albert Chan

The Coresight Research team attended NRF 2022: Retail’s Big Show in New York City, US, from January 16 to 18. The event, hosted by the National Retail Federation (NRF) brought together retail technology innovators, industry experts, brands and retailers to participate in panel discussions, present on key topics in retail and showcase their solutions.

In this report, we present our top insights from day three of the show on January 18, 2022.

NRF 2022 Day Three: Coresight Research Insights

Video Commerce Is the Future of E-Commerce

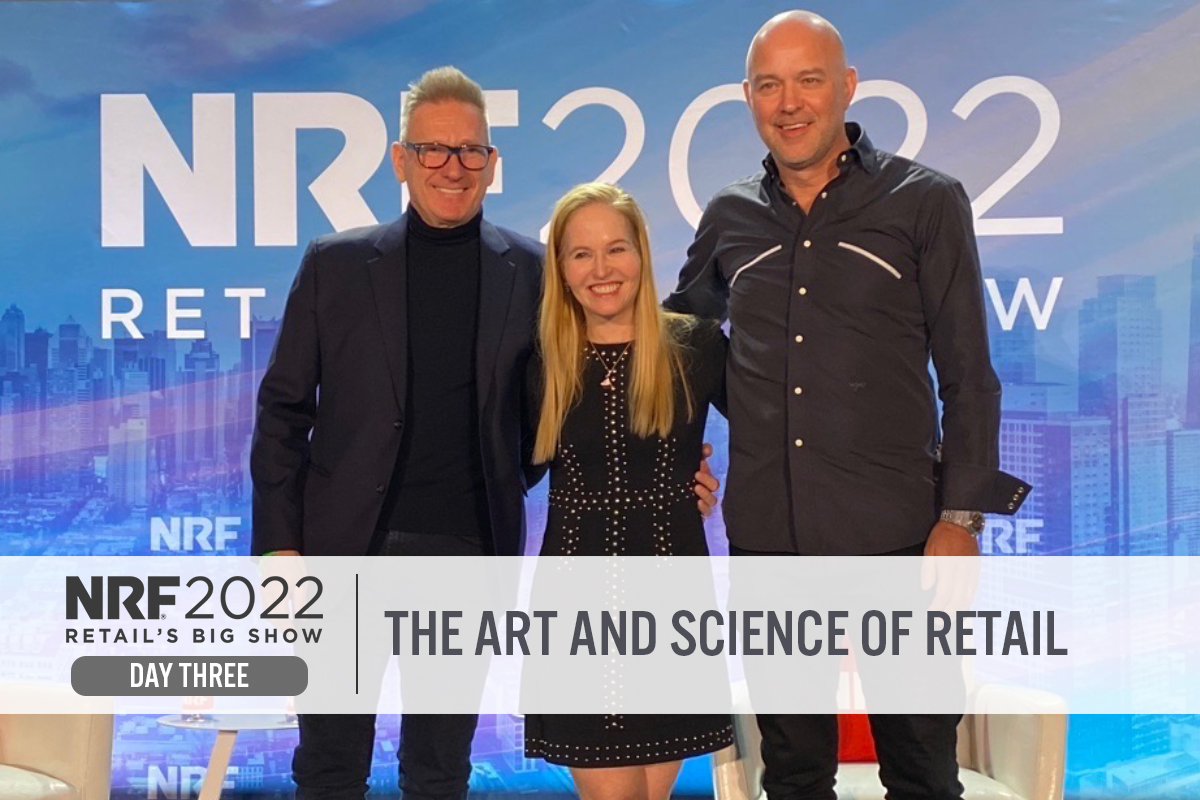

Jason Sigala, Director of Events and Experiences at The Avon Company, and Brian Beitler, CMO of QVC and HSN US, spoke with Deborah Weinswig, CEO and Founder of Coresight Research, about how video commerce is transforming the shopping experience by blending entertainment and engagement with instant purchasing.

Weinswig emphasized that, by integrating live video sessions into e-commerce platforms, brands and retailers can enable viewers to make a purchase without having to leave the livestream experience, addressing the biggest pain point of video commerce: payment.

Sigala and Beitler stated that livestreaming is not just a selling tool; it is a platform for engagement. The panelists cautioned retailers not to be left behind in livestreaming adoption, remarking that they had seen retailers that delayed e-commerce implementation lose mind and market share in the past. Video commerce is the future of commerce, and it is coming fast.

[caption id="attachment_139712" align="aligncenter" width="550"] Deborah Weinswig, CEO and Founder of Coresight Research, discusses video commerce with Jason Sigala, Director of Events and Experiences at The Avon Company, and Brian Beitler, CMO of QVC and HSN US

Deborah Weinswig, CEO and Founder of Coresight Research, discusses video commerce with Jason Sigala, Director of Events and Experiences at The Avon Company, and Brian Beitler, CMO of QVC and HSN USSource: Coresight Research[/caption]

Livestreaming Makes Online Shopping Feel Human

Livestreaming is making digital shopping social by taking e-commerce as close to physical retail as possible. This enables livestreaming to add a human quality to online shopping that appeals to many consumers.

For instance, communities develop around livestreaming hosts and their brands as shoppers engage with key opinion leaders (KOLs), sales associates and other consumers in a livestream and grow to trust their recommendations. As such, livestreaming supports the interactive element of shopping that e-commerce largely eliminated.

Beitler said that HSN hosts develop strong relationships with shoppers and that the most successful livestreams offer great product and engaging hosts. Sigala explained that livestreaming aligns firmly with the foundation of Avon in working with reps with friendly personalities. The panelists agreed that the imperfect is perfect on a livestream, creating real authentic moments that cement relationships with humor.

Weinswig summed up the additional benefits of livestreaming, including returns rates reduced by up to 50% as consumers are more confident in their purchases.

- Read about livestreaming through Coresight Research’s extensive coverage of this major retail trend.

Global Brand Success Hinges on Relevant Localization

Weinswig was joined by Harlan Bratcher, Global Business Development Head at JD.com, and Nick Woodhouse, President and Chief Marketing Officer at Authentic Brands Group (ABG), to discuss preparing for and capitalizing on opportunity in China’s shopping festivals. The panel discussed strategies that work in the mid-market of 700 million Chinese consumers who expect rapid delivery, heightened personalization and seamless transactions.

Shopping festivals are big business in China, where events such as Singles’ Day and 6.18 continue to heat up, year over year. JD.com reached sales of $54.7 billion during the Singles’ Day 2021 festival—this compares to US Black Friday online sales of $9 billion in 2021, according to Adobe. Not surprisingly, many global and US brands are therefore eager to tap into this large and growing market.

Woodhouse explained that it is important to start planning three to six months in advance of Singles’ Day, and by working with JD.com, ABG had access to data insights into the amount of product it can expect to sell.

Crucially, the panelists discussed the significance of using in-country partners to make a brand locally relevant and tailor products accordingly. Woodhouse discussed the example of its iconic tracksuits from ABG’s brand Juicy Couture—the company’s local partners identified demand for the brand in Bangalore but as tracksuits are made from velour, which is incompatible with the region’s weather, the iconic tracksuit was redesigned in linen to be suitable for the local market. One of the keys to success for global brands is a locally relevant personalization.

[caption id="attachment_139713" align="aligncenter" width="550"] Deborah Weinswig discusses opportunity in China’s shopping festivals with Harlan Bratcher, Global Business Development Head at JD.com, and Nick Woodhouse, President and Chief Marketing Officer at ABG

Deborah Weinswig discusses opportunity in China’s shopping festivals with Harlan Bratcher, Global Business Development Head at JD.com, and Nick Woodhouse, President and Chief Marketing Officer at ABGSource: Coresight Research[/caption]

Nordstrom’s Online, Category and Partnership Expansion Is a Win-Win for Consumers and Brands

Phil Wahba, Senior Writer at Forbes Magazine, hosted a keynote session in conversation with Pete Nordstrom, President and Chief Brand Officer of the eponymous department store, on “the art and science of merchandising.”

Pete Nordstrom discussed the department stores’ partnership announcements, online and category expansions, and its specialty retailer partnerships as being key to the company’s merchandising success. A notable driver of the company’s online business expansion is the ability to offer more products than in a store due to physical constraints. Pete Nordstrom explained, “We were never in the home business in a big way, but we were like, ‘what are we going to shrink to fit that in the store?’ So, online, we thought about what businesses we could get in. Online allowed us to flex to what customers were interested in.”

Nordstrom has also launched a home store in its New York City flagship in the last year, taking a different approach to product offerings. The company designed the curated assortment to reflect what consumers expect from Nordstrom, offering pieces that are “uniquely New York” and support the spontaneity of brick-and-mortar shopping, Pete Nordstrom said.

Over the past year, the company has entered into two partnership agreements—with ASOS and with Fanatics licensed sportswear. Pete Nordstrom said that these partnerships are opportunities to offer more products that today’s consumer is interested in. He said that the company is in the early days of learnings for both partnerships, but he sees these partnerships as a win-win for both the brands and the consumers.

The company will continue to offer its premium brands in an elevated way online and use personalization and data to present the customer with what they like; it does not seek to be an aggregator and will still have a point of view.

Pete Nordstrom highlighted that the retailer is continuously open to trying new models of operating with brand and retail partners and its aim is to keep its customers happy in line with its foundation in great customer service.

[caption id="attachment_139714" align="aligncenter" width="550"] Phil Wahba, Senior Writer at Forbes Magazine, in conversation with Pete Nordstrom, President and Chief Brand Officer of Nordstrom

Phil Wahba, Senior Writer at Forbes Magazine, in conversation with Pete Nordstrom, President and Chief Brand Officer of NordstromSource: Coresight Research[/caption]

Old Navy Is Targeting Inclusivity with Its BODEQUALITY Launch

CNBC Retail Reporter Lauren Thomas hosted a “power hour” discussion with Nancy Green, President and CEO of Old Navy, on size inclusivity in apparel retail.

Green discussed the company’s August 2021 launch of BODEQUALITY, a size-inclusive brand for women that promotes democracy of style and access to high-quality products at great prices. Old Navy has always had an extended size business, but it was small and treated as an extension of its women’s business. The launch comes from the company’s desire to cater for all women—Old Navy’s customer base reflects the diversity of the US where the average women’s size is 14–16.

Two years ago, Old Navy embarked on a study of what true inclusivity looked, discovering that consumers want to shop extended sizes in the same areas of the store as standard sizes and want the prices to be the same; extended sizes are often sold at a higher price point. These insights informed the launch of BODEQUALITY. Green said that customer engagement has been very strong and that the company is gaining new customers to the brand. She said that its customers feel “seen” by the brand and it gets a very emotional reaction. The company is using these learnings for potential opportunities to expand the category for men, starting online.

[caption id="attachment_139715" align="aligncenter" width="550"] CNBC Retail Reporter Lauren Thomas discusses size inclusivity with Nancy Green, President and CEO of Old Navy

CNBC Retail Reporter Lauren Thomas discusses size inclusivity with Nancy Green, President and CEO of Old NavySource: Coresight Research[/caption]

AI in Fit Technology Is Increasing Conversion and Informing Product Development

At the “Innovation in Sizing Technology” panel on day three, US intimates company ThirdLove presented on how it is using technology to solve fit issues. VP of Brand Marketing and Communications Colleen Conkling explained that the company was founded in 2013 as an “an anti-Victoria’s Secret brand” with a focus on providing the perfect fit.

ThirdLove launched its proprietary “Fit Finder” online tool in 2017, which uses AI (artificial intelligence) and machine learning algorithms to help the consumer find their perfect bra. Over 100 million women have used the tool and the conversion rate is over 4X for women that use the Fit Finder, according to the company.

Data collected by the company revealed that 80% of women were wearing the wrong bra size. In response, ThirdLove developed and launched half sizes for its bras, claiming to be the only intimates brand in the industry to do so.

[caption id="attachment_139716" align="aligncenter" width="300"] Colleen Conkling, VP of Brand Marketing and Communications at ThirdLove, discusses using technology to solve for fit

Colleen Conkling, VP of Brand Marketing and Communications at ThirdLove, discusses using technology to solve for fitSource: Coresight Research[/caption]

DTC Learnings Improve Wholesale Execution

Ken Natori, President of The Natori Company, and Melissa Dixon, Director of Content at BigCommerce, discussed the transformation to hybrid retail.

Founded in 1977 by Josie Cruz Natori, The Natori Company offers lingerie, athleticwear and athleisure, footwear, fine jewelry and home textiles across four brands. When Ken Natori joined in 2007, he soon added an online business to what he describes was a “high-end wholesale business concentrated with a few key high-end department stores and vulnerable to eroding customer loyalty to retail brands and channels.”

Pre-covid, DTC (direct-to-consumer) business had grown to account for around 20% of The Natori Company’s sales. As its department store clients have been consolidated, the company has greater control of its wholesale business in key accounts. This is where its online business provides instant insight into consumer demand, spending, promotional incentives that work and what products to send to its wholesale clients: department stores. As such, the company is leveraging DTC insights to apply to its wholesale business.

[caption id="attachment_139717" align="aligncenter" width="550"] Ken Natori, President of The Natori Company, and Melissa Dixon, Director of Content at BigCommerce, discuss the transformation to hybrid retail

Ken Natori, President of The Natori Company, and Melissa Dixon, Director of Content at BigCommerce, discuss the transformation to hybrid retailSource: Coresight Research[/caption]

Sustainability Will Become More Affordable

Sustainability will steadily become more affordable thanks to consumer engagement and corporate commitments, according to Javier Quiñones, CEO and Chief Sustainability Officer of IKEA US. He stated that 50% of global consumers have recently bought sustainability items and 30% said they would pay more for sustainability.

In 1997, when Quiñones began work at IKEA, the Sweden-based conglomerate only had a basic, albeit advanced compared with other US corporations, sustainability program in place, he recalled. The program has since evolved into a holistic initiative that puts sustainability at the core of corporate values.

The successful integration of sustainability at IKEA is self-evident in a number of areas, according to Quiñones. In the US, IKEA now produces more electricity than it uses thanks to a comprehensive green program. The US subsidiary has yet to achieve energy self-sufficiency, but all facilities are powered by green or renewable energy, Quiñones explained. Moreover, by 2025, all IKEA products will be circular.

To integrate sustainability into a corporate organization, Quiñones stated that it is important to keep it competitive with other corporate goals and values. Finally, he pointed to the need for corporations to satisfy sustainability demands from consumers, who are increasingly vocal about reducing environmental impact.

The Post-Pandemic Consumer Economy Looks Strong

A rise in consumer spending will continue to lead the US economy in 2022, according to Carla Harris, Vice Chairman and Managing Director of Morgan Stanley. Despite some softening, the consumer economy remains strong. The ratio of personal consumption to income is at a historic low since the 1970s and interest rates are still low. Most of all, monetary and fiscal measures still accommodate stimulus. Dollars in the hands of consumers are a very strong multiplier, she stated.

According to Harris, the pandemic has led to two shifts: the amplification of choice and voice and a shift to consumers in contractual relations. All these were illustrated by the “Great Resignation,” which Harris repositioned as the “Great Contemplation,” explaining that people were offered an opportunity to rethink their lives and livelihoods during the two years of the pandemic.

In a post-pandemic world, according to Harris, choice will trump loyalty as consumers can choose what to want, when to want and how to want. They will develop a new appetite for choice due to diverse payment methods, delivery channels and brands.

[caption id="attachment_139718" align="aligncenter" width="550"] Carla Harris, Vice Chairman and Managing Director of Morgan Stanley, discusses the post-Covid retail environment

Carla Harris, Vice Chairman and Managing Director of Morgan Stanley, discusses the post-Covid retail environmentSource: Coresight Research[/caption]