Nitheesh NH

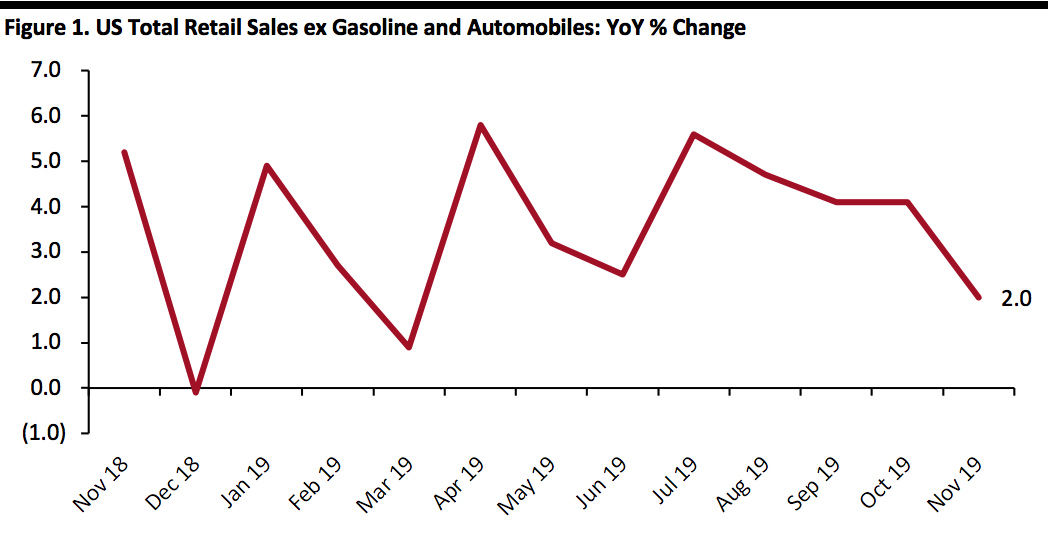

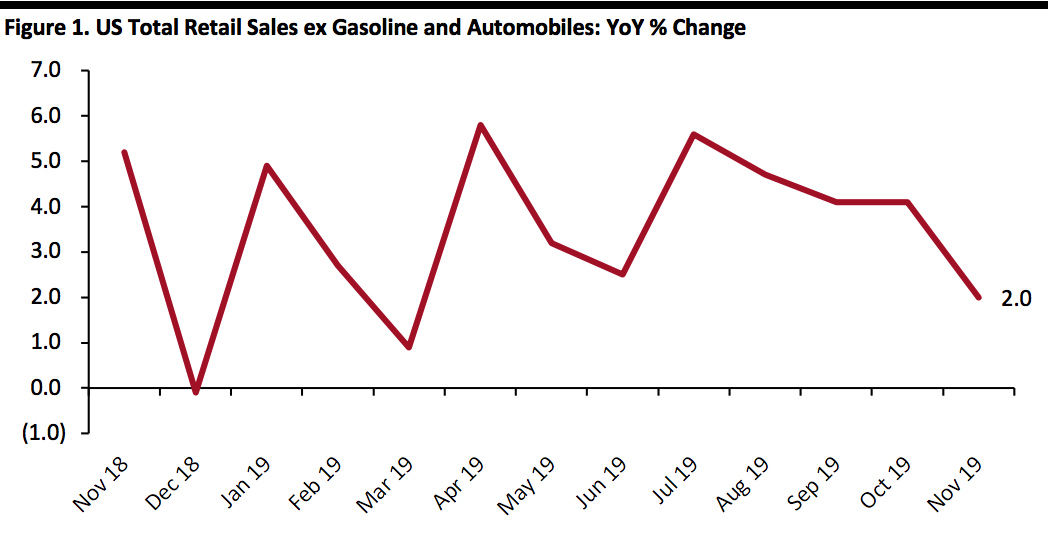

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric stood at 2.0% in November, slowing from 4.1% in October.

The timing of Thanksgiving, Black Friday and Cyber Monday, all of which fell a week later this year than last year (and pushed Cyber Monday and its revenues into December), pushed down November sales growth.

[caption id="attachment_101255" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

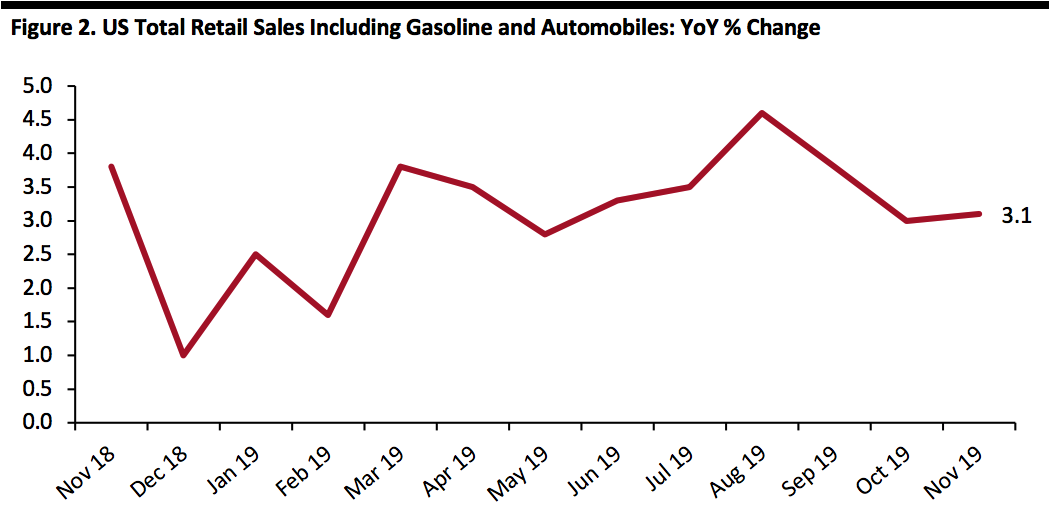

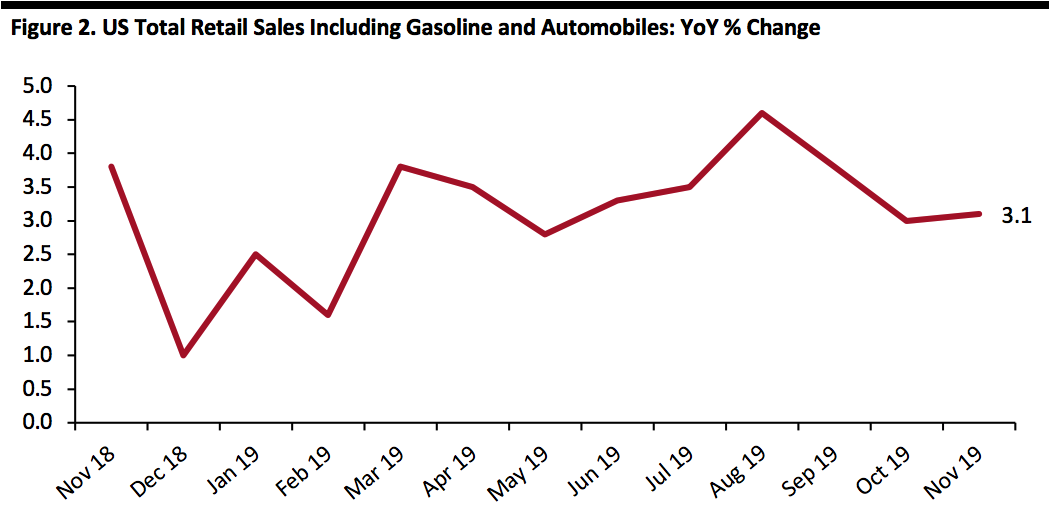

Source: US Census Bureau/Coresight Research[/caption] Retail Sales Increase Month Over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure grew 3.1% year over year in November, mostly in line with October’s 3.0%. On a month-over-month basis and seasonally adjusted, retail sales increased 0.3% in November. [caption id="attachment_101256" align="aligncenter" width="700"] Data is seasonally adjusted

Data is seasonally adjusted

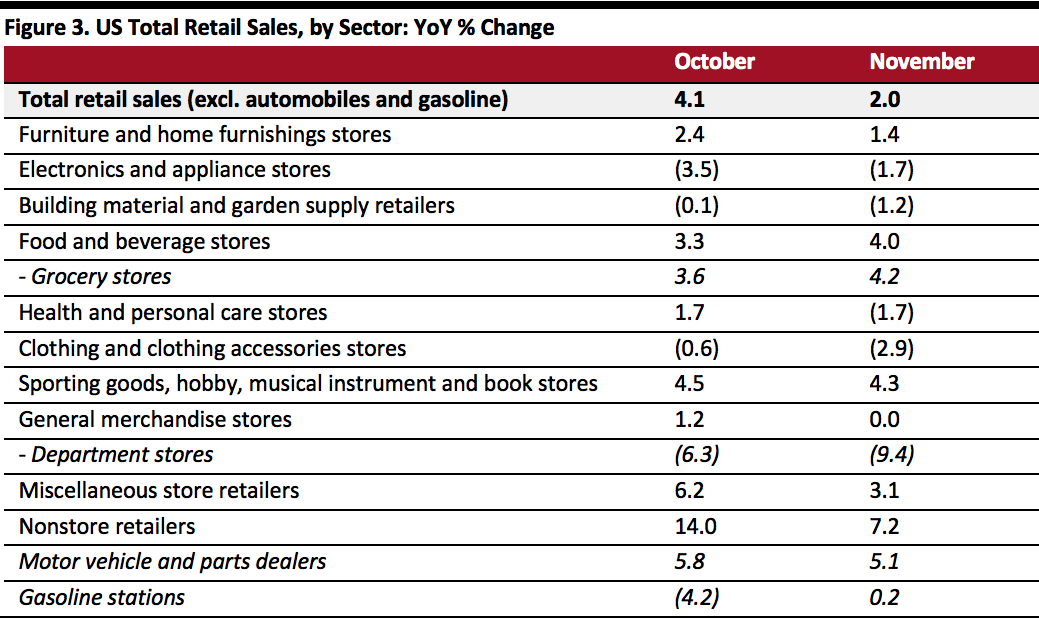

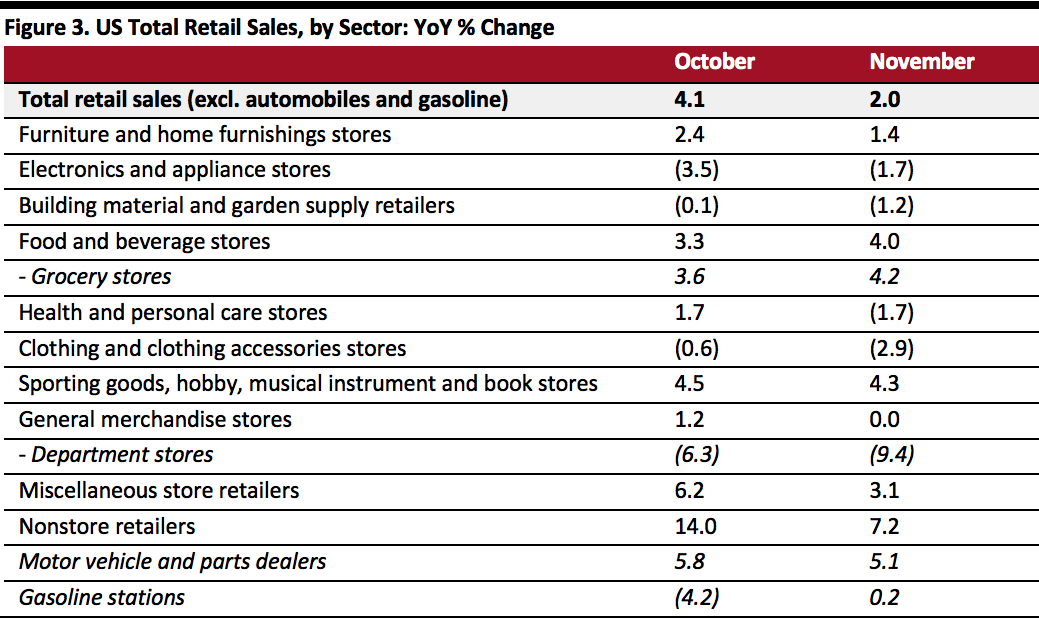

Source: US Census Bureau[/caption] Retail Sales Growth by Sector Several sectors saw sequentially slower growth in November, including furniture and home-furnishings stores, general merchandise stores and nonstore retailers. Sales growth accelerated in food and beverage stores, driven by grocery. Sales at department stores (a sub-set of general-merchandise stores) slid 9.4% in November, accelerating after October’s 6.3% decline. Clothing-store sales declined 2.9% in November, worsening from a 0.6% slip in October. Nonstore retailer sales growth decelerated to 7.2% in November, from 14.0% in October and likely impacted by Cyber Monday falling in December this year. Gasoline station sales growth turned positive in November on the back of rising gas prices. [caption id="attachment_101257" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

Source: US Census Bureau/Coresight Research[/caption]

Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Increase Month Over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure grew 3.1% year over year in November, mostly in line with October’s 3.0%. On a month-over-month basis and seasonally adjusted, retail sales increased 0.3% in November. [caption id="attachment_101256" align="aligncenter" width="700"]

Data is seasonally adjusted

Data is seasonally adjustedSource: US Census Bureau[/caption] Retail Sales Growth by Sector Several sectors saw sequentially slower growth in November, including furniture and home-furnishings stores, general merchandise stores and nonstore retailers. Sales growth accelerated in food and beverage stores, driven by grocery. Sales at department stores (a sub-set of general-merchandise stores) slid 9.4% in November, accelerating after October’s 6.3% decline. Clothing-store sales declined 2.9% in November, worsening from a 0.6% slip in October. Nonstore retailer sales growth decelerated to 7.2% in November, from 14.0% in October and likely impacted by Cyber Monday falling in December this year. Gasoline station sales growth turned positive in November on the back of rising gas prices. [caption id="attachment_101257" align="aligncenter" width="700"]

Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]