albert Chan

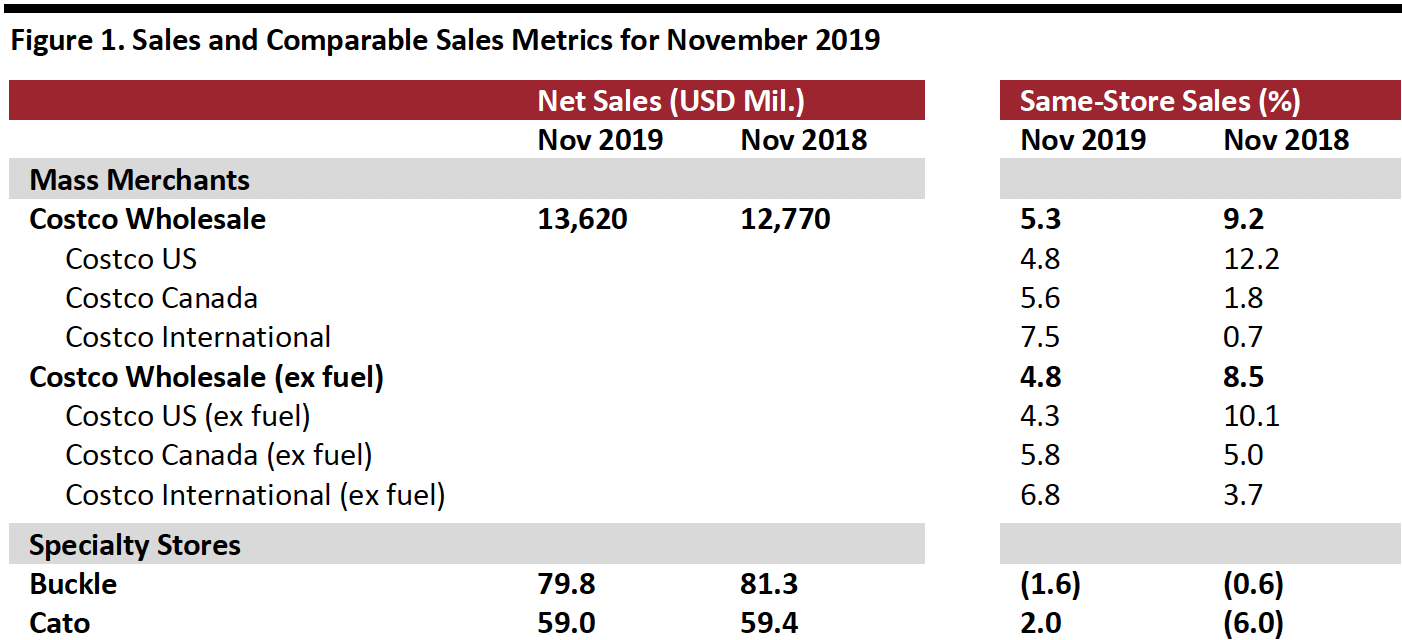

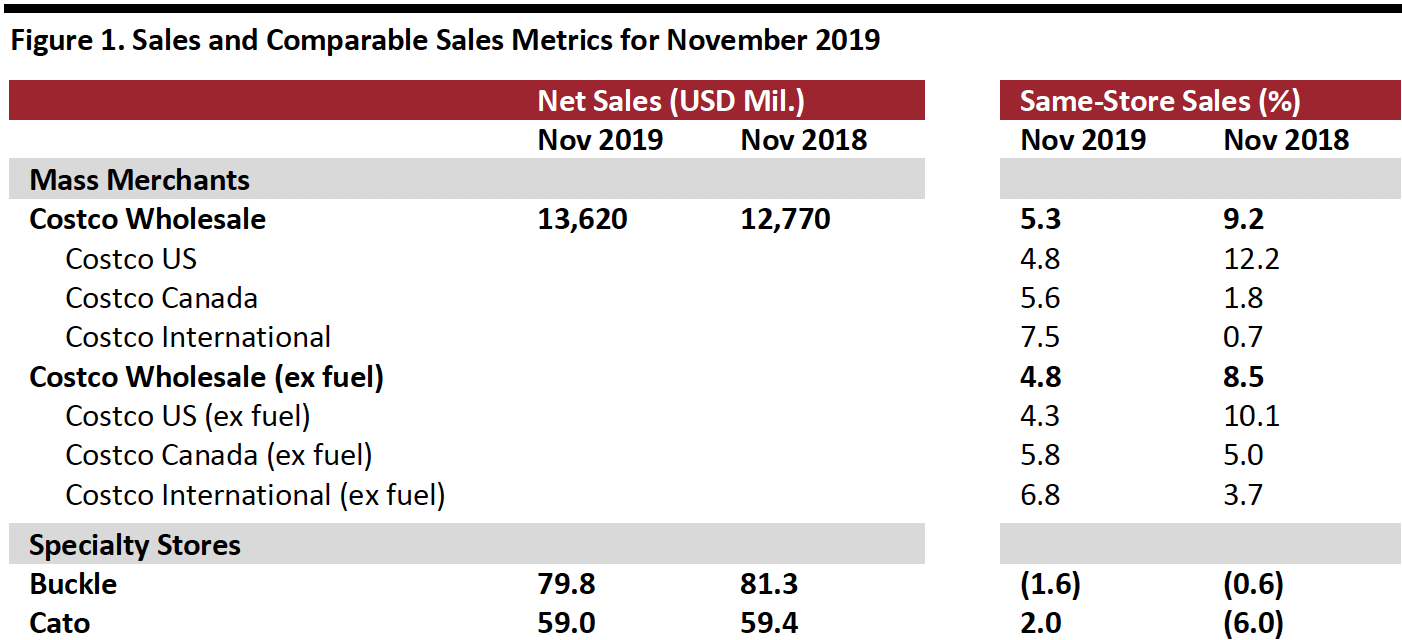

[caption id="attachment_101092" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

Costco Comps Growth Slows, Online Comps Decline

- In November, Costco grew global same-store sales 5.3% year over year, slowing from 5.7% growth in October. Ex fuel, global comps were up 4.8% in November. The company’s e-commerce comparable sales declined 3.6% in November, a sharp turnaround from October’s 16.5% growth.

- The timing of Thanksgiving, Black Friday and Cyber Monday, which fell a week later this year than last year (and pushed Cyber Monday and its revenues into December), and, to some extent, performance issues on the company’s US and Canadian websites on Thanksgiving and Black Friday, drove down Costco’s November online sales an estimated 20 percentage points. Total sales and comps were adversely impacted by about one and half percent.

- Ex fuel, Costco US comps were up 4.3% in November, slowing from 6.8% in October. Results were strongest in the San Francisco Bay Area, Texas and the US midwest. Internationally, Costco saw strong sales growth in the UK, Taiwan and Mexico.

- Currency fluctuations positively impacted international comps by about 10 basis points (bps) overall: Canada same-store sales growth was negatively impacted by 30 bps, while other international comp growth was positively impacted by approximately 90 bps.

- Cannibalization from newly opened locations negatively impacted US comps by about 10 bps and other international segments by 120 bps. Overall, cannibalization negatively impacted comparable sales by 20 bps.

- In the merchandise segment, excluding currency effects, comps for food and sundries were positive mid-single digits: Departments that showed the strongest results were freezer, liquor and deli. Hardlines posted comps in the positive low-single digits: Departments with strong performance included beauty, health, hardware and majors. Softlines grew mid-single digits: Departments that showed stronger performance were special order kiosks, apparel and housewares.

- Fresh-food comparable sales were up mid to high single digits, with service deli and produce performing better than other departments.

- The ancillary businesses (gas, hearing aids and optical) saw the strongest comp sales increases.

- Gasoline price inflation positively impacted total comps by about 40 bps, with the overall average selling price increasing to $2.89 per gallon this year from $2.79 last year.

Buckle’s Comps Decrease in Both Men’s and Women’s Segments

- Buckle’s comparable sales slid 1.6% year over year in November compared to an 8.5% increase in October. In November, net sales fell 1.8% year over year following an 8.0% rise in October.

- The company said November’s total sales and comps were negatively impacted by the late Thanksgiving. In November 2019, Buckle’s brick-and-mortar comps, excluding online sales, grew 2.4% year over year.

- By business segment, total sales in men’s were down 2.0% year over year. The men’s segment accounted for approximately 55.5% of total sales in November 2019, the same as in November 2018, but November 2019 price points were about 0.5% higher.

- Total sales in the women’s segment were down 1.5% year over year. The women’s segment accounted for 44.5% of total monthly sales in November 2019, unchanged from November 2018. Price points in women’s were up about 1.0% in November 2019.

- By product type, accessory sales were down 0.5% year over year in November and accounted for 8.0% of total sales. Footwear sales were up 18.5% year over year and represented 8.5% of total sales. Average accessory price points remained unchanged and average footwear price points were down about 10.0%.

- In October, units per transaction fell about 2.5%.

Cato Same-Store Sales Growth Slows, Management Remains Cautiously Optimistic

- Cato’s comparable sales grew 2.0% year over year in November, slowing from 3.0% in October. Cato’s total sales fell 1.0% year over year to $59.0 million in November, compared to 1.0% growth in October.

- CEO John Cato commented that “November same-store sales continued our current trend. We remain cautiously optimistic about the rest of the year as we consider the impact of current and future tariffs.”

- As of November 30, 2019, the company operated 1,302 stores in 31 states, down from 1,349 stores in 33 states as of December 1, 2018.