Nitheesh NH

Coresight Research x Fillogic: Not Your Regular Mall-Based Stores—Part One

During the Covid-19 pandemic, retail stores in malls witnessed steep brick-and-mortar sales declines that led to a build-up of excess inventory. Many retailers have been seeking out new ways to improve their top line by offering multichannel fulfillment options to customers—including BOPIS (buy online, pick up in store), curbside pickup, ship to store and ship from store (SFS). Leveraging their mall-based stores to fulfill online orders presents huge opportunity for retailers to reduce store-based inventories, manage reverse logistics, meet consumer demand more efficiently and thus improve their top and bottom line. We explore this opportunity in our three-part series entitled “Not Your Regular Mall-Based Stores.” In this report—the first in the series—we discuss the need for retailers to expand their fulfillment capabilities in the current environment and key considerations in the adoption of alternative fulfillment methods, with a focus on SFS. We leverage findings from a June 2021 Coresight Research survey of 150 executives at US mall-based retailers. This report is sponsored by Fillogic, a logistics-as-a-service platform provider that converts underutilized space at retail centers into tech-enabled, micro distribution hubs.Ship from Store Presents a Profitable Online Order-Fulfillment Opportunity: In Detail

The Sudden Surge in E-Commerce Remains a Pain Point for Retailers The US retail industry is slowly recovering from the heavy impacts of the Covid-19 pandemic. Our June 2021 survey found that the sudden surge in e-commerce last year remains the top pandemic-related challenge for mall-based retailers, cited by more than half of all respondents (51.3%). According to Coresight Research analysis of Census Bureau data, US online retail sales increased by 33.2% year over year in 2020, to $713 billion. This growth was against a backdrop of declining overall sales in many retail markets. For example, we estimate that the US clothing and footwear market experienced 27.2% e-commerce growth in 2020 compared to 2019, but the total apparel market declined by 12.2% during the same period. Many retailers were unable to adapt to the consumer shift to e-commerce. The pandemic-led dramatic footfall and sales declines in the brick-and-mortar channel have been particularly damaging for retailers that previously relied on physical stores, with numerous major retailers having filed for bankruptcy since the outbreak of Covid-19 in March 2020—including Ascena Retail Group, Brooks Brothers, GNC, JCPenney, Lord & Taylor and Neiman Marcus. In our recent survey, 42.0% of respondents cited the footfall declines at physical stores as a key challenge. The sudden surge in online shopping has also added strain on last-mile logistics, with capacity constraints presenting challenges alongside rising consumer demand for free and fast delivery. Furthermore, consumers are increasingly seeking integrated and seamless journeys when shopping across channels with the same retailer—covering both online and offline channels, mail order, social commerce and more. Among our survey respondents, 45.3% cited rising consumer demand for a multichannel shopping experience as a key pandemic-induced challenge. Pent-up demand and inflationary pricing are fueling e-commerce growth this year: We estimate that US online retail sales will increase by 11.0% in 2021, to $791 billion. Retailers therefore need to continue to overcome challenges in balancing e-commerce and brick-and-mortar operations.Figure 1. Top Three Pandemic-Induced Challenges Faced by US Mall-Based Retailers (% of Respondents) [caption id="attachment_131710" align="aligncenter" width="700"]

Base: 150 executives at US mall-based retailers

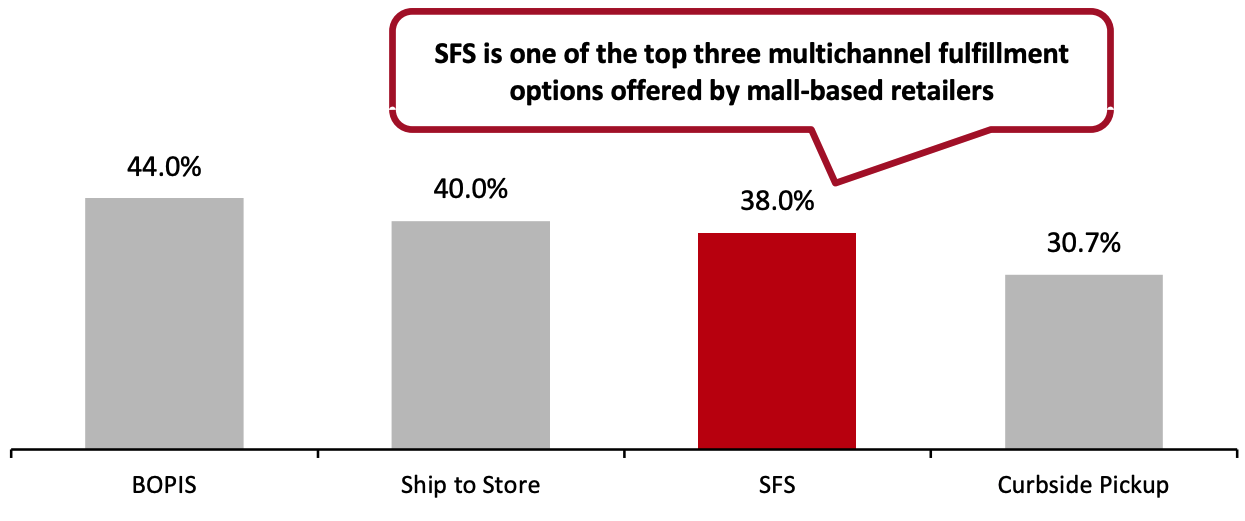

Base: 150 executives at US mall-based retailersSource: Coresight Research[/caption] Multichannel Fulfillment Options: The Rise of Ship from Store Multichannel fulfillment is the method through which retailers and brands sell their items through various channels. Options include BOPIS, ship to store, curbside pickup and SFS. The Covid-19 outbreak prompted a surge in popularity of these services in 2020, as consumers demanded convenience while being reluctant to visit stores. Our survey found that 77.3% of US mall-based retailers offer multichannel fulfillment options to customers. We focus here on SFS, which is among the top three multichannel fulfillment options offered by US mall-based retailers, according to our survey (see Figure 2).

Figure 2. Multichannel Fulfillment Options Offered by US Mall-Based Retailers (% of Respondents) [caption id="attachment_131711" align="aligncenter" width="700"]

Base: 150 executives at US mall-based retailers

Base: 150 executives at US mall-based retailersSource: Coresight Research[/caption]

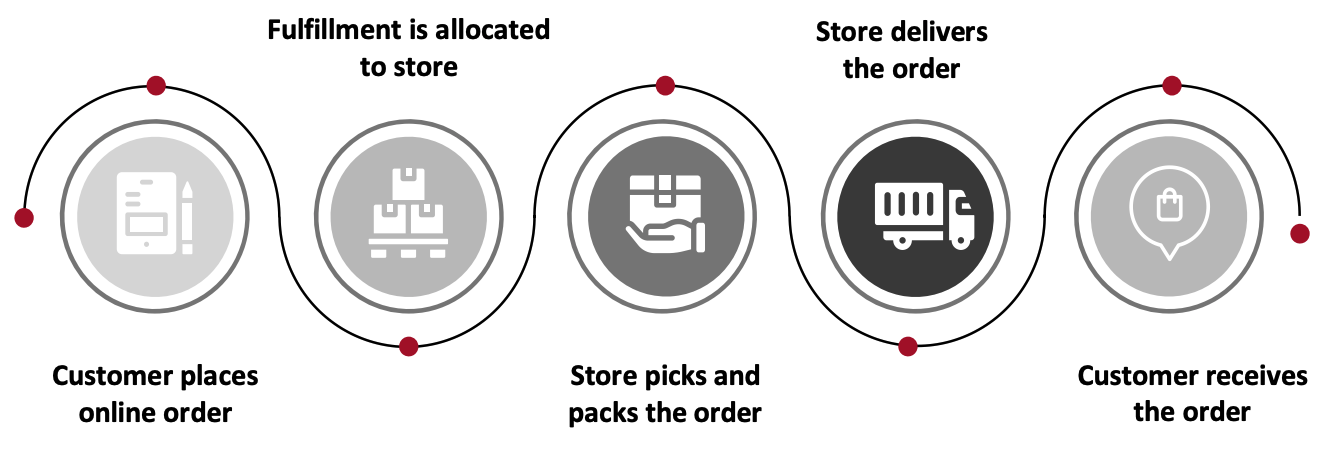

Figure 3. The SFS Fulfillment Model [caption id="attachment_131712" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

SFS is gaining traction among retailers: Apple, Bed, Bath & Beyond, Best Buy, Target and Walmart have implemented the SFS fulfillment model, for example.

Source: Coresight Research[/caption]

SFS is gaining traction among retailers: Apple, Bed, Bath & Beyond, Best Buy, Target and Walmart have implemented the SFS fulfillment model, for example.

- According to Bed Bath & Beyond, it shipped nearly 40% of its e-commerce orders from stores across the US and Canada in the second quarter of 2020.

- Best Buy piloted the SFS model in September 2020 and started shipping online orders from its 250 stores in the US. Later, the company decided to add 90 more stores to the program. According to Corie Barry, CEO of Best Buy, “All [of the retailer’s] stores will continue to ship online orders, but these locations are positioned to ship out significantly more volume and utilize dedicated labor aimed at fulfilling orders originating online. These locations required minimal capital investment, as we had the technology in place, and were chosen due to their available warehouse space and proximity to carrier partners.”

- Target fulfilled 95% of its online orders from stores in 2020, according to the company. Michael Fiddelke, Chief Financial Officer at Target, said, “Target would prefer to seize on nearby real estate opportunities and open an additional store rather than turn to an alternative fulfillment option. Everything is cheaper when it comes to store.”

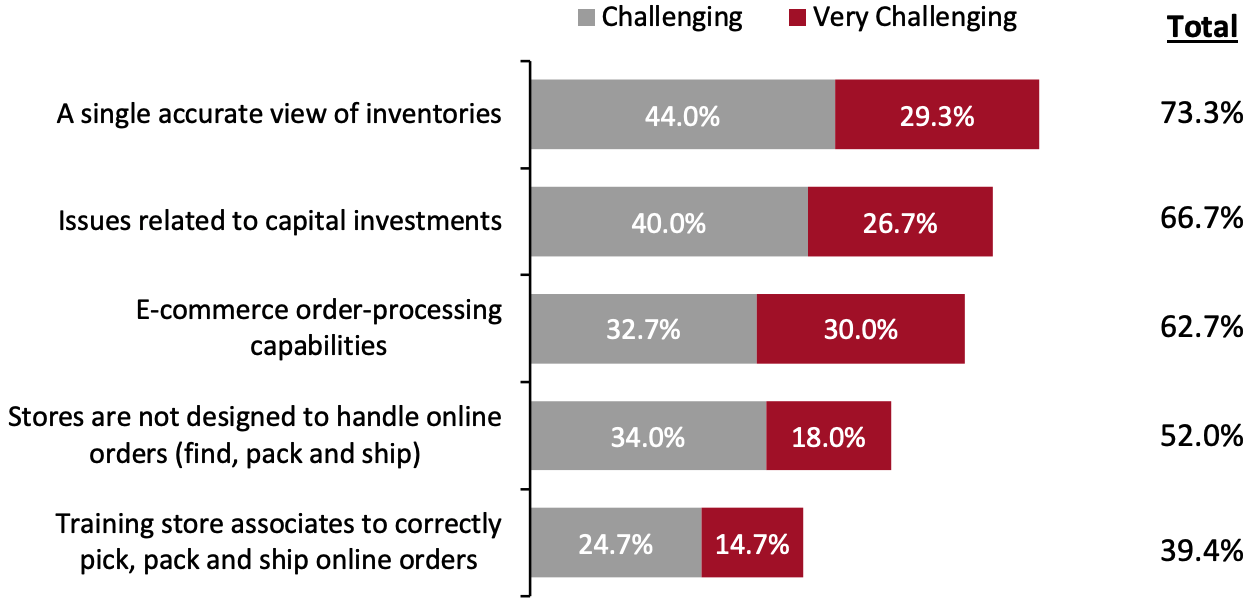

Figure 4. Perceived Challenges Faced by Mall-Based Retailers in Operating SFS Fulfillment (% of Respondents) [caption id="attachment_131713" align="aligncenter" width="700"]

Base: 150 executives at US mall-based retailers

Base: 150 executives at US mall-based retailersSource: Coresight Research[/caption] The mall-based retail ecosystem simply was not designed to fulfill online orders. Mall-based retailers find it challenging to implement this fulfillment option, and more often, they need the assistance of logistics and solutions service providers. Retail real estate owners and logistics providers are also faced with challenges in this space. We present the major challenges across the mall-based retail ecosystem in the figure below.

Figure 5. Challenges Faced by the Mall-Based Retail Ecosystem [caption id="attachment_131714" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]