Executive Summary

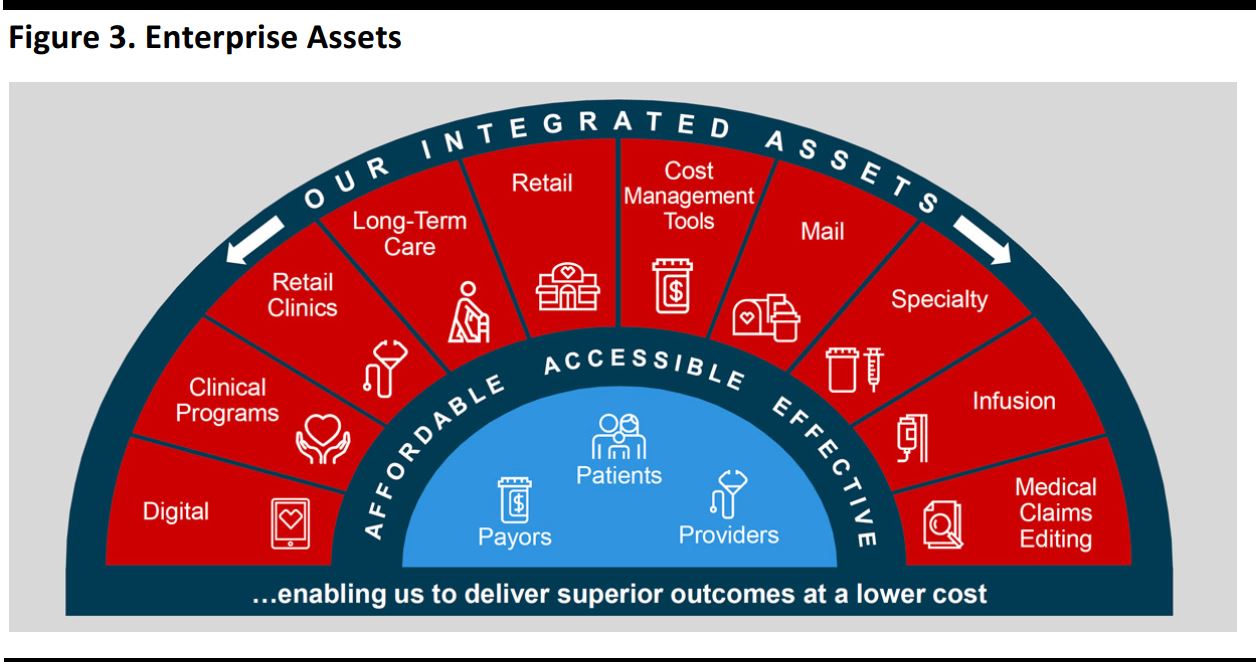

CVS held an upbeat analyst day event in New York City on December 15, during which it outlined its financial and other growth objectives. Specifically, the company seeks to make care more affordable, more accessible and more effective. CVS believes that it has the most extensive assets of its peer group, and says these provide touchpoints between health systems, providers, patients, the senior living segment, employers, government and health plans. It also says that it is the best-positioned PBM.

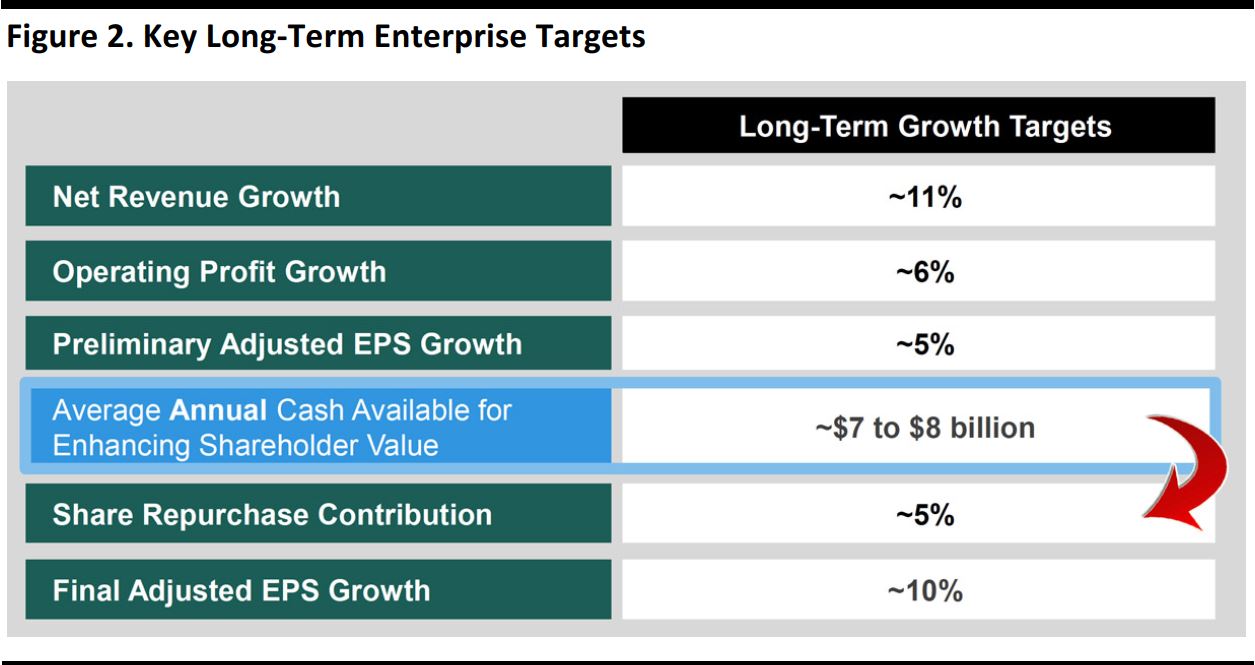

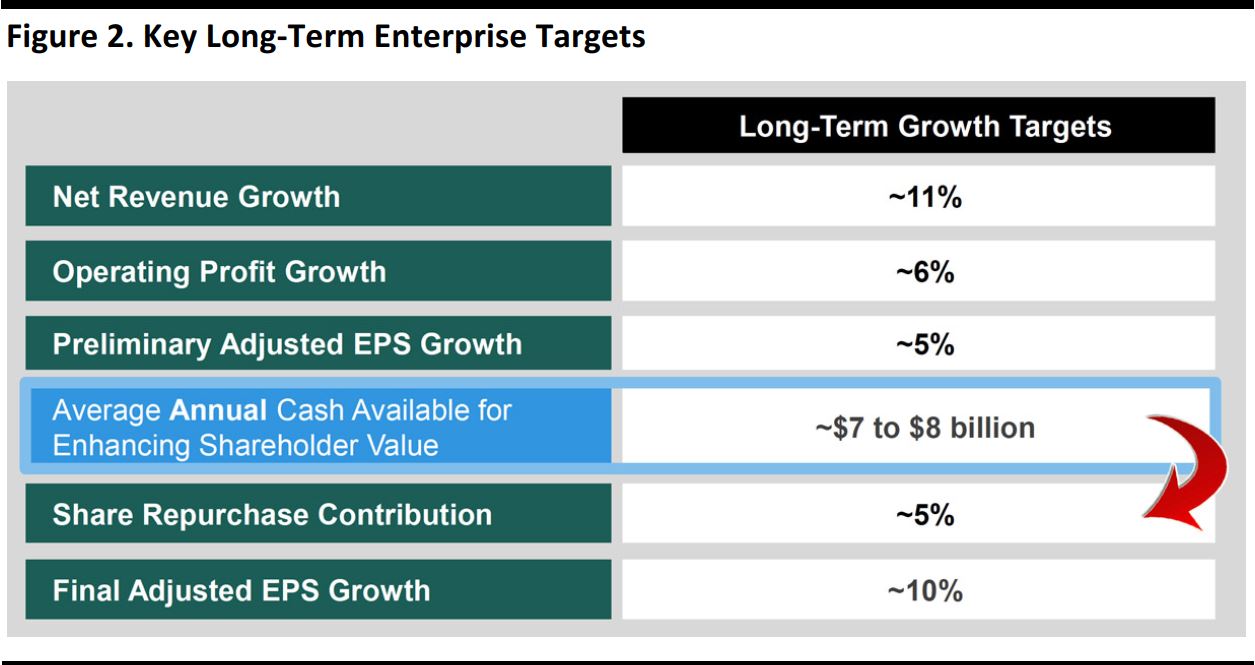

Moreover, CVS believes that its unique, integrated PBM + Specialty model is best positioned to meet the diverse needs of patients, payers and providers, and that its retail pharmacy business can be the best partner for all PBMs and health plans. The company believes the combination of these growth drivers will enable it to grow adjusted EPS by 10% a year and deliver $7–$8 billion a year for enhancing shareholder value.

Highlights from the Premeeting Press Release

Growth Objectives

Before the meeting, CVS disseminated a press release outlining the areas of growth and long-term financial targets that would be discussed at the analyst day event. The company outlined three objectives, saying that its goal is to make care:

- More affordable.

- More accessible.

- More effective.

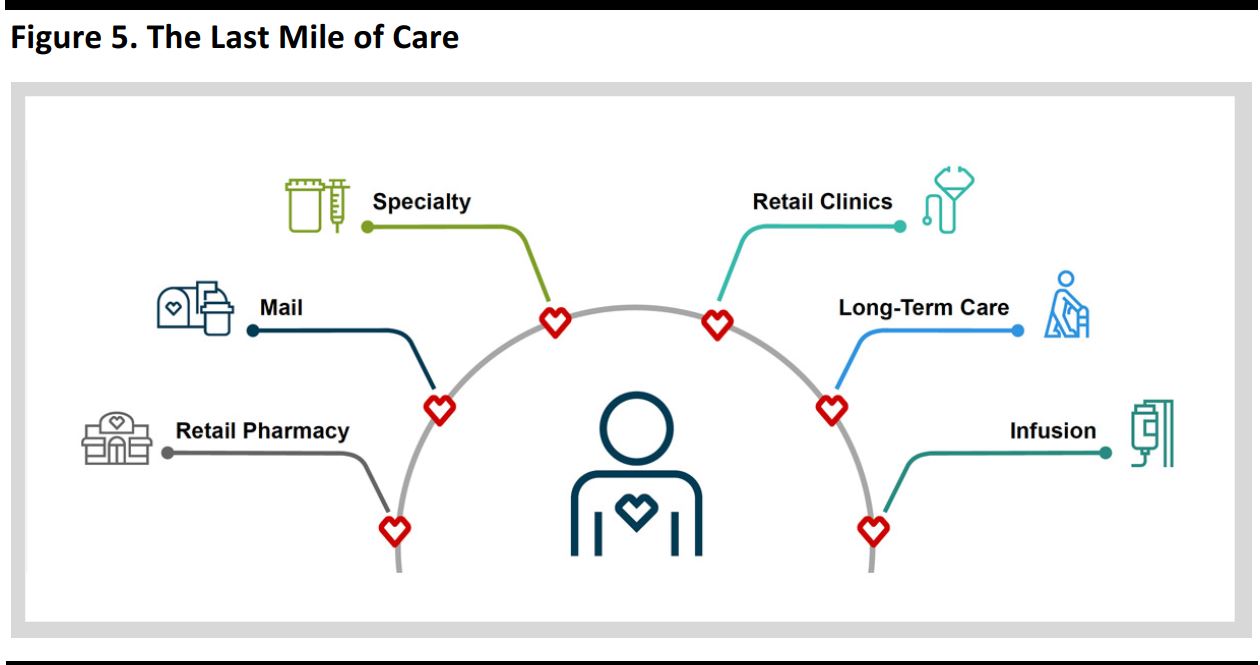

The company also commented that it has the “most extensive suite of enterprise assets,” which gives it the “ability, largely through technology, to integrate pharmacy care from the payer, to the provider, to the patient.” CEO Larry Merlo used “last mile,” a term borrowed from the telecom industry, to describe CVS’s relationship with consumers:

We own the last mile of service in the delivery of healthcare. … The face-to-face interactions between 30,000 pharmacists and clinicians provide us with an unmatched ability to help change consumer behavior and drive better health outcomes at a lower cost. With increasing consumerism and what we call the “retailization” of healthcare, improving clinical outcomes and patient satisfaction is of significant value to our healthcare partners.

Financial Objectives

Historically, the company has achieved its goal of 10% growth in adjusted EPS. The company also aims to:

- Generate $7–$8 billion of cash annually for enhancing shareholder value.

- Achieve $700–$750 million of annual savings, with a total of $3 billion in savings over the next five years.

The company also updated its guidance, as follows:

2016

- Reduced GAAP EPS guidance to $4.82–$4.88 versus $4.84–$4.90 previously (due to asset impairment and lease obligation charges)

- Reaffirmed adjusted EPS guidance of $5.77–$5.83

- Reaffirmed cash flow from operations guidance of $9.1–$9.3 billion and free cash flow guidance of $6.8–$7.0 billion for the full year

2017

- Reduced GAAP EPS guidance to $5.02–$5.18 versus $5.16–$5.33 previously

- Reaffirmed adjusted EPS guidance of $5.77–$5.93

- Assumes $5 billion of share repurchases during the year

- Guided for cash flow from operations of $7.7–$8.6 billion and free cash flow of $6.0–$6.4 billion

Below, we offer key points from management’s presentations at the analyst day event.

Larry Merlo, President and CEO—Opening Remarks

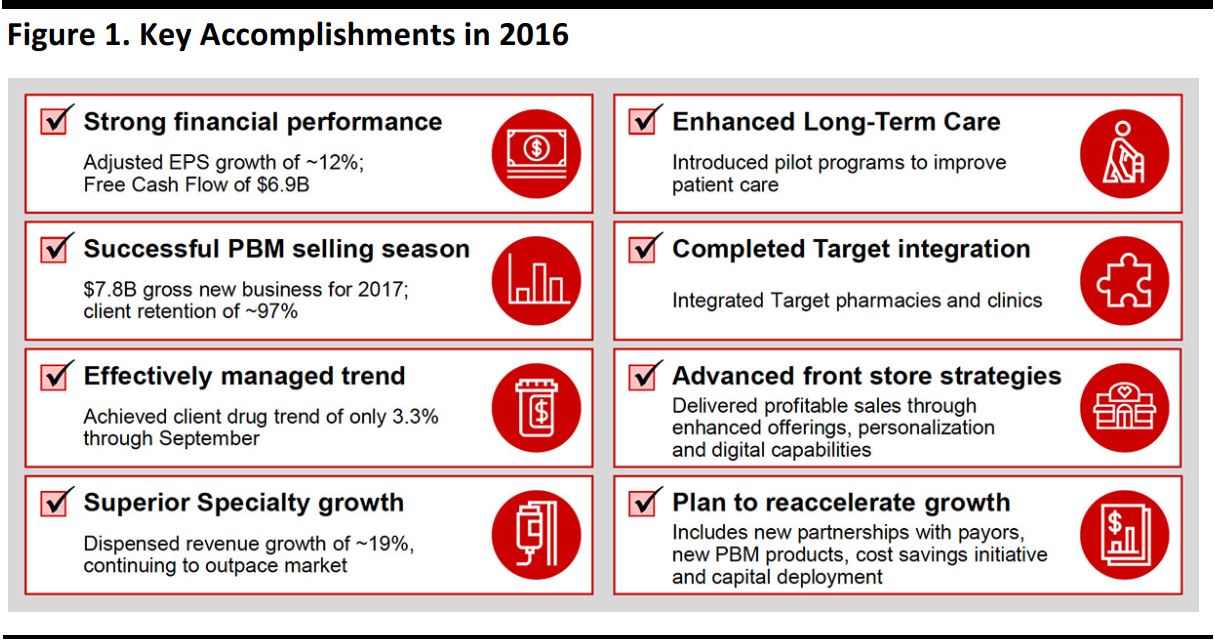

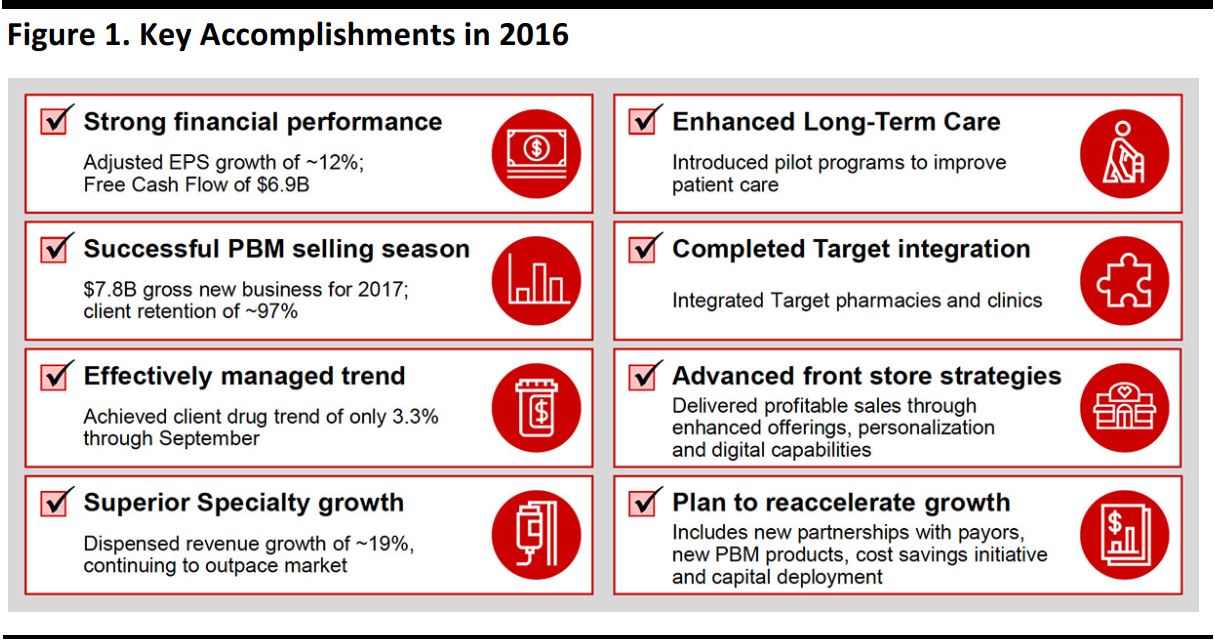

Larry Merlo began his remarks by enumerating CVS’s key accomplishments in 2016, as listed in the graphic below.

Source: CVS

- As mentioned in the premeeting press release, CVS aims to drive more affordable, accessible healthcare. These goals will take the form of:

- Driving outcomes and savings.

- Providing the front door and last mile.

- Being the best partner for PBMs and health plans.

- Providing integrated pharmacy care.

- Being positioned for long-term enterprise growth.

Dave Denton, EVP and CFO—Maximizing Shareholder Value with an Enterprise Mindset

Summary: Dave Denton reviewed CVS’s expectations for 2016 and 2017 and also discussed the company’s long-term growth targets and plans to maximize shareholder value.

The key points from Denton’s remarks follow.

- CVS has a strong record of execution:

- It remains focused on maximizing shareholder value through long-term, productive growth, generating significant cash flow and optimizing capital allocation.

- It has achieved many financial accomplishments thus far in 2016, including ~12% adjusted EPS growth and ~19% enterprise script and claims growth.

- The company expects solid performance in 2016, including 16.0%–16.5% net revenue growth and $6.8–$7.0 billion of free cash flow.

- CVS has met its enterprise growth targets through 2016, including a ~10% CAGR in operating profit and a ~14% CAGR in adjusted EPS.

- It is generating significant cash flow, which is up from $4.4 billion in 2013 to an estimated $6.9 billion in 2016.

- CVS is committed to maintaining a healthy balance sheet, with a target ratio of debt equal to 2.7 times EBITDA.

- The company is maintaining well-laddered debt maturities.

- It has been efficiently deploying cash since 2014, and deployment has been focused on three pillars: dividends, acquisitions and ventures, and share repurchases.

- The company has maintained a solid history of enhancing returns using all three pillars.

- It expects an 18% dividend increase and further share repurchases in 2018

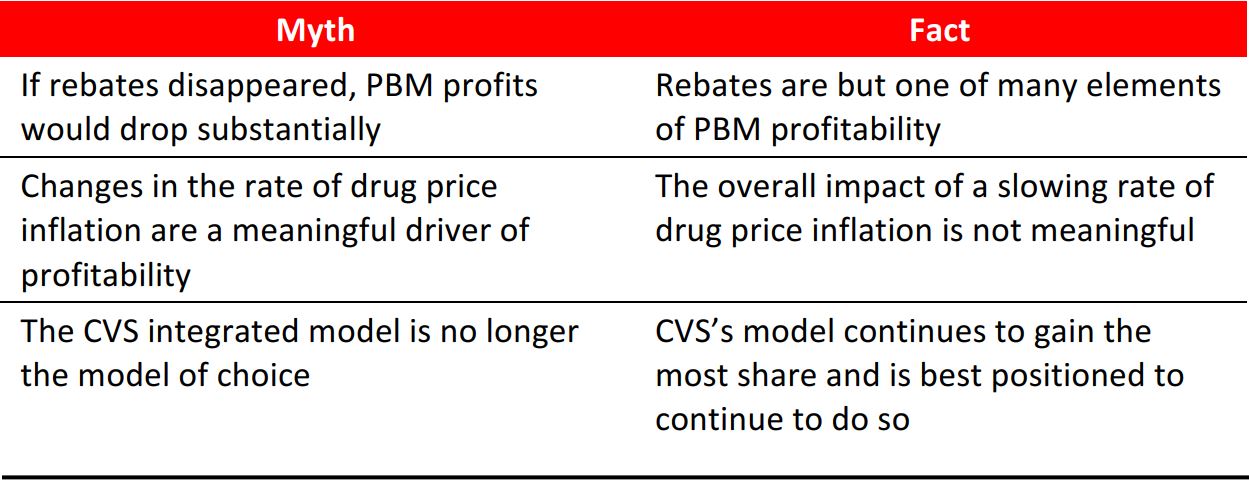

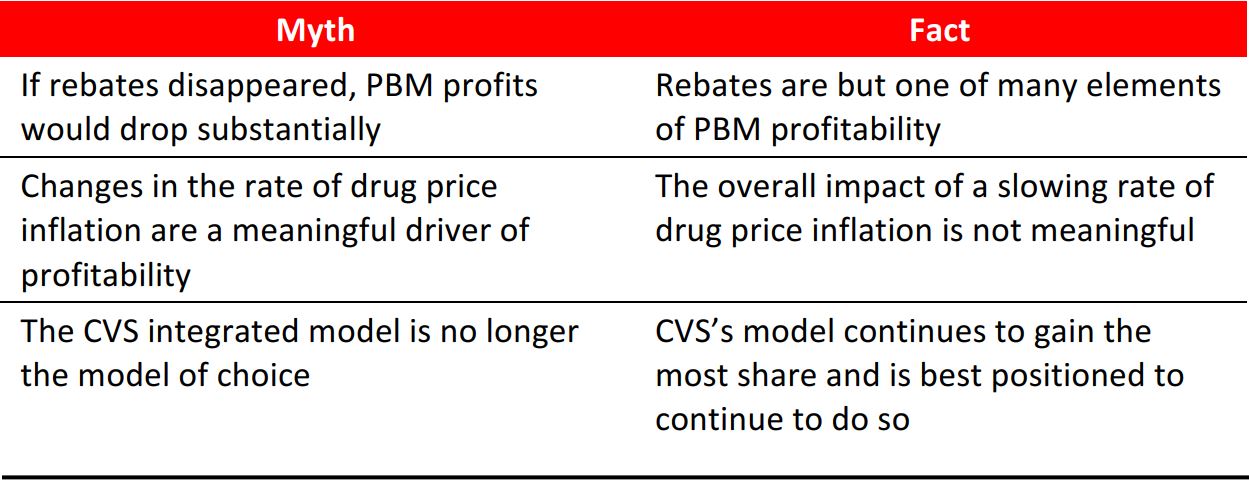

- There are some marketplace misconceptions, and Denton debunked three common ones:

Source: CVS

- Denton’s comments on the company’s 2017 guidance largely mirrored the information the company had already provided in the premeeting press release. He noted that other key drivers of 2017 expectations include:

- Reimbursement and pricing pressure.

- Impact of recent network changes.

- Accretion from Omnicare and Target assets.

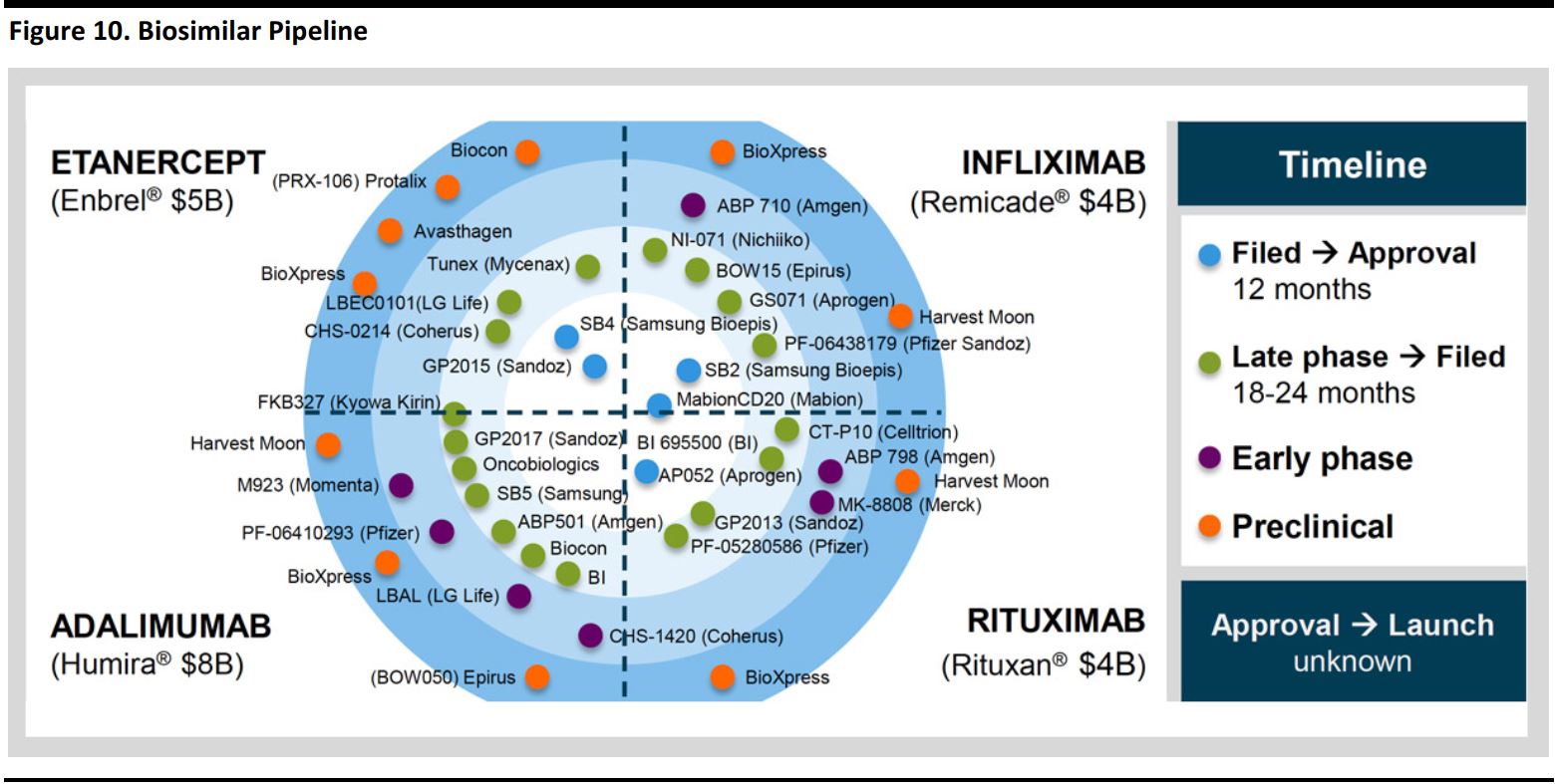

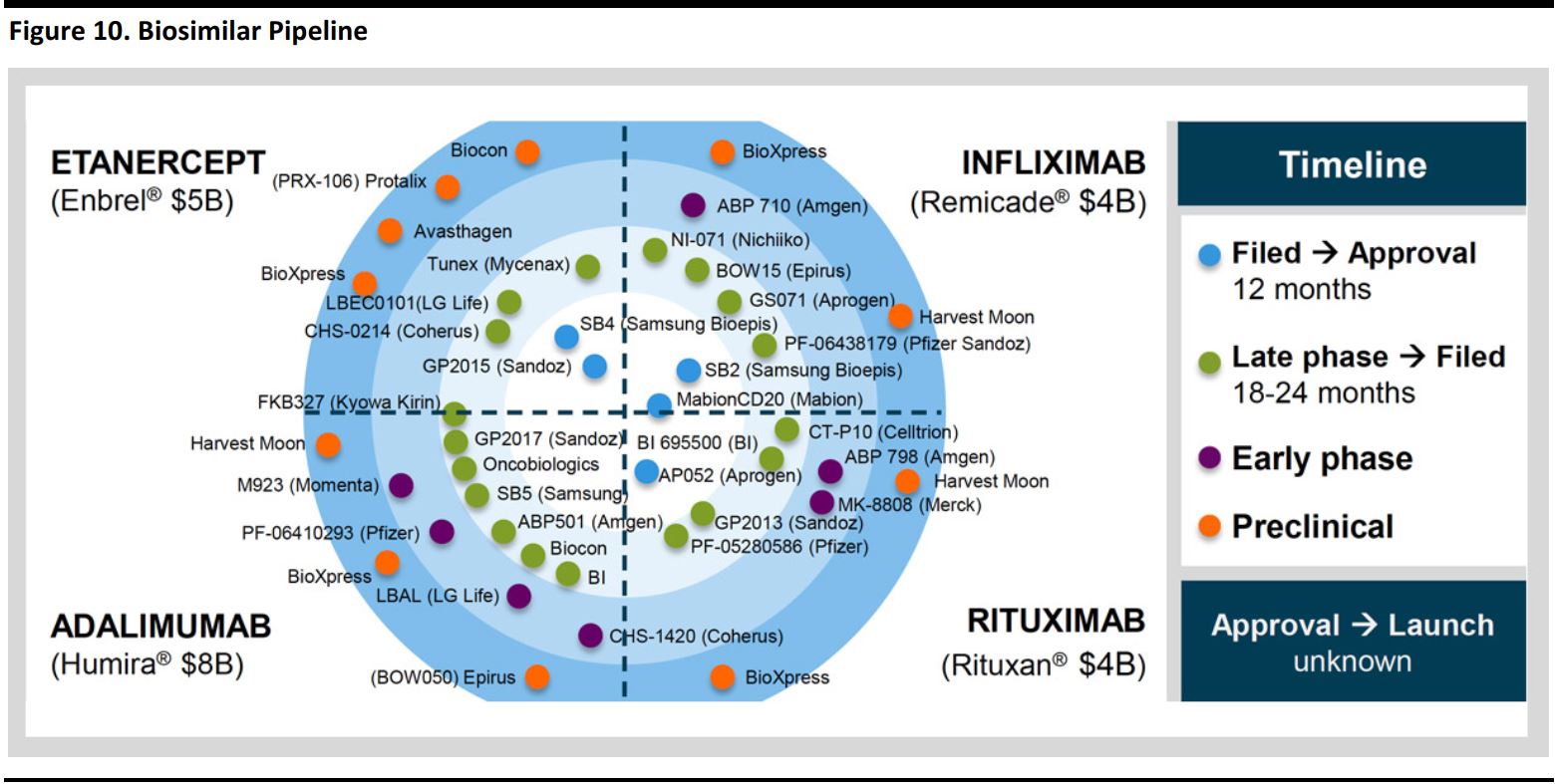

- Timing of generic launches and biosimilars.

- Enterprise streamlining initiatives.

- In addition:

- Generics remain an opportunity.

- Biosimilars represent an additional opportunity.

- The company is streamlining to maximize the use of its enterprise assets.

- 2017 earnings growth is weighted toward the back half of the year.

- Denton said the company’s long-term outlook is solid. CVS’s long-term targets are listed in the graphic below.

Source: CVS

Larry Merlo, President and CEO—Delivering Value for All Healthcare Stakeholders

Summary: Merlo commented that CVS’s value proposition has never been stronger and that the company sees robust opportunities in a robust healthcare market. He also offered his plans for driving long-term enterprise growth.

CVS’s value proposition has never been stronger:

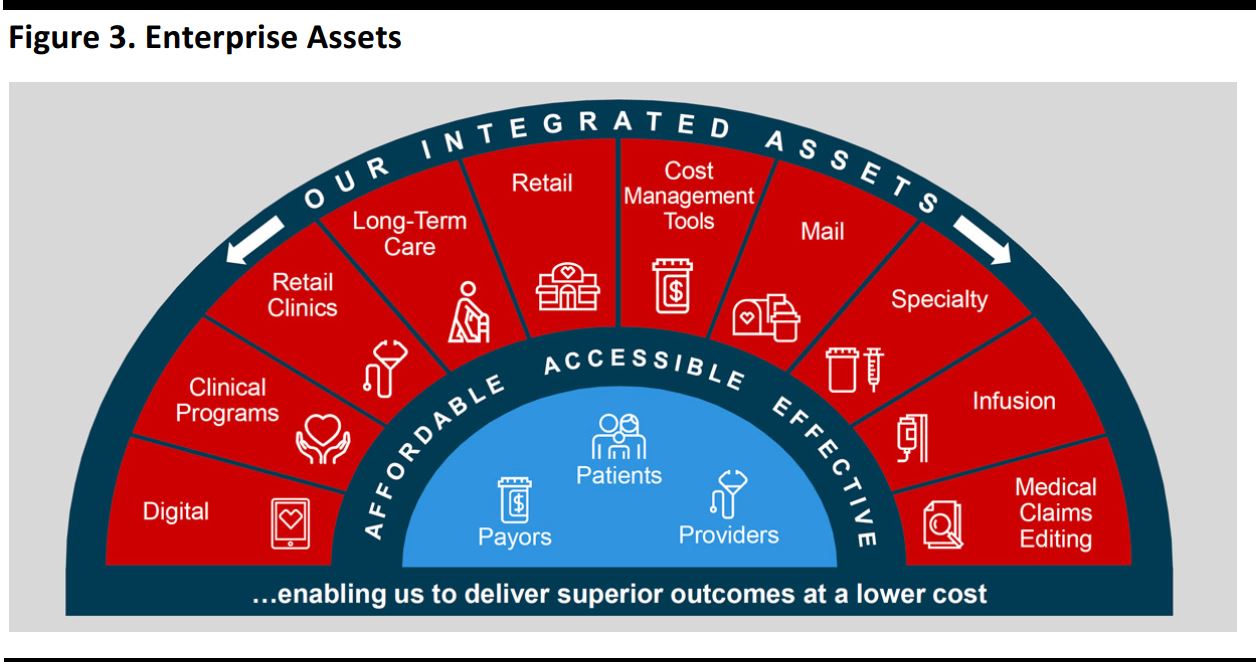

- The company possesses the most extensive suite of leading assets, as pictured below.

Source: CVS

- Its integrated model drives more affordable, accessible and effective care.

- Traditional touchpoints of competitors are limited in scope.

- By contrast, CVS’s suite of assets provides touchpoints across all healthcare stakeholders, including health systems, providers, patients, the senior living segment, employers, government and health plans.

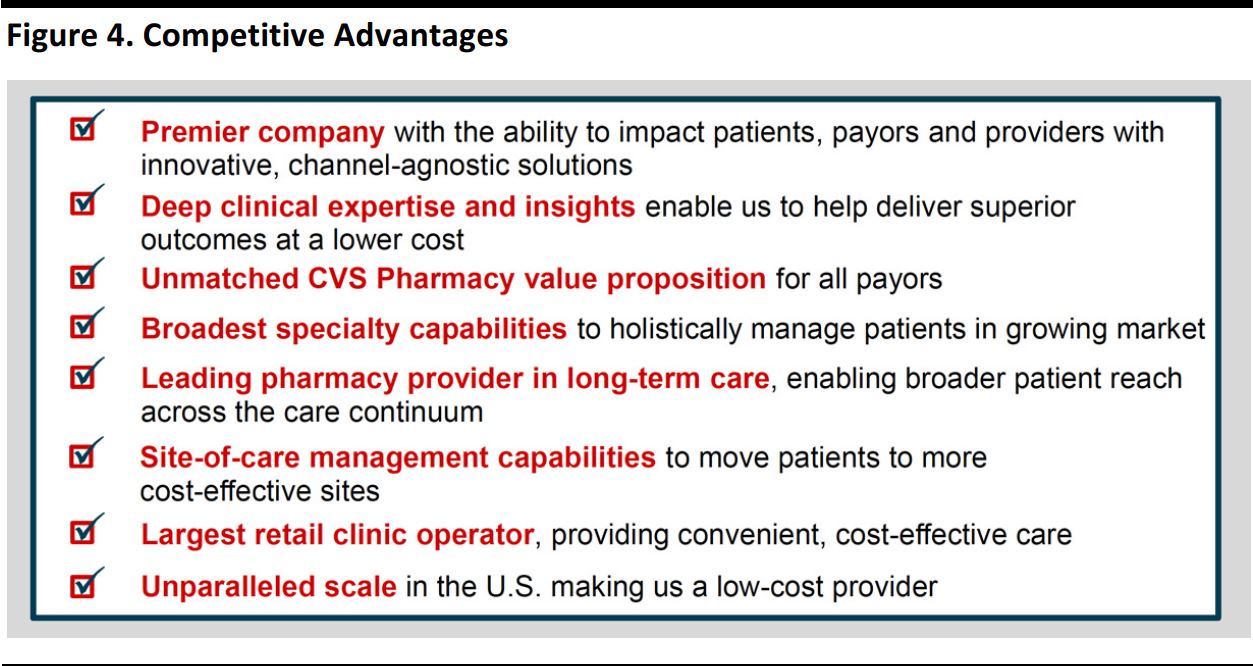

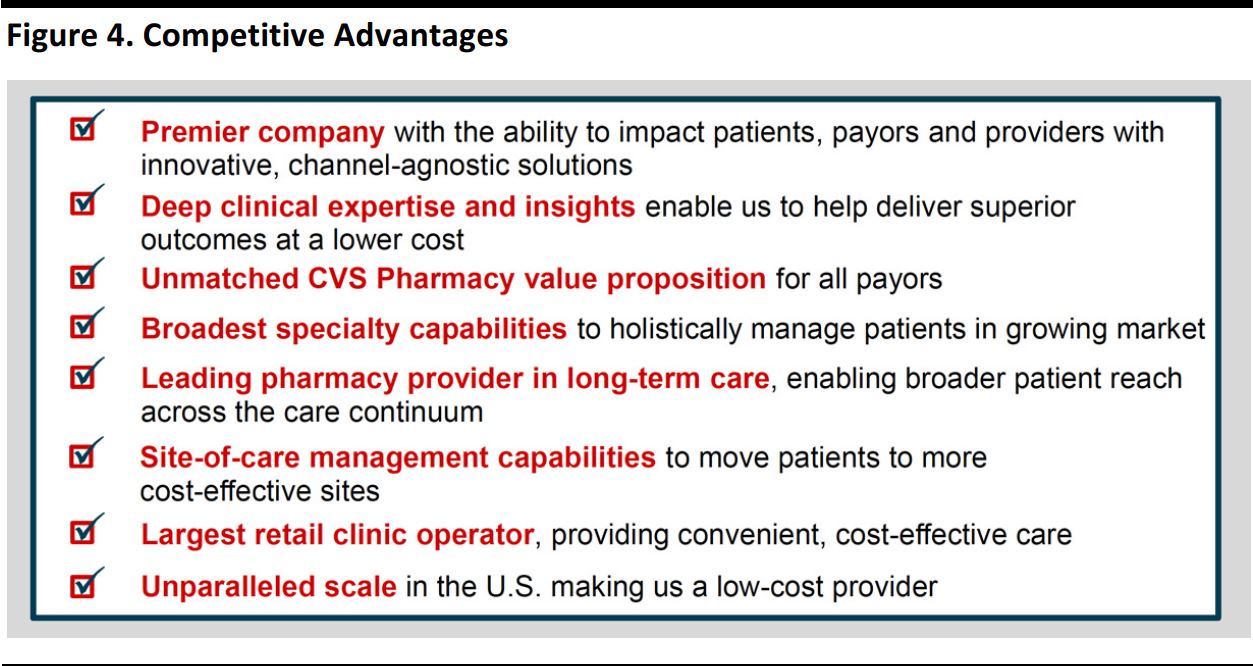

- CVS’s competitive advantages are listed in the graphic below.

Source: CVS

- Moreover, CVS’s continued selling season success is fueling growth in PBM and Medicare lives served by PBMs as well as enterprise volume.

CVS sees robust opportunities in a robust healthcare market:

- Focus on trend management—Growth in healthcare and pharmacy spending is projected to outpace GDP growth. Clients continue to value PBMs as an indispensable solution to rising costs. Moreover, CVS possesses a suite of capabilities for improving healthcare affordability and has mitigated branded-product price increases with cost management solutions.

- Evolving role of government in healthcare—Government accounts for two-thirds of health insurance spending and demand for cost-effective care will remain despite the uncertainty surrounding healthcare reform. CVS is well positioned to capitalize on growth in Medicare.

- Movement to value-based care is slow, but inevitable—The movement toward value-based care creates the need for new cost management solutions. However, there are a multitude of ways CVS can provide cost-effective care.

- Ongoing benefits of size and scale—CVS possesses unsurpassed procurement scale through enterprise dispensing volume and the company’s ability to aggregate claims creates value for clients.

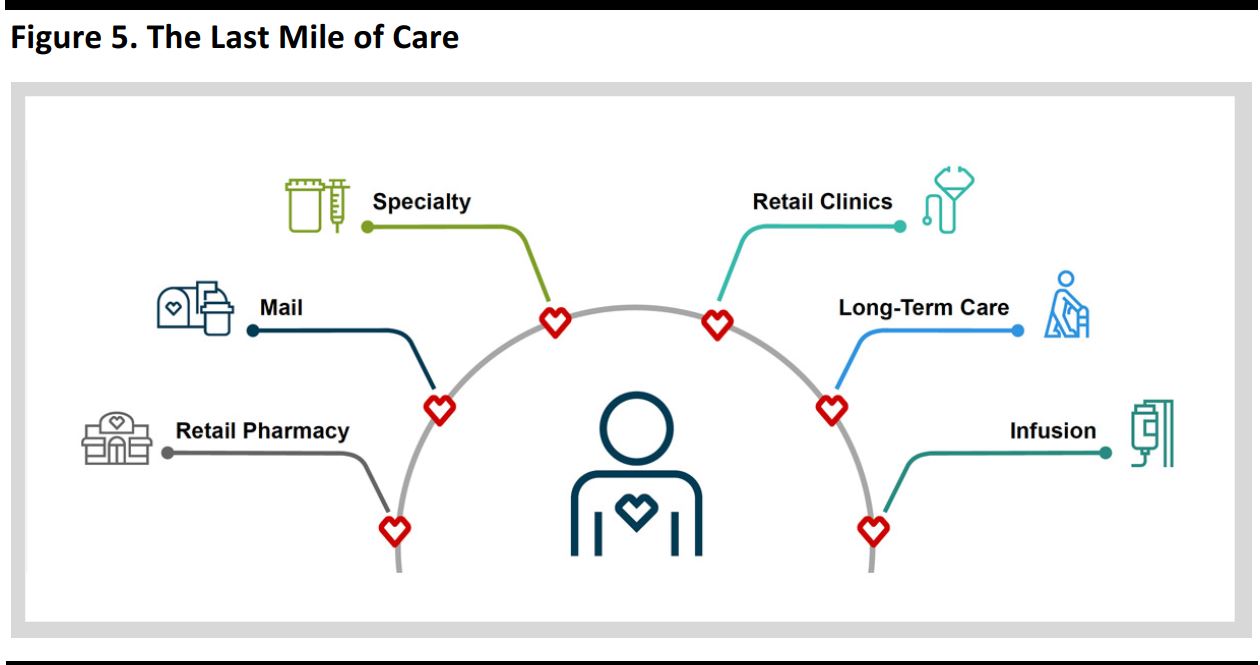

- Increasing consumerism/retailization of healthcare—Consumer-directed health plans are gaining traction, and CVS owns the last mile of care through its unmatched number of patient touch points.

Source: CVS

- Growing role of digital—CVS’s digital strategy is focused on three pillars: adoption, an integrated health experience and ongoing innovation.

CVS aims to drive long-term enterprise growth.

Merlo outlined several actions designed to capitalize on market dynamics:

- Partner more broadly—Utilize the full suite of CVS’s enterprise capabilities to enhance the CVS Pharmacy value proposition, make clinical capabilities a competitive edge in value-based care, and leverage the new strategic relationship with Optum.

- Develop new, innovative PBM products—Use clinical solutions to support all stages of care and value-based contracting approaches, implement new retail network strategies and performance-based networks, and continually innovate.

- Enterprise streamlining initiative—Further improve productivity to solidify low-cost-provider status, with a focus on store rationalization, enhancing efficiency of corporate shared services and optimizing the pharmacy delivery platform, which should generate nearly $3 billion in cumulative savings by 2021.

- Return value to shareholders—Optimize use of capital to drive shareholder returns, continue to evaluate strategic opportunities to drive long-term growth, effect annual dividend increases and execute share repurchases.

Jon Roberts, EVP and President, CVS Caremark—Meeting the Healthcare Challenges of Tomorrow

Summary: Jon Roberts addressed how CVS Health’s PBM business continues to be the best-positioned PBM. The business saw another successful selling season and is continually innovating to meet the latest healthcare challenges.

Roberts’s remarks centered on the following points:

- PBMs are needed now more than ever—Challenged by evolving market dynamics, payers are looking for more from PBMs. With the most extensive suite of leading assets, CVS’s integrated model positions the company as the PBM of choice.

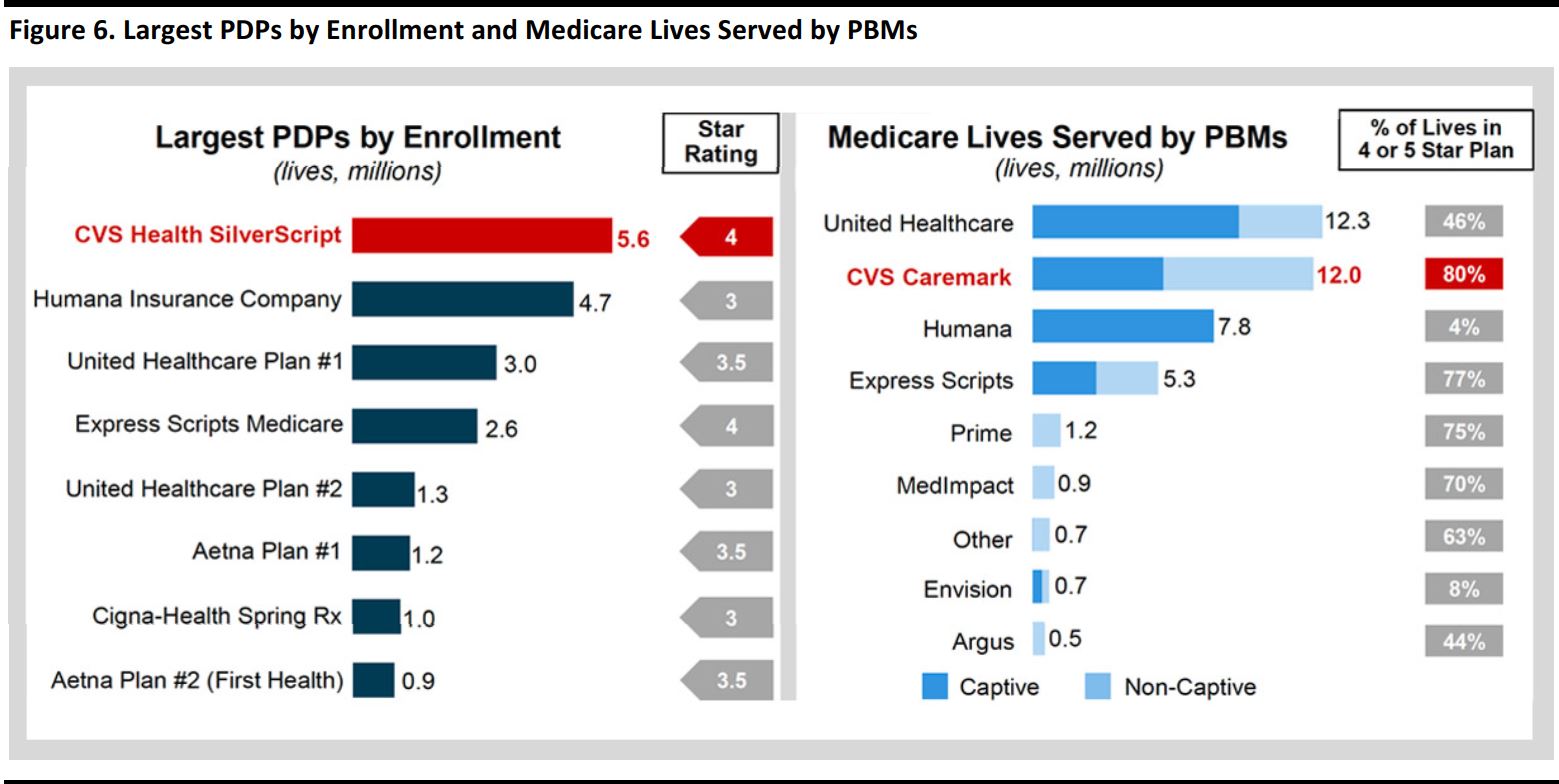

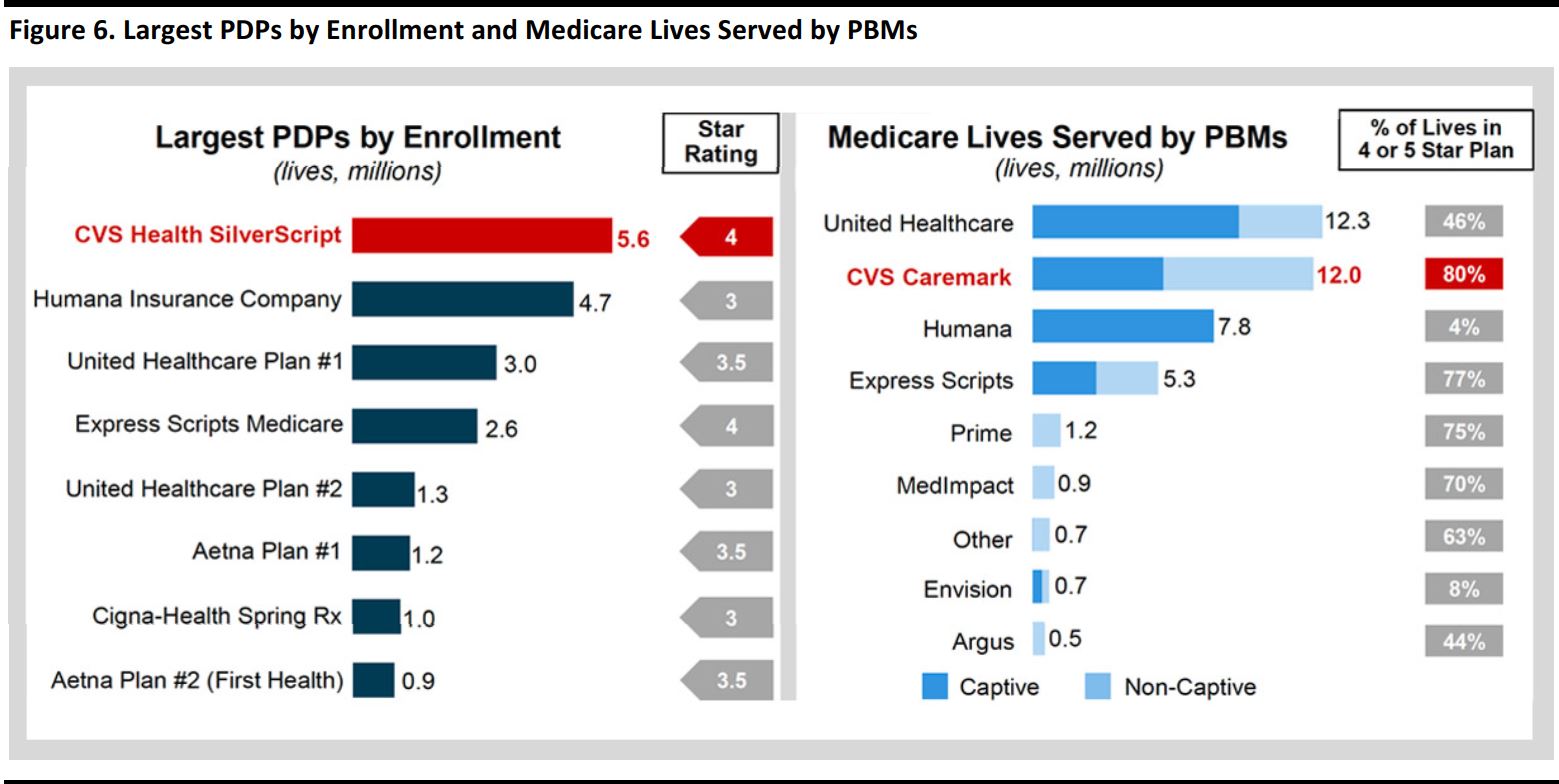

- Performance highlights—CVS continues to report strong PBM results, and 2017 is expected to be another outstanding selling season, with the company expecting to win more than 50% of revenue from clients changing PBMs and achieve ~97% client retention. New business is providing a platform to grow enterprise dispensing, and CVS has a strong record of success in building prescription volume with health plans. The company is leading in Medicare by delivering service and quality, as shown in the graphic below. Moreover, CVS is helping its health plan clients grow their Medicare business, and specialty growth continues to outpace the market. The company is delivering high levels of client and member service continuously.

Source: CVS

- Addressing the payers’ top priority: reducing cost—Despite market forces, CVS has helped its clients cut the trend of brand price inflation. In addition, higher launch prices are contributing to rising specialty spending, and the aging population and new drugs are leading to increased utilization in specialty. To combat inflation, CVS has taken a differentiated, three-pronged approach to reducing costs in order to win with payers. CVS uses intelligent purchasing, which is foundational to helping deliver the lowest net cost and also dramatically reduces impact of utilization and drug price inflation. The company also uses real-time surveillance and dynamic management to stay ahead of market volatility. Its core safety and monitoring programs have saved clients $100 million, and versatile cost management strategies address client priorities across all lines of business. In a rapidly evolving market, cost management demands more from a PBM.

- Integrated where it matters—Given the complex challenges of population health, CVS’s health engagement engine transforms data into actionable interventions, and its unique model and capabilities deliver better clinical results.

- Innovating for the future—CVS continues to innovate to anticipate and address unmet needs for clients and members in all income brackets. CVS also engages in value-based contracting with pharma manufacturers as well as value-based retail networks to help deliver savings and improved performance. The cost of diabetes is staggering, and the company’s Transform Diabetes Care programs improve clinical outcomes and reduce costs. The company also offers expanding member options, such as Maintenance Choice 3.0, which help each member along their path to better health.

Alan Lotvin, MD, EVP, CVS Specialty—Leading the Evolution of the Specialty Model

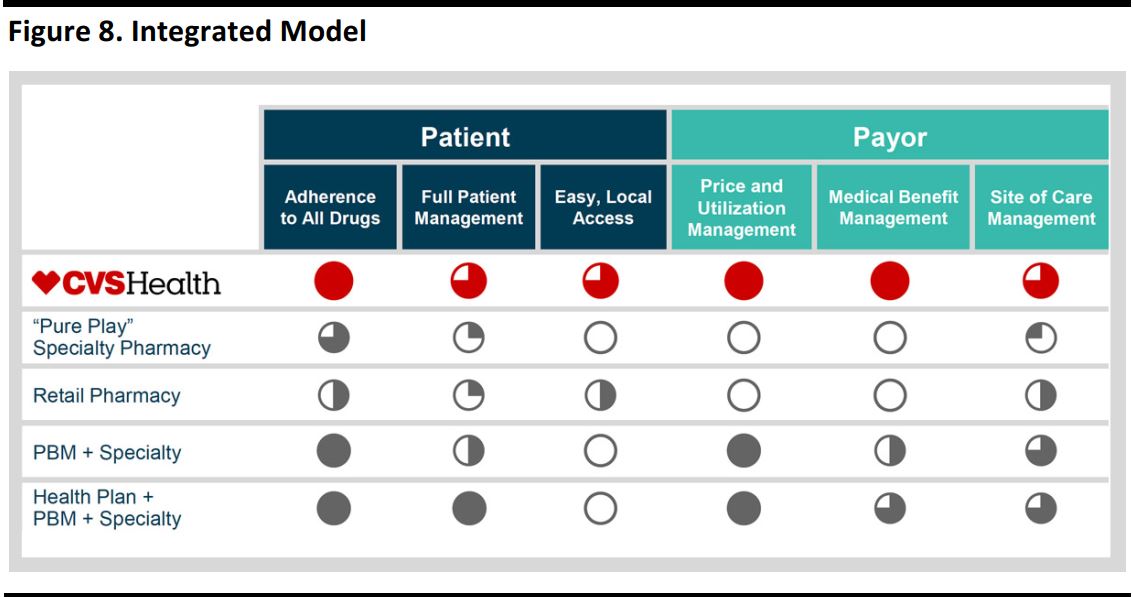

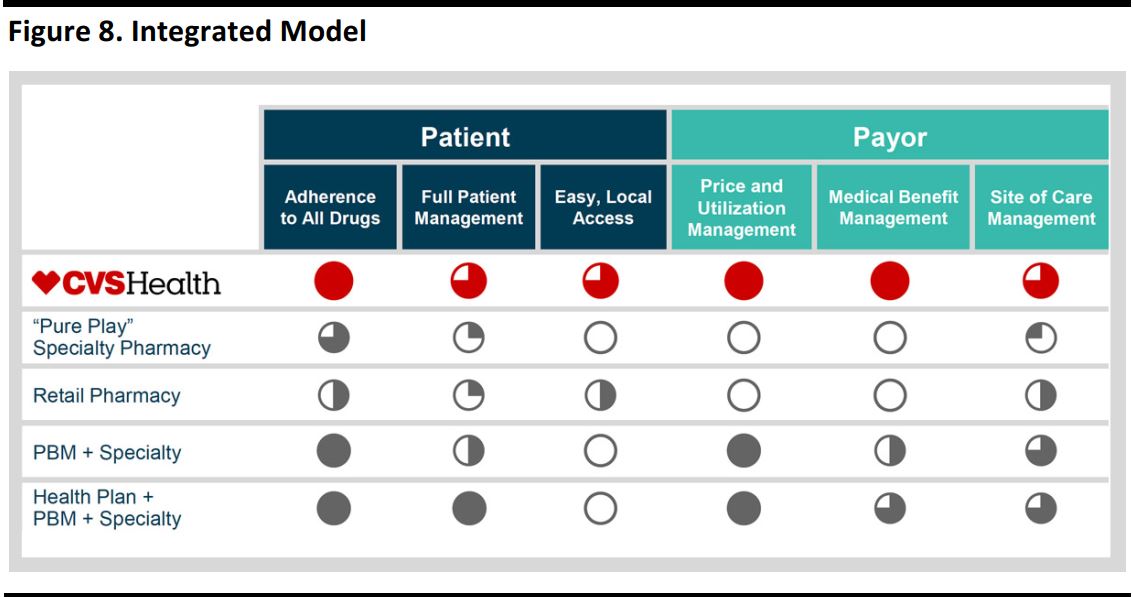

Summary: Dr. Alan Lotvin discussed how the company’s unique, integrated PBM Specialty model is best positioned to meet the diverse and complex needs of patients, payers and providers.

Lotvin’s remarks are summarized as follows:

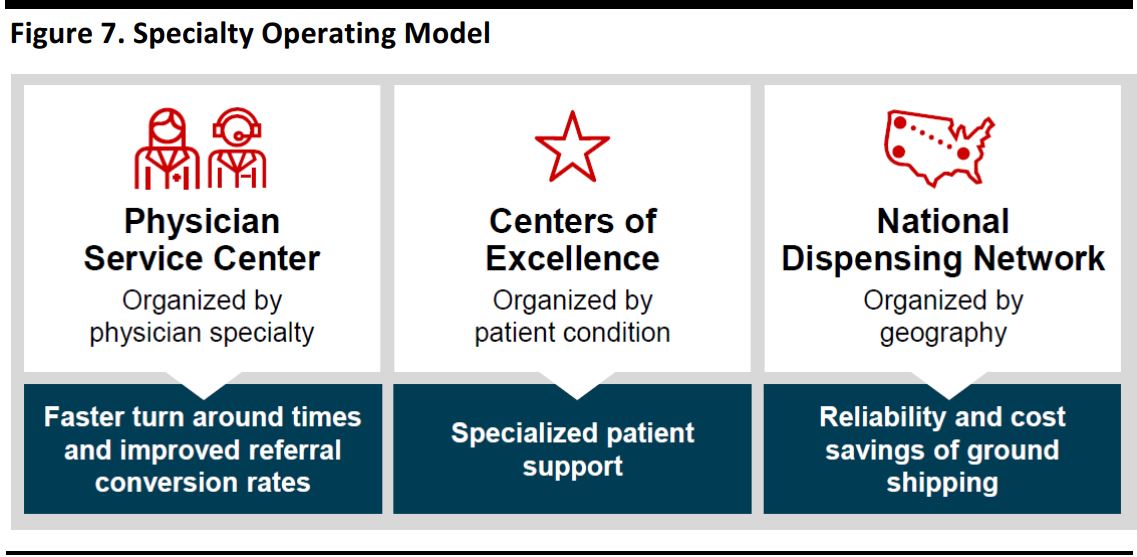

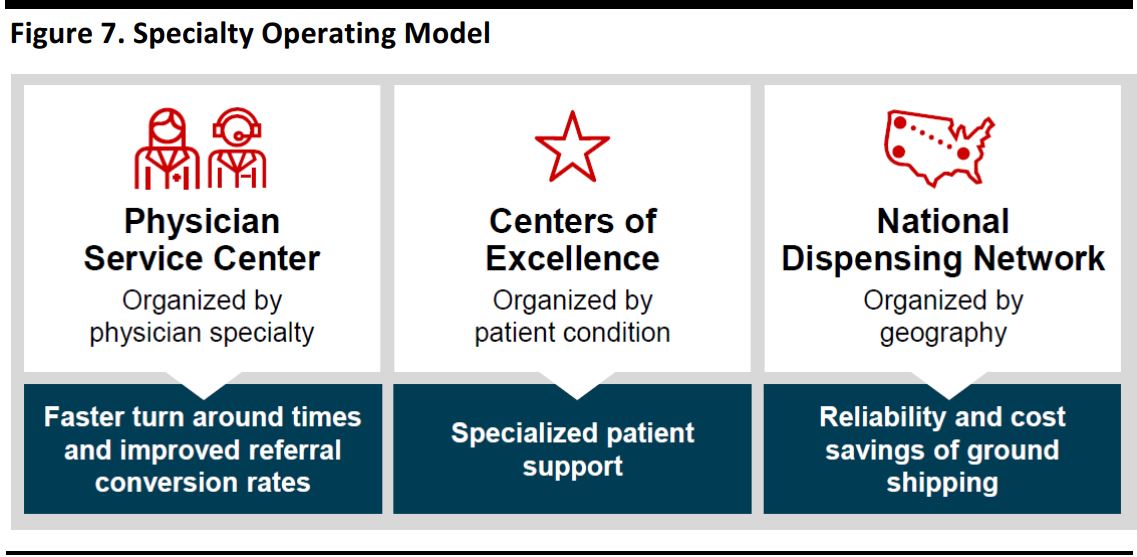

- Performance highlights—CVS continues to grow in the specialty segment, and CVS Specialty is growing faster than nearly all its large competitors. There are multiple contributors to 2012–2016E gross profit growth, and access to new drugs is an important contributor to performance. The enhanced CVS Specialty operating model is expected to improve the physician experience and patient outcomes, as illustrated below.

Source: CVS

Source: CVS

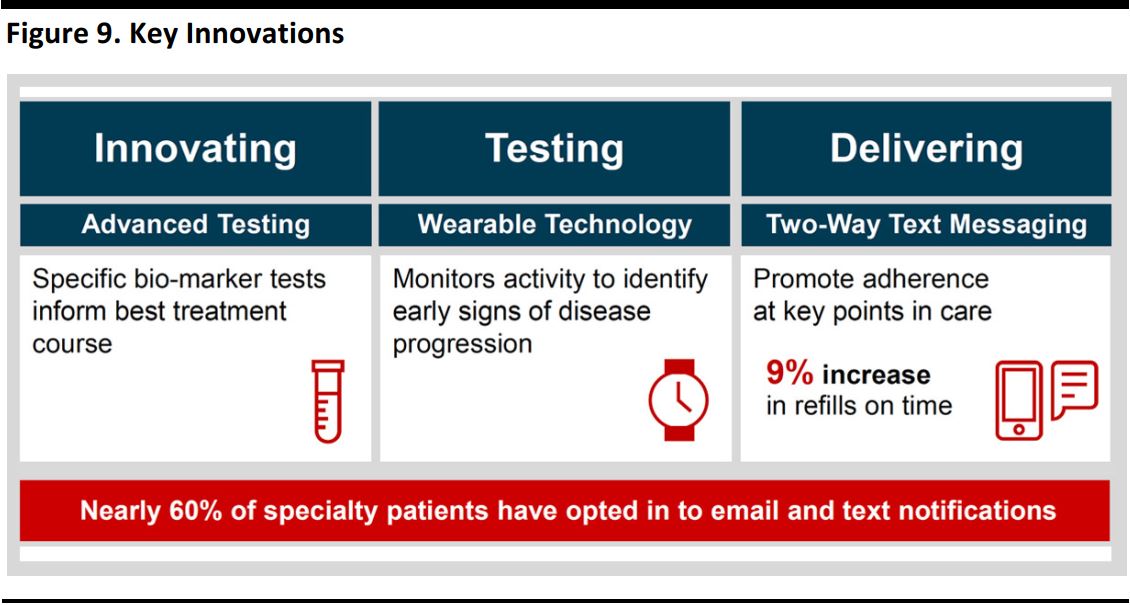

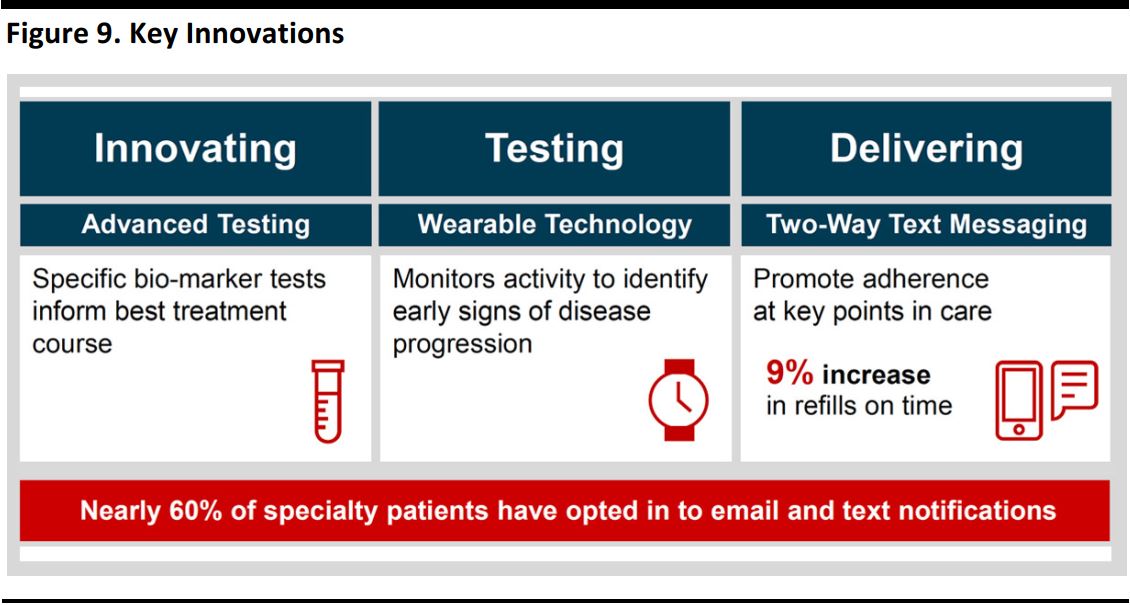

For patients, improving care and outcomes is important—Specialty patients with complex needs drive a large portion of healthcare costs, and the CVS Care Management model addresses more than adherence; it also helps reduce overall healthcare costs, and its results are measureable. The Specialty Connect model helps improve patient convenience, satisfaction and adherence. Moreover, key innovations can help deliver significant value, as illustrated below

Source: CVS

- Payers want to optimize total spend—The integrated PBM + Specialty model can provide value in several ways:

- In comprehensive management, there are significant savings opportunities for even the most sophisticated clients.

- Prior authorization provides the richest, most timely data set for specialty management.

- Utilization is a key driver of specialty growth, demanding continued innovation.

- Inflation and higher launch prices create a need for innovative management solutions.

- A rich biosimilar pipeline creates savings opportunities, as depicted below.

- An integrated PBM + Specialty model produces better results.

- The management of drugs paid for under the medical benefit remains a significant opportunity.

- CVS Specialty medical claims management offers significant savings.

- The payer value proposition is that it offers the broadest set of capabilities to manage specialty spending across benefits, access to all needed data in near real time and proven, in-market operational programs.

Helena Foulkes, EVP and President, CVS Pharmacy—Capitalizing on the Retailization of Healthcare

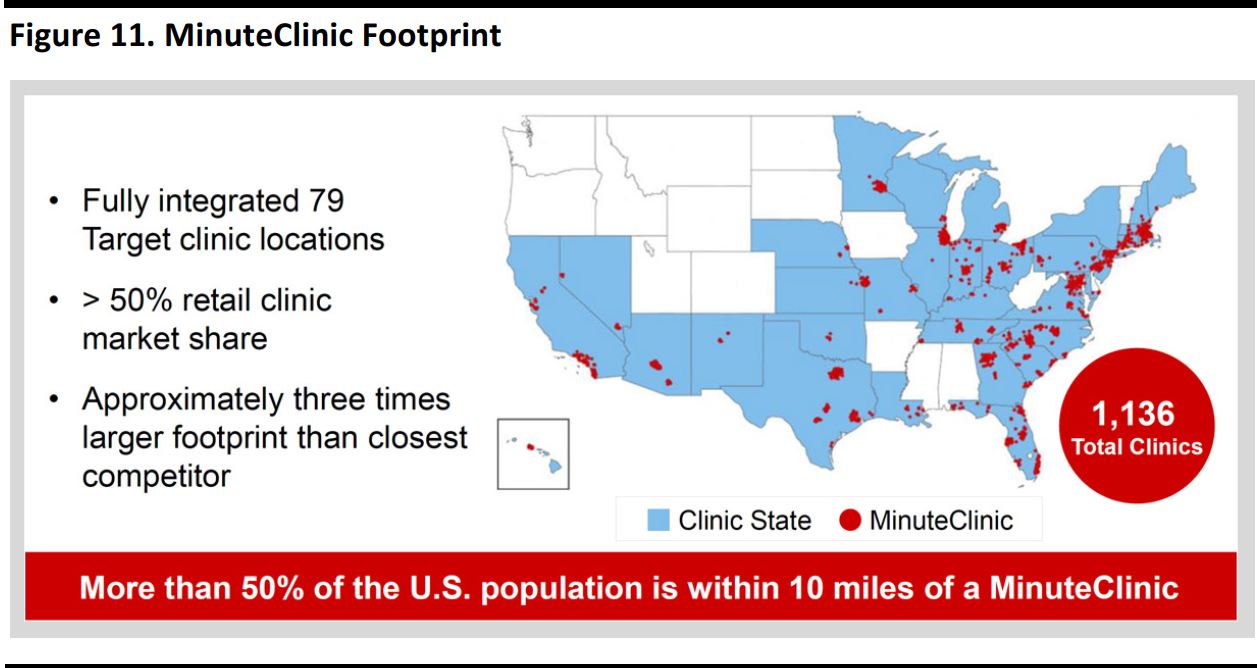

Summary: Helena Foulkes outlined how CVS’s retail pharmacy business can be the best partner for all PBMs and health plans because it can leverage all of the company’s enterprise assets and offer a menu of bundled services that can provide significant value to payers. Foulkes also highlighted growth strategies for the front store, long-term care pharmacy and MinuteClinic businesses.

- Retail pharmacy—CVS’s estimated 2016 pharmacy revenue comprises 75% pharmacy and 25% front store. The company has experienced strong pharmacy share growth over the past several years. CVS has a significant presence in the US retail pharmacy market and a strong track record of leading performance. The company’s success is driven by integrating clinical programs into its workflow system. CVS continues to innovate in its patient communications and adherence programs: ScriptSync drives adherence through improved convenience, and its text alerts are easier for patients and teams. Due to its unique capabilities, CVS has grown faster than the market. The majority of CVS’s scripts (65%) are non-Caremark scripts.

- Partnering through enterprise capabilities—CVS brings together assets from all of CVS Health to win with PBMs and health plans. CVS deployed selected assets for a non-PBM Medicaid payer seeking to drive cost efficiencies and retention, and the payer saw improved clinical results. Another non-PBM client achieved improvements in star ratings across multiple plans. In addition, CVS Health is launching a strategic relationship with Optum.

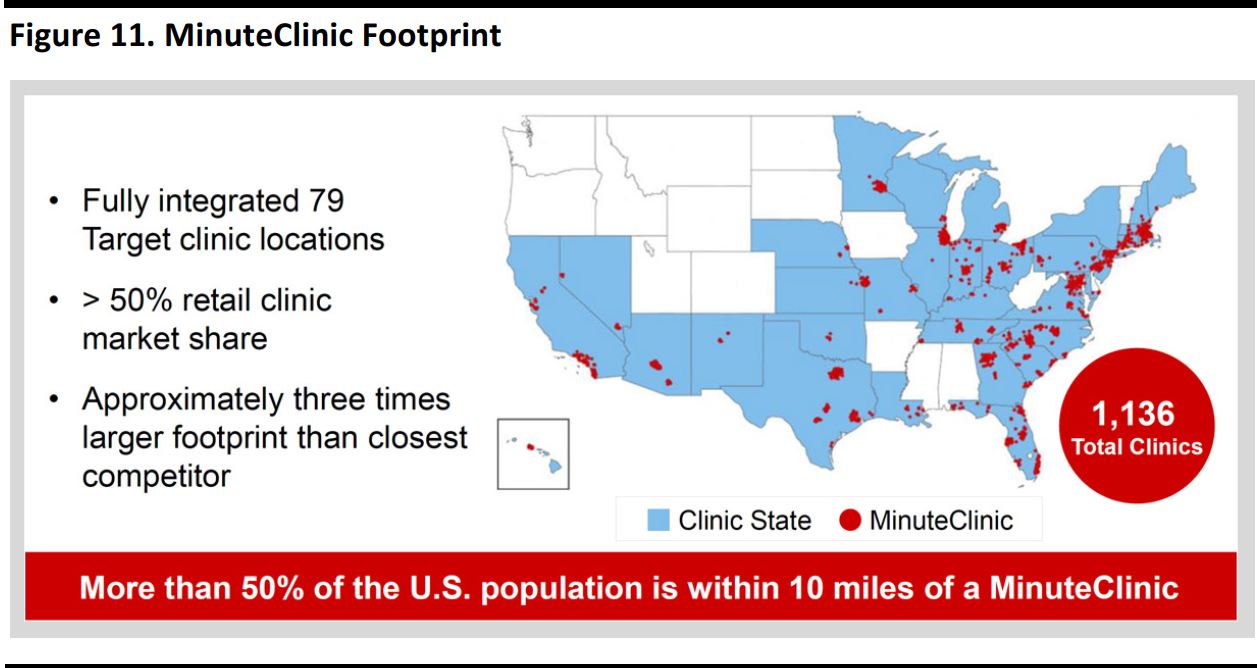

- Update on key assets—The MinuteClinic footprint (illustrated below) covers the most populous US areas and enhances the CVS value proposition for patients, providers, payers and PBMs. Omnicare has significant growth opportunities and CVS has applied its operational excellence across the Omnicare footprint. Investments in transitions enhance CVS’s market positioning and initiatives are in flight to accelerate growth in the senior living business. The acquisition of Target’s pharmacies is helping to fill in CVS’s geographic footprint. CVS has successfully completed the integration of these pharmacies, which are already driving traffic and business into Target, with more to come in 2017.

Source: CVS

- Front store growth strategy—CVS believes the role of the front store is to support its pharmacy and drive margins. The company has seen success in high-margin health and beauty categories and continued success in store brands. CVS is focusing on key categories and on personalization and digital to drive profitable growth. CVS is updating its stores by growing core categories; it is expanding and elevating its health assortment, healthy food selection, and beauty offering, and has seen positive run-rate results in 400 stores. The rollout continues to be successful, as traditional circular vehicles are in decline. CVS is optimizing its approach to promotions and investing in personalization, which helps deliver the right messages to the right customers. Personalization through the ExtraCare program is effective at growing customer value, and the company has invested in digital while leveraging its 9,600+ store locations. CVS’s front store future plans include:

- Growing its profitable health, healthy food and beauty categories.

- Continuing to deliver innovative products and digital experiences to customers.

- Expanding personalization to build stronger relationships with loyal customers.

Conclusion

CVS held an upbeat analyst day event in New York City on December 15, during which the company outlined its financial and other growth objectives. In addition to providing solid earnings gains and value for shareholders, the company is seeking to make care more affordable, more accessible and more effective. CVS believes that it has the most extensive assets among its peers. These provide touchpoints between health systems, providers, patients, the senior living segment, employers, government and health plans. The company also considers itself the PBM of choice, with its retail pharmacy business serving as the centerpiece to meet all of its customers’ and clients’ diverse needs.