albert Chan

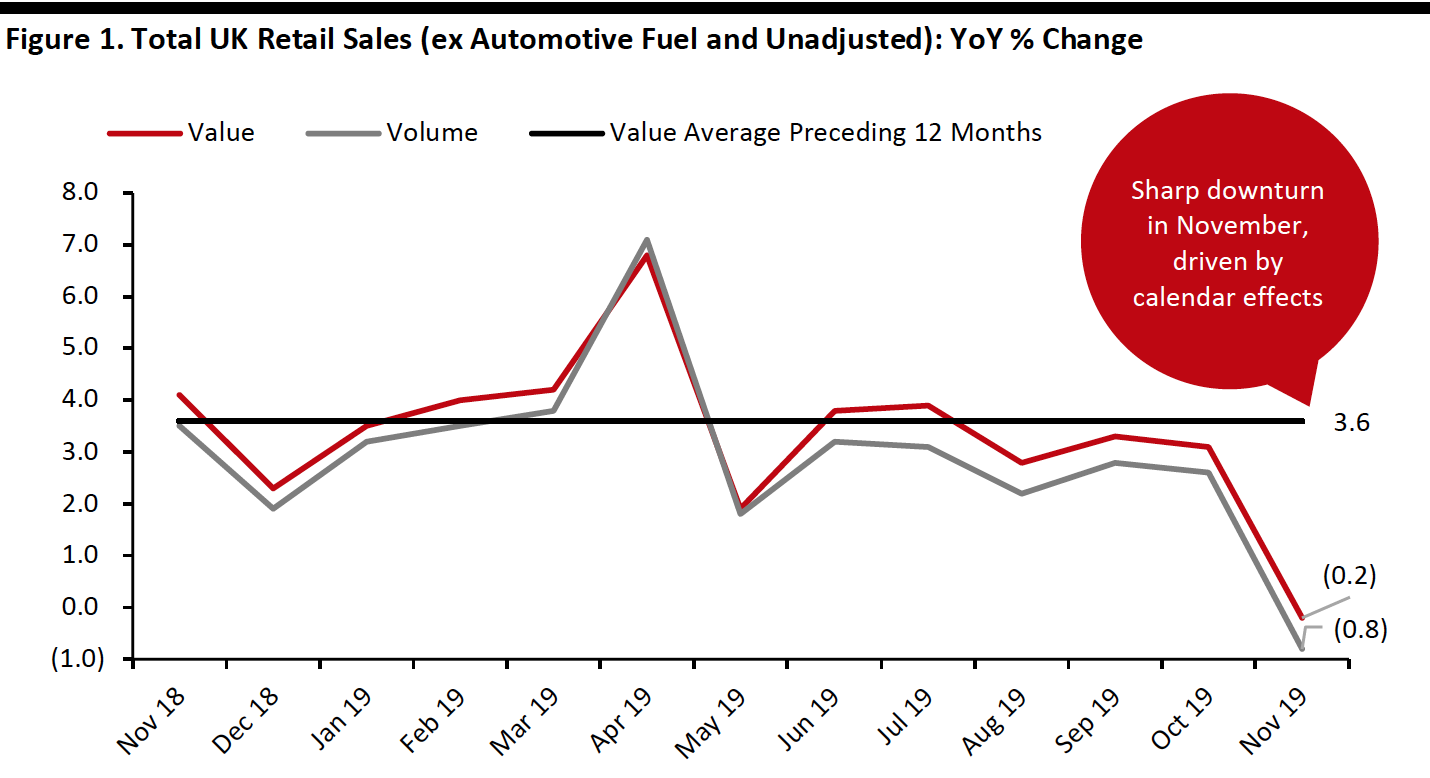

Data in this report is not seasonally adjusted

Data in this report is not seasonally adjustedSource: ONS/Coresight Research[/caption]

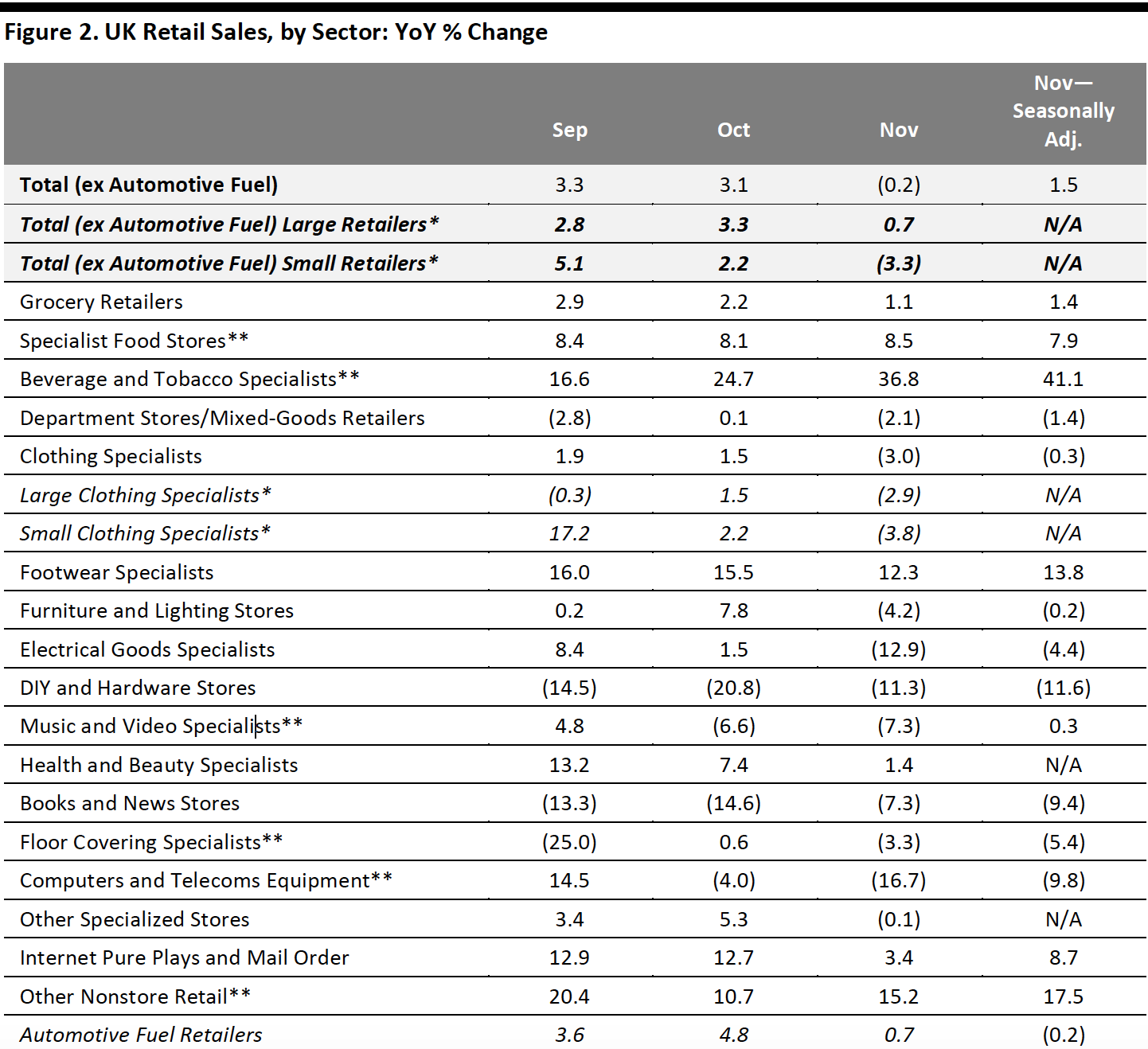

Retail Sales Growth by Sector

Because of the impact of Black Friday timing, we include seasonally adjusted data for November in the table below, in addition to our usual metric of unadjusted monthly sales growth. Even focusing only on those adjusted numbers shows a sequential slowing of growth in November across a number of sectors.

Growth at grocery stores was soft, and growth at clothing and department stores turned negative. Reported sales fell significantly at electrical-goods retailers and were down slightly at furniture stores—collectively showing continued weak demand for big-ticket categories. Total sales at store-based nonfood retailers (not broken out in the table below) were down 1.3% on an adjusted basis in November, compared to an increase of 0.8% in October.

Mail-order retailers and Internet pure plays saw adjusted growth slow to single digits.

We continued to see large rises or falls in fragmented sectors for which ONS data has long been volatile—for example, food and drink specialists; DIY and hardware stores; and, computers and telecoms specialists.

The ONS recorded shop-price inflation of 0.5% in November, versus 0.4% in October. In November, food-store inflation stood at 1.7% (versus 1.4% in October) and nonfood retailer inflation stood at (0.2)% (the same as in October).

[caption id="attachment_101495" align="aligncenter" width="700"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption] Online Retail Sales Growth Unadjusted total Internet retail sales were down 0.8% year over year in November, versus 8.4% growth in October. Adjusting for the shift of Black Friday, total Internet sales were up by a still-modest 2.6% in November. In November, seasonally adjusted Internet sales were down 1.2% at food retailers, down 4.9% at nonfood retailers and up 8.9% at nonstore retailers. This indicates that Internet pure plays continue to gain share of total online sales.