DIpil Das

US Retail Sales: November 2021

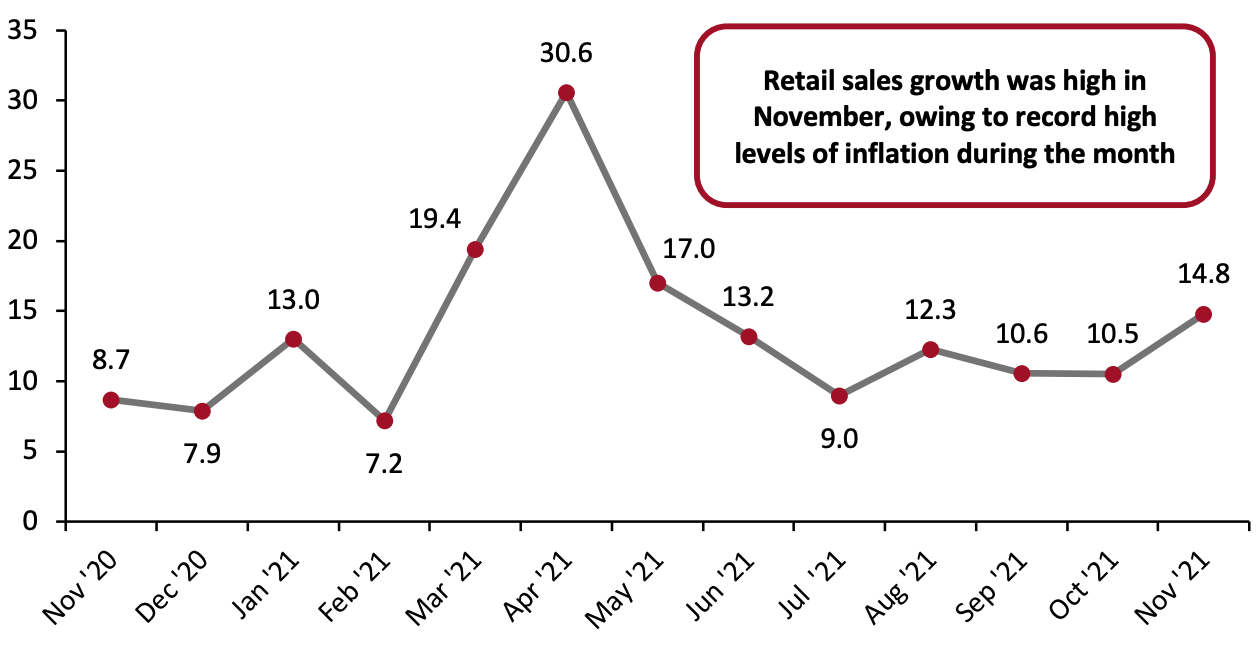

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding sales of gasoline and motor vehicle and parts dealers. This metric was strong in November, as US retail sales grew 14.8% when compared to 2020. November retail sales growth is an acceleration from the 10.5% revised year-over-year growth in October, as reported by the Census Bureau on December 15, 2021. The acceleration in retail sales growth was supported by the record-high inflation experienced during the month. In November, consumer prices increased 6.8% compared to a year earlier, representing a 39-year high in inflation, partly driven by volatile food and gas prices. Food-at-home inflation of 6.4% in November would have contributed to the strength of retail sales, but price rises in gasoline and other nonretail categories would not have fed into the retail metric. November retail sales numbers demonstrate that consumer demand for goods remains strong. The low unemployment rate, increasing average hourly wages, and savings built up during the pandemic may be contributing to consumers’ ability to spend despite the increase in prices.Figure 1. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change [caption id="attachment_138199" align="aligncenter" width="700"]

Data are not seasonally adjusted

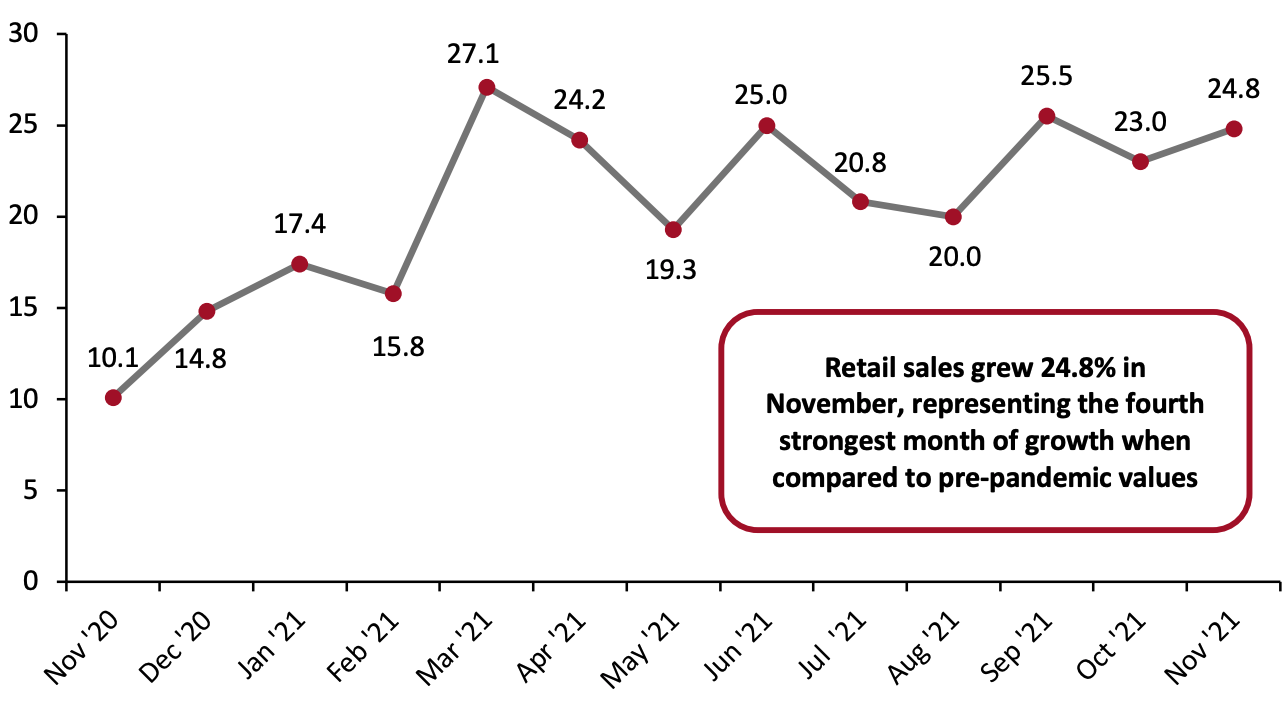

Data are not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] In relation to the more consistent comparatives of 2019, November retail sales remained in line with recent two-year growth trends. Retail sales grew 24.8% from 2019 values in November, slightly higher than October’s 23.0% revised two-year growth. On a two-year basis, November surpassed October and became the fourth-strongest month of growth compared to pre-pandemic values.

Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: % Change from Two Years Prior [caption id="attachment_138200" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

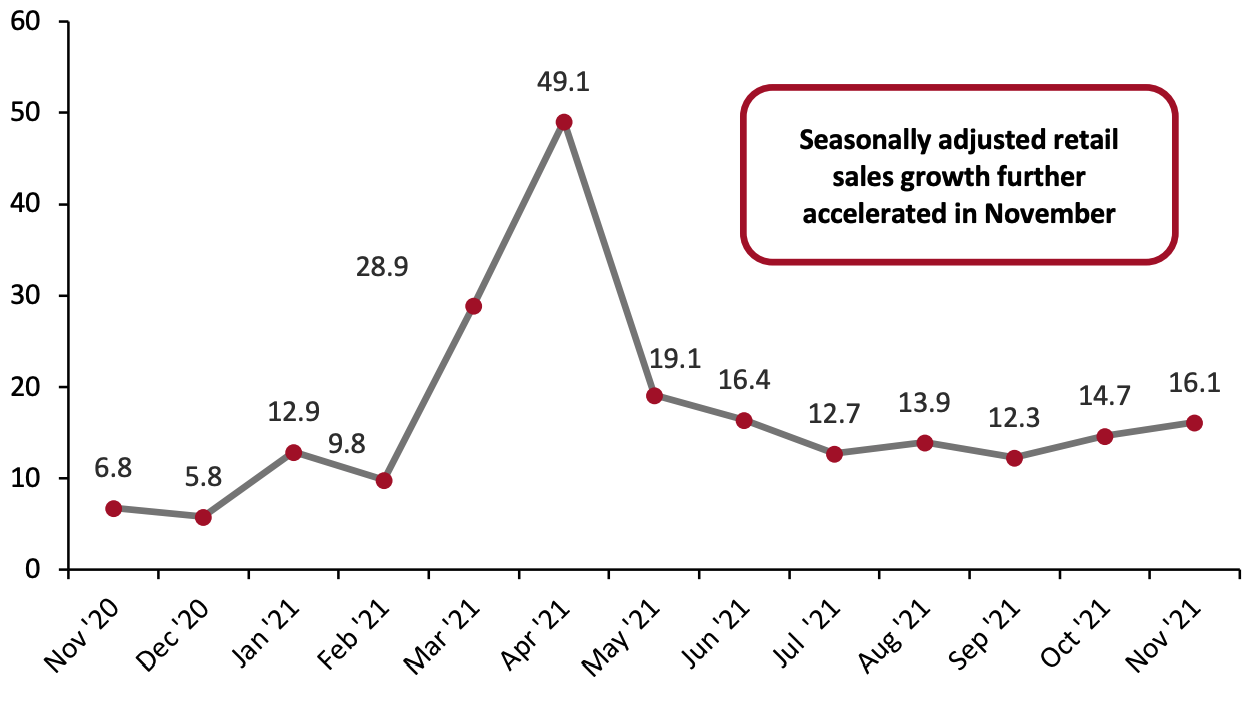

Seasonally adjusted retail sales, including automobiles and gasoline, grew 16.1% year over year, accelerating from October’s 14.7% growth. In November, the sales of motor vehicles and parts dealers declined from October, demonstrating the persistent impact of the global semiconductor shortage on the auto industry.

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusted retail sales, including automobiles and gasoline, grew 16.1% year over year, accelerating from October’s 14.7% growth. In November, the sales of motor vehicles and parts dealers declined from October, demonstrating the persistent impact of the global semiconductor shortage on the auto industry.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: Seasonally Adjusted YoY % Change [caption id="attachment_138201" align="aligncenter" width="700"]

Data are seasonally adjusted

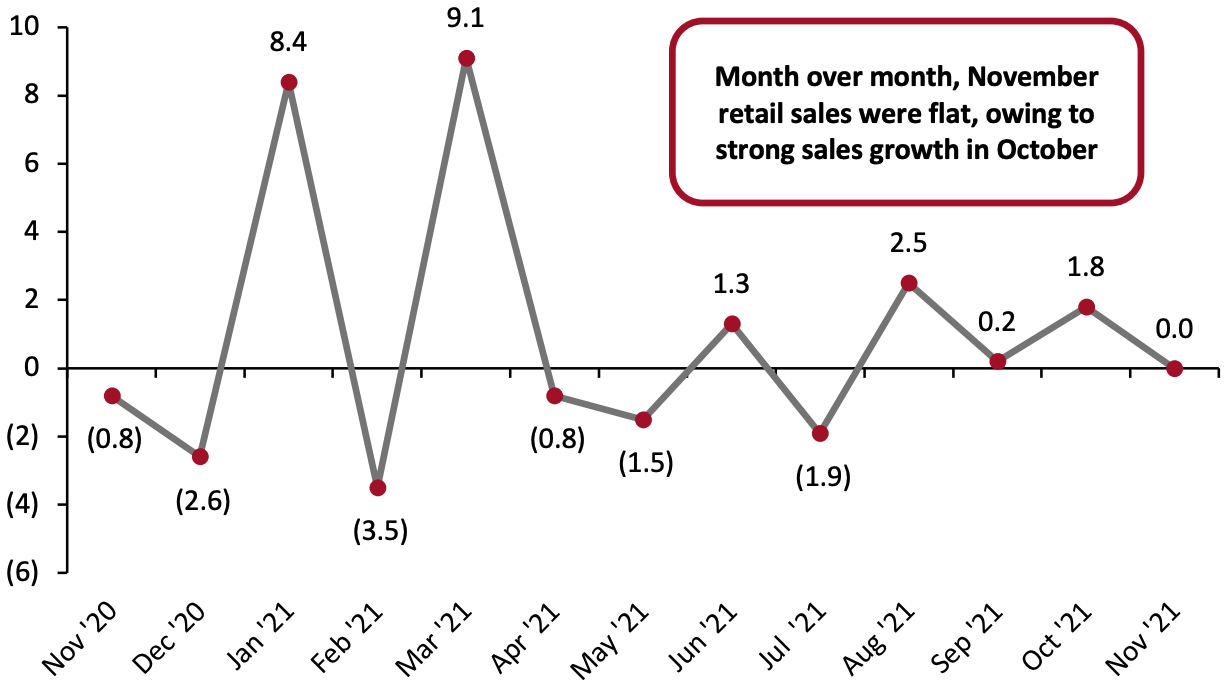

Data are seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Sales Slightly Increase Month over Month On a month-over-month basis, seasonally adjusted sales (excluding automobiles and gas) were flat in November, owing to stronger than expected retail sales in October—which were themselves caused by an unusually early start to holiday shopping this year. November’s strong retail sales continue the year’s overall positive trend of high retail sales, as we approach the end of what we expect to be a very strong holiday season, with sales increases of 9%–10% versus 2020.

Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_138202" align="aligncenter" width="700"]

Data are seasonally adjusted

Data are seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Growth by Sector Although overall retail sales saw double-digit sales growth from November 2020, the spread of Covid-19 through the US last spring hit some sectors much harder than others. To control for the effects of the pandemic in 2020’s retail sales figures, we largely compare November 2021 sales to pre-pandemic November 2019 sales in this section. In a very strong month, several sectors saw sales growth of 15% or more from 2019 levels:

- Sporting goods and hobby store sales rose 38.5% from 2019 values. Compared to 2020 values, the sector saw growth of 22.1% year over year.

- Building material and garden supply dealers saw sales rise by 30.5% from 2019 values. On a year-over-year basis, building material and garden supply sales rose by 12.2%.

- Nonstore retailers continued to thrive in November, with sales growing by nearly half from 2019 values, posting a two-year growth of 47.3% in November. This sector still saw strong sales growth of 15.1% from 2020, against stronger comparatives when the pandemic forced many people to make purchases online. Continued surges in this sector, even as stores across the country are now open without restrictions, suggest that e-commerce is continuing to grow in 2021.

- Miscellaneous store retailers saw solid sales growth of 28.7% from 2019, in line with October’s 28.8% revised two-year growth.

- Furniture and home-furnishings stores—which did not perform nearly as well as home-improvement retailers amid the outbreak of Covid-19—continued a strong year of recovery, recording growth of 20.2% in November 2021 compared to November 2019.

- General merchandise stores saw sales growth of 15.2% on a two-year basis. The department stores subsector showed respectable mid-single digit growth of 4.9% compared to pre-pandemic values.

- Food and beverage stores continued to see elevated sales, rising 17.8% from 2019 levels while year-over-year growth stood at 8.8%. Grocery stores saw 17.3% growth from 2019 and 8.7% growth from 2020.

- Clothing and clothing accessories stores continued to see strong two-year sales growth in the mid-teens. In November, clothing and clothing accessory sales grew 14.4% from 2019 levels and 35.3% growth compared to weaker 2020 comparatives. This supports our expectation of strong recovery in the overall US apparel and footwear market in 2021.

- Electronics and appliance stores saw steady two-year growth of 5.7% in November. Consumers have spent well on electronics throughout the pandemic. For much of 2020, they directed their spending away from specialty electronics retailers to online-focused channels. While sales growth remains strong, we believe the sector has gradually begun to feel tangible impacts of the growing scarcity of microchips (used in electronics and appliances) that has already hit the auto industry.

Figure 5. US Total Retail Sales, by Sector: YoY % Change from 2020 (Top) and 2019 (Bottom) [wpdatatable id=1553] [wpdatatable id=1554]

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research