billion, down 30.8% year over year and slightly ahead of the $2.20 billion consensus estimate.

Adjusted EPS was $0.88, down 57.0% year over year and beating the $0.57 consensus estimate. GAAP EPS was $0.64, down from $1.98 in the year-ago quarter.

Results by Segment

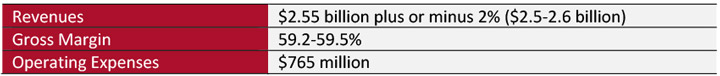

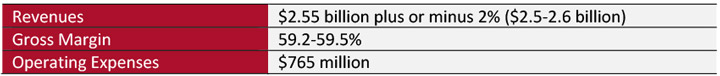

Based on these figures, adjusted EPS should fall within $1.07-1.20, above the $0.90 consensus estimate.

Based on these figures, adjusted EPS should fall within $1.07-1.20, above the $0.90 consensus estimate.

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

NVIDIA reported fiscal 1Q20 revenues of $2.22 billion, down 30.8% year over year and slightly ahead of the $2.20 billion consensus estimate.

Adjusted EPS was $0.88, down 57.0% year over year and beating the $0.57 consensus estimate. GAAP EPS was $0.64, down from $1.98 in the year-ago quarter.

Results by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 1Q20 Results

NVIDIA reported fiscal 1Q20 revenues of $2.22 billion, down 30.8% year over year and slightly ahead of the $2.20 billion consensus estimate.

Adjusted EPS was $0.88, down 57.0% year over year and beating the $0.57 consensus estimate. GAAP EPS was $0.64, down from $1.98 in the year-ago quarter.

Results by Segment

- GPU revenues were $2.0 billion, down 26.9% year over year, reflecting decreases in gaming and data-center revenue and the $289 million of revenue from cryptocurrency mining processors (CMP) in the year-ago quarter.

- Tegra processor revenues, which include automotive, system-on-a-chip (SOC) modules for gaming platforms and embedded edge-AI platforms, were $198 million, down 55.2% year over year. The decrease was driven by fewer shipments of gaming graphics processing unit (GPU) system-on-a-chip (SOC) modules for gaming platforms, yet revenues from gaming GPUs increased sequentially.

- Gaming revenues were $1.1 billion, down 38.8% year over year due to lower shipments of gaming CPUs and SOC modules for gaming platforms.

- Professional visualization revenues were $266 million, up 6.0% year over year due to strength across both desktop and mobile workstation products.

- Data center revenues were $634 million, down 9.6% year over year due to a slowdown among certain hyperscale and enterprise customers, partially offset by higher inference sales.

- Automotive revenues were $166 million, up 14.5% year over year due to growth in AI cockpit modules.

- OEM and other revenues were $99 million, down 74.4% year over year, owing to lower CMP sales year over year.

- Introduced the CUDA-X AI platform for accelerating data science.

- Announced the availability of T4 Tensor Core GPUs from leading OEMs.

- Launched beta access to Quadro Virtual Workstation in the Alibaba Cloud Marketplace.

- Introduced the GeForce GTX 1660 Ti, GTX 1660 and GTX 1650 gaming GPUs.

- Announced gaming laptops based on Turing GPUs, bringing the total to nearly 100.

- Announced that real-time ray tracing integrated into game engines Unreal and Unity.

- Announced expanded adoption of RTX ray-tracing by top 3D application providers.

- Unveiled the Omniverse platform to simplify creative workflows for content creation.

- Partnered with Toyota Research Institute to develop and train self-driving vehicles.

- Unveiled DRIVE AP2X, a complete Level 2+ automated driving solution.

- Announced the NVIDIA DRIVE Constellation autonomous vehicle simulation platform.

- Launched Jetson Nano, an AI computer for small, low-cost, low-power devices.

- Announced free public availability of Isaac SD as a robotics developer toolbox.

- Announced that the Jetson AI computer platform now supports Amazon Web Services RoboMaker.

- Teamed up with AWS IoT Greengrass to enable customers to deploy AI and deep learning to connected devices with NVIDIA Jetson.

- Collaborated with Microsoft to make cities smarter by integrating DeepStream Edge AI and Microsoft Azure IoT.

Based on these figures, adjusted EPS should fall within $1.07-1.20, above the $0.90 consensus estimate.

Based on these figures, adjusted EPS should fall within $1.07-1.20, above the $0.90 consensus estimate.