DIpil Das

Coresight Research x Fillogic: Not Your Regular Mall-Based Stores–Part Three

As part of efforts to provide customers with seamless shopping experiences and improve sales and profits, retailers are increasingly offering multichannel order-fulfillment options. Coresight Research has identified the sharpening of last-mile strategies as a key trend to watch in retail. Although services such as BOPIS (buy online, pick up in store), curbside pickup, ship to store and SFS are attractive to customers, there are many challenges for retailers in integrating these options into their existing business models. Third-party logistics providers support retailers in successfully implementing, and realizing the full benefits of, multichannel fulfillment services. We explore the opportunity that shipping from mall-based stores provides retailers in our three-part series entitled Not Your Regular Mall-Based Stores. In this report—the third and final in the series—we discuss the key challenges retailers face when incorporating online fulfillment capabilities, and present solutions to these challenges. We leverage findings from a June 2021 Coresight Research survey of 150 executives at US mall-based retailers. This report is sponsored by Fillogic, a logistics-as-a-service platform provider that converts underutilized space at retail centers into tech-enabled, micro distribution hubs.Solving for Online Fulfillment Challenges: In Detail

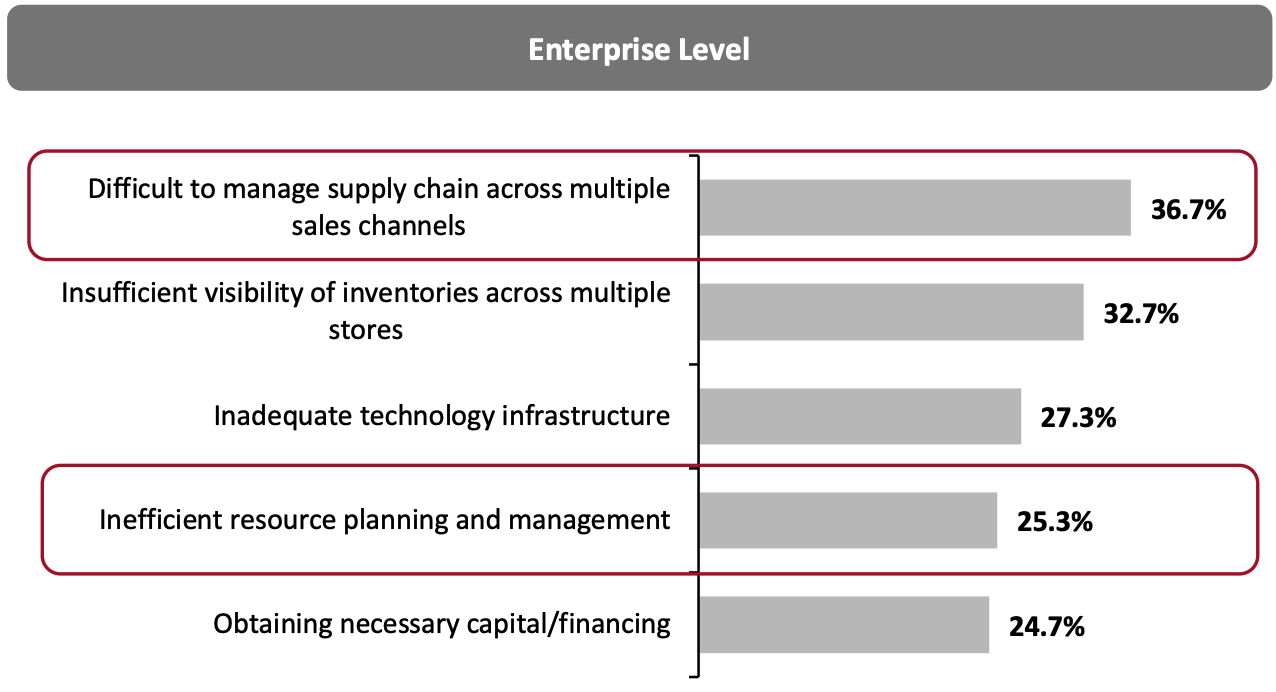

Fulfillment-Related Challenges at the Enterprise and Store Levels At an enterprise (organizational) level, more than one-third of mall-based retailers find it challenging to manage the supply chain across various sales channels when implementing and operating multiple fulfillment options—making it the topmost challenge, according to our proprietary survey (see Figure 1). At the store level, inefficient resource planning and management is the primary challenge for retailers in offering multiple fulfillment options, cited by 36.0% of survey respondents.Figure 1. Top Five Challenges Faced by Mall-Based Retailers in Implementing and Operating Multiple Fulfillment Options, at the Enterprise Level (Top) and Store Level (Bottom) (% of Respondents)

[caption id="attachment_134929" align="aligncenter" width="600"]

[caption id="attachment_134929" align="aligncenter" width="600"] Respondents were asked to select their top three challenges

Respondents were asked to select their top three challengesBase: 150 US mall-based retail executives

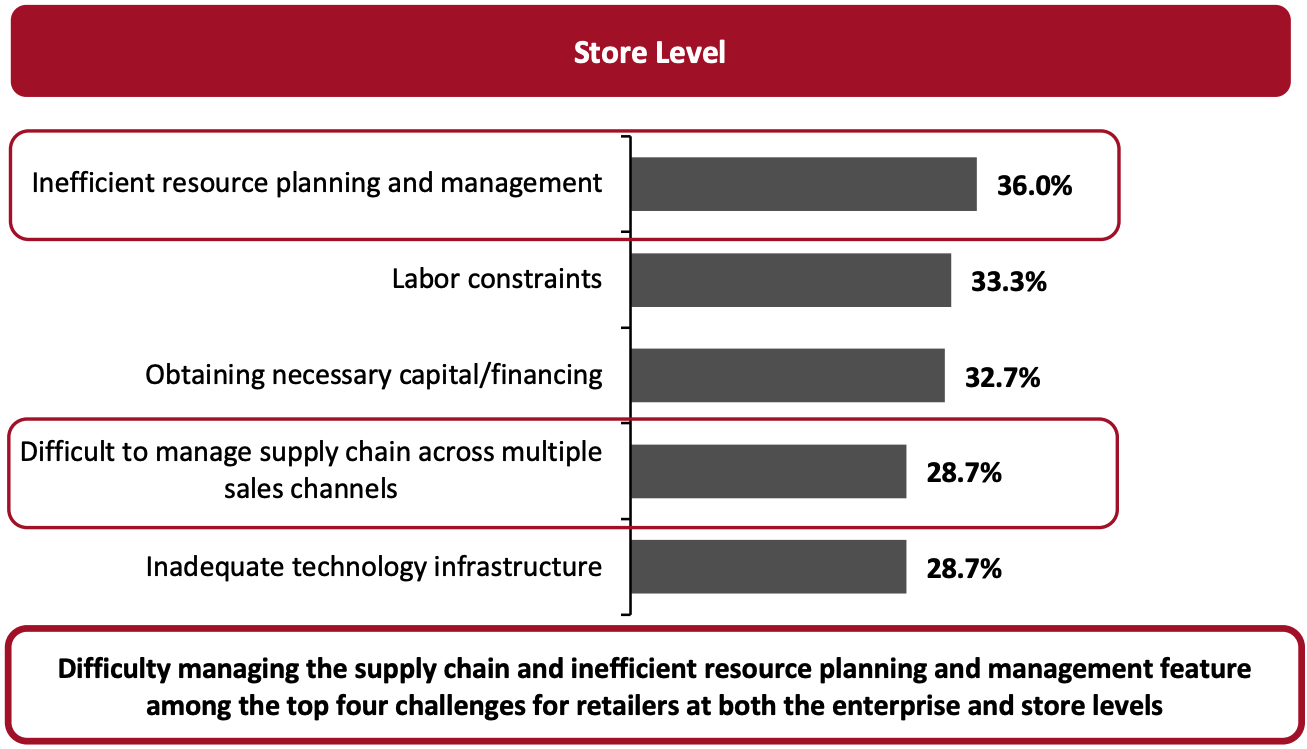

Source: Coresight Research[/caption] How Can Partnerships with Third-Party Logistics Providers Help? Partnering with third-party logistic providers can aid retailers in resource planning and supply chain management, enabling retailers to spend less time on e-commerce logistics and supply chain efficiency and more time on strategic business initiatives and enhancing their top line. According to our survey, 88.0% of respondents have partnered, are currently partnered with, or plan to partner with technology companies that offer retail and logistics services. Furthermore, 45.3% of mall-based retailers are focusing, or plan to focus, their logistics budget toward partnering with tech-enabled logistics service providers (see Figure 2).

Figure 2. Areas in Which Retailers Are Focusing, or Plan To Focus, Their Logistics Budget (% of Respondents) [caption id="attachment_134930" align="aligncenter" width="600"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 150 US mall-based retail executives

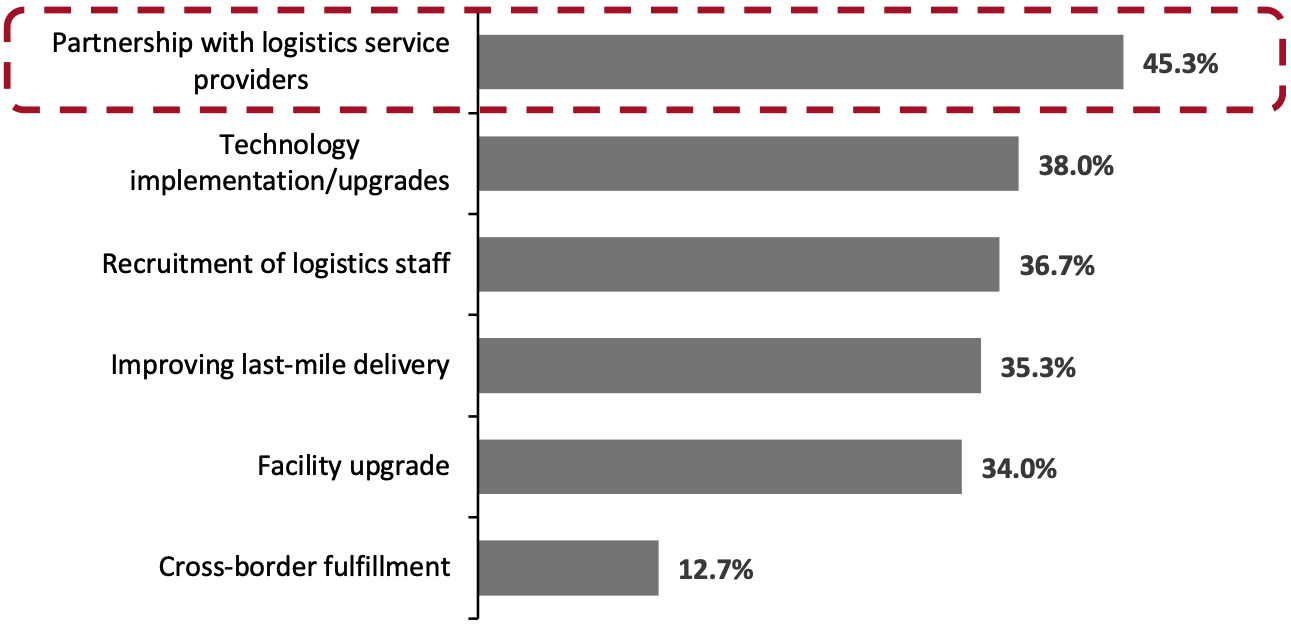

Source: Coresight Research[/caption] Product Returns When implementing online fulfillment strategies, additional challenges arise with product returns—and managing reverse logistics has put extra pressure on retailers during the pandemic-induced spike in e-commerce. According to Coresight Research’s proprietary survey data from March 2021, 42.4% of respondents returned unwanted products in the prior 12 months, with clothing being the most returned product category. (Read our separate report on US retail returns.) High levels of returns erode profitability at the product, store and enterprise levels. Negative returns experiences undermine the overall customer-retailer relationship and impact the lifetime value of a customer. Returns also incur high shipping, handling and processing costs—particularly in e-commerce. According to our June survey, nearly half of all mall-based retailers cited high costs as a key returns-related challenge—second only to difficulties in selling returned products, which also negatively impacts revenues (see Figure 3).

Figure 3. Product Returns: Top Five Challenges Faced by Retailers (% of Respondents) [caption id="attachment_134931" align="aligncenter" width="700"]

Respondents were asked to select their top three challenges

Respondents were asked to select their top three challengesBase: 150 US mall-based retail executives

Source: Coresight Research[/caption] Solutions To minimize the impacts of reverse logistics on revenues, retailers should make efforts to reduce product returns by helping consumers purchase products they will want to keep. For example, retailers should support shoppers in choosing clothing sizes: Customers are less likely to return clothing items that fit, and shoppers that are confident when making a purchase are also less likely to buy multiples of a product with the intention of returning those that don’t fit. Basic tools that can be used to boost consumer confidence in their purchases and thus reduce returns include consumer reviews, sizing guides and diverse imagery; global retailers have started displaying pictures with models of different skin tones and body types to give shoppers a better idea of how a product would look on them. However, technology can empower retailers to tackle high returns more effectively. Advanced tools use individuals’ past shopping behaviors to inform personalized product and sizing recommendations. Online retailers including Stitch Fix and Trunk Club have adopted artificial intelligence (AI)-driven clienteling tools to recommend the right products to their customers. Another way for retailers to solve reverse logistics issues is by partnering with post-purchase specialist solutions providers such as Fillogic, Narvar and Optoro, which can help simplify returns processes and improve retailers’ capabilities.

- Narvar, a US-based customer experience platform, partnered with Simon Property Group in November 2020 to enable customers to drop off returns from around two dozen retail brands (which are clients of Narvar) at a particular Simon Property Group location. Narvar also partnered with UPS in the same month, to enable no-label and cardboard-free returns at nearly 5,000 UPS store locations.

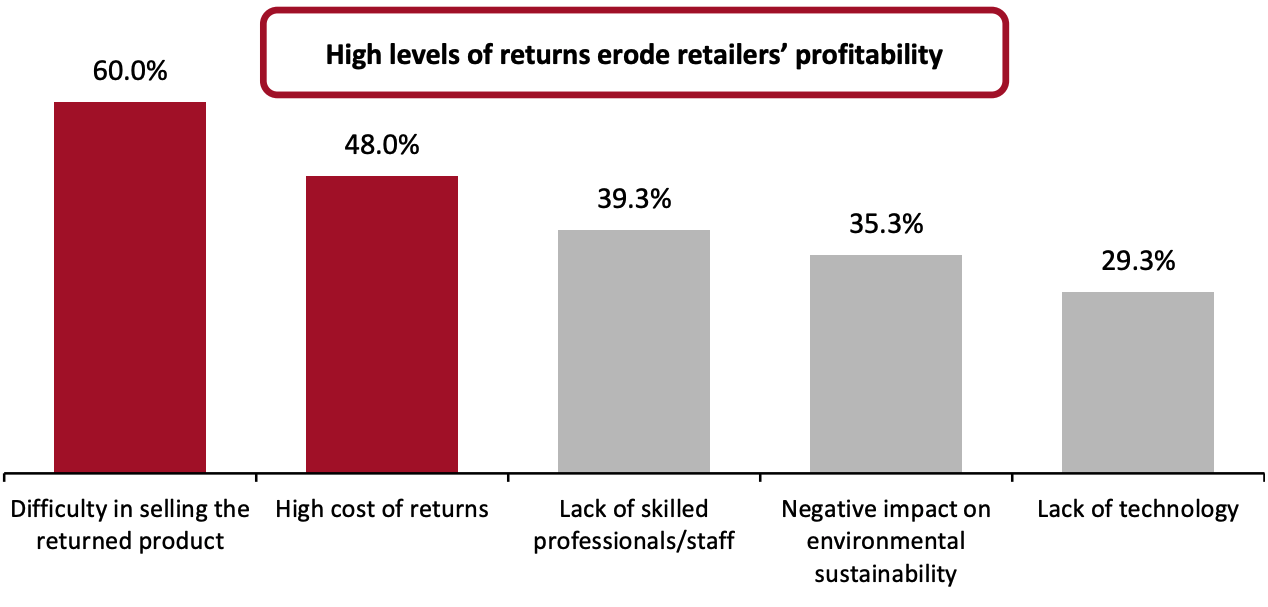

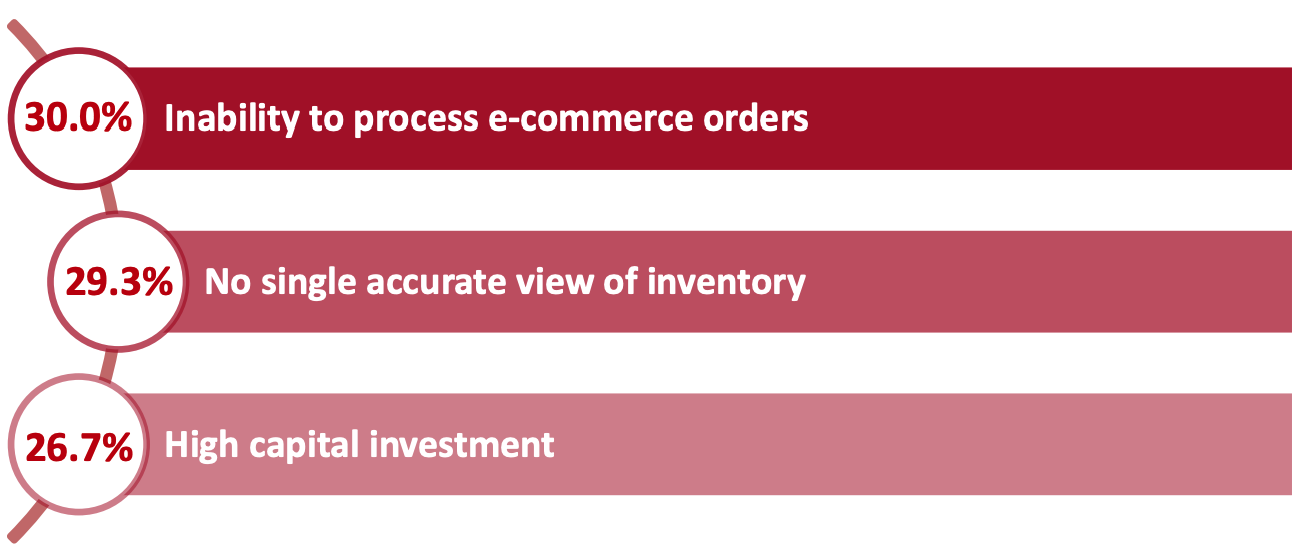

Figure 4. Top Three Challenges* Faced by Mall-Based Retailers in Operating SFS Fulfillment (% of Respondents) [caption id="attachment_134932" align="aligncenter" width="600"]

*Cited by the highest proportions of respondents as “very challenging”

*Cited by the highest proportions of respondents as “very challenging”Base: 150 executives at US mall-based retailers

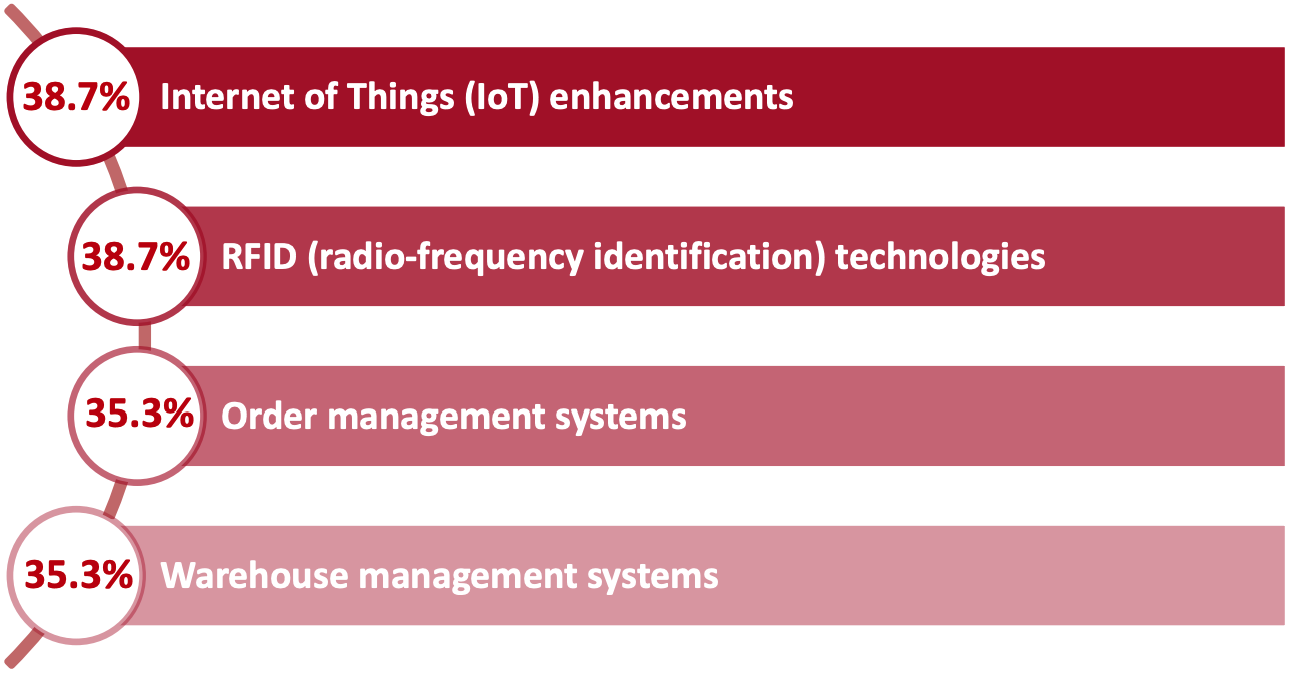

Source: Coresight Research[/caption] Inability to process e-commerce orders According to our survey results, 30.0% of mall-based retailers find it very challenging to process and handle e-commerce orders. Mall-based retail stores are not built to function as fulfillment centers; they are built for shopping, displaying merchandise and customer engagement—they have generally limited packing facilities. No single accurate view of inventory Businesses do not always have an accurate view of inventories, particularly when it is spread across retail stores and distribution centers. Without an accurate and real-time view of their inventory, retailers could lose sales by showing stockouts when stock might be available at a different location, overpromising to customers when stock is not available, and carrying excess safety stock to prevent stockouts. High capital investment When setting up the SFS model, retailers may incur significant upfront costs in modifying store layouts and investing in technologies to establish fulfillment capabilities. Solutions By partnering with third-party logistics service providers, mall-based retailers can achieve the accurate inventory visibility required to offer SFS, with real-time data and insights. A good inventory management system allows retailers to plan effectively to meet consumer demand and boost profits. Third-party logistics service providers also give retailers access to key advanced technologies that many of our survey respondents believe would help implement and enhance the SFS model, as shown in Figure 5.

Figure 5: Top Four Technology and Logistics Infrastructure Elements That Mall-Based Retailers Believe Would Make It Easier To Ship from Stores (% of Respondents) [caption id="attachment_134933" align="aligncenter" width="600"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 150 US mall-based retail executives

Source: Coresight Research[/caption] In addition, mall-based retailers can benefit from concierge services offered by malls, including delivery assistance and a centralized hub for order pickup and online returns. Mall owners are leveraging advanced technologies to offer a convenient shopping experience to customers and thus attract and retain foot traffic.

- Mall owner Simon Property Group has installed a concierge desk at some of its malls where customers can return orders from multiple retail brands (mall tenants), including Gap and Levi’s. Simon Property Group partnered with Fillogic in July 2020 to improve its delivery services. As part of the deal, the mall owner leverages Fillogic’s on-site staff, logistics infrastructure and proprietary technology. Simon Property Group launched technology-enabled micro-distribution hubs using technology from Fillogic at Gloucester Premium Outlets, an outlet mall in New Jersey, US.