DIpil Das

NRF 2021, the annual “Retail’s Big Show” event hosted by the National Retail Federation (NRF), is taking place online over six days between January 12 and 22.

The Coresight Research team is presenting takeaways from each day of the event in separate reports: Read our coverage of day one, day two, day three and day four.

In this report, we provide insights from a digital session hosted by Deborah Weinswig, CEO and Founder of Coresight Research, and Ethan Chernovsky, Vice President of Marketing of location data analytics startup Placer.ai, at NRF on January 19, 2021. The session was titled “Offline Retail in 2021: A Data-Driven Look at the Trends That Will Define Retail Success in 2021” and focused on the population shifts that occurred in 2020 and the sectors that are most likely to benefit from a recovery in 2021.

[caption id="attachment_122135" align="aligncenter" width="725"] Ethan Chernovsky, Vice President of Marketing at Placer.ai, talks offline retail traffic at NRF 2021

Ethan Chernovsky, Vice President of Marketing at Placer.ai, talks offline retail traffic at NRF 2021

Source: NRF/Placer.ai [/caption] Source: Placer.ai[/caption]

Source: Placer.ai[/caption]

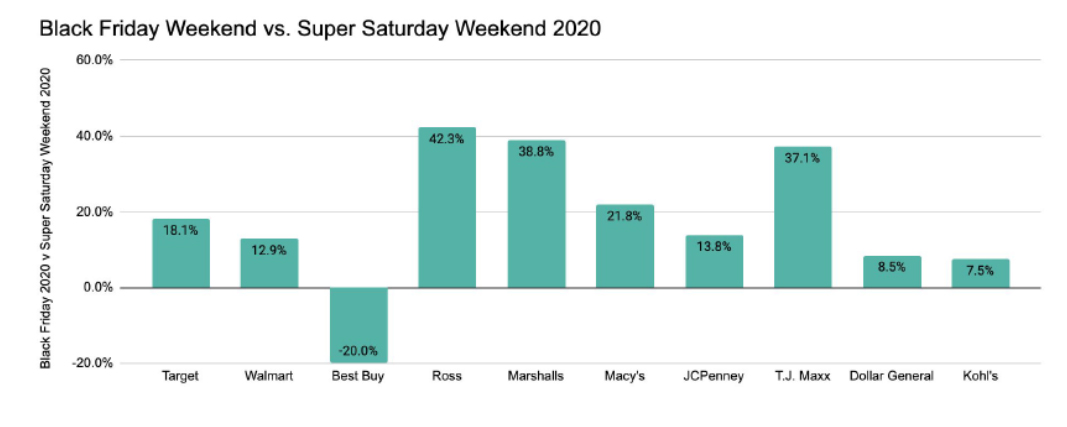

At NRF 2021, Placer.ai presented store traffic results for the main December holiday shopping weekend versus Black Friday weekend

At NRF 2021, Placer.ai presented store traffic results for the main December holiday shopping weekend versus Black Friday weekend

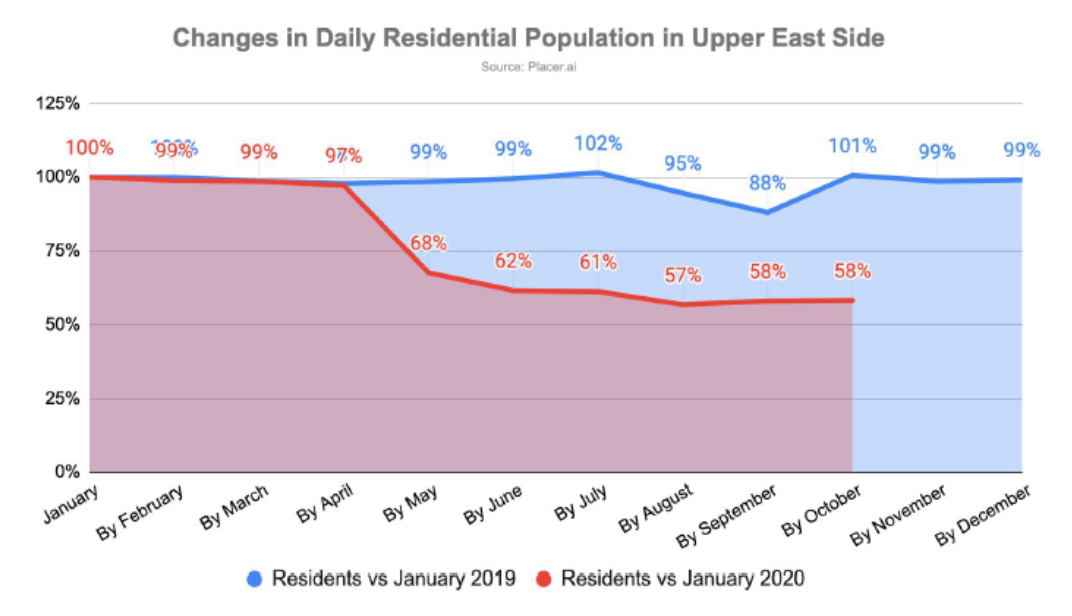

Source: Placer.ai [/caption] Consumer Behavior: What Will Happen Once the Pandemic Subsides? Chernovsky said that Placer.ai has identified two key trends amid the Covid-19 pandemic: the population shift from cities to the suburbs; and economic uncertainty, the consequences of which are likely to be longer-lasting. The Placer.ai chart in the image below shows changes in residential population on the Upper East Side in Manhattan, underscoring the flight of consumers out of cities to other locations—a trend that may reverse when consumers consider it safe to return to cities post pandemic. [caption id="attachment_122139" align="aligncenter" width="725"] Source: Placer.ai[/caption]

Chernovsky and Weinswig discussed the question of how US retail will fare once the pandemic subsides, as consumer behaviors have changed significantly in the past year. Many consumers have established new daily routines and work-related habits amid coronavirus-led lockdowns, for example. Other parts of the world that are farther along in dealing with the pandemic have seen routines return to pre-crisis normality, with consumers releasing pent-up spending on retail and travel. In China, for instance, “revenge shopping” was a trend, whereby consumers vigorously reasserted their spending ability following the lifting of lockdowns.

During the Covid-19 crisis, outdoor retailers in the US have seen strength as consumers look to spend time outside for recreation. Post pandemic, many of the hardest-hit segments, such as department stores and gyms, could see a sharp rebound.

The Future of Physical Retail

Despite many retailer bankruptcies and permanent store closures due to the Covid-19 pandemic, Weinswig argued that there is a future for stores as they function as venues that bring people together. The outlook for flagship stores is less optimistic because many flagships are located in city centers and have become uneconomical due to significant rent expenses combined with low sales volumes. On a positive note, some defunct retailers such as Stein Mart have found second lives as online-only retailers.

Placer.ai offered optimistic comments about store openings in 2021. Chernovsky sees a more diverse mix in brick-and-mortar retailers as higher numbers of mid-sized brands open fewer stores—50–100 locations rather than the 800–1,000 goal that we may have seen in previous years, for example. Weinswig added that partnerships between retailers, such as between Kohl’s and Sephora, could proliferate. Such collaborations offer interesting concepts and expand the scope of offerings for consumers while driving traffic and extending the customer base for both retail partners.

Like stores, malls also offer a sense of community. Chernovsky explained that some retailers have expanded into vacant spaces at shopping centers as staging locations or have even opened additional stores within the same mall as their existing locations due to pandemic-induced store-occupancy limits—enabling them to maximize store traffic. In many cases, landlords and tenants have worked together in partnership to find solutions to challenges presented by the pandemic.

Many malls have historically been copycats of each other, but Placer.ai sees an opportunity for malls to become more varied and differentiate themselves through their tenant mix, catering to different consumer shopping interests.

On this topic, Coresight Research has published a series of reports, America’s Changing Shopping Centers.

Retailers Should Think More Strategically About 2021

Whereas 2020 was a tactical year for retailers, which had to take quick action to deal with urgent challenges, planning in 2021 can be more strategic, Weinswig emphasized. Retailers should be asking themselves how they could drive longevity, particularly in hard-hit sectors such as department stores.

Source: Placer.ai[/caption]

Chernovsky and Weinswig discussed the question of how US retail will fare once the pandemic subsides, as consumer behaviors have changed significantly in the past year. Many consumers have established new daily routines and work-related habits amid coronavirus-led lockdowns, for example. Other parts of the world that are farther along in dealing with the pandemic have seen routines return to pre-crisis normality, with consumers releasing pent-up spending on retail and travel. In China, for instance, “revenge shopping” was a trend, whereby consumers vigorously reasserted their spending ability following the lifting of lockdowns.

During the Covid-19 crisis, outdoor retailers in the US have seen strength as consumers look to spend time outside for recreation. Post pandemic, many of the hardest-hit segments, such as department stores and gyms, could see a sharp rebound.

The Future of Physical Retail

Despite many retailer bankruptcies and permanent store closures due to the Covid-19 pandemic, Weinswig argued that there is a future for stores as they function as venues that bring people together. The outlook for flagship stores is less optimistic because many flagships are located in city centers and have become uneconomical due to significant rent expenses combined with low sales volumes. On a positive note, some defunct retailers such as Stein Mart have found second lives as online-only retailers.

Placer.ai offered optimistic comments about store openings in 2021. Chernovsky sees a more diverse mix in brick-and-mortar retailers as higher numbers of mid-sized brands open fewer stores—50–100 locations rather than the 800–1,000 goal that we may have seen in previous years, for example. Weinswig added that partnerships between retailers, such as between Kohl’s and Sephora, could proliferate. Such collaborations offer interesting concepts and expand the scope of offerings for consumers while driving traffic and extending the customer base for both retail partners.

Like stores, malls also offer a sense of community. Chernovsky explained that some retailers have expanded into vacant spaces at shopping centers as staging locations or have even opened additional stores within the same mall as their existing locations due to pandemic-induced store-occupancy limits—enabling them to maximize store traffic. In many cases, landlords and tenants have worked together in partnership to find solutions to challenges presented by the pandemic.

Many malls have historically been copycats of each other, but Placer.ai sees an opportunity for malls to become more varied and differentiate themselves through their tenant mix, catering to different consumer shopping interests.

On this topic, Coresight Research has published a series of reports, America’s Changing Shopping Centers.

Retailers Should Think More Strategically About 2021

Whereas 2020 was a tactical year for retailers, which had to take quick action to deal with urgent challenges, planning in 2021 can be more strategic, Weinswig emphasized. Retailers should be asking themselves how they could drive longevity, particularly in hard-hit sectors such as department stores.

Ethan Chernovsky, Vice President of Marketing at Placer.ai, talks offline retail traffic at NRF 2021

Ethan Chernovsky, Vice President of Marketing at Placer.ai, talks offline retail traffic at NRF 2021 Source: NRF/Placer.ai [/caption]

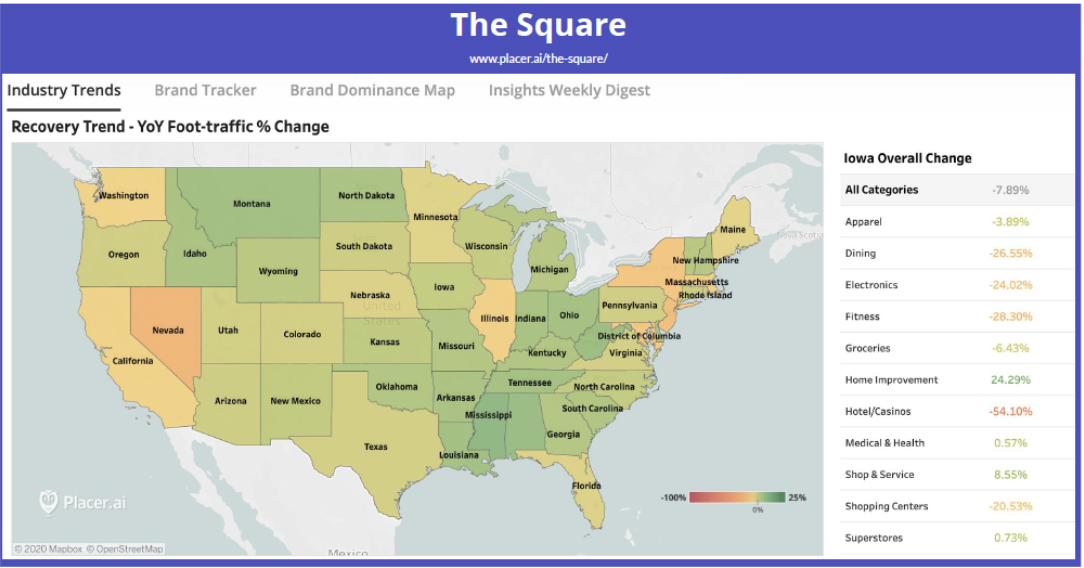

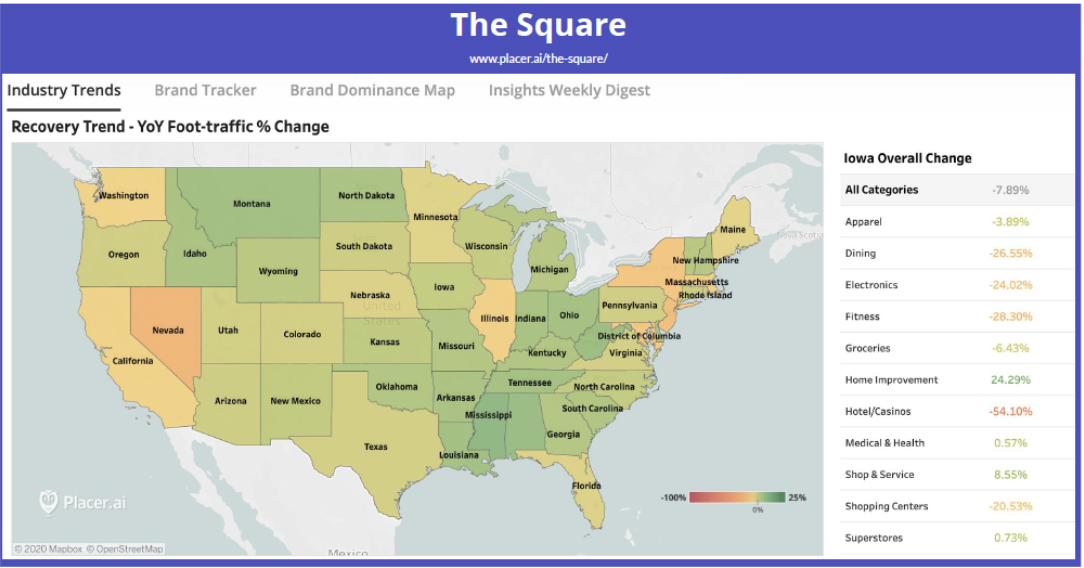

An Introduction to Placer.ai

Placer.ai collects anonymized location data from 30 million active devices (i.e., smartphone location data) and analyzes this data using artificial intelligence and machine learning. The company offers a free version of its tools, called The Square, on its website. An example of data from The Square is shown below, which depicts a US map of year-over-year growth in foot traffic by color grading, and also breaks out foot traffic in Iowa by retail category. [caption id="attachment_122137" align="aligncenter" width="725"] Source: Placer.ai[/caption]

Source: Placer.ai[/caption]

NRF 2021: Coresight Research and Placer.ai Discuss Offline Retail in 2021

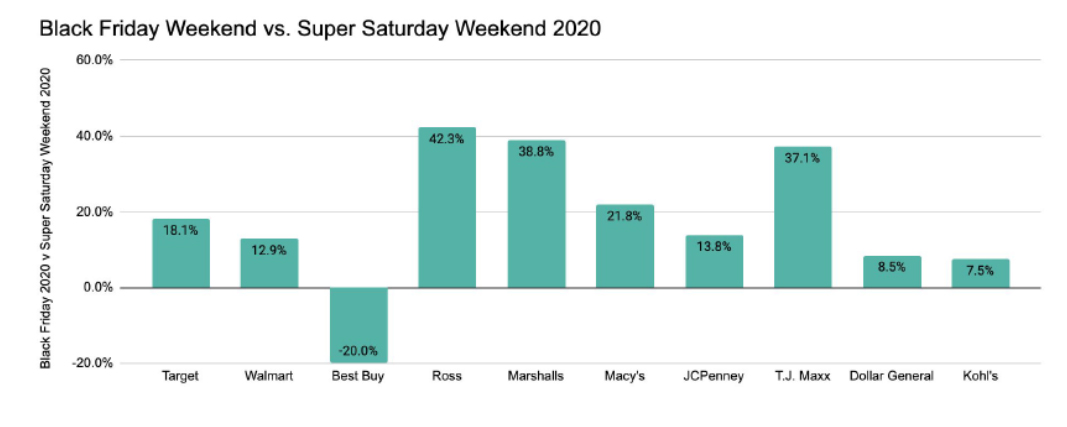

Holiday Traffic Update Looking at the recent holiday season, Placer.ai data suggest a significant drop in physical store traffic for Black Friday in 2020, which was exacerbated by a lack of doorbuster deals. Almost across the board, major US retailers saw higher store traffic during Super Saturday weekend (the last weekend before Christmas) in December than during Black Friday weekend (Friday to Sunday) at the end of November. As shown in the image below, taken from Placer.ai’s presentation at NRF, most of the selected major US retailers saw higher traffic by at least double-digit percentages during the Super Saturday weekend compared to Black Friday weekend. Interestingly, Best Buy is the only retailer for which traffic was lower during the December holiday weekend—likely due to electronics being a particularly popular product for Black Friday deals. [caption id="attachment_122138" align="aligncenter" width="725"] At NRF 2021, Placer.ai presented store traffic results for the main December holiday shopping weekend versus Black Friday weekend

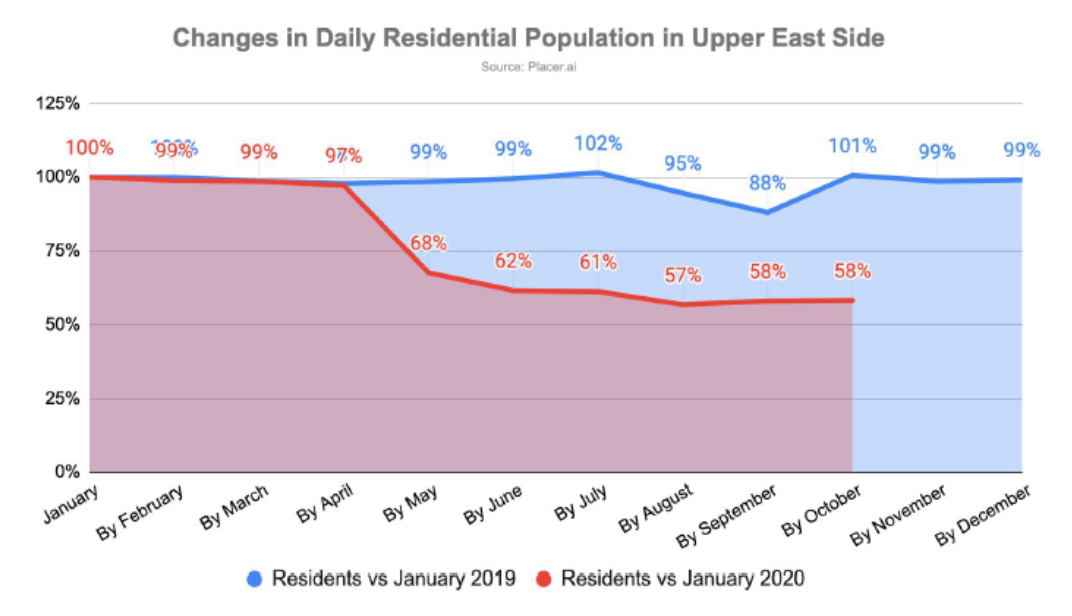

At NRF 2021, Placer.ai presented store traffic results for the main December holiday shopping weekend versus Black Friday weekend Source: Placer.ai [/caption] Consumer Behavior: What Will Happen Once the Pandemic Subsides? Chernovsky said that Placer.ai has identified two key trends amid the Covid-19 pandemic: the population shift from cities to the suburbs; and economic uncertainty, the consequences of which are likely to be longer-lasting. The Placer.ai chart in the image below shows changes in residential population on the Upper East Side in Manhattan, underscoring the flight of consumers out of cities to other locations—a trend that may reverse when consumers consider it safe to return to cities post pandemic. [caption id="attachment_122139" align="aligncenter" width="725"]

Source: Placer.ai[/caption]

Chernovsky and Weinswig discussed the question of how US retail will fare once the pandemic subsides, as consumer behaviors have changed significantly in the past year. Many consumers have established new daily routines and work-related habits amid coronavirus-led lockdowns, for example. Other parts of the world that are farther along in dealing with the pandemic have seen routines return to pre-crisis normality, with consumers releasing pent-up spending on retail and travel. In China, for instance, “revenge shopping” was a trend, whereby consumers vigorously reasserted their spending ability following the lifting of lockdowns.

During the Covid-19 crisis, outdoor retailers in the US have seen strength as consumers look to spend time outside for recreation. Post pandemic, many of the hardest-hit segments, such as department stores and gyms, could see a sharp rebound.

The Future of Physical Retail

Despite many retailer bankruptcies and permanent store closures due to the Covid-19 pandemic, Weinswig argued that there is a future for stores as they function as venues that bring people together. The outlook for flagship stores is less optimistic because many flagships are located in city centers and have become uneconomical due to significant rent expenses combined with low sales volumes. On a positive note, some defunct retailers such as Stein Mart have found second lives as online-only retailers.

Placer.ai offered optimistic comments about store openings in 2021. Chernovsky sees a more diverse mix in brick-and-mortar retailers as higher numbers of mid-sized brands open fewer stores—50–100 locations rather than the 800–1,000 goal that we may have seen in previous years, for example. Weinswig added that partnerships between retailers, such as between Kohl’s and Sephora, could proliferate. Such collaborations offer interesting concepts and expand the scope of offerings for consumers while driving traffic and extending the customer base for both retail partners.

Like stores, malls also offer a sense of community. Chernovsky explained that some retailers have expanded into vacant spaces at shopping centers as staging locations or have even opened additional stores within the same mall as their existing locations due to pandemic-induced store-occupancy limits—enabling them to maximize store traffic. In many cases, landlords and tenants have worked together in partnership to find solutions to challenges presented by the pandemic.

Many malls have historically been copycats of each other, but Placer.ai sees an opportunity for malls to become more varied and differentiate themselves through their tenant mix, catering to different consumer shopping interests.

On this topic, Coresight Research has published a series of reports, America’s Changing Shopping Centers.

Retailers Should Think More Strategically About 2021

Whereas 2020 was a tactical year for retailers, which had to take quick action to deal with urgent challenges, planning in 2021 can be more strategic, Weinswig emphasized. Retailers should be asking themselves how they could drive longevity, particularly in hard-hit sectors such as department stores.

Source: Placer.ai[/caption]

Chernovsky and Weinswig discussed the question of how US retail will fare once the pandemic subsides, as consumer behaviors have changed significantly in the past year. Many consumers have established new daily routines and work-related habits amid coronavirus-led lockdowns, for example. Other parts of the world that are farther along in dealing with the pandemic have seen routines return to pre-crisis normality, with consumers releasing pent-up spending on retail and travel. In China, for instance, “revenge shopping” was a trend, whereby consumers vigorously reasserted their spending ability following the lifting of lockdowns.

During the Covid-19 crisis, outdoor retailers in the US have seen strength as consumers look to spend time outside for recreation. Post pandemic, many of the hardest-hit segments, such as department stores and gyms, could see a sharp rebound.

The Future of Physical Retail

Despite many retailer bankruptcies and permanent store closures due to the Covid-19 pandemic, Weinswig argued that there is a future for stores as they function as venues that bring people together. The outlook for flagship stores is less optimistic because many flagships are located in city centers and have become uneconomical due to significant rent expenses combined with low sales volumes. On a positive note, some defunct retailers such as Stein Mart have found second lives as online-only retailers.

Placer.ai offered optimistic comments about store openings in 2021. Chernovsky sees a more diverse mix in brick-and-mortar retailers as higher numbers of mid-sized brands open fewer stores—50–100 locations rather than the 800–1,000 goal that we may have seen in previous years, for example. Weinswig added that partnerships between retailers, such as between Kohl’s and Sephora, could proliferate. Such collaborations offer interesting concepts and expand the scope of offerings for consumers while driving traffic and extending the customer base for both retail partners.

Like stores, malls also offer a sense of community. Chernovsky explained that some retailers have expanded into vacant spaces at shopping centers as staging locations or have even opened additional stores within the same mall as their existing locations due to pandemic-induced store-occupancy limits—enabling them to maximize store traffic. In many cases, landlords and tenants have worked together in partnership to find solutions to challenges presented by the pandemic.

Many malls have historically been copycats of each other, but Placer.ai sees an opportunity for malls to become more varied and differentiate themselves through their tenant mix, catering to different consumer shopping interests.

On this topic, Coresight Research has published a series of reports, America’s Changing Shopping Centers.

Retailers Should Think More Strategically About 2021

Whereas 2020 was a tactical year for retailers, which had to take quick action to deal with urgent challenges, planning in 2021 can be more strategic, Weinswig emphasized. Retailers should be asking themselves how they could drive longevity, particularly in hard-hit sectors such as department stores.