DIpil Das

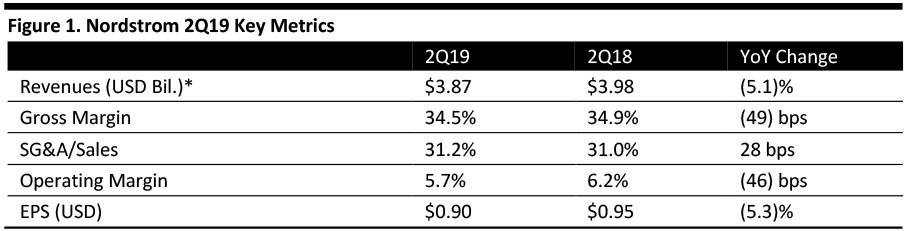

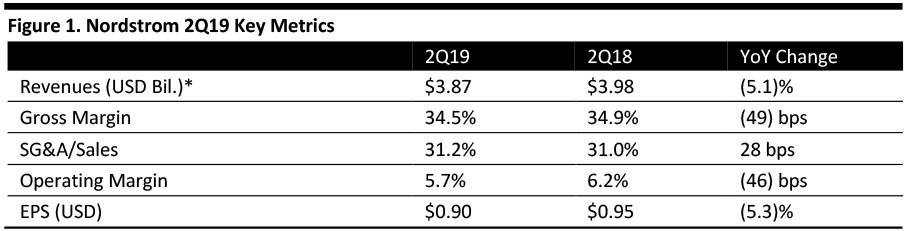

[caption id="attachment_95015" align="aligncenter" width="700"] *Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales

*Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales

Source: Company reports/Coresight Research [/caption] 2Q19 Results Nordstrom reported 2Q19 revenues of $3.87 billion, down 5.1% year over year and below the consensus estimate of $3.92 billion. The company’s EPS declined 5.3% year over year to $0.90, beating the consensus estimate of $0.76. By category, full-price business sales declined 5.1% year over year versus the market expectation of a 2.2% decrease, reflecting broad-based declines across most categories. Off-price business sales decreased 0.6%, missing the consensus estimate of a 3.4% increase. The company reported on two drivers of its business performance: (1) its anniversary sale at full-price locations and online, and (2) its off-price business. The annual anniversary sale offers new arrivals at reduced prices for a limited time. The anniversary sale has three objectives: increase customer satisfaction, drive sales and improve the economics of the event. The sale was consistent with current market trends but that sales were softer than expected overall. Management added that the sale was concentrated around key items, but it did not have enough depth due to disproportionate demand around its top brands. It ran out faster than anticipated of top items. In off-price, management said sales fell short of expectations. The company will increase the number of flash events to drive traffic to Nordstrom Rack and HauteLook in the second half of the year. The company reported that more than one-third of Nordstrom customers who place an online order had previously visited the store to help inform the purchase. Its business is concentrated in top markets, and its top 10 markets account for 60% of sales. Based on success in its largest market, Los Angeles, Nordstrom will expand its local market strategy. Nordstrom Local stores do not hold inventory, but offer services including alterations, pickup of online orders, return orders, and some stores offer spa services. Management reported that its local market strategy delivers customers who spend 2.5 times more than in store, that 30% of order pickups and alterations increased by more than 10% and product returns come in eight days faster, driving greater inventory efficiencies. Nordstrom ended the first quarter with 381 total stores compared to 372 stores in the same quarter last year. Nordstrom is expanding its local market strategy to New York City, its largest market for online sales, with the opening of a flagship store on October 24 and two Nordstrom Local neighborhood hubs in September 2019. The Nordstrom loyalty program grew to 12 million active customers, increasing 12% over last year and making up 64% of the company’s second quarter sales. Outlook The company lowered its 2019 guidance and now expects a net sales decline of 2%, versus the prior guidance of a net sales decline of 2% to flat. Nordstrom lowered the top end of EPS guidance from $3.65 to $3.50, for a guidance range of $3.25 to $3.50, compared to the consensus of $3.26.

*Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales

*Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales Source: Company reports/Coresight Research [/caption] 2Q19 Results Nordstrom reported 2Q19 revenues of $3.87 billion, down 5.1% year over year and below the consensus estimate of $3.92 billion. The company’s EPS declined 5.3% year over year to $0.90, beating the consensus estimate of $0.76. By category, full-price business sales declined 5.1% year over year versus the market expectation of a 2.2% decrease, reflecting broad-based declines across most categories. Off-price business sales decreased 0.6%, missing the consensus estimate of a 3.4% increase. The company reported on two drivers of its business performance: (1) its anniversary sale at full-price locations and online, and (2) its off-price business. The annual anniversary sale offers new arrivals at reduced prices for a limited time. The anniversary sale has three objectives: increase customer satisfaction, drive sales and improve the economics of the event. The sale was consistent with current market trends but that sales were softer than expected overall. Management added that the sale was concentrated around key items, but it did not have enough depth due to disproportionate demand around its top brands. It ran out faster than anticipated of top items. In off-price, management said sales fell short of expectations. The company will increase the number of flash events to drive traffic to Nordstrom Rack and HauteLook in the second half of the year. The company reported that more than one-third of Nordstrom customers who place an online order had previously visited the store to help inform the purchase. Its business is concentrated in top markets, and its top 10 markets account for 60% of sales. Based on success in its largest market, Los Angeles, Nordstrom will expand its local market strategy. Nordstrom Local stores do not hold inventory, but offer services including alterations, pickup of online orders, return orders, and some stores offer spa services. Management reported that its local market strategy delivers customers who spend 2.5 times more than in store, that 30% of order pickups and alterations increased by more than 10% and product returns come in eight days faster, driving greater inventory efficiencies. Nordstrom ended the first quarter with 381 total stores compared to 372 stores in the same quarter last year. Nordstrom is expanding its local market strategy to New York City, its largest market for online sales, with the opening of a flagship store on October 24 and two Nordstrom Local neighborhood hubs in September 2019. The Nordstrom loyalty program grew to 12 million active customers, increasing 12% over last year and making up 64% of the company’s second quarter sales. Outlook The company lowered its 2019 guidance and now expects a net sales decline of 2%, versus the prior guidance of a net sales decline of 2% to flat. Nordstrom lowered the top end of EPS guidance from $3.65 to $3.50, for a guidance range of $3.25 to $3.50, compared to the consensus of $3.26.