albert Chan

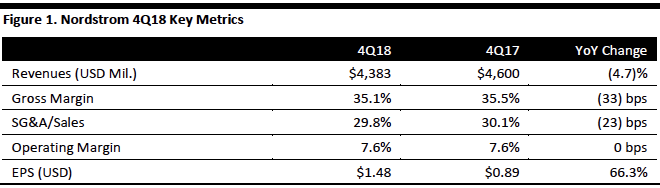

[caption id="attachment_79074" align="aligncenter" width="660"] Source: Company reports/Coresight Research; quarter ended February 2, 2019[/caption]

4Q18 Results

Nordstrom reported 4Q18 EPS of $1.48, beating the consensus estimate of $1.42, up 66.3% year-over-year.

Total revenues, which includes $101 million of credit card revenues, declined 4.7% to $4.5 billion, missing the consensus estimate of $4.6 billion. $2.98 billion came from the full-price division and $1.39 billion came from off-price, both lower than last year’s $3.27 billion and $1.43 billion, respectively. Digital sales grew 16%, representing 30% of net sales.

Comp sales increased 0.1%, below the consensus estimate of 1.2%. Comps in full-price declined 1.6%, missing the consensus estimate of 0.2%, reflecting broad-based declines across most categories except shoes. Off-price comps increased 4%, in line with company’s expectations and beating the consensus estimate of 3.8%.

Gross margin was 35.1%, down 33 bps year-over-year, missing the consensus estimate of 35.7%. The company took higher markdowns due to a softer full-price trend and in response to an elevated promotional environment. Ending inventory decreased 2.4% from last year.

SG&A as a percentage of net sales decreased 23 bps to 29.8%, mainly driven by a one-time employee investment of $16 million associated with last year’s tax reform.

Operating margin was flat at 7.6%, reflecting the modest gross margin contraction offset by SG&A expense leverage.

In fiscal 2019, the company is opening two full-price stores, one in New York and one in Connecticut, and five off-price stores with two in California, one in Colorado, one in Maryland and one in New York.

FY18 Results

Total revenues reported were $15.9 billion, up 2.3% from last year.

Credit card revenues increased 11.4% to $380 million.

Comps for full-price increased 0.9% and for off-price increased 3.5%.

EPS increased 28.2% to $3.32.

Outlook

Nordstrom’s strategy centers around three strategic objectives: continuing market share gain, improving profitability and returns, and maintaining disciplined capital allocation.

The company provided guidance for FY19:

Source: Company reports/Coresight Research; quarter ended February 2, 2019[/caption]

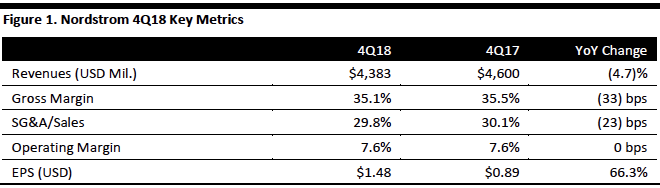

4Q18 Results

Nordstrom reported 4Q18 EPS of $1.48, beating the consensus estimate of $1.42, up 66.3% year-over-year.

Total revenues, which includes $101 million of credit card revenues, declined 4.7% to $4.5 billion, missing the consensus estimate of $4.6 billion. $2.98 billion came from the full-price division and $1.39 billion came from off-price, both lower than last year’s $3.27 billion and $1.43 billion, respectively. Digital sales grew 16%, representing 30% of net sales.

Comp sales increased 0.1%, below the consensus estimate of 1.2%. Comps in full-price declined 1.6%, missing the consensus estimate of 0.2%, reflecting broad-based declines across most categories except shoes. Off-price comps increased 4%, in line with company’s expectations and beating the consensus estimate of 3.8%.

Gross margin was 35.1%, down 33 bps year-over-year, missing the consensus estimate of 35.7%. The company took higher markdowns due to a softer full-price trend and in response to an elevated promotional environment. Ending inventory decreased 2.4% from last year.

SG&A as a percentage of net sales decreased 23 bps to 29.8%, mainly driven by a one-time employee investment of $16 million associated with last year’s tax reform.

Operating margin was flat at 7.6%, reflecting the modest gross margin contraction offset by SG&A expense leverage.

In fiscal 2019, the company is opening two full-price stores, one in New York and one in Connecticut, and five off-price stores with two in California, one in Colorado, one in Maryland and one in New York.

FY18 Results

Total revenues reported were $15.9 billion, up 2.3% from last year.

Credit card revenues increased 11.4% to $380 million.

Comps for full-price increased 0.9% and for off-price increased 3.5%.

EPS increased 28.2% to $3.32.

Outlook

Nordstrom’s strategy centers around three strategic objectives: continuing market share gain, improving profitability and returns, and maintaining disciplined capital allocation.

The company provided guidance for FY19:

Source: Company reports/Coresight Research; quarter ended February 2, 2019[/caption]

4Q18 Results

Nordstrom reported 4Q18 EPS of $1.48, beating the consensus estimate of $1.42, up 66.3% year-over-year.

Total revenues, which includes $101 million of credit card revenues, declined 4.7% to $4.5 billion, missing the consensus estimate of $4.6 billion. $2.98 billion came from the full-price division and $1.39 billion came from off-price, both lower than last year’s $3.27 billion and $1.43 billion, respectively. Digital sales grew 16%, representing 30% of net sales.

Comp sales increased 0.1%, below the consensus estimate of 1.2%. Comps in full-price declined 1.6%, missing the consensus estimate of 0.2%, reflecting broad-based declines across most categories except shoes. Off-price comps increased 4%, in line with company’s expectations and beating the consensus estimate of 3.8%.

Gross margin was 35.1%, down 33 bps year-over-year, missing the consensus estimate of 35.7%. The company took higher markdowns due to a softer full-price trend and in response to an elevated promotional environment. Ending inventory decreased 2.4% from last year.

SG&A as a percentage of net sales decreased 23 bps to 29.8%, mainly driven by a one-time employee investment of $16 million associated with last year’s tax reform.

Operating margin was flat at 7.6%, reflecting the modest gross margin contraction offset by SG&A expense leverage.

In fiscal 2019, the company is opening two full-price stores, one in New York and one in Connecticut, and five off-price stores with two in California, one in Colorado, one in Maryland and one in New York.

FY18 Results

Total revenues reported were $15.9 billion, up 2.3% from last year.

Credit card revenues increased 11.4% to $380 million.

Comps for full-price increased 0.9% and for off-price increased 3.5%.

EPS increased 28.2% to $3.32.

Outlook

Nordstrom’s strategy centers around three strategic objectives: continuing market share gain, improving profitability and returns, and maintaining disciplined capital allocation.

The company provided guidance for FY19:

Source: Company reports/Coresight Research; quarter ended February 2, 2019[/caption]

4Q18 Results

Nordstrom reported 4Q18 EPS of $1.48, beating the consensus estimate of $1.42, up 66.3% year-over-year.

Total revenues, which includes $101 million of credit card revenues, declined 4.7% to $4.5 billion, missing the consensus estimate of $4.6 billion. $2.98 billion came from the full-price division and $1.39 billion came from off-price, both lower than last year’s $3.27 billion and $1.43 billion, respectively. Digital sales grew 16%, representing 30% of net sales.

Comp sales increased 0.1%, below the consensus estimate of 1.2%. Comps in full-price declined 1.6%, missing the consensus estimate of 0.2%, reflecting broad-based declines across most categories except shoes. Off-price comps increased 4%, in line with company’s expectations and beating the consensus estimate of 3.8%.

Gross margin was 35.1%, down 33 bps year-over-year, missing the consensus estimate of 35.7%. The company took higher markdowns due to a softer full-price trend and in response to an elevated promotional environment. Ending inventory decreased 2.4% from last year.

SG&A as a percentage of net sales decreased 23 bps to 29.8%, mainly driven by a one-time employee investment of $16 million associated with last year’s tax reform.

Operating margin was flat at 7.6%, reflecting the modest gross margin contraction offset by SG&A expense leverage.

In fiscal 2019, the company is opening two full-price stores, one in New York and one in Connecticut, and five off-price stores with two in California, one in Colorado, one in Maryland and one in New York.

FY18 Results

Total revenues reported were $15.9 billion, up 2.3% from last year.

Credit card revenues increased 11.4% to $380 million.

Comps for full-price increased 0.9% and for off-price increased 3.5%.

EPS increased 28.2% to $3.32.

Outlook

Nordstrom’s strategy centers around three strategic objectives: continuing market share gain, improving profitability and returns, and maintaining disciplined capital allocation.

The company provided guidance for FY19:

- • Net sales growth of 1 to 2%, approximately $15.6 billion to $15.8 billion.

- • Credit card revenues growth of mid to high single-digits.

- • EBIT from $915 to $970 million.

- • EBIT margin between 5.9% and 6.1%.

- • EPS between $3.65 to $3.90.

- • $900 million CapEx or around 6% of sales, with 50% for technology and supply chain, and 30% for the women’s New York Flagship store opening in late October.