SUMMARY

The Fung Global Retail & Technology team attended Kroger’s 2016 Investor Conference and store tour this week. The meeting was held at the headquarters of Kroger’s 84.51° division, demonstrating the division’s crucial role in the business both today and in the future. Following the presentations and Q&A, investors and analysts were invited to tour a Kroger store. The morning before the meeting, Kroger issued a press release reiterating its guidance.

RODNEY MCMULLEN, CHAIRMAN AND CEO

CEO Rodney McMullen’s remarks centered on Kroger’s culture, the exciting large opportunity the company faces and synergies that the company has created through acquisitions.

- Culture: Kroger operates within a culture of continuous improvement. Its motto is “Worked hard, done well, will do better!” and the company seeks to never underestimate its competitors.

- Opportunity: The total US food market is worth approximately $1.5 trillion. Kroger’s share of the market is currently just $110 billion, so it sees plenty of opportunity ahead.

Source: Kroger

- Acquisitions: The 84.51° acquisition added enormous capabilities for data analytics, and the Harris Teeter acquisition enabled the launch of Kroger’s ClickList click-and-collect service, which is now available at more than 500 locations.

- Employees: McMullen showed a video highlighting the dedication to quality of one manager and his team, who helped to dramatically raise customer satisfaction levels at the store’s meat department.

MIKE SCHLOTMAN, EVP AND CFO

Mike Schlotman kicked off his remarks by talking about how Kroger had done a good job of executing on the shareholder-value goals the company announced in 2012. He noted that Kroger has increased its market share, increased return on invested capital, expanded FIFO operating margins and identified sales increases. He also covered several additional topics:

- Roundy’s update: This acquisition was an atypical “fixer-upper,” and Kroger sent experienced operations experts to work on the chain. The company has already remodeled 13 stores and has received positive customer feedback.

- Gross margins: The decline in margins is a function of reduced share of lower-margin grocery category sales combined with continuing investment in lower prices.

- Loyalty: The number of loyal customers and average spend per customer have increased in tandem, and have been aided by the 84.51° acquisition.

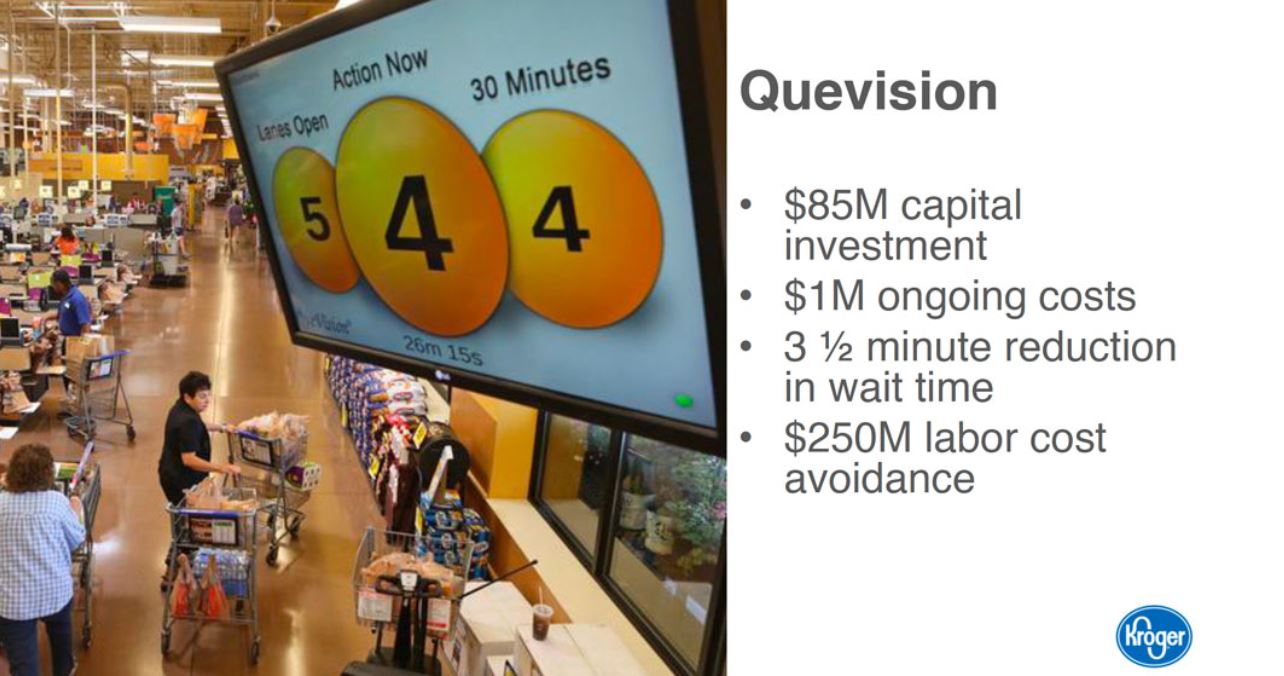

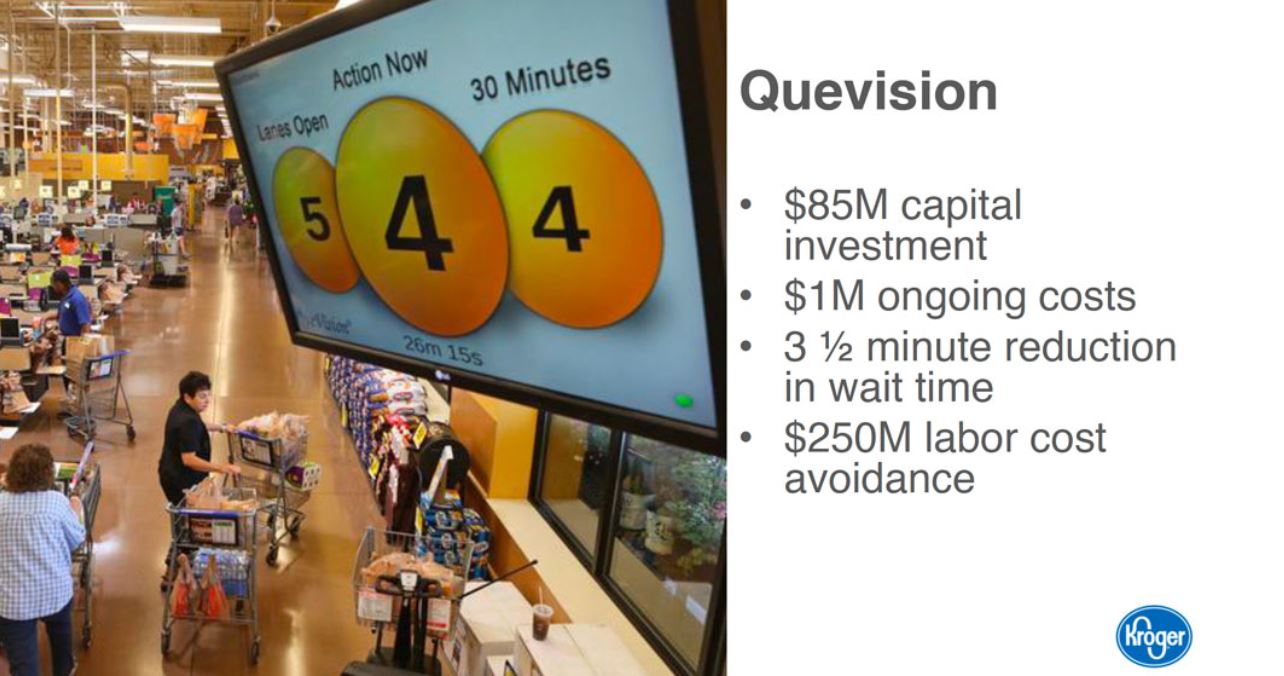

QueVision: This video system guides store managers in checkout staffing. An $85 million capital investment has achieved a 3.5-minute reduction in wait times in addition to $250 million saved in labor costs.

Source: Kroger

- Connected temperature monitoring of freezers ensures compliance with laws and avoidance of ethical issues, and has achieved annual cost savings of $25 million on an initial investment of less than $50 million.

- Kroger continues to adjust its store mix by opening new stores, renovating and relocating existing stores, and executing store closures as well.

MIKE DONNELLY, EVP OF MERCHANDISING, AND STUART AITKEN, PRESIDENT AND CEO, 84.51°

Mike Donnelly’s and Stuart Aitken’s presentation began with the news that Kroger had tied for first place in the Kantar Retail 2016 PoweRanking survey, as well as ranking first in the following categories: Best Retailer to Do Business With, Best Practice Category Leadership, Best Buying Teams and Most Innovative Merchandising. The company also tied for first in the Clearest Strategy category.

In their remarks, Donnelly and Aitken discussed how data is changing the business and the opportunities it offers, as well as the challenges and opportunities that responding to customers presents and how Kroger offers personalization.

- Huge amount of data: Every day, Kroger welcomes 8.5 million customers, records 106 million items purchased, receives 36,000 feedback surveys, sees 3.7 million coupons downloaded and produces 4.1 million personalized offers.

- New opportunities from data: Data offers more touchpoints through which to reach customers via new channels and offerings. New data sources are being created through emerging technology and science, and the synergy between the two drives exponential growth and differentiation.

- Listening to customers: Kroger receives millions of data points from customers through surveys and social media. The company uses natural language processing and machine learning to mine open-ended responses. The process provides actionable insights on strengths and opportunities.

- Offering personalization: Consumers want to save money and time, be connected, and shop at retailers that care about them and inspire them (for example, by offering suggestions for what to make for dinner Friday night). Kroger offers personalization such as yellow tag sales items, digital coupons, weekly ad items and predictive shopping lists (based on 500 machine-learning models, 1.5 billion coupons and 1–2 trillion rows of data).

Source: Kroger

- Ready for the future: Kroger’s use of data enables it to prepare for future trends by listening to customers, creating great experiences and driving loyalty.

FRED MORGENTHALL, EVP OF RETAIL OPERATIONS, AND MARY ELLEN ADCOCK, GROUP VP OF RETAIL OPERATIONS

Fred Morgenthall shared a graphic illustration with “Customer 1st” in the center surrounded by four actions: Strong ID Sales Growth, Operating Cost Leverage, Invest in Shopping Experience and Improve Connection with Customers. He also reiterated the company’s “four keys”: people, prices, products and experience.

Training and retraining managers is an opportunity to improve productivity, he noted. The company’s growth and acquisitions have resulted in many new managers joining who have not yet thoroughly embraced the company’s culture and processes, so Kroger is creating programs to educate them on best practices.

Mary Ellen Adcock outlined several areas for improving productivity:

- Process change and productivity: Improvement is “finding seconds,” she said, as saving an hour per day per store can raise Kroger’s EPS by a penny. In the main grocery selling area, in some cases, groceries are handled seven times.

- QueVision: The platform has been a huge success in terms of reducing transaction time.

- Staffing optimization: Each store previously employed a store secretary, which was not needed.

- Shrink and in-stock: Kroger is moving toward best practices in shrink, and ClickList is helping to improve in-stock levels and analysis of substitutes. Restocking carts typically include fast-moving merchandise and a quick card that indicates in which aisle the items belong.

Source: Kroger

JESSICA ADELMAN, GROUP VP OF CORPORATE AFFAIRS

Jessica Adelman outlined Kroger’s 100-year commitment to living its values and the use of data in managing “squishy” areas such as reputation. A majority of millennials, in particular, are motivated to shop at retailers that are good corporate citizens, and according to a 2016 Cone survey. 91% of millennials would switch to a brand that is affiliated with a particular cause. Adelman discussed several additional points:

- Sustainability: Kroger is moving toward creating zero waste in its stores and warehouses by 2020.

- Social outreach and reducing hunger: As a food provider, the company is keenly focused on ending hunger and has donated 1 billion meals to hungry Americans. Kroger supports more than 145,000 community organizations and its customers have a say in deciding how the donations are made.

Source: Kroger

- Rainforest Alliance Award: In recognition of its efforts to achieve a green sourcing platform, Kroger received the first-ever Supply Chain Partnership Award from the Rainforest Alliance.

NOTES FROM THE STORE TOUR

Following the presentations and Q&A session, conference attendees were transported to a Kroger supermarket for a tour. The location is classified as Kroger’s largest store, and the space is enormous, housing fresh and cooked food, sample stations, clothing, a jewelry store, and a pharmacy with a medical clinic, where pharmacists and assistants are trained to give inoculations and take blood-pressure measurements. The interior stretches practically as far as the eye can see. Attendees were able to sample the food at the sample stations and at the in-house beer and wine restaurant, which provides small plates to customers.

There was also a demo of Kroger’s Simple Truth organic line of food and household products. Company representatives said that Simple Truth is the number-one brand overall in the US, and that natural and organic food is expected to be a $100 billion market in 2017. Attendees were also given a brief presentation on Kroger’s ClickList service, which is offered at the store.

CONCLUSION

Kroger’s investor conference was a bit atypical, as it focused more on technology and the benefits of data analytics than on the company’s in-depth financials and business model. Still, it illuminated the company’s culture for investors and analysts and highlighted how Kroger is getting a good return on its technology investments, as well as the good results it has seen from its acquisitions. Kroger management emphasized the company’s constant drive to improve while also doing good for the communities in which it operates.

�