albert Chan

NRF 2021, the annual “Retail’s Big Show” event hosted by the National Retail Federation (NRF), took place online over six days between January 12 and 22.

The Coresight Research team is presenting takeaways from each day of the event in separate reports: Read our coverage of day one, day two, day three, day four and day five.

In this report, we offer our closing thoughts on the event as a whole, as well as five key insights from day six.

NRF 2021: Closing Thoughts

This year’s NRF unsurprisingly focused on helping brands and retailers find new ways to engage consumers online and optimize their omnichannel business. Panels focused on responding to the impacts of Covid-19 and identifying ways in which retailers can leverage data to keep their businesses agile and quickly make real-time changes to strategy to effectively respond to shifts in consumer behavior.

A key theme during NRF was the role that data can play in creating seamless, enjoyable shopping experiences for consumers online through personalization and by leveraging immersive new technologies such as augmented and virtual reality.

Although entirely virtual for the first time in its history, the event went smoothly with few technology glitches. Attendees could watch events live or replay them on their own time. If watching live, a Q&A feature helped attendees stay engaged and interact with panelists in real time. Whether it will be entirely in-person or not remains to be seen, but NRF’s “Retail’s Big Show” in 2022 may benefit from again recording sessions and enabling attendees to watch multiple sessions that may run live at the same time.

NRF 2021 Day Six: Five Key Insights

On the sixth day of NRF 2021, discussions centered around opportunities in the health and wellness market, as well as the growth of China’s luxury market.

1. New Opportunities Abound in the Health and Wellness MarketSharon Leite, CEO at nutritional supplements retailer The Vitamin Shoppe, and Mindy Grossman, President and CEO of global wellness company and weight management program provider WW International Inc., both spoke on how the pandemic has driven a spike in demand for health and wellness products. They discussed new trends emerging in the industry and emphasized that for most consumers, health is now more important than ever. Consumers appear focused on finding new ways to achieve a stress-free, balanced life.

In a November 2020 poll of US consumers conducted by The Vitamin Shoppe, 56% of respondents said they were seeking new ways to unwind and find balance. Both WW and The Vitamin Shoppe have pivoted their businesses to capitalize on this trend. The Vitamin Shoppe launched its own brand of CBD products and has partnered with the Martha Stewart CBD brand—with gummy packs of the latter selling out in the lead up to the holidays. The Vitamin Shoppe remains the only national retailer selling CBD, putting it in pole position in the retail race toward CBD health and wellness.

In response to consumers seeking balance in new ways, WW added a new pillar to its existing three pillars (fitness, mindset and nutrition): sleep. Consumers can access WW’s sleep resources, along with the company’s other offerings, all in the same place on the myWW+ app, which was launched in November 2020 and uses artificial intelligence and machine learning to create personalized experiences for consumers across the company’s four pillars.

Moving forward, both Grossman and Leite expect that the health and wellness trend is here to stay.

[caption id="attachment_122279" align="aligncenter" width="700"] Sharon Leite, CEO at The Vitamin Shoppe, and Mindy Grossman, President and CEO of WW International Inc,. speak with Glenda McNeal, President of Enterprise Strategy at American Express, on the growing health and wellness market.

Sharon Leite, CEO at The Vitamin Shoppe, and Mindy Grossman, President and CEO of WW International Inc,. speak with Glenda McNeal, President of Enterprise Strategy at American Express, on the growing health and wellness market.Source: NRF[/caption] 2. The Way Consumers Shop Has Changed for Good

Judith McKenna, President and CEO of Walmart International, spoke with Glenda McNeal, President of Enterprise Strategic Partnerships at American Express, on how Walmart International is thinking about its business amid the rapid shifts in consumer behavior. McKenna expects changes in consumer behavior that have transpired during the pandemic to stick, with a particular emphasis on the new “nesting” consumer who spends more time in the home. McKenna told McNeal she believes that this newly home-focused consumer will not shop exclusively online but will instead be a more channel-agnostic consumer.

This willingness to shop either online or in-store for most products spans even categories that consumers shopped almost exclusively offline pre-pandemic, such as grocery. While many consumers used to be wary of having store associates pick out their produce for them, the pandemic has forced consumers to take up online grocery shopping at record rates in the US and elsewhere: According to our latest US Consumer Tracker survey, roughly one in four US consumers shopped for groceries online in the past two weeks. McKenna said that Walmart has been successfully maintained its online grocery business by creating a bond of trust with its customers: The company instructs associates to shop for online orders as if they were shopping for themselves.

3. Consumers Have Higher Retail Expectations Across the BoardIn a panel on fashion’s digital transformation, Jessica Murphy, Co-Founder and Chief Customer Officer at personalization platform True Fit, joined Karin Tracy, Head of Industry for Retail/Fashion/Luxury at Facebook, and Chris Field, Managing Editor at Retail Connections, to discuss how the growing expectations of consumers has pushed brands and retailers to accelerate digital innovation.

The panelists agreed that it is increasingly difficult to capture the attention and dollars of today’s consumer online. Tracy highlighted that in the current digital retail environment, the shopping experience must be completely seamless: Consumers want the product on their own time with no complications.

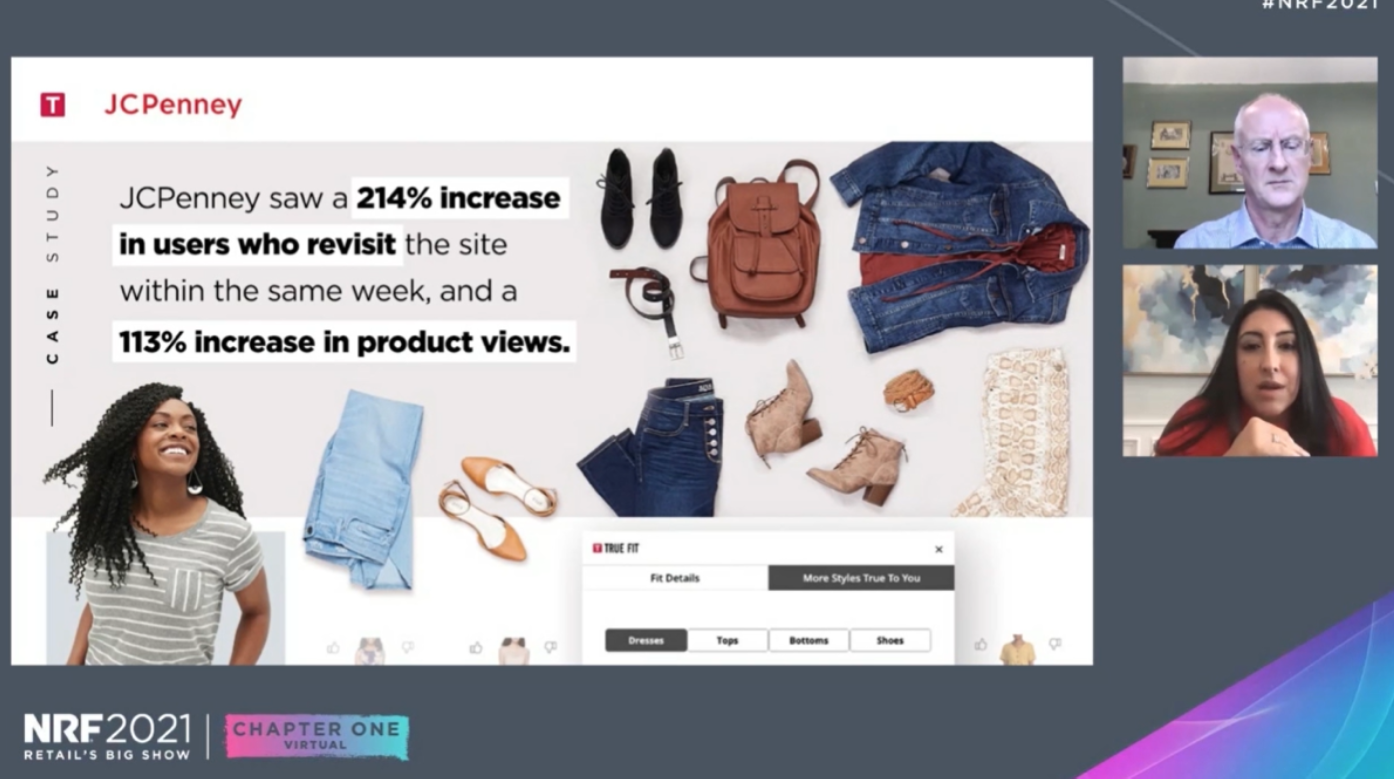

In fashion, finding the right fit can often be an inhibitor of a smooth online purchase process. True Fit can help brands and retailers ensure a seamless shopping journey for their customers. Murphy said that the company has seen a strong uptick in customers during the pandemic: The age groups of 19–34 and 64+ saw the strongest growth in True Fit registration in October 2020. True Fit’s solution appears effective: After working with the platform, JCPenney saw a 214% increase in users who revisited its site within the same week and a 113% increase in product views.

[caption id="attachment_122280" align="aligncenter" width="700"] Jessica Murphy, Co-Founder and Chief Customer Officer at True Fit, discusses the company’s solutions with Chris Field, Managing Editor at Retail Connections

Jessica Murphy, Co-Founder and Chief Customer Officer at True Fit, discusses the company’s solutions with Chris Field, Managing Editor at Retail ConnectionsSource: NRF/True Fit[/caption]

As fashion moves online, consumers are increasingly demanding the same discovery experience that they would have in-store. Tracy spoke of the role that targeted advertising via social media platforms Facebook and Instagram can play in enabling consumers to seamlessly buy products selected specifically for them. By personalizing recommendations, the social networks can create a curated window-shopping experience for users, helping brands more effectively reach their target audience and replicating the offline discovery process in a digital format.

4. The Chinese Luxury Market Experiences Diversified Online GrowthKevin Jiang, President of International Business at JD Fashion and Lifestyle, discussed the recent growth of China’s luxury market. He cited the strong growth of household and grocery products early in 2020, at the height of the pandemic in China, but said that demand since then has diversified: JD.com saw a transaction volume of over $41 billion over four days for Singles’ Day 2020, buoyed by strong luxury performance.

Foreign luxury brands in particular did well during the holiday season, Jiang said, due to their name brand recognition. While he indicated that foreign brands continue to dominate, Jiang said that emerging Chinese designer brands have begun to find their footing and appeal to niche customers on JD.com. In addition to the growing diversity in brands and designers, Jiang emphasized the widening assortment of customers who have begun shopping online for luxury and other products with JD.com: He said that lower-tier cities saw the fastest growth in customers during Singles’ Day 2020.

5. Collaboration with Influencers Is a Two-Way StreetIn a discussion with Lauren Sherman, Chief Correspondent at The Business of Fashion, influencer experts Jennifer Powell, CEO and Founder of Jennifer Powell, Inc., and Jarno Vanhatapio, CEO of NA-KD.com, spoke about their careers in the industry and how brands and retailers can best work with influencers.

Explaining the current approach he takes to influencer marketing, Vanhatapio highlighted his long tenure of experience in the influencer space. He started working with what we now call “influencers” in 2003, when they were more commonly referred to as “bloggers.” Vanhatapio said he was drawn to these individuals because he had always suspected that curated content was more effective. However, speaking at NRF 2021, both he and Sherman emphasized the importance of authenticity in influencer marketing: Posts and promotions cannot be too scripted or else they lose their persuasiveness.

One key way in which brands and retailers can ensure authenticity in influencer marketing is to give influencers creative license over the stories they tell to sell the product. By putting influencers in the driver’s seat, brands and retailers can avoid the pitfalls of campaigns that may seem too corporate or scripted. He also recommended that companies maintain a dialogue with their influencers. Vanhatapio said that he welcomes input from influencers into what his company and retailers can be doing better.