DIpil Das

Coresight Research x Fillogic: Not Your Regular Mall-Based Stores–Part Two

In today’s retail environment, supply chain collaboration and innovation is vital amid increased pressure on the last mile—i.e., the delivery process of getting the product into the hands, or onto the doorstep, of the consumer. Many retailers are seeking out new ways to improve their sales and profits by offering multichannel fulfillment options to customers—including BOPIS (buy online, pick up in store), curbside pickup, ship to store and ship from store (SFS). Coresight Research has identified the sharpening of last-mile strategies as a key trend to watch in retail. We explore the significant opportunity shipping from mall-based stores provides retailers and brands in our three-part series entitled Not Your Regular Mall-Based Stores. In this report—the second in the series—we discuss the benefits to retailers of shipping from mall-based retail stores, with a focus on last-mile cost savings. We leverage findings from a June 2021 Coresight Research survey of 150 executives at US mall-based retailers. This report is sponsored by Fillogic, a logistics-as-a-service platform provider that converts underutilized space at retail centers into tech-enabled, micro distribution hubs.Reducing Retailers’ Last-Mile Delivery Expenses: In Detail

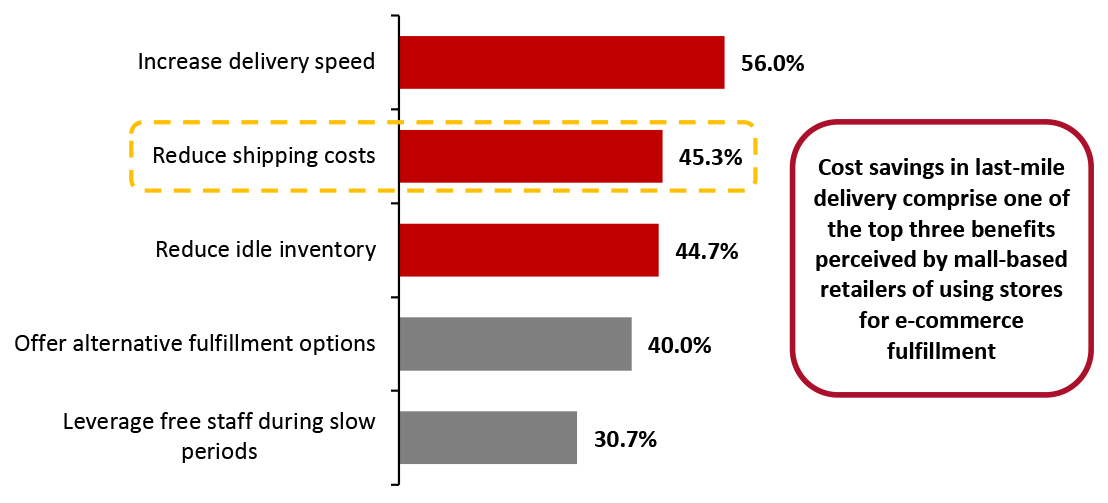

Retailers Recognize the Benefits of Fulfilling Online Orders from Mall-Based Stores Coresight Research’s survey found that 77.3% of US mall-based retailers offer multichannel fulfillment options to customers, yet only 53.3% do so from their mall-based stores. Another 40.7% are planning to provide such options from their mall-based stores in future. As we showed in the first report in this series, fulfillment options currently being offered by our survey respondents include BOPIS (44.0% of respondents), ship to store (40.0%), SFS (38.0%) and curbside pickup (30.7%). There are multiple benefits to retailers of turning to their mall-based stores for e-commerce fulfillment. In addition to increasing delivery speed and reducing idle inventory, store-based fulfillment enables retailers to cut down shipping costs as they are closer to customers: These were the top three benefits perceived by mall-based retailers in our survey (see Figure 1). With the Covid-19 pandemic having increased pressure on mall-based retailers’ top and bottom lines—through store closures and steep brick-and-mortar traffic and sales declines amid a shift to e-commerce—we focus our discussion in the following sections on the fiscal benefits that store-based e-commerce fulfillment provides.Figure 1. Top Five Benefits of Using Mall-Based Stores as Fulfillment Centers (% of Respondents) [caption id="attachment_132873" align="aligncenter" width="725"]

Retailers were asked to select all benefits that apply to them

Retailers were asked to select all benefits that apply to them Base: 150 US mall-based retail executives

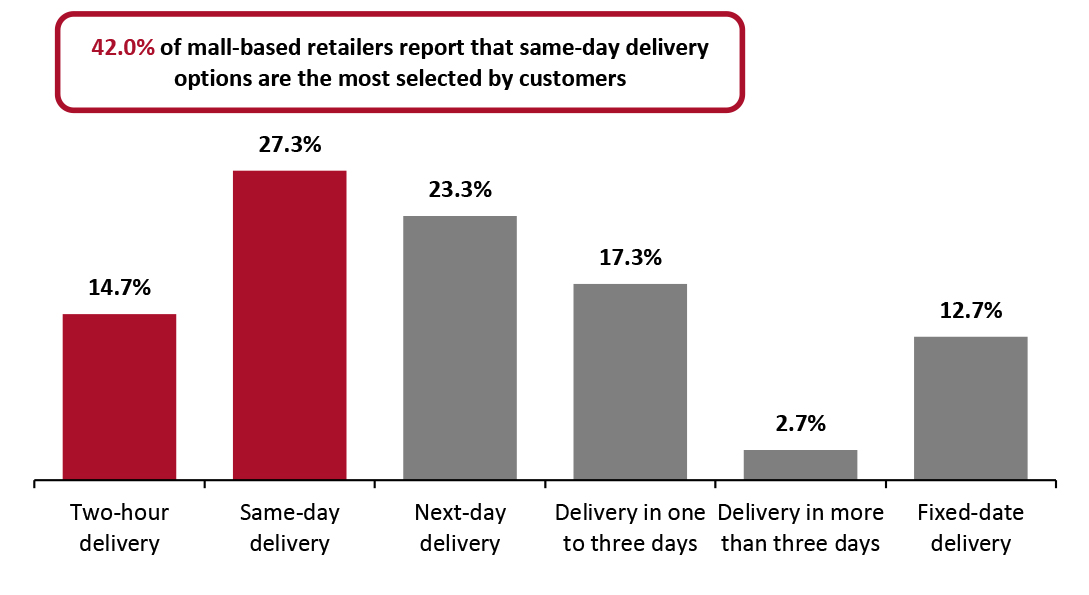

Source: Coresight Research [/caption] Last-Mile Delivery Costs Account for a Significant Share of Total Supply Chain Costs Consumers are increasingly demanding faster delivery from retailers. According to our survey, fast delivery options are the most popular among consumers, with only 32.7% of mall-based retailers reporting that delivery options longer than one day are most selected by customers (see Figure 2).

Figure 2. Most Selected Delivery Options by Customers (% of Respondents) [caption id="attachment_132874" align="aligncenter" width="725"]

Numbers may not sum to 100 due to rounding

Numbers may not sum to 100 due to rounding Base: 150 US mall-based retail executives

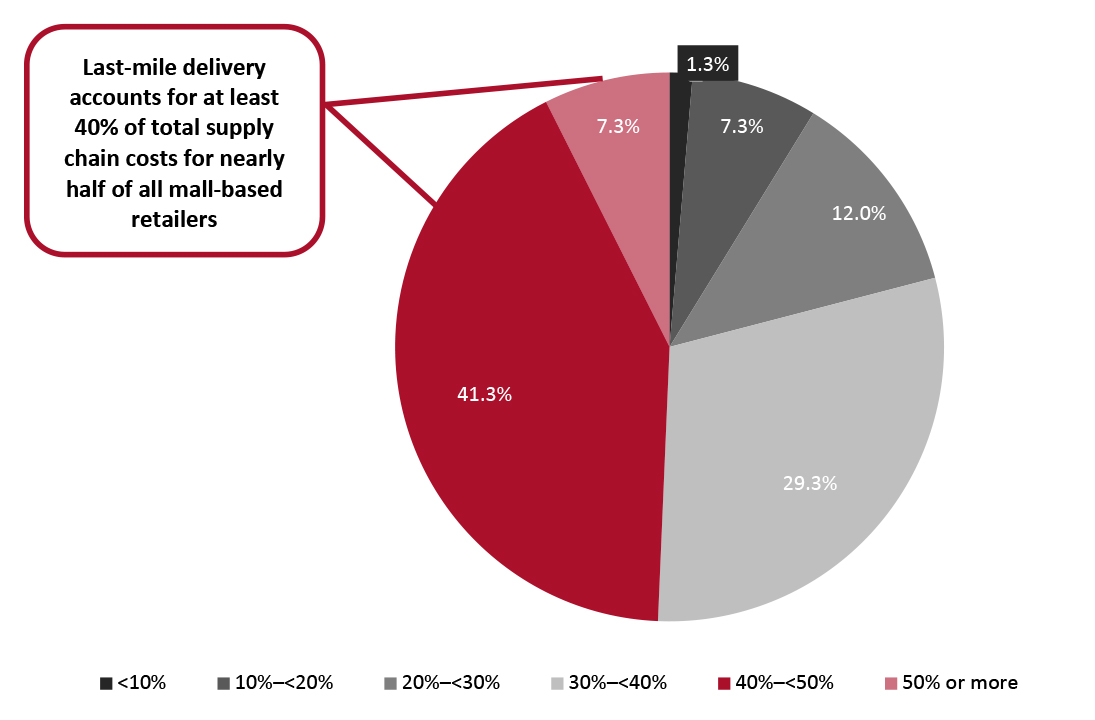

Source: Coresight Research [/caption] It is critical for retailers to meet consumers’ delivery expectations in order to remain competitive. However, e-commerce fulfillment is not cheap: Last-mile delivery accounts for at least 40% of total supply chain costs for 48.6% of mall-based retailers, according to our survey—and the 40%–<50% bracket was the most cited among our respondents (see Figure 3).

Figure 3. Last-Mile Delivery Costs as Proportion of Total Supply Chain Costs (% of Respondents) [caption id="attachment_132875" align="aligncenter" width="725"]

Numbers may not sum to 100 due to rounding

Numbers may not sum to 100 due to rounding Base: 150 US mall-based retail executives

Source: Coresight Research [/caption] Strategies for Managing Last-Mile Costs While Meeting Consumer Demand for Fast Delivery SFS Model One of the ways in which retailers can reduce last-mile delivery expenses is through fulfilling online orders from their mall-based retail stores. This is primarily because stores are closer to customers than out-of-town warehouses. Our survey found that 28.6% of retailers were able to save 8%–10% of total last-mile delivery costs by shipping from their mall-based stores, and 31.4% of retailers reported savings of 5%–8%.

- In March 2021, mall owner Tanger Factory Outlets partnered with Fillogic to help its retailers successfully implement the SFS model at its Deer Park Center in Long Island, New York. As part of the strategy, Fillogic will support inventory management and assist in same-day, next-day deliveries.

- Grocery company Albertsons partnered with Tortoise, a US-based technology startup in March 2021 to launch a pilot program at three Safeway stores in North Carolina. Through the partnership, the retailer is using remote-controlled delivery carts to make scheduled drop-offs to customers within a radius of approximately five kilometers.

- Starship Technologies partnered with Save Mart Companies in September 2020, its first grocery partner in the US, to autonomously deliver from its flagship store in Modesto, California.

- Kroger and Walmart have been testing a self-driving robot by robotics startup Nuro, delivering groceries and other small goods—and Nuro tested its second-generation delivery robot, R2, with the two retailers in 2020. Additionally, Walmart launched a pilot program with drone operator Flytrex in September 2020 to deliver select grocery and household items from Walmart stores in Fayetteville, North Carolina.

Walmart’s autonomous delivery vehicle, Nuro

Walmart’s autonomous delivery vehicle, Nuro Source: Walmart [/caption] Smart Lockers Smart lockers are electronic storage solutions that enable retailers to store parcels at convenient locations—including store premises, shopping centers, public terminals and residential areas—for consumers to pick up. Once notified that their order is ready for collection, consumers can access smart lockers through various electronic means, such as by scanning a barcode, RFID tag or their fingerprint.

- Quadient, a France-based parcel-locker solutions provider, announced in March 2021 that its base of smart locker stations exceeded 13,000 worldwide, representing more than 600,000 boxes overall. According to Geoffrey Godet, CEO at Quadient, the company continues “to efficiently execute on [its] vision of building large, dense and open networks of locker stations in targeted countries, relying on patented technology and innovations as well as leveraging operational synergies and sales experience across our international teams.”

Quadient’s smart lockers

Quadient’s smart lockers Source: Quadient [/caption]