DIpil Das

China Retail Sales: November 2021

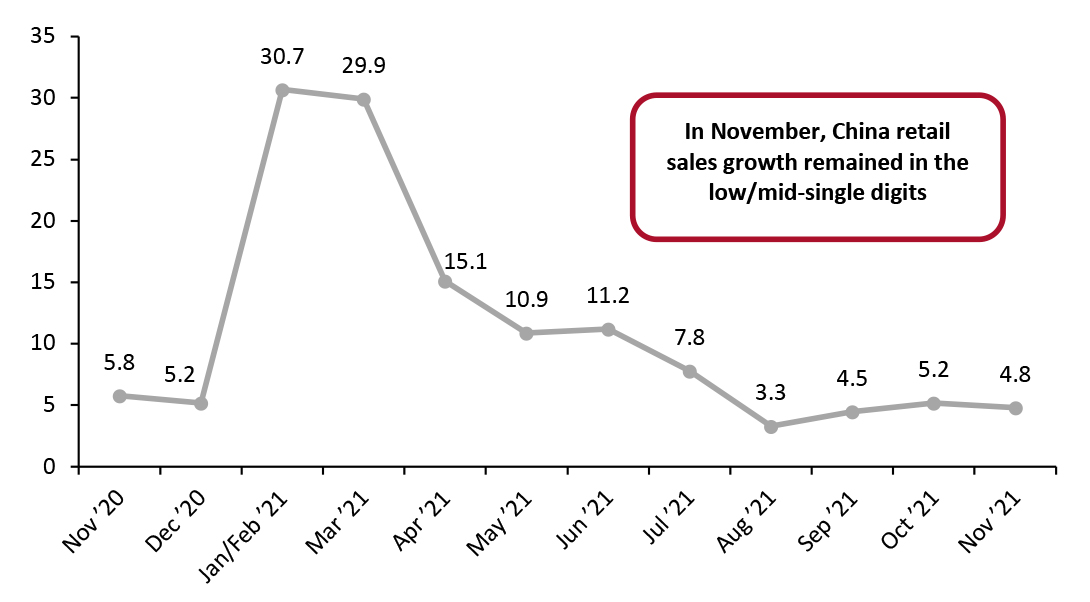

In November, China’s total retail sales growth (ex. food service, incl. automobiles and gasoline) increased 4.8% year over year, in line with October’s 5.2% year-over-year growth. November’s marginal deceleration in year-over-year growth reflects challenges to consumer spending, due in part to China’s strict measures to contain Covid-19 outbreaks The number of Covid-19 cases in China continued to increase in November, which likely further dampened household consumption during the month. The government’s strict approach to controlling Covid-19 outbreaks has resulted in sporadic travel restrictions which limit tourist and business activity. Furthermore, China’s urban unemployment rate ticked up in November, potentially altering consumer spending patterns due to heightened concerns over future income.Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_138225" align="aligncenter" width="701"]

January and February figures are reported together

January and February figures are reported together Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector In November, five sectors saw double-digit growth compared to sales from a year ago. However, two notable sectors did see declines.

- Sales of school and office supplies showed continued strength. In November, school and office supplies saw sales growth of 18.1% compared to 2020. Compared to 2019, school and office supplies sales were up 35.0%.

- In November, the apparel and footwear sector posted its fourth consecutive month of negative growth, although these declines have been easing, and November’s decline was marginal: The apparel and footwear category posted a 0.5% sales decline compared to November 2020. On a two-year basis, apparel and footwear sales saw 4.0% growth.

- Auto sales continued to show the impact of the global microchip shortage, declining by 9.0% year over year. On a two-year basis, however, auto sales were up 9.0%.

- Furniture sales growth accelerated for the first time since June. Furniture sales grew 6.1% in November, up from October’s 2.4% sales growth. On a two-year basis, sales remained down by 13.6%.

- The food sector’s strong performance continued in November, accelerating from October’s growth to 14.8% year over year. On a two-year basis, food retail sales increased by 19.0%. Furthermore, beverage sales grew 15.5% from November 2020, and notably grew by 39.2% when compared to 2019.

- The beauty sector continued to see gains in November: Sales growth accelerated to 8.2% compared to November 2020, up from October’s 7.2% year-over-year growth. On a two-year basis, beauty sales grew by an incredible 72.7% compared to November 2019.

- Construction and decoration sales growth continued to accelerate in November. Compared to November 2020, construction and decoration sales increased by 14.1%, although the sector saw sales decline by 2.2% compared to 2019 values.

- After an impressive October, communication equipment sales grew marginally by 0.3% year over year. However, the sector performed strongly compared to 2019, growing 48.5% on a two-year basis.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY% Change and Two-Year % Change [wpdatatable id=1555 table_view=regular]

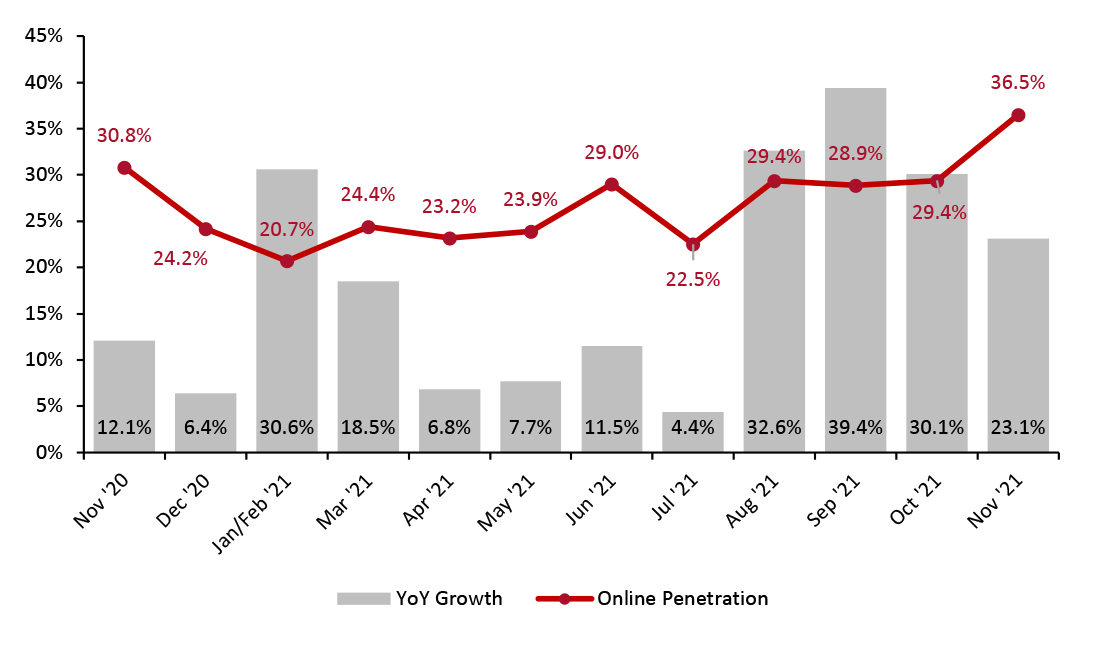

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics Online Retail Sales Account for 36.5% of All Retail Sales In November, online retail sales growth decelerated year over year for the second consecutive month, but remained healthy at 23.1%. The channel accounted for a very substantial 36.5% of total retail sales in the period, the highest level of online sales penetration in 2021. Elevated online penetration in the last few months is likely related to strict restrictions introduced to control infections. In November specifically, online sales penetration was likely boosted by the Singles’ Day shopping festival, also known as 11.11, the world’s largest online shopping event, hosted by e-commerce giants Alibaba and JD.com. This year, Singles’ Day sales started earlier, with sales starting from November 1 and lasting until midnight on November 12. Both Alibaba and JD.com reported record Singles’ Day sales in 2021, likely boosting higher overall online sales penetration in November. Online retail sales include food service, as the National Bureau of Statistics does not provide online data that exclude food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales (YoY % Change) as a Proportion of Total Retail Sales (%) (incl. Automobiles, Gas and Food Service) [caption id="attachment_138226" align="aligncenter" width="699"]

Online retail sales include food service

Online retail sales include food service January and February figures are reported together

Source: National Bureau of Statistics [/caption]