Web Developers

On October 4, Coresight Research CEO and Founder Deborah Weinswig and InReality Director of Product Marketing David Adams cohosted a webinar called “How the In-Store Experience Affects Buyer Behavior.” Weinswig and Adams spoke about the evolution of consumer behavior and retail, and how companies can adapt to the new retail landscape, where customers are empowered. Here, we summarize our key takeaways from the webinar.

According to Prosper Insights & Analytics surveys conducted in 2017 and 2018, consumers are spending more and eating meals out more frequently this year than they did last year. In this year’s survey, “Spending less overall” and “Dining out less frequently” were the two categories that showed the greatest change, with a 4% decrease year over year in the number of respondents agreeing with either statement.

Our Weekly Store Openings and Closures Tracker series—which tracks store openings and closures for a selected group of retailers in the US and the UK—continues to show store closures vastly outpacing store openings in the US.As of October 19, US retailers had announced 4,972store closures this year and only 2,919 openings.

We believe that these closures mainly stem from the US being over stored. Seven of the 29 retailers whose closures we’ve tracked have filed for bankruptcy, and many of the others have large footprints and carry a great deal of inventory, including Sears, Kmart, Walgreens and Best Buy. Conversely, store openings have mainly been fueled by discount retailers, including Dollar General, Aldi and Walmart, and discount remains a segment where most shoppers do their buying in stores rather than online.

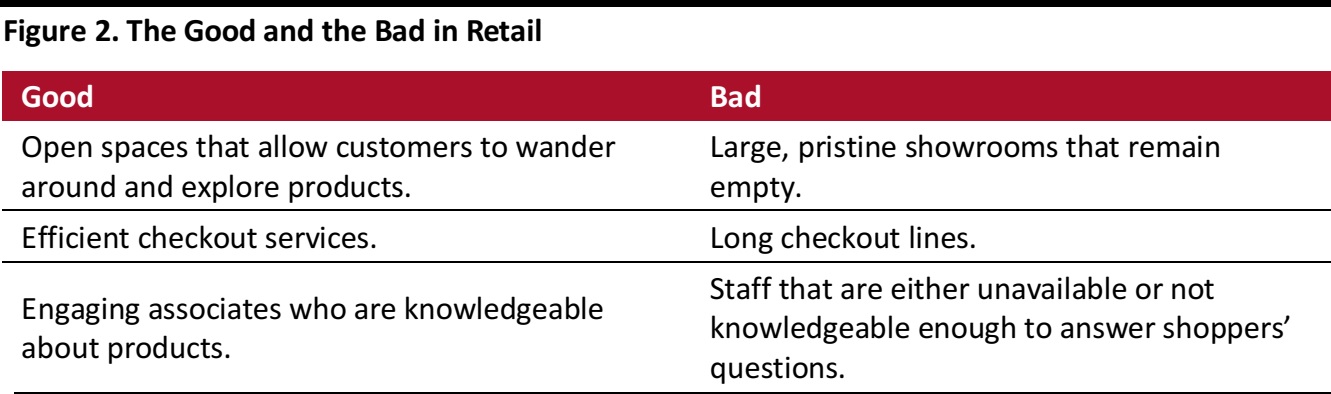

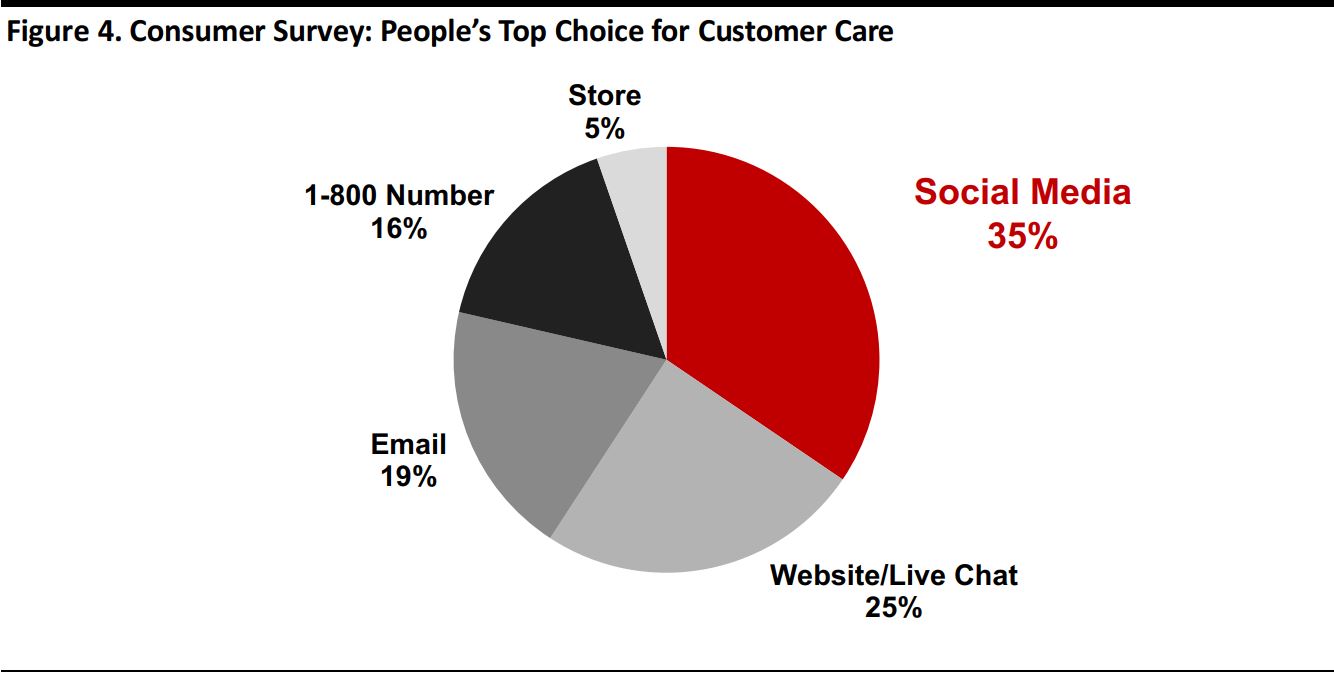

In a survey conducted by Sprout Social, a social media management solutions company, 35% of all respondents cited social media as their top choice for engaging with a brand. Social media has provided consumers with more avenues than ever before to communicate with brands, and shoppers expect brands to respond and engage via these platforms in a timely manner.

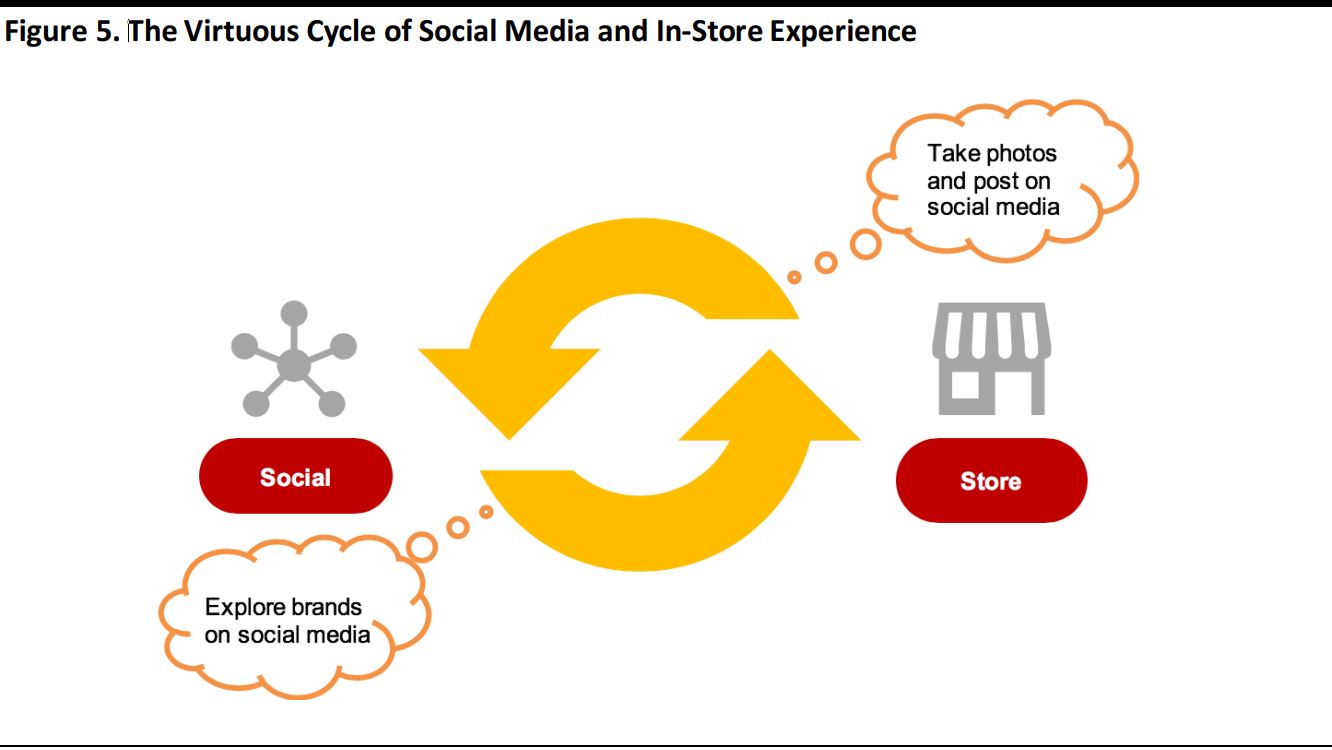

Social media campaigns, when planned and executed well, can offer a virtuous cycle of brand engagement and advertising. This cycle can drive more foot traffic to stores and even turn customers into brand evangelists. Companies ranging from Guess to the Museum of Ice Cream have successfully used social media platforms to disseminate location information and, to a large extent, market their events.

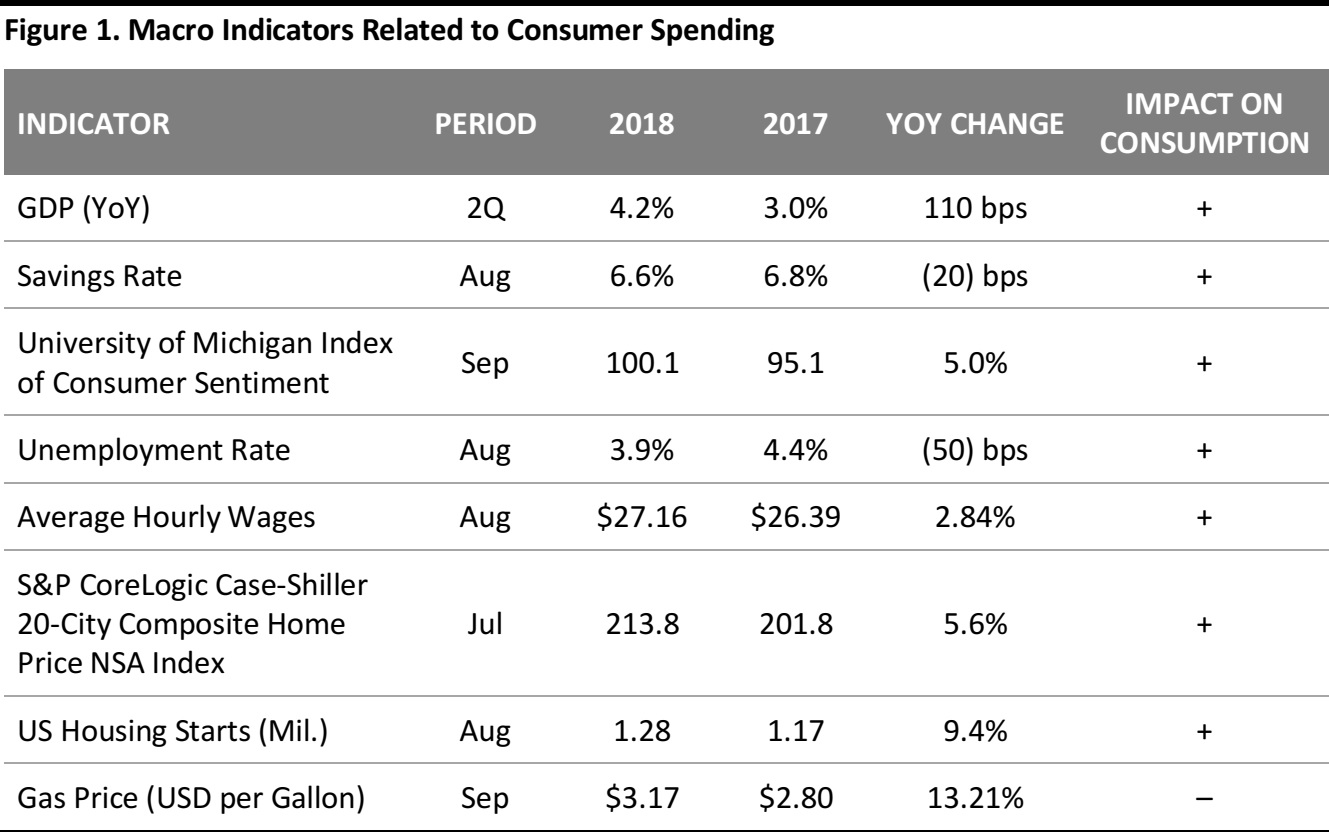

1. A Strong Macro Environment Indicates Positive Growth for Retailers

All current macro indicators for the US—except for an increase in gas prices—suggest that consumers have more money in hand,as well as the confidence to spend it on retail items. Source: US Bureau of Economic Analysis/University of Michigan/US Bureau of Labor Statistics/S&P Dow Jones/Bloomberg/US Energy Information Administration

Source: US Bureau of Economic Analysis/University of Michigan/US Bureau of Labor Statistics/S&P Dow Jones/Bloomberg/US Energy Information Administration

According to Prosper Insights & Analytics surveys conducted in 2017 and 2018, consumers are spending more and eating meals out more frequently this year than they did last year. In this year’s survey, “Spending less overall” and “Dining out less frequently” were the two categories that showed the greatest change, with a 4% decrease year over year in the number of respondents agreeing with either statement.

Our Weekly Store Openings and Closures Tracker series—which tracks store openings and closures for a selected group of retailers in the US and the UK—continues to show store closures vastly outpacing store openings in the US.As of October 19, US retailers had announced 4,972store closures this year and only 2,919 openings.

We believe that these closures mainly stem from the US being over stored. Seven of the 29 retailers whose closures we’ve tracked have filed for bankruptcy, and many of the others have large footprints and carry a great deal of inventory, including Sears, Kmart, Walgreens and Best Buy. Conversely, store openings have mainly been fueled by discount retailers, including Dollar General, Aldi and Walmart, and discount remains a segment where most shoppers do their buying in stores rather than online.

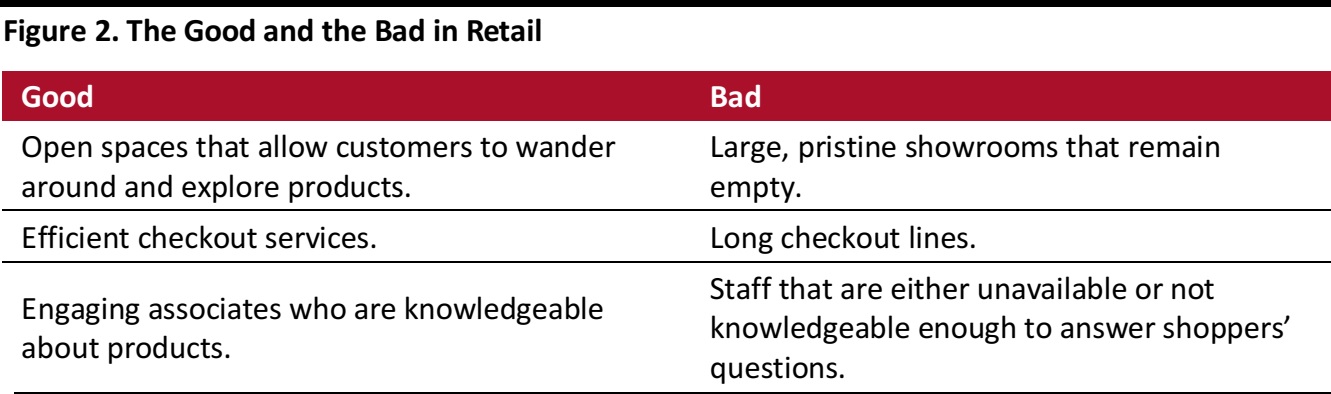

2. Retail Isn’t Dead…Bad Retail Is Dead

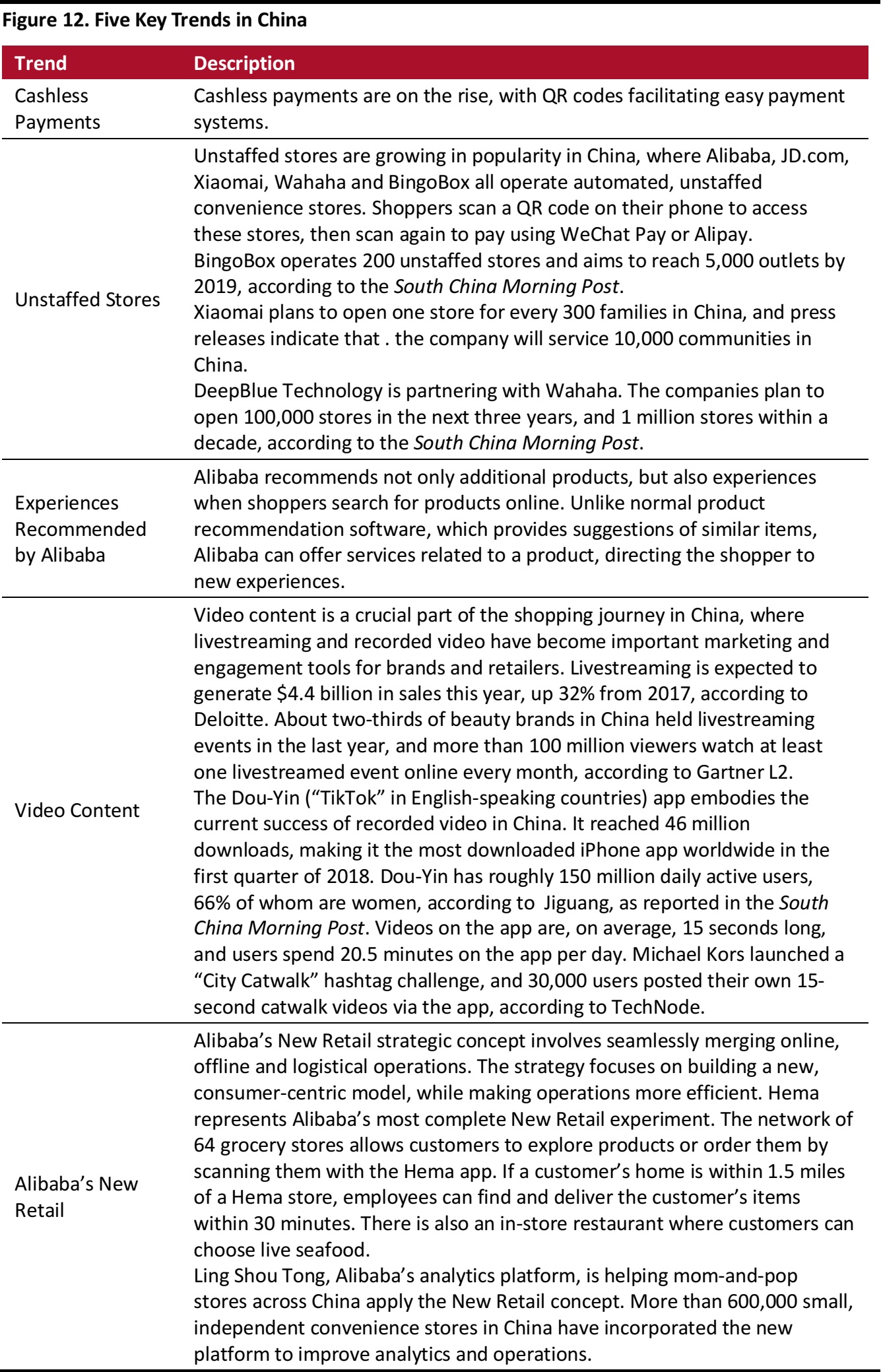

Traditional retailers cannot rely on opening large, pristine showrooms to attract shoppers, because aesthetics alone no longer draw shoppers in. Consumers are now looking for something more engaging within showroom spaces, while also seeking to avoid busy stores that have long checkout lines and offer aggravating shopping experiences. Newly empowered consumers are increasingly demanding that store associates be knowledgeable and that store experiences be personalized and engaging in ways that make shopping enjoyable and worthwhile. The onus is now on store operators to understand which customers need assistance, and what kind, as well as how they want it delivered. “Exciting” stores have changed over the years, shifting from luxurious, large formats to smaller, more innovative ones. Apple, Bonobos, Sugarfina and Tesla all run nontraditional stores, yet they attract large numbers of highly informed, purpose-driven customers who are further down the buying funnel.

Source: Coresight Research

According to InReality’s research, 86% of shoppers are more likely to shop at stores that provide experiences tailored to fit their needs and interests. However, only 13% of shoppers feel that stores offer the kind of experience that they would like. Retailers can benefit by learning as much as they can about what their customers want. According to InReality, 82% of all shoppers are more likely to make a purchase after talking to a knowledgeable sales associate. Unfortunately, 56% of all shoppers say that they know more about products than store associates.3. What’s Changing: Product Discovery Is Starting Online

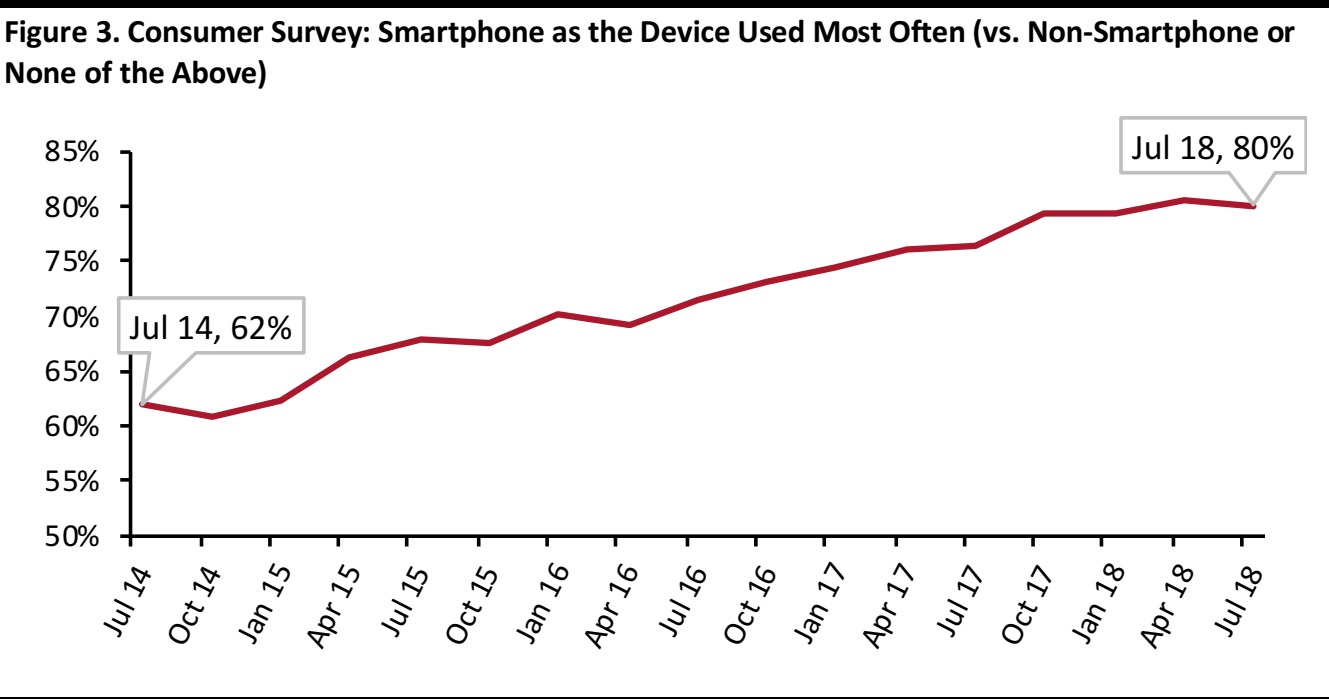

Data from Prosper Insights & Analytics show that 80% of all US consumers use their smartphone as the primary device for gathering information about products—and that figure has risenby18 percentage points over the last three years. The increase reveals how significant smartphones are in helping consumers find and shop for products.Even though American shoppers do not use their smartphones to purchase items as frequently as their peers in some other countries do, the devices inevitably impact their shopping journeys. Base: 7,050 US Mobile Device Users 18+, surveyed quarterly of each year shown

Source: Prosper Insights & Analytics

Base: 7,050 US Mobile Device Users 18+, surveyed quarterly of each year shown

Source: Prosper Insights & Analytics

In a survey conducted by Sprout Social, a social media management solutions company, 35% of all respondents cited social media as their top choice for engaging with a brand. Social media has provided consumers with more avenues than ever before to communicate with brands, and shoppers expect brands to respond and engage via these platforms in a timely manner.

Base: 1,062 online respondents surveyed between April 8, 2016 and April 11, 2016 .

Source: Sprout Social

Base: 1,062 online respondents surveyed between April 8, 2016 and April 11, 2016 .

Source: Sprout Social

Social media campaigns, when planned and executed well, can offer a virtuous cycle of brand engagement and advertising. This cycle can drive more foot traffic to stores and even turn customers into brand evangelists. Companies ranging from Guess to the Museum of Ice Cream have successfully used social media platforms to disseminate location information and, to a large extent, market their events.

Source: Coresight Research

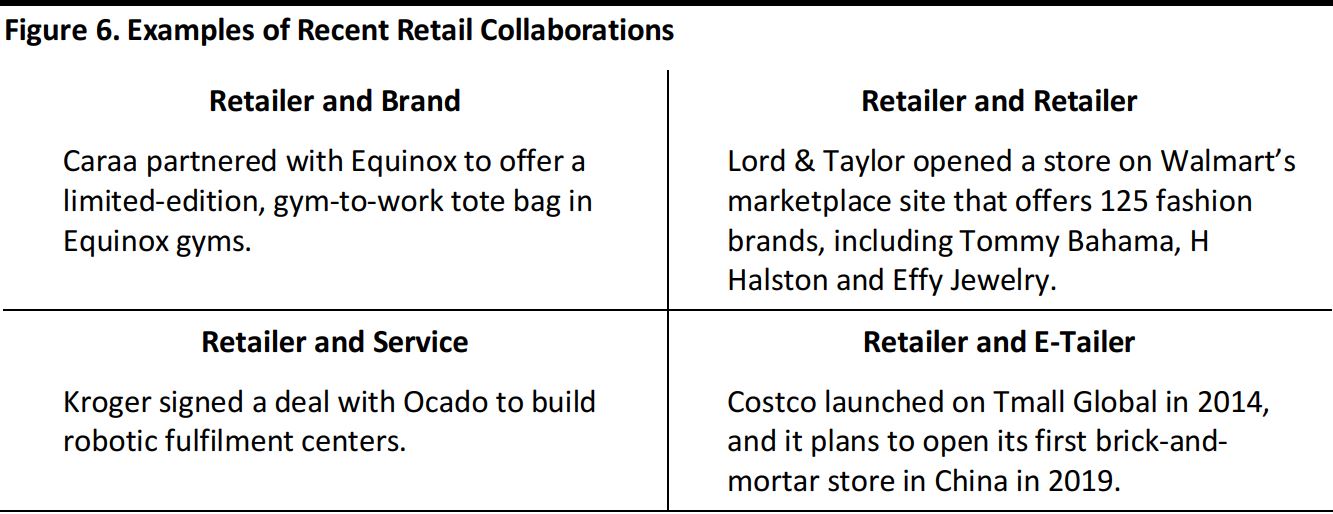

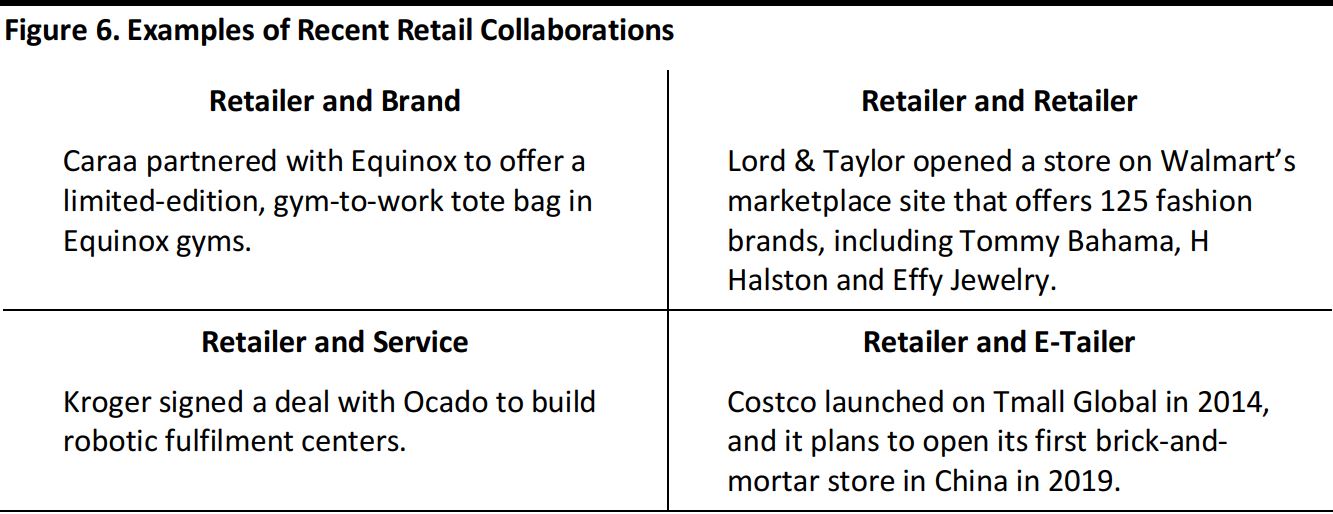

4. Retailers Are Forming New Partnerships and Exploring All Forms of Collaboration

Unexpected retail collaborations and partnership scan drive conversion and loyalty, often strengthening in-store sales and creating more seamless experiences. Companies do not have to create everything in-house, nor do they have to invest their money acquiring smaller companies.These partnerships and collaborations often provide less risky, more easily implementable solutions to expand business. In some cases, such as with Costco opening a store on Alibaba’s Tmall Global platform, online partnerships can allow retailers to enter new markets.

Source: Coresight Research

The race to innovate last-mile delivery is driving many new retail partnerships, especially between large retailers and tech-based delivery companies. However, waiting at home for up to two hours for a delivery is often less convenient for customers than picking up a product that is ready in-store. Signifyd, a company that offers fraud protection solutions, conducted a survey of 250 retail professionals with at least $100 million in annual sales.It found that buy online, pickup in-store (BOPIS) accounted for 21%–30% of online revenue for 28.8% of respondents. The three main benefits of BOPIS are:- It increases foot traffic to stores, allowing customers to discover new products, which, in turn, results in increased impulse-buy opportunities.

- It makes logistics and shipping more efficient.

- It gives shoppers more flexibility to get products on their own schedule.

5. Pop-Up Stores Are Gaining Popularity

Pop-up stores were originally a format for seasonal retailers to sell their products, but large retailers and ambitious startups now regularly use pop-ups to test products and technologies, generate buzz, build brand awareness and drive sales.These stores allow brands and retailers to connect more personally with new and existing customers and provide unique, limited-time experiences, keeping the in-store environment and products fresh and exciting. According to pop-up services provider PopUp Republic, pop-ups were a $50 billion segment in the US in 2016, and the segment only seems to be growing. InReality and SK-II partnered to launch pop-ups in Asia called Future X Smart Stores.Online and in-store experiences are seamlessly integrated in these temporary stores, where customers can learn more about their skin and interact with the SK-II brand in new ways. SK-II’s Internet of Things (IoT) strategy enables the company to understand how its in-store shoppers interact with products and the store space itself.The company’s in-store technologies include:- An interactive skincare wall that displays information about users’ skin condition and provides a set of tailored recommendations.

- An installation called “The Art of You,” which is a large-scale digital wall that uses facial detection to read a visitor’s expressions and head, eye and mouth movements. Each expression correlates to a different color scheme, while eye blinks trigger energy lines to pass across the screen,allowing visitors to generate their own personal art pieces.

- Sensor-enabled smart bottles that track how often a user opens and uses the product.

6. The Growth of Smaller Stores

Beyond pop-ups, retailers are testing small-format permanent stores and attempting to minimize overhead from unnecessarily large store footprints. Kohl’s, for example, has introduced 12 new stores that are just 35,000 square feet each, making them 60% smaller than the average Kohl’s location. Kohl’s is also reportedly adjusting its existing stores, rightsizing them and leasing or selling underutilized retail space. In March this year, Aldi and Kohl’s announced a partnership that will see Aldi open stores in 10 underutilized Kohl’s locations. In another effort to take advantage of underutilized space, Kohl’s made a deal with Amazon to accept the latter’s returns in its locations and house a Smart Home section with Amazon products and associates. This arrangement has helped Kohl’s convert a part of e-commerce purchases into in-store sales.According to a Gordon Haskett Research Advisors study, traffic to Kohl’s stores that accept Amazon returns is 8.5% higher than at stores that don’t offer the program, and participating Kohl’s stores have seen an increase in the number of new customers, too. Retailers and brands are also turning to vending machines to sell their products, as these formats meet consumers’ expectations of instant gratification. Uniqlo has found success with a vest vending machine in San Francisco’s airport: the company made headlines for taking advantage of the now infamous Silicon Valley uniform, the fleece vest. Carvana now has 10 car vending machines in the US, where shoppers can pick up cars that they have bought online.7. The Importance of Associates

Amazon is planning to open about 50 cashierless Amazon Go stores by the end of 2019, and more than3,000 by 2021, according to unconfirmed Bloomberg reports. Despite the rise of cashierless retail formats, consumers still like to be able to ask in-store employees for assistance when they need it. In fact, Amazon Go employs associates who guide unfamiliar shoppers, answer questions, and offer advice and recommendations, making the shopping experience more human and welcoming.

Source: Amazon.com

For many years, Apple Stores have provided some of the best in-store experiences for shoppers, even though the brand has a relatively narrow range of product offerings. Apple prioritizes aesthetics and service, and ensures that its in-store associates are knowledgeable and engaging. Associates are also able to checkout customers from anywhere in the store, which means that conversations about products lead to the point of sale with as little friction as possible.In 2017, the company launched Today at Apple, a series of free educational programs led by highly educated team members.8. More than Just a Store: The Store as Platform

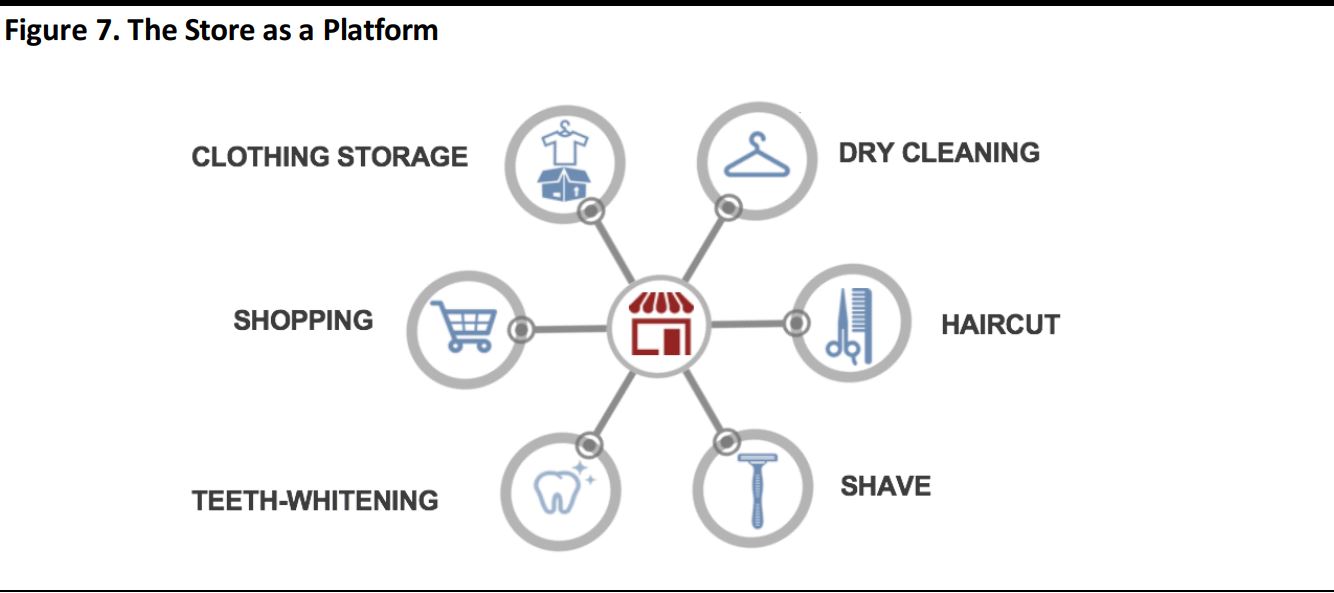

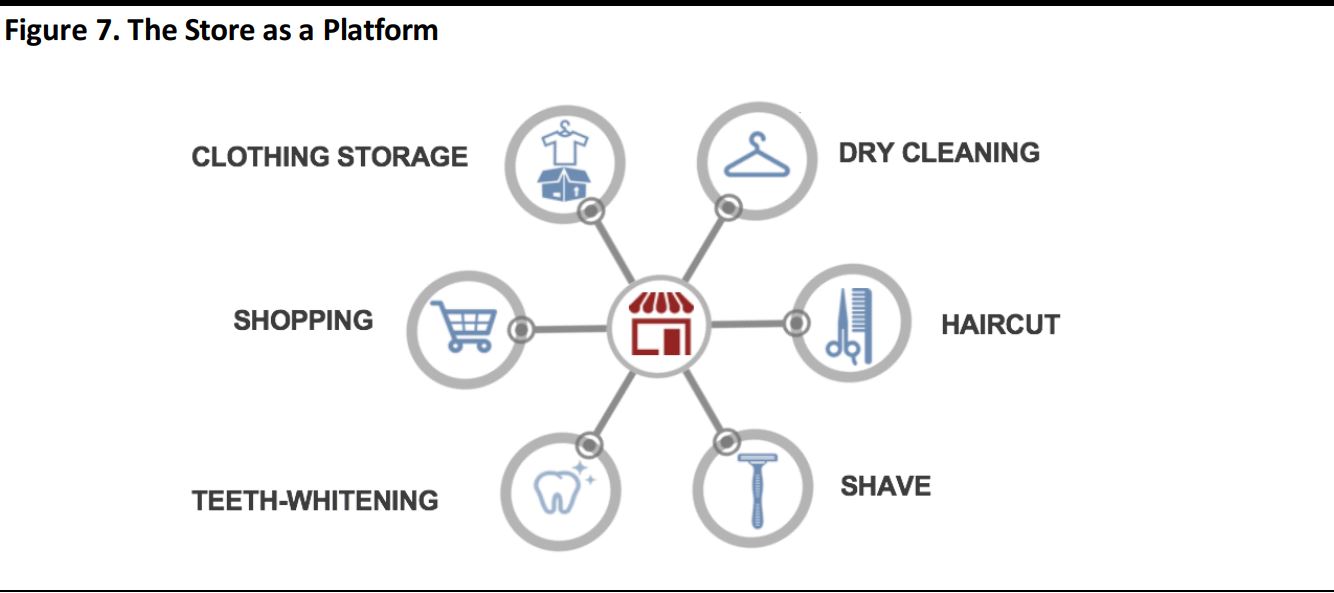

Retailers large and small are seeking to engage customers in more personal ways and make their stores hubs that offer services and convenience as well as products.Extended offerings range from dry cleaning to grooming services to dining options. For example, UK-based fashion retailer Topshop offers haircuts and piercings in certain locations, and American Girl, which sells personalized dolls and accessories, has afternoon tea services. Neighborhood Goods is a department store that is working to build a retail community.Set to launch in November in Texas, the store will offer more than 30 dynamic brands, including some that were previously available only online, a restaurant and bar, and events designed to create a community. Neighborhood Goods views itself as “a department store with a story,” and aims to help brands tell their story and tailor their in-store experience.

Source: Coresight Research

Many large-format showrooms are becoming more interactive. Products are not obviously labeled, but customers can interact with them organically and try them before buying. Inventory is often off-site, so overhead is low, and shoppers can have items delivered to their homes. “There’s something more intimate about walking into a shopping space where you’re handed a glass of wine—you’re already experiencing the product in a way that seems natural,” says Rachel Cohen, cofounder of home retailer Snowe. RH (formerly Restoration Hardware) has “Galleries” where customers can use the products available in fully furnished showrooms. At the RH Gallery in Chicago, shoppers can order food from wherever they are sitting in the store. The experience is meant to feel luxurious and make shoppers feel well taken care of, creating an impression that, ideally, shoppers will continue to associate with the products even after leaving the store.9. Artificial Intelligence: Retail Investment Continues

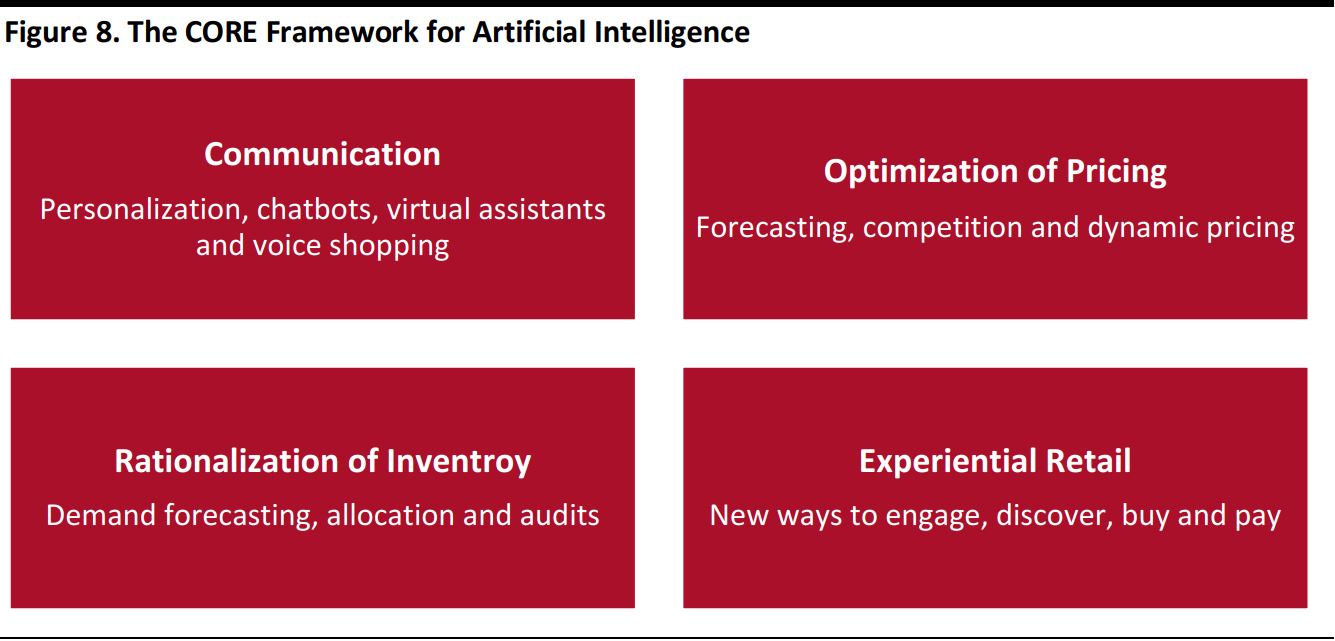

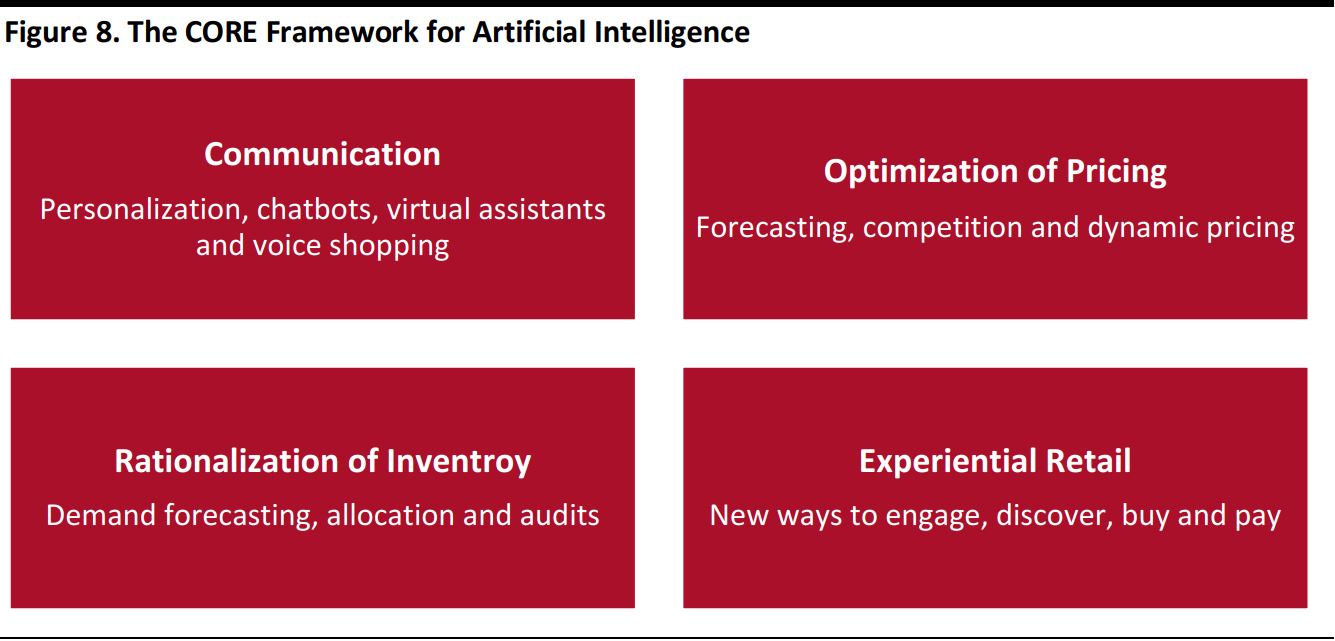

Investment in artificial intelligence (AI) continues to grow, and Gartner projects that global AI-derived business value will reach roughly $3.9 trillion by 2022. Brands and retailers are looking for new technologies that help them better understand their customers. AI and the IoT both provide tools that help retailers understand unknown in-store shoppers. AI covers a wide variety of data-based algorithms that can use large data sets and adjust to fit dynamic issues. The IoT represents a broad category of sensor-based data-gathering technologies that retailers can use to gather information about in-store shoppers, thereby filling a data void.

Source: Coresight Research

10. Untapped Potential

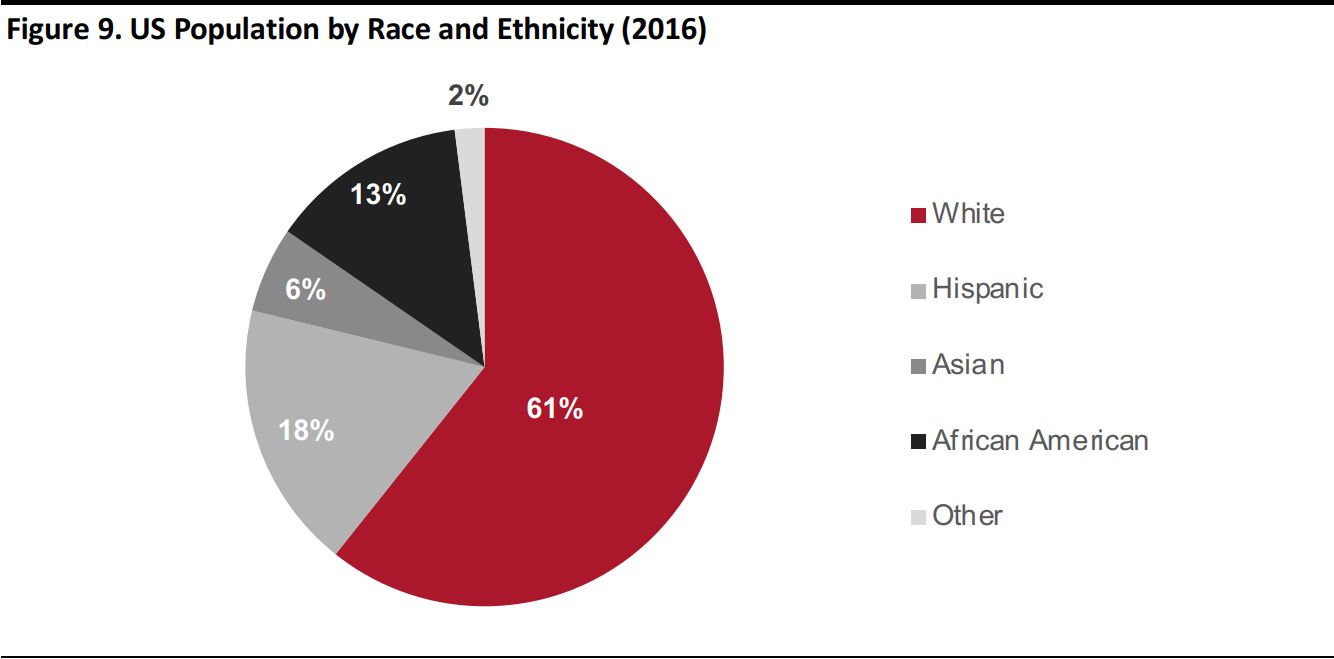

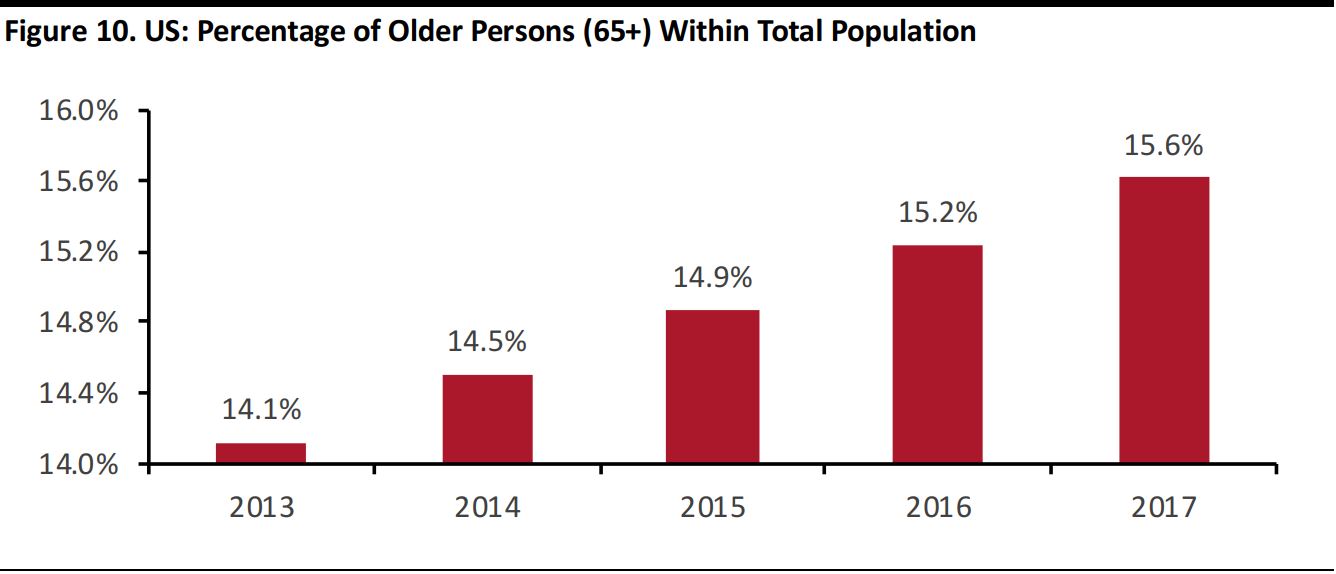

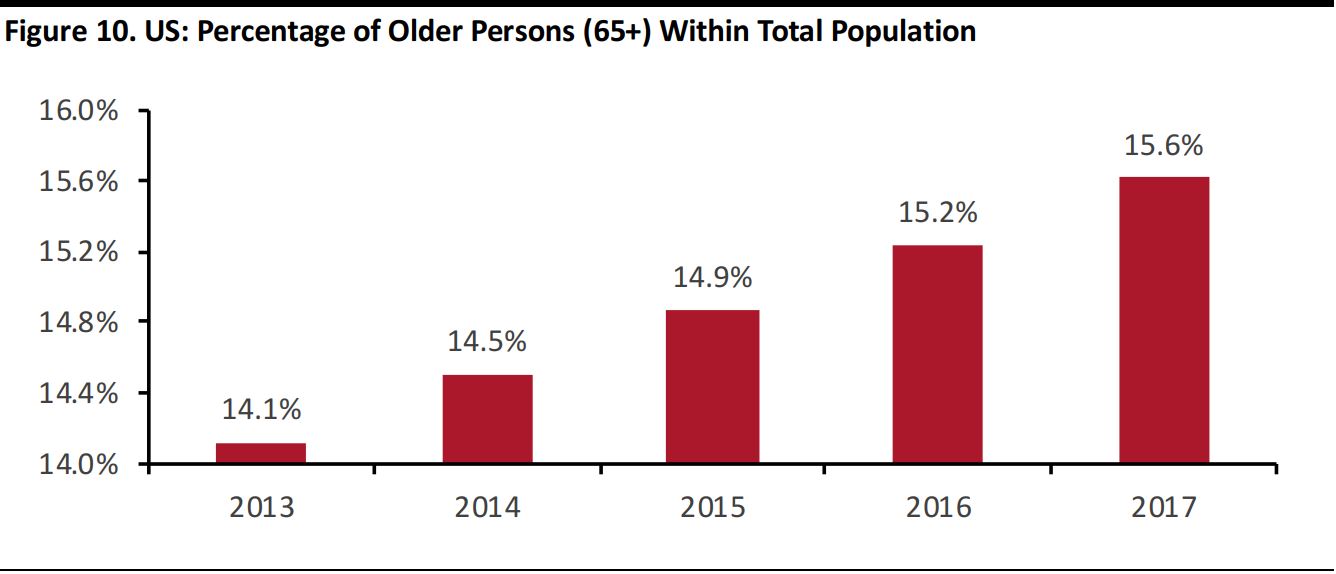

The US’s demographics are rapidly changing as the country’s population becomes more diverse and continues to age. According to US Census Bureau data published in 2014, the US Hispanic population is estimated to reach 29% of the total population by 2060 and the US African American population is expected to reach 18% by 2060. The Asian population in the US grew by 72% between 2000 and 2015, according to data from the Pew Research Center.With increasingly diverse demographics in the US, most retailers will have to change their offerings to meet the expectations of new consumer bases.Source: US Census Bureau

The US is currently home to 50 million people aged 65 and above.With the population growing older every year, retailers must change their approaches, both online and in-store, in order to cater to older shoppers’ needs and preferences.

Source: US Census Bureau

Coresight Research valued the adaptive apparel market, which includes apparel for individuals with physical disabilities as well as for the elderly and others who may face physical challenges,at $44.5 billion this year, and The NPD Group projects that the plus-size apparel market will reach $24 billion by 2020. Both of these markets are growing, and brands are focusing on making higher-quality, fashionable adaptive and inclusive apparel. Traveler demographic shifts are also affecting US retailers. Coresight Research has found that Chinese outbound tourists are spending marginally lesson leisure and shopping per trip this year than they did last year,but are traveling more frequently, with Chinese travelers from tier-1 cities taking an average of 2.3 trips last year. Within the US, this trend mainly affects luxury fashion,but more and more stores are offering the WeChat and Alipay mobile payment systems in order to cater to Chinese shoppers. Retailers must learn about this new customer base quickly and change their strategies in order to engage Chinese customers visiting their US stores.11. How Retailers Are Implementing In-Store Technology

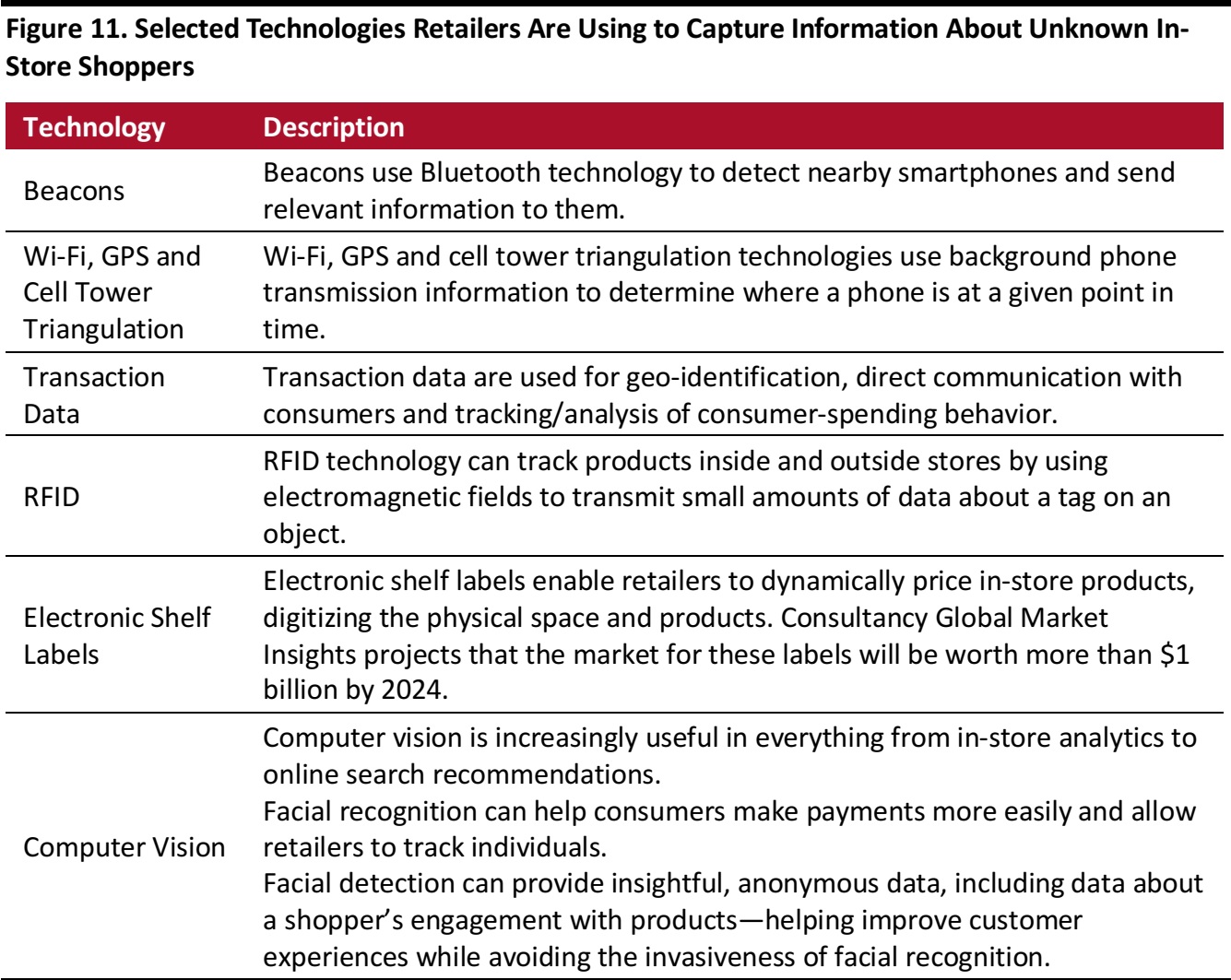

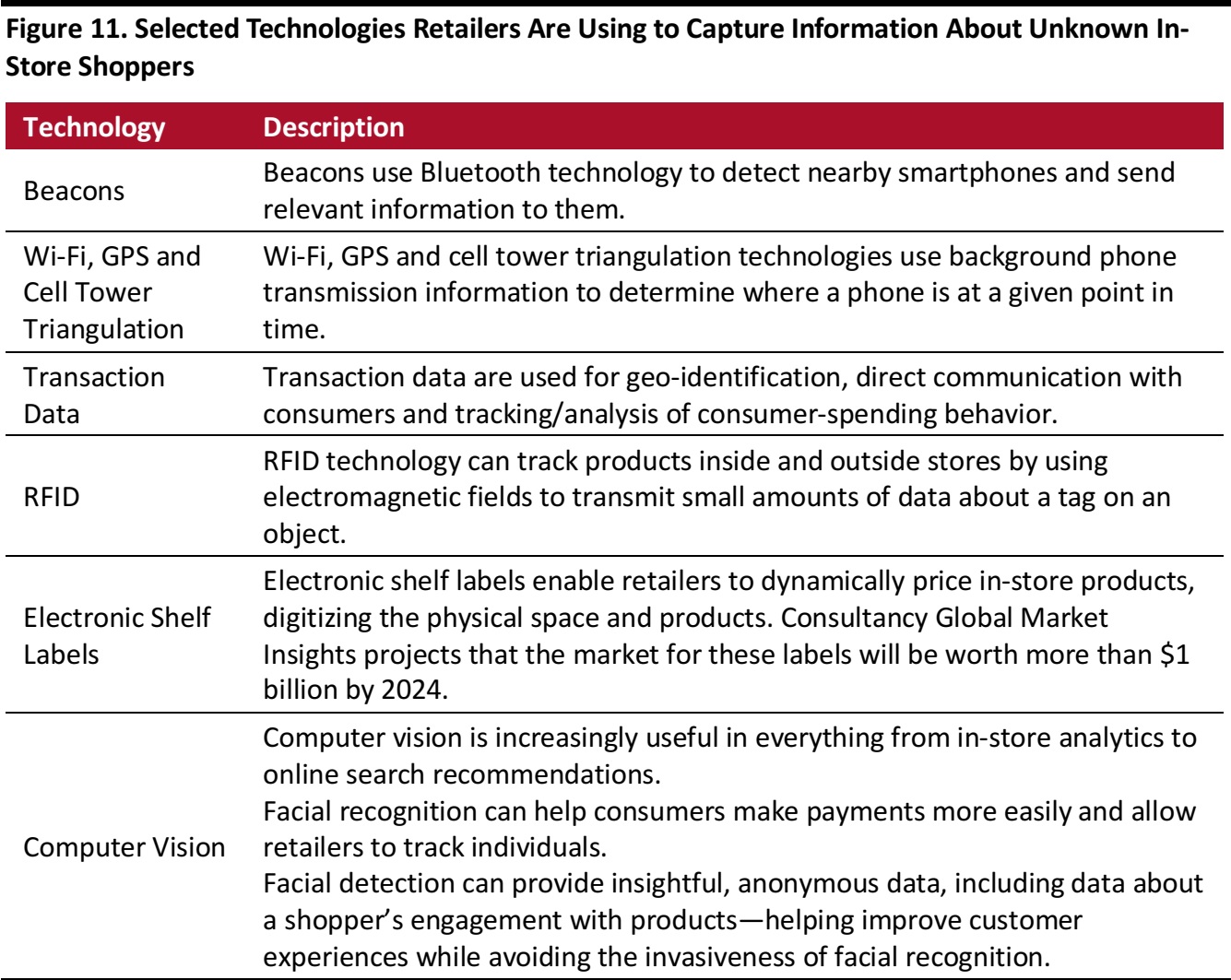

Retailers are slowly adopting technology to improve in-store shopping experiences for customers.The table below describes some of the technologies that companies are currently implementing in order to learn more about their customer bases.

Source: Coresight Research

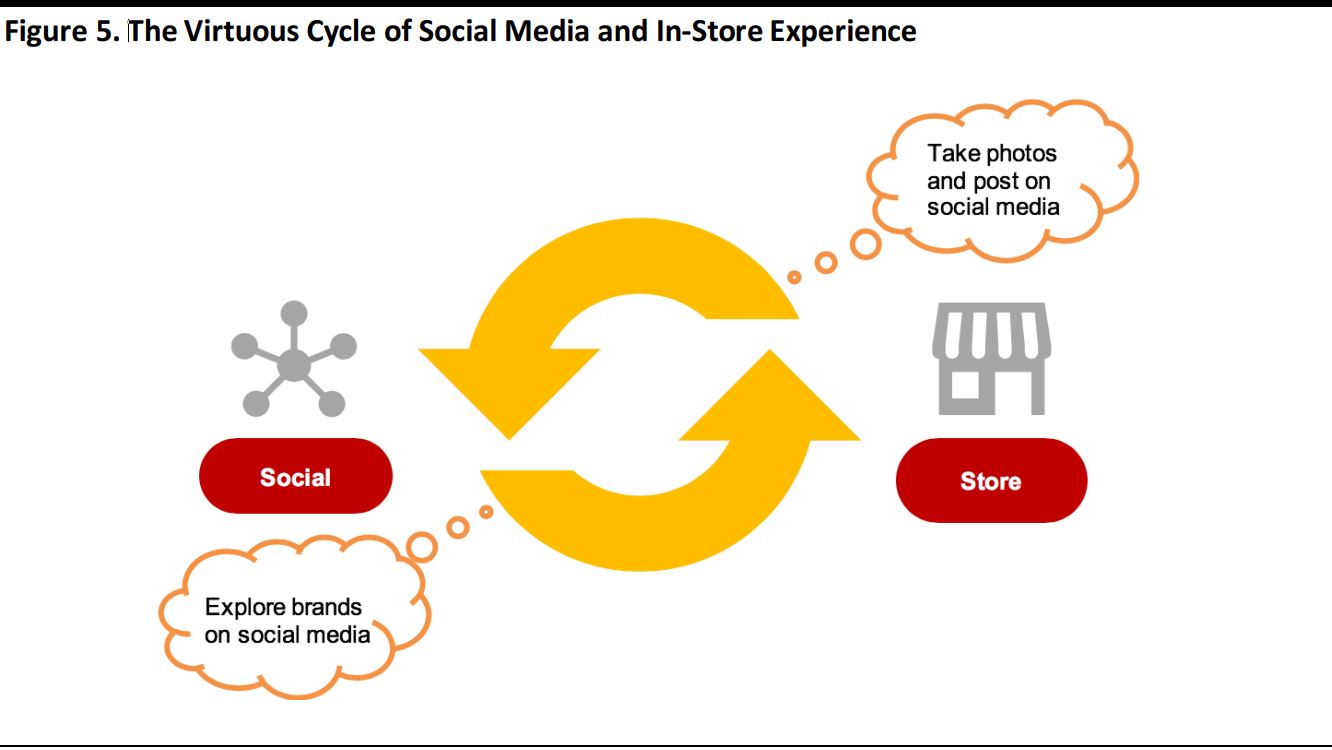

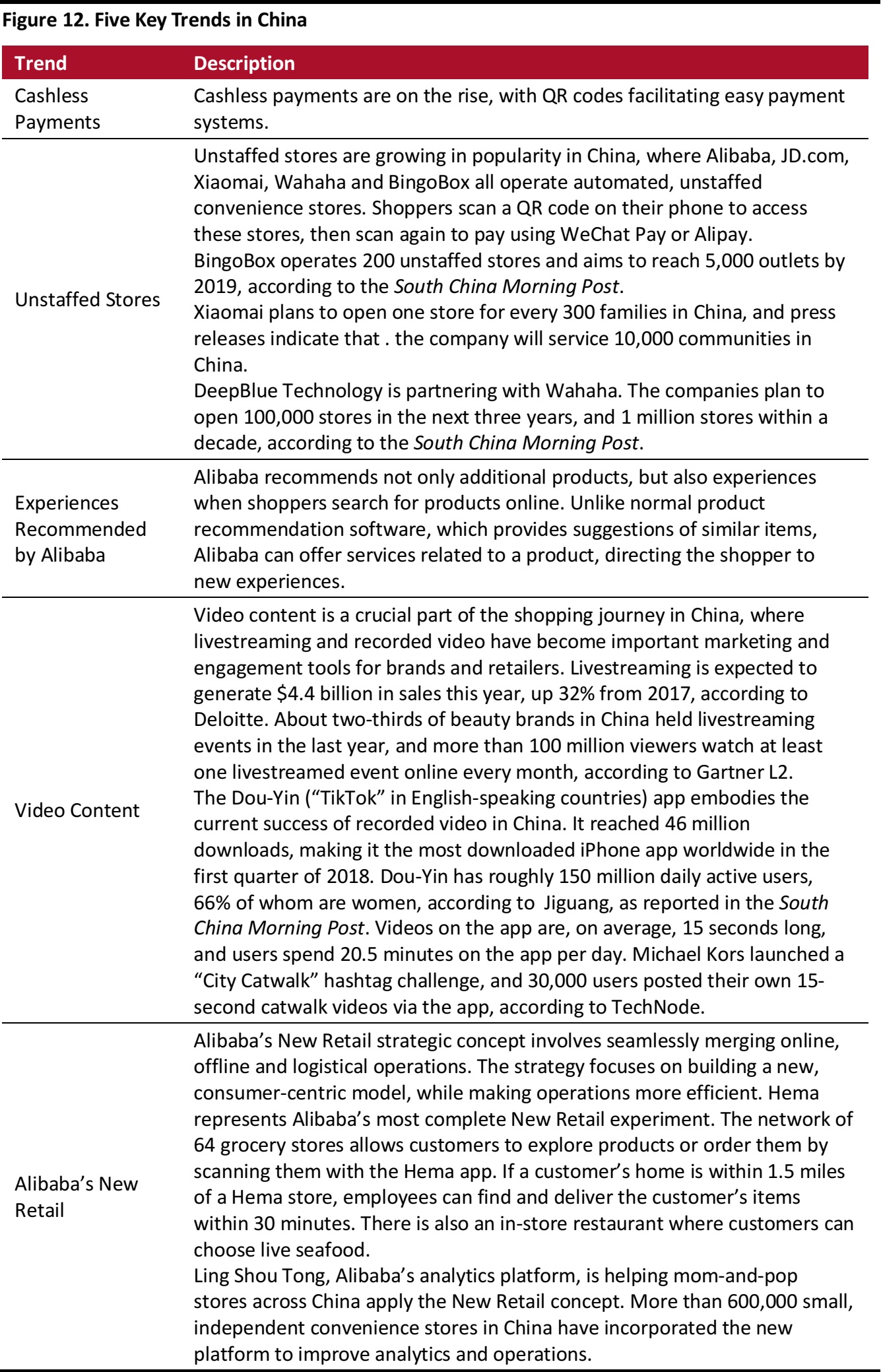

12. China Is Leading the Retail Transformation: Five Things You Need to Know

With a maturing market and a growing population, China is able to implement new, technologically driven innovations in all sectors of retail.And consumers are proactively shaping demand for retail innovations in China. The US may be too mature a market to directly follow China’s lead, but these trends show a glimpse into the future of retail globally.