DIpil Das

Intel held its annual investor meeting at its Santa Clara, California headquarters on May 8, 2019. The meeting kicked off with comments from Intel CEO Bob Swan.

Highlights of general remarks by Bob Swan, CEO, on strategy

Source: Company reports [/caption]

Swan laid out Intel’s plans as follows:

Source: Company reports [/caption]

Swan laid out Intel’s plans as follows:

Source: Company reports [/caption]

These are the highlights of Chief Engineering Officer Dr. Murthy Renduchintala’s remarks:

Data growth and opportunity: The amount of digital data generated is expected to grow to at least 160 zettabytes (one zettabyte is 1021 bytes) in 2020-2025, from 2 zettabytes in 2005-2010, driven by the web, mobile and IoT/analytics.

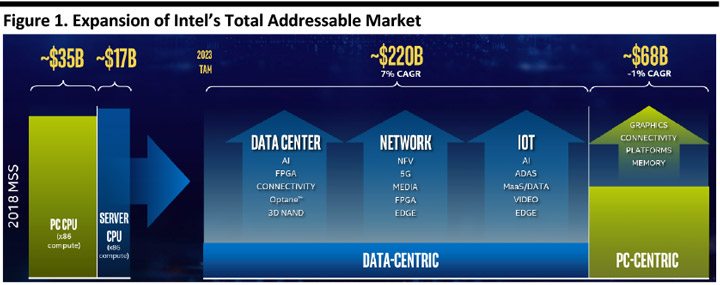

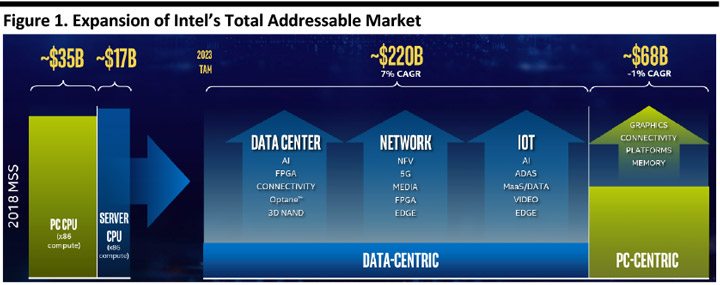

Data-centric product leadership: Intel aims to make the transition from the PC-centric era to the data-centric era by focusing on workload-optimized platforms that consist of software, security, interconnection, memory, XPUs, architectures and process and packaging technology.

Product highlights: Include a processor using 10nm feature sizes codenamed “Ice Lake” to ship in June 2019 and a graphics processor/graphics processing unit using 7nm technology scheduled for launch in 2021.

These are the highlights of Executive VP and GM, Data Center Group, Navin Shenoy’s remarks:

Source: Company reports [/caption]

These are the highlights of Chief Engineering Officer Dr. Murthy Renduchintala’s remarks:

Data growth and opportunity: The amount of digital data generated is expected to grow to at least 160 zettabytes (one zettabyte is 1021 bytes) in 2020-2025, from 2 zettabytes in 2005-2010, driven by the web, mobile and IoT/analytics.

Data-centric product leadership: Intel aims to make the transition from the PC-centric era to the data-centric era by focusing on workload-optimized platforms that consist of software, security, interconnection, memory, XPUs, architectures and process and packaging technology.

Product highlights: Include a processor using 10nm feature sizes codenamed “Ice Lake” to ship in June 2019 and a graphics processor/graphics processing unit using 7nm technology scheduled for launch in 2021.

These are the highlights of Executive VP and GM, Data Center Group, Navin Shenoy’s remarks:

Source: Company reports [/caption]

Source: Company reports [/caption]

- Make the world’s best semiconductors.

- Lead the artificial intelligence (AI), 5G and autonomous revolutions.

- Be the leading end-to-end platform provider for the new data world.

- Relentlessly focus on operational excellence and efficiency.

- Continue to hire, develop and retain the best, most diverse and inclusive talent.

Source: Company reports [/caption]

Swan laid out Intel’s plans as follows:

Source: Company reports [/caption]

Swan laid out Intel’s plans as follows:

- Lead in technology inflections: AI, 5G and autonomous systems.

- Extend product leadership: And redefine “Intel Inside” as an extreme processing unit (XPU) platform inside all kinds of devices in computing centers, PCs, energy, manufacturing, homes and vehicles.

- Make big bets, with attractive returns: Intel will vet investments to ensure they address the leading edge of a technology inflection and allow the company to play a larger role in the success of its customers and offer a clear path to profitability or attractive returns, all subject to regular evaluation.

- Focus on execution: Including meeting customer demand, recouping process leadership and delivering on schedule with predictability.

- Evolve the company’s culture: To create a corporate culture based on transparency and being fearless, operating as “one Intel,” and remaining customer obsessed, while practicing inclusion.

- Lead in corporate social responsibility (CSR) and diversity and inclusion (D&I): Intel is recruiting innovative and diverse talent, employing an innovative supply chain to support diverse-owned businesses and has closed the gap in pay for different genders.

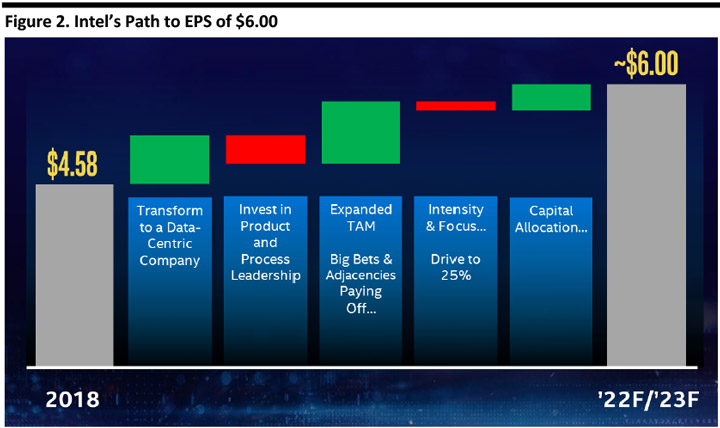

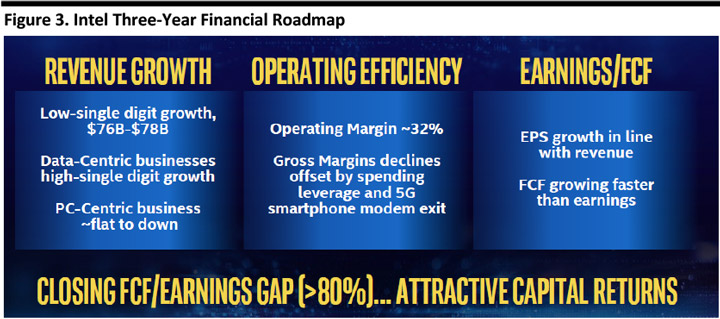

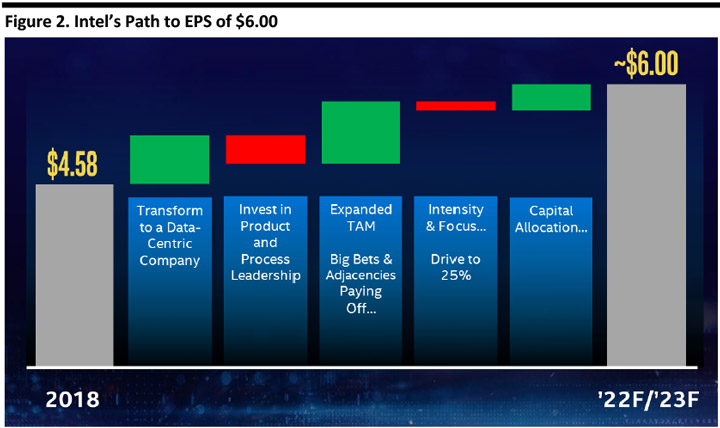

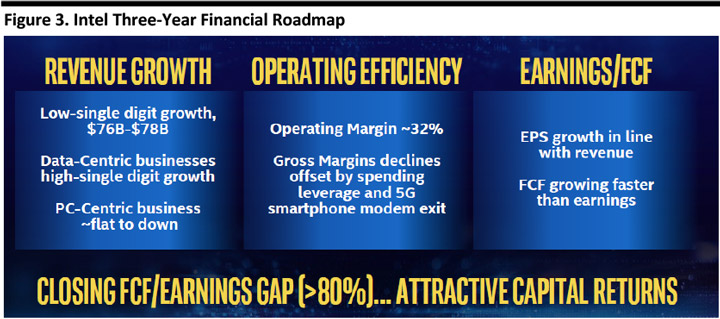

- Revenue growth in the low single digits to $76-78 billion, with the data-centric businesses generating growth in the high single digits and the PC-centric business flat to slightly down.

- Gross margin declines should be offset by spending leverage and saving from exiting the 5G modem business, resulting in 32% operating margins.

- EPS growth in line with revenues and free cash flow (FCF) growing faster than earnings.

Source: Company reports [/caption]

These are the highlights of Chief Engineering Officer Dr. Murthy Renduchintala’s remarks:

Data growth and opportunity: The amount of digital data generated is expected to grow to at least 160 zettabytes (one zettabyte is 1021 bytes) in 2020-2025, from 2 zettabytes in 2005-2010, driven by the web, mobile and IoT/analytics.

Data-centric product leadership: Intel aims to make the transition from the PC-centric era to the data-centric era by focusing on workload-optimized platforms that consist of software, security, interconnection, memory, XPUs, architectures and process and packaging technology.

Product highlights: Include a processor using 10nm feature sizes codenamed “Ice Lake” to ship in June 2019 and a graphics processor/graphics processing unit using 7nm technology scheduled for launch in 2021.

These are the highlights of Executive VP and GM, Data Center Group, Navin Shenoy’s remarks:

Source: Company reports [/caption]

These are the highlights of Chief Engineering Officer Dr. Murthy Renduchintala’s remarks:

Data growth and opportunity: The amount of digital data generated is expected to grow to at least 160 zettabytes (one zettabyte is 1021 bytes) in 2020-2025, from 2 zettabytes in 2005-2010, driven by the web, mobile and IoT/analytics.

Data-centric product leadership: Intel aims to make the transition from the PC-centric era to the data-centric era by focusing on workload-optimized platforms that consist of software, security, interconnection, memory, XPUs, architectures and process and packaging technology.

Product highlights: Include a processor using 10nm feature sizes codenamed “Ice Lake” to ship in June 2019 and a graphics processor/graphics processing unit using 7nm technology scheduled for launch in 2021.

These are the highlights of Executive VP and GM, Data Center Group, Navin Shenoy’s remarks:

- The datacentric opportunity is massive: Technologies increasing demand for computing and diversifying workload needs include:

- AI

- Analytics

- Highly parallel computing

- Multi-cloud and orchestration

- Networks

- In-memory databases

- Virtualization

- Security

- Industry megatrends leverage Intel‘s strengths: These megatrends include the growth of AI, the proliferation of cloud computing and the “cloudification” of the network and edge of the network.

- Intel has an unparalleled array of assets to fuel growth: Products in Intel’s datacentric portfolio include Ethernet adapters, solid-state drives, persistent memory and line of processors.

- Aggregating processing at the network edge.

- Video inference.

- High-performance computing.

- Revenues of $69 billion.

- Operating margin of 32%.

- EPS of $4.35.

Source: Company reports [/caption]

Source: Company reports [/caption]