Nitheesh NH

NRF 2021, the annual “Retail’s Big Show” event hosted by the National Retail Federation (NRF), is taking place online over six days between January 12 and 22.

The Coresight Research team is presenting takeaways from each day of the event in separate reports. Read our coverage of day one here and day two here. In this report, we offer 10 key insights from day three.

Source: The Home Depot[/caption]

According to Siddiqui, Home Depot’s supply chain and logistics network is complex, with different vendors supplying products in thousands of SKUs (stock-keeping units). Through Google, the company has upgraded its capabilities; it is using machine learning and artificial intelligence (AI) to connect data on the back end, which provides the customer with one view of product availability.

3. Five Segments of Home Shoppers: “The Creative” Spends Most

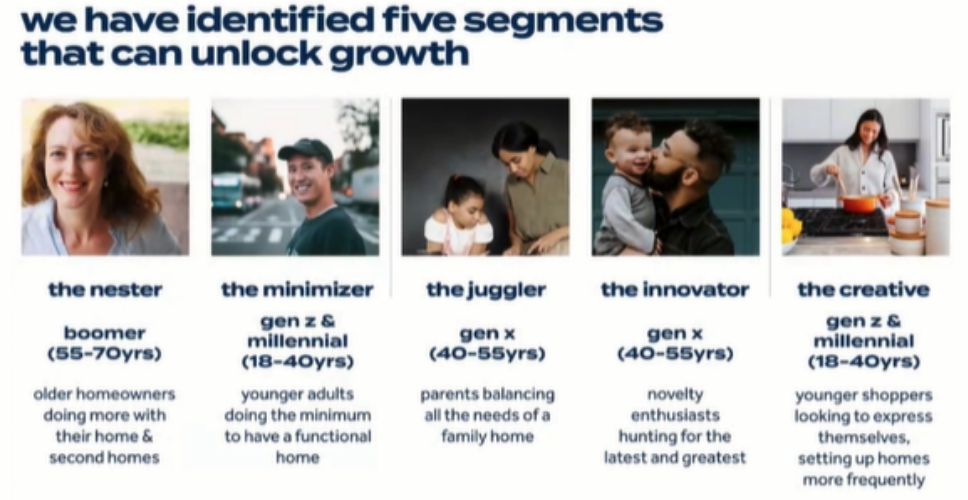

Bed Bath & Beyond management is using Google Analytics to identify five core consumer segments across its business, with the aim of identifying opportunities to increase revenue in popular product categories.

At NRF 2021, Cindy Davis, Chief Brand Officer at Bed Bath & Beyond, explained a few key learnings about the core home customer segments (see the age demographics of each segment in the image below):

Source: The Home Depot[/caption]

According to Siddiqui, Home Depot’s supply chain and logistics network is complex, with different vendors supplying products in thousands of SKUs (stock-keeping units). Through Google, the company has upgraded its capabilities; it is using machine learning and artificial intelligence (AI) to connect data on the back end, which provides the customer with one view of product availability.

3. Five Segments of Home Shoppers: “The Creative” Spends Most

Bed Bath & Beyond management is using Google Analytics to identify five core consumer segments across its business, with the aim of identifying opportunities to increase revenue in popular product categories.

At NRF 2021, Cindy Davis, Chief Brand Officer at Bed Bath & Beyond, explained a few key learnings about the core home customer segments (see the age demographics of each segment in the image below):

Source: Bed Bath & Beyond[/caption]

John Hartmann, EVP and Chief Operating Officer at Bed Bath & Beyond, said that being data driven is allowing the company to make customer-centric decisions, forecast and predict demand, and make real-time decisions. Davis also emphasized that the company has a renewed passion for the customer and understanding who he/she is.

4. Consumers Continue To Change the Way They Think and Shop

On NRF 2021 day three, retail technology solutions provider Sensormatic and furniture and home-goods retailer Wayfair held a joint session, during which Phil Hall, Pre-Sales Data Analyst of Enterprise at software company Looker, spoke on the speed with which consumer behavior has and will continue to change.

Hall said it takes just 66 days to form a new habit—meaning that consumers have had plenty of time to completely change their ways of living and thinking over the course of the now near-year-long pandemic. Panelists on previous days remarked on how crazy it would have sounded just a year ago to most people if they were to be told that someone else would be picking out and delivering their fresh produce to them—but Hall expects that even behaviors like this, that may have seemed especially strange prior to the pandemic, are likely to stick. He said that more than 25% of consumers have purchased something online over the course of the pandemic that they would have typically bought in a store, and over the course of far more than 66 days, they have had plenty of time to reinforce that habit.

5. Easily Accessible, Real-Time Data Is Necessary To Adapt to a Volatile Retail World

Following a common theme throughout the first three days of the event, Hall spoke of the role that data plays in enabling retailers to capitalize on new consumer habits and adapt to an ever-changing retail environment. In a discussion with Matthew Hartwig, Associate Director of Product Management at Wayfair, he highlighted the necessity for retailers to remain agile by using data-backed systems that enable them to adjust on the fly. Hall cited BOPIS (buy online, pick up in store) as a key area in which retailers have had to rapidly adopt over the past year. Since the start of the Covid-19 pandemic, 55% of US consumers have utilized BOPIS services—once a niche avenue of commerce unknown to many.

When drastic shifts in behavior like this occur, retailers must be able to adapt quickly and without reducing the quality of their service or product. Hartwig said that Wayfair utilized Looker and other Google tools to ensure that it could keep up with changed consumer behaviors and meet the skyrocketing demand that helped the company double its sales volume during the pandemic. Hartwig emphasized that having a yearly product cycle is now nowhere near flexible enough to be competitive in the retail industry, and added that the tools Wayfair employed to enable employees to access data-driven insights were instrumental to the company’s success in 2020.

6. Retention of Pandemic-Driven Changed Behaviors Will Vary by Demographic

Nuno Pedro, Head of SAP Commerce, joined Melanie Noronha, The Economist Intelligence Unit Senior Editor, to look past the pandemic and understand what changed consumer behaviors will stick. Noronha reported that while overall expenditures dropped 9% during the pandemic, online spending grew 15%. Somewhat surprisingly, baby boomers have been the most drastic adopters of online commerce during the pandemic: On average, they increased their online spending as a percentage of total spending from 25% to 75%.

However, looking ahead to the other side of the pandemic, Noronha expects that many members of older generations will revert to their previous shopping habits. While more than 60% of total shoppers plan to retain their changed online shopping behaviors, that number drops to closer to 50% for older generations, according to Noronha.

7. The New Consumer Will Expect a Streamlined, Omnichannel Retail Experience

Building on Noronha’s comments on how certain pandemic-driven changes in consumer shopping patterns will shift, Pedro honed in on the importance of providing an omnichannel shopping experience to customers who are increasingly utilizing a variety of both online and offline channels. For example, consumers want to be able to discover a product in a store and then buy it online, or discover products online and then go into a store to try on the product or get a better sense of how it looks and feels.

To enable this flexible commerce, Pedro said that retailers must rely on a robust and scalable sales platform and ensure seamless connectivity between the back and front ends to be able to swiftly create multiple storefronts and meet the consumer wherever they prefer to shop.

8. Capturing Data at Brick-and-Mortar Stores Helps Retailers Understand the Consumer Journey

While consumers have shifted much of their spending online, retailers must remain conscious of the role that physical stores play and continue to optimize their brick-and-mortar locations.

Cisco’s Meraki solution can help retailers better collect and leverage in-store data about customer traffic and sentiment. At NRF 2021, the company highlighted its Modcam solution, which stitches together raw data from individual cameras into an overview of the goings-on in the store. From this data, retailers can understand the paths individuals take through stores, create heat maps of the most common areas customers stop, and help ensure their stores are adhering to social-distancing guidelines.

Moving forward with this technology, retailers may find it useful to capture data on “smiles per hour” and other encapsulations of sentiment that can help them better understand the consumer journey.

9. Supply Chain Technology Helps Exceed Customer Expectations in Food Service

Kareem Yusuf, General Manager of AI Applications at technology company IBM, discussed how IBM’s supply chain technology helped food-service company Golden State Foods optimize its operations by using IoT (Internet of Things) sensors.

Bob Wolpert, Corporate Senior VP and Chief Strategy & Innovation Officer at Golden State Foods, cited an example of how a simple advancement in technology has helped save the company time and money. A typical hamburger patty can typically travel in trucks of temperatures between 34 and 38 degrees, but the company had no way of tracking the specific temperature throughout the journey. As a result, Golden State Foods calculated a 14-day shelf life for hamburger patties based on an estimated variation of temperatures within this range. Using IBM sensor technology, the company has been able to verify that the patties are being transported at optimal temperatures, enabling Golden State Foods to not just ensure product quality but also increase product shelf life.

10. Labor Management Can Be Optimized Through Technology Solutions

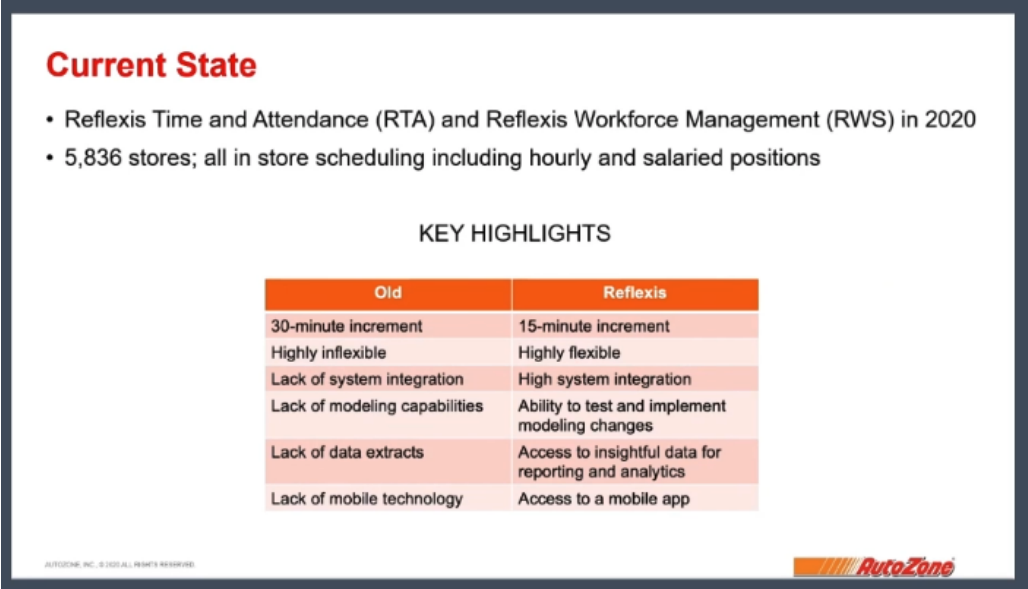

Tom Newbern, EVP of Store Operations at auto parts retailer AutoZone, held a session with Kevin Tapscott, VP of Solution Consulting at Zebra Technologies’ Reflexis, a provider of AI-powered workforce management solutions. AutoZone employs Reflexis technology to mitigate the impact of rising labor costs. Newbern noted that for AutoZone, a company that prides itself on its customer service, improving workforce efficiency is a key area of investment.

Prior to working with Reflexis, the company’s workforce management system was inflexible, and had few modeling and mobile technology capabilities. Furthermore, the company had struggled to adapt to changing minimum-wage laws. By using Reflexis over the past seven years, AutoZone has been able to forecast labor precisely down to 15-minute increments, quickly implement labor tests and recently adapt quickly to changes in workforce scheduling brought on by the Covid-19 pandemic.

[caption id="attachment_121818" align="aligncenter" width="580"]

Source: Bed Bath & Beyond[/caption]

John Hartmann, EVP and Chief Operating Officer at Bed Bath & Beyond, said that being data driven is allowing the company to make customer-centric decisions, forecast and predict demand, and make real-time decisions. Davis also emphasized that the company has a renewed passion for the customer and understanding who he/she is.

4. Consumers Continue To Change the Way They Think and Shop

On NRF 2021 day three, retail technology solutions provider Sensormatic and furniture and home-goods retailer Wayfair held a joint session, during which Phil Hall, Pre-Sales Data Analyst of Enterprise at software company Looker, spoke on the speed with which consumer behavior has and will continue to change.

Hall said it takes just 66 days to form a new habit—meaning that consumers have had plenty of time to completely change their ways of living and thinking over the course of the now near-year-long pandemic. Panelists on previous days remarked on how crazy it would have sounded just a year ago to most people if they were to be told that someone else would be picking out and delivering their fresh produce to them—but Hall expects that even behaviors like this, that may have seemed especially strange prior to the pandemic, are likely to stick. He said that more than 25% of consumers have purchased something online over the course of the pandemic that they would have typically bought in a store, and over the course of far more than 66 days, they have had plenty of time to reinforce that habit.

5. Easily Accessible, Real-Time Data Is Necessary To Adapt to a Volatile Retail World

Following a common theme throughout the first three days of the event, Hall spoke of the role that data plays in enabling retailers to capitalize on new consumer habits and adapt to an ever-changing retail environment. In a discussion with Matthew Hartwig, Associate Director of Product Management at Wayfair, he highlighted the necessity for retailers to remain agile by using data-backed systems that enable them to adjust on the fly. Hall cited BOPIS (buy online, pick up in store) as a key area in which retailers have had to rapidly adopt over the past year. Since the start of the Covid-19 pandemic, 55% of US consumers have utilized BOPIS services—once a niche avenue of commerce unknown to many.

When drastic shifts in behavior like this occur, retailers must be able to adapt quickly and without reducing the quality of their service or product. Hartwig said that Wayfair utilized Looker and other Google tools to ensure that it could keep up with changed consumer behaviors and meet the skyrocketing demand that helped the company double its sales volume during the pandemic. Hartwig emphasized that having a yearly product cycle is now nowhere near flexible enough to be competitive in the retail industry, and added that the tools Wayfair employed to enable employees to access data-driven insights were instrumental to the company’s success in 2020.

6. Retention of Pandemic-Driven Changed Behaviors Will Vary by Demographic

Nuno Pedro, Head of SAP Commerce, joined Melanie Noronha, The Economist Intelligence Unit Senior Editor, to look past the pandemic and understand what changed consumer behaviors will stick. Noronha reported that while overall expenditures dropped 9% during the pandemic, online spending grew 15%. Somewhat surprisingly, baby boomers have been the most drastic adopters of online commerce during the pandemic: On average, they increased their online spending as a percentage of total spending from 25% to 75%.

However, looking ahead to the other side of the pandemic, Noronha expects that many members of older generations will revert to their previous shopping habits. While more than 60% of total shoppers plan to retain their changed online shopping behaviors, that number drops to closer to 50% for older generations, according to Noronha.

7. The New Consumer Will Expect a Streamlined, Omnichannel Retail Experience

Building on Noronha’s comments on how certain pandemic-driven changes in consumer shopping patterns will shift, Pedro honed in on the importance of providing an omnichannel shopping experience to customers who are increasingly utilizing a variety of both online and offline channels. For example, consumers want to be able to discover a product in a store and then buy it online, or discover products online and then go into a store to try on the product or get a better sense of how it looks and feels.

To enable this flexible commerce, Pedro said that retailers must rely on a robust and scalable sales platform and ensure seamless connectivity between the back and front ends to be able to swiftly create multiple storefronts and meet the consumer wherever they prefer to shop.

8. Capturing Data at Brick-and-Mortar Stores Helps Retailers Understand the Consumer Journey

While consumers have shifted much of their spending online, retailers must remain conscious of the role that physical stores play and continue to optimize their brick-and-mortar locations.

Cisco’s Meraki solution can help retailers better collect and leverage in-store data about customer traffic and sentiment. At NRF 2021, the company highlighted its Modcam solution, which stitches together raw data from individual cameras into an overview of the goings-on in the store. From this data, retailers can understand the paths individuals take through stores, create heat maps of the most common areas customers stop, and help ensure their stores are adhering to social-distancing guidelines.

Moving forward with this technology, retailers may find it useful to capture data on “smiles per hour” and other encapsulations of sentiment that can help them better understand the consumer journey.

9. Supply Chain Technology Helps Exceed Customer Expectations in Food Service

Kareem Yusuf, General Manager of AI Applications at technology company IBM, discussed how IBM’s supply chain technology helped food-service company Golden State Foods optimize its operations by using IoT (Internet of Things) sensors.

Bob Wolpert, Corporate Senior VP and Chief Strategy & Innovation Officer at Golden State Foods, cited an example of how a simple advancement in technology has helped save the company time and money. A typical hamburger patty can typically travel in trucks of temperatures between 34 and 38 degrees, but the company had no way of tracking the specific temperature throughout the journey. As a result, Golden State Foods calculated a 14-day shelf life for hamburger patties based on an estimated variation of temperatures within this range. Using IBM sensor technology, the company has been able to verify that the patties are being transported at optimal temperatures, enabling Golden State Foods to not just ensure product quality but also increase product shelf life.

10. Labor Management Can Be Optimized Through Technology Solutions

Tom Newbern, EVP of Store Operations at auto parts retailer AutoZone, held a session with Kevin Tapscott, VP of Solution Consulting at Zebra Technologies’ Reflexis, a provider of AI-powered workforce management solutions. AutoZone employs Reflexis technology to mitigate the impact of rising labor costs. Newbern noted that for AutoZone, a company that prides itself on its customer service, improving workforce efficiency is a key area of investment.

Prior to working with Reflexis, the company’s workforce management system was inflexible, and had few modeling and mobile technology capabilities. Furthermore, the company had struggled to adapt to changing minimum-wage laws. By using Reflexis over the past seven years, AutoZone has been able to forecast labor precisely down to 15-minute increments, quickly implement labor tests and recently adapt quickly to changes in workforce scheduling brought on by the Covid-19 pandemic.

[caption id="attachment_121818" align="aligncenter" width="580"] Source: AutoZone[/caption]

Source: AutoZone[/caption]

NRF 2021 Day Three: 10 Key Insights

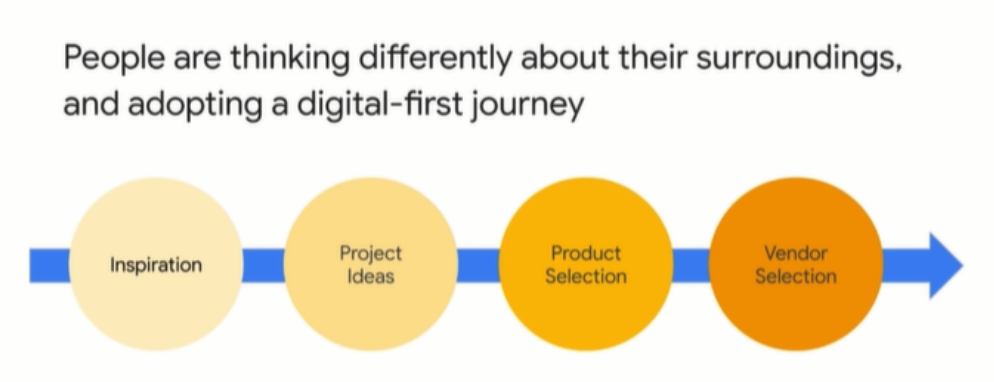

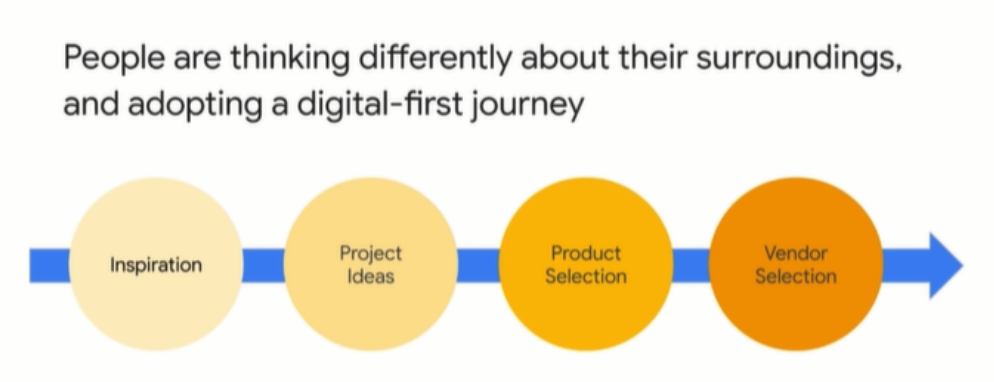

On the third day of NRF 2021, panelists and speakers highlighted the importance of understanding consumers, many of whom have changed their behaviors over the course of the pandemic. They also spoke in detail on the benefits of integrating technology across all retail operations, from supply chain to stores. 1. China’s New Luxury Consumer Is Young, Discerning and Spending Luxury brands are increasingly engaging with Chinese consumers. At Alibaba’s 11.11 Global Shopping Festival (also known as Singles’ Day) in 2020, 200 luxury brands participated—65 of those for the first time. Christina Fontana, Head of Fashion and Luxury at Tmall’s Luxury Division, said that usually, shopping festivals are associated with deep promotions, but luxury brands instead created exclusive capsule collections and products to drive sales. During the Singles’ Day festival, luxury brands also created over 100,000 videos to engage with consumers, which were shared by over 1.5 billion people, according to Fontana. Of the purchases made during 11.11, 70% were by “new luxury consumers,” a term which Fontana used to describe consumers born after 1990 and who are discerning and attentive to quality, materials, product creation and the craftsmanship behind brands. When asked about customer loyalty, she highlighted that the new luxury consumer is still in a period of exploration and discovery of new brands, providing an opportunity for luxury brands to connect with potential customers by presenting their brand’s heritage, DNA and brand story. Stefano Secchi, Managing Director at Italian luxury fashion house Moschino, characterized the Chinese consumer as very demanding, discerning and up to speed with fashion. He said that today’s luxury shoppers are advanced and attentive to fashion trends—and that this is not a new and emerging market. Moschino has seen success in China due to its merging of streetwear, casualwear and playfulness, which has been a “perfect match to the Chinese consumer,” according to Secchi. Moschino has been working on dedicated capsule collections to create surprise and novelty for the consumer. Secchi said that China will be very important for the luxury market and suggested that new brands seeking to enter the market should think about the long term, build partnerships and respect, and seek to understand the culture. 2. Digital Capabilities Expand as Retailers Adapt to a Digital-First Home Consumer Due to the Covid-19 pandemic, consumers are thinking about their home environments more. At NRF 2021, Fahim Siddiqui, Senior Vice President of IT at The Home Depot, highlighted that the consumer journey begins on digital channels, because consumers research inspiration for their rooms or homes before looking to make purchases. Often, this involves redesigning an area, leading to projects that require materials and products. Siddiqui emphasized that consumers want to know available product colors and styles that they can view in physical stores, and that delivery options are a key consideration for home shoppers. [caption id="attachment_121816" align="aligncenter" width="520"] Source: The Home Depot[/caption]

According to Siddiqui, Home Depot’s supply chain and logistics network is complex, with different vendors supplying products in thousands of SKUs (stock-keeping units). Through Google, the company has upgraded its capabilities; it is using machine learning and artificial intelligence (AI) to connect data on the back end, which provides the customer with one view of product availability.

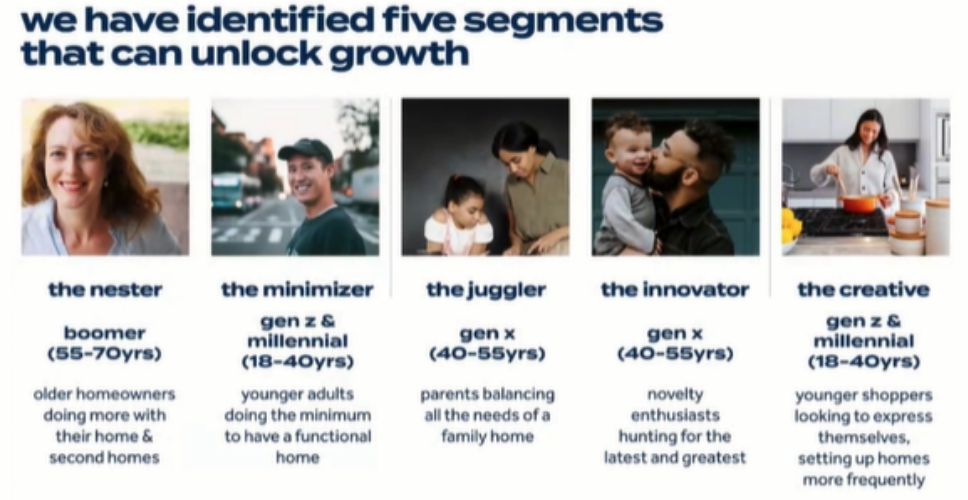

3. Five Segments of Home Shoppers: “The Creative” Spends Most

Bed Bath & Beyond management is using Google Analytics to identify five core consumer segments across its business, with the aim of identifying opportunities to increase revenue in popular product categories.

At NRF 2021, Cindy Davis, Chief Brand Officer at Bed Bath & Beyond, explained a few key learnings about the core home customer segments (see the age demographics of each segment in the image below):

Source: The Home Depot[/caption]

According to Siddiqui, Home Depot’s supply chain and logistics network is complex, with different vendors supplying products in thousands of SKUs (stock-keeping units). Through Google, the company has upgraded its capabilities; it is using machine learning and artificial intelligence (AI) to connect data on the back end, which provides the customer with one view of product availability.

3. Five Segments of Home Shoppers: “The Creative” Spends Most

Bed Bath & Beyond management is using Google Analytics to identify five core consumer segments across its business, with the aim of identifying opportunities to increase revenue in popular product categories.

At NRF 2021, Cindy Davis, Chief Brand Officer at Bed Bath & Beyond, explained a few key learnings about the core home customer segments (see the age demographics of each segment in the image below):

- “The creative” is the youngest segment and also has the highest spend across all of the Bed Bath & Beyond segments, spending 40% higher than other segments.

- “The nester” and “the minimizer” together comprise 37% of the market.

- “The juggler” and “the innovator” are 10% more likely to shop omnichannel.

Source: Bed Bath & Beyond[/caption]

John Hartmann, EVP and Chief Operating Officer at Bed Bath & Beyond, said that being data driven is allowing the company to make customer-centric decisions, forecast and predict demand, and make real-time decisions. Davis also emphasized that the company has a renewed passion for the customer and understanding who he/she is.

4. Consumers Continue To Change the Way They Think and Shop

On NRF 2021 day three, retail technology solutions provider Sensormatic and furniture and home-goods retailer Wayfair held a joint session, during which Phil Hall, Pre-Sales Data Analyst of Enterprise at software company Looker, spoke on the speed with which consumer behavior has and will continue to change.

Hall said it takes just 66 days to form a new habit—meaning that consumers have had plenty of time to completely change their ways of living and thinking over the course of the now near-year-long pandemic. Panelists on previous days remarked on how crazy it would have sounded just a year ago to most people if they were to be told that someone else would be picking out and delivering their fresh produce to them—but Hall expects that even behaviors like this, that may have seemed especially strange prior to the pandemic, are likely to stick. He said that more than 25% of consumers have purchased something online over the course of the pandemic that they would have typically bought in a store, and over the course of far more than 66 days, they have had plenty of time to reinforce that habit.

5. Easily Accessible, Real-Time Data Is Necessary To Adapt to a Volatile Retail World

Following a common theme throughout the first three days of the event, Hall spoke of the role that data plays in enabling retailers to capitalize on new consumer habits and adapt to an ever-changing retail environment. In a discussion with Matthew Hartwig, Associate Director of Product Management at Wayfair, he highlighted the necessity for retailers to remain agile by using data-backed systems that enable them to adjust on the fly. Hall cited BOPIS (buy online, pick up in store) as a key area in which retailers have had to rapidly adopt over the past year. Since the start of the Covid-19 pandemic, 55% of US consumers have utilized BOPIS services—once a niche avenue of commerce unknown to many.

When drastic shifts in behavior like this occur, retailers must be able to adapt quickly and without reducing the quality of their service or product. Hartwig said that Wayfair utilized Looker and other Google tools to ensure that it could keep up with changed consumer behaviors and meet the skyrocketing demand that helped the company double its sales volume during the pandemic. Hartwig emphasized that having a yearly product cycle is now nowhere near flexible enough to be competitive in the retail industry, and added that the tools Wayfair employed to enable employees to access data-driven insights were instrumental to the company’s success in 2020.

6. Retention of Pandemic-Driven Changed Behaviors Will Vary by Demographic

Nuno Pedro, Head of SAP Commerce, joined Melanie Noronha, The Economist Intelligence Unit Senior Editor, to look past the pandemic and understand what changed consumer behaviors will stick. Noronha reported that while overall expenditures dropped 9% during the pandemic, online spending grew 15%. Somewhat surprisingly, baby boomers have been the most drastic adopters of online commerce during the pandemic: On average, they increased their online spending as a percentage of total spending from 25% to 75%.

However, looking ahead to the other side of the pandemic, Noronha expects that many members of older generations will revert to their previous shopping habits. While more than 60% of total shoppers plan to retain their changed online shopping behaviors, that number drops to closer to 50% for older generations, according to Noronha.

7. The New Consumer Will Expect a Streamlined, Omnichannel Retail Experience

Building on Noronha’s comments on how certain pandemic-driven changes in consumer shopping patterns will shift, Pedro honed in on the importance of providing an omnichannel shopping experience to customers who are increasingly utilizing a variety of both online and offline channels. For example, consumers want to be able to discover a product in a store and then buy it online, or discover products online and then go into a store to try on the product or get a better sense of how it looks and feels.

To enable this flexible commerce, Pedro said that retailers must rely on a robust and scalable sales platform and ensure seamless connectivity between the back and front ends to be able to swiftly create multiple storefronts and meet the consumer wherever they prefer to shop.

8. Capturing Data at Brick-and-Mortar Stores Helps Retailers Understand the Consumer Journey

While consumers have shifted much of their spending online, retailers must remain conscious of the role that physical stores play and continue to optimize their brick-and-mortar locations.

Cisco’s Meraki solution can help retailers better collect and leverage in-store data about customer traffic and sentiment. At NRF 2021, the company highlighted its Modcam solution, which stitches together raw data from individual cameras into an overview of the goings-on in the store. From this data, retailers can understand the paths individuals take through stores, create heat maps of the most common areas customers stop, and help ensure their stores are adhering to social-distancing guidelines.

Moving forward with this technology, retailers may find it useful to capture data on “smiles per hour” and other encapsulations of sentiment that can help them better understand the consumer journey.

9. Supply Chain Technology Helps Exceed Customer Expectations in Food Service

Kareem Yusuf, General Manager of AI Applications at technology company IBM, discussed how IBM’s supply chain technology helped food-service company Golden State Foods optimize its operations by using IoT (Internet of Things) sensors.

Bob Wolpert, Corporate Senior VP and Chief Strategy & Innovation Officer at Golden State Foods, cited an example of how a simple advancement in technology has helped save the company time and money. A typical hamburger patty can typically travel in trucks of temperatures between 34 and 38 degrees, but the company had no way of tracking the specific temperature throughout the journey. As a result, Golden State Foods calculated a 14-day shelf life for hamburger patties based on an estimated variation of temperatures within this range. Using IBM sensor technology, the company has been able to verify that the patties are being transported at optimal temperatures, enabling Golden State Foods to not just ensure product quality but also increase product shelf life.

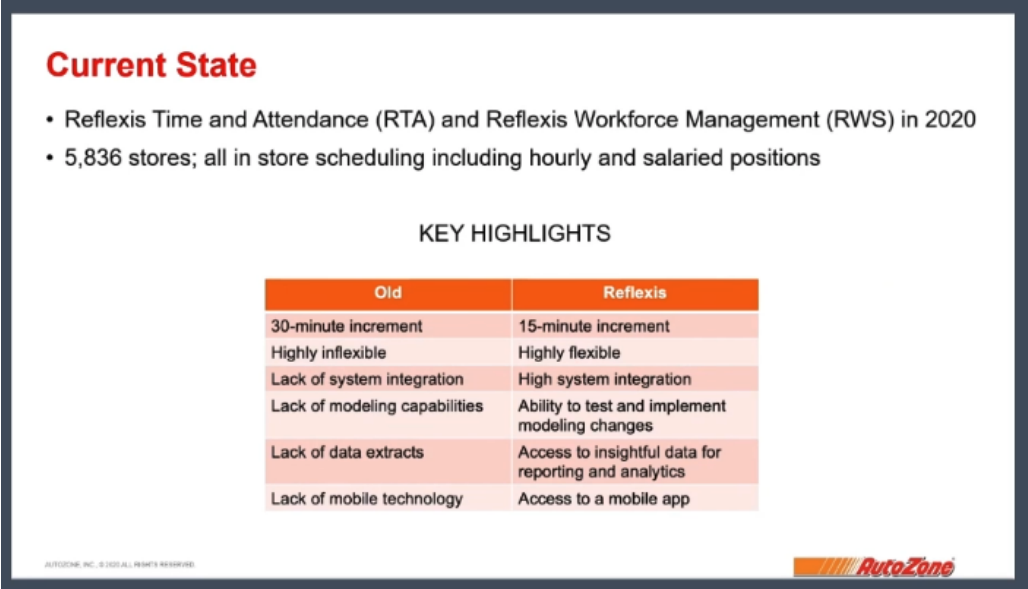

10. Labor Management Can Be Optimized Through Technology Solutions

Tom Newbern, EVP of Store Operations at auto parts retailer AutoZone, held a session with Kevin Tapscott, VP of Solution Consulting at Zebra Technologies’ Reflexis, a provider of AI-powered workforce management solutions. AutoZone employs Reflexis technology to mitigate the impact of rising labor costs. Newbern noted that for AutoZone, a company that prides itself on its customer service, improving workforce efficiency is a key area of investment.

Prior to working with Reflexis, the company’s workforce management system was inflexible, and had few modeling and mobile technology capabilities. Furthermore, the company had struggled to adapt to changing minimum-wage laws. By using Reflexis over the past seven years, AutoZone has been able to forecast labor precisely down to 15-minute increments, quickly implement labor tests and recently adapt quickly to changes in workforce scheduling brought on by the Covid-19 pandemic.

[caption id="attachment_121818" align="aligncenter" width="580"]

Source: Bed Bath & Beyond[/caption]

John Hartmann, EVP and Chief Operating Officer at Bed Bath & Beyond, said that being data driven is allowing the company to make customer-centric decisions, forecast and predict demand, and make real-time decisions. Davis also emphasized that the company has a renewed passion for the customer and understanding who he/she is.

4. Consumers Continue To Change the Way They Think and Shop

On NRF 2021 day three, retail technology solutions provider Sensormatic and furniture and home-goods retailer Wayfair held a joint session, during which Phil Hall, Pre-Sales Data Analyst of Enterprise at software company Looker, spoke on the speed with which consumer behavior has and will continue to change.

Hall said it takes just 66 days to form a new habit—meaning that consumers have had plenty of time to completely change their ways of living and thinking over the course of the now near-year-long pandemic. Panelists on previous days remarked on how crazy it would have sounded just a year ago to most people if they were to be told that someone else would be picking out and delivering their fresh produce to them—but Hall expects that even behaviors like this, that may have seemed especially strange prior to the pandemic, are likely to stick. He said that more than 25% of consumers have purchased something online over the course of the pandemic that they would have typically bought in a store, and over the course of far more than 66 days, they have had plenty of time to reinforce that habit.

5. Easily Accessible, Real-Time Data Is Necessary To Adapt to a Volatile Retail World

Following a common theme throughout the first three days of the event, Hall spoke of the role that data plays in enabling retailers to capitalize on new consumer habits and adapt to an ever-changing retail environment. In a discussion with Matthew Hartwig, Associate Director of Product Management at Wayfair, he highlighted the necessity for retailers to remain agile by using data-backed systems that enable them to adjust on the fly. Hall cited BOPIS (buy online, pick up in store) as a key area in which retailers have had to rapidly adopt over the past year. Since the start of the Covid-19 pandemic, 55% of US consumers have utilized BOPIS services—once a niche avenue of commerce unknown to many.

When drastic shifts in behavior like this occur, retailers must be able to adapt quickly and without reducing the quality of their service or product. Hartwig said that Wayfair utilized Looker and other Google tools to ensure that it could keep up with changed consumer behaviors and meet the skyrocketing demand that helped the company double its sales volume during the pandemic. Hartwig emphasized that having a yearly product cycle is now nowhere near flexible enough to be competitive in the retail industry, and added that the tools Wayfair employed to enable employees to access data-driven insights were instrumental to the company’s success in 2020.

6. Retention of Pandemic-Driven Changed Behaviors Will Vary by Demographic

Nuno Pedro, Head of SAP Commerce, joined Melanie Noronha, The Economist Intelligence Unit Senior Editor, to look past the pandemic and understand what changed consumer behaviors will stick. Noronha reported that while overall expenditures dropped 9% during the pandemic, online spending grew 15%. Somewhat surprisingly, baby boomers have been the most drastic adopters of online commerce during the pandemic: On average, they increased their online spending as a percentage of total spending from 25% to 75%.

However, looking ahead to the other side of the pandemic, Noronha expects that many members of older generations will revert to their previous shopping habits. While more than 60% of total shoppers plan to retain their changed online shopping behaviors, that number drops to closer to 50% for older generations, according to Noronha.

7. The New Consumer Will Expect a Streamlined, Omnichannel Retail Experience

Building on Noronha’s comments on how certain pandemic-driven changes in consumer shopping patterns will shift, Pedro honed in on the importance of providing an omnichannel shopping experience to customers who are increasingly utilizing a variety of both online and offline channels. For example, consumers want to be able to discover a product in a store and then buy it online, or discover products online and then go into a store to try on the product or get a better sense of how it looks and feels.

To enable this flexible commerce, Pedro said that retailers must rely on a robust and scalable sales platform and ensure seamless connectivity between the back and front ends to be able to swiftly create multiple storefronts and meet the consumer wherever they prefer to shop.

8. Capturing Data at Brick-and-Mortar Stores Helps Retailers Understand the Consumer Journey

While consumers have shifted much of their spending online, retailers must remain conscious of the role that physical stores play and continue to optimize their brick-and-mortar locations.

Cisco’s Meraki solution can help retailers better collect and leverage in-store data about customer traffic and sentiment. At NRF 2021, the company highlighted its Modcam solution, which stitches together raw data from individual cameras into an overview of the goings-on in the store. From this data, retailers can understand the paths individuals take through stores, create heat maps of the most common areas customers stop, and help ensure their stores are adhering to social-distancing guidelines.

Moving forward with this technology, retailers may find it useful to capture data on “smiles per hour” and other encapsulations of sentiment that can help them better understand the consumer journey.

9. Supply Chain Technology Helps Exceed Customer Expectations in Food Service

Kareem Yusuf, General Manager of AI Applications at technology company IBM, discussed how IBM’s supply chain technology helped food-service company Golden State Foods optimize its operations by using IoT (Internet of Things) sensors.

Bob Wolpert, Corporate Senior VP and Chief Strategy & Innovation Officer at Golden State Foods, cited an example of how a simple advancement in technology has helped save the company time and money. A typical hamburger patty can typically travel in trucks of temperatures between 34 and 38 degrees, but the company had no way of tracking the specific temperature throughout the journey. As a result, Golden State Foods calculated a 14-day shelf life for hamburger patties based on an estimated variation of temperatures within this range. Using IBM sensor technology, the company has been able to verify that the patties are being transported at optimal temperatures, enabling Golden State Foods to not just ensure product quality but also increase product shelf life.

10. Labor Management Can Be Optimized Through Technology Solutions

Tom Newbern, EVP of Store Operations at auto parts retailer AutoZone, held a session with Kevin Tapscott, VP of Solution Consulting at Zebra Technologies’ Reflexis, a provider of AI-powered workforce management solutions. AutoZone employs Reflexis technology to mitigate the impact of rising labor costs. Newbern noted that for AutoZone, a company that prides itself on its customer service, improving workforce efficiency is a key area of investment.

Prior to working with Reflexis, the company’s workforce management system was inflexible, and had few modeling and mobile technology capabilities. Furthermore, the company had struggled to adapt to changing minimum-wage laws. By using Reflexis over the past seven years, AutoZone has been able to forecast labor precisely down to 15-minute increments, quickly implement labor tests and recently adapt quickly to changes in workforce scheduling brought on by the Covid-19 pandemic.

[caption id="attachment_121818" align="aligncenter" width="580"] Source: AutoZone[/caption]

Source: AutoZone[/caption]