Nitheesh NH

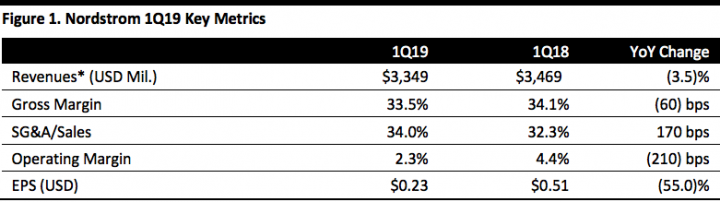

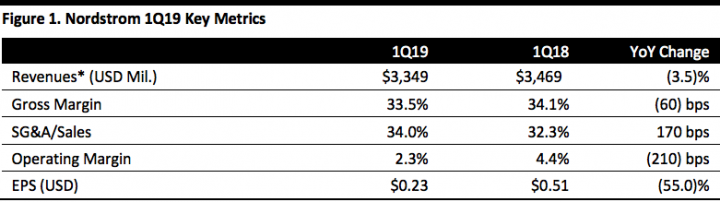

[caption id="attachment_89392" align="aligncenter" width="720"] *Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales

*Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales

Source: Company reports/Coresight Research[/caption] 1Q19 Results Nordstrom’s fiscal 1Q19 net sales declined 3.5% year over year to $3.3 billion, below the consensus estimate of $3.5 billion. EPS of $0.23 substantially missed the consensus estimate of $0.43. The softer top and bottom line performances were due mainly to three company-specific factors: misexecution in the rollout of the new “Nordy Club” loyalty program; a reduction in digital marketing spend (on expectation that the loyalty program would offset it); and, merchandise assortment issues, especially related to women’s apparel, such as fashion and beauty. By category, full-price business sales declined 5.1% year over year versus the market expectation of a 2.2% decrease, reflecting broad-based declines across most categories. Off-price business sales decreased 0.6%, missing the consensus estimate of a 3.4% increase. Digital sales grew 7% year over year in the quarter, and accounted for 31% of sales, compared to 28% for the same period last year. Nordstrom reported robust growth in digital sales and store traffic in the Los Angeles market. Gross margin was 33.5%, down 60 bps year-over-year as the company took higher markdowns to realign inventory to sales trends and deleverage on occupancy expense. Ending inventory declined 5.3% year over year. SG&A as a percent of net sales increased 170 bps to 34.0% owing to deleveraging of fixed expenses on lower sales volume. Operating margin declined 210 bps to 2.3%, reflecting the gross margin contraction and rise in SG&A expense. Nordstrom ended the first quarter with 380 total stores compared to 373 stores in the same quarter last year. The company currently operates 137 full-price stores and 243 off-price stores. Year to date, the company opened three stores, closed two stores and relocated one. The company remained on track to expand its presence in New York City with the opening of its first department store for women in October 2019. Nordstrom also plans to open two Nordstrom Local neighborhood hubs this fall. Management said the company is approaching the end of its heavy generational investment cycle in fiscal 2019 and expects its Nordstromrack.com/HauteLook, Trunk Club, Canada and New York City businesses to expand scale and contribute to top-line and bottom-line growth this year. Over the past couple of years, Nordstrom has been focusing on cost-containment efforts and is on track to achieve savings of $150 to $200 million in fiscal 2019. Outlook Nordstrom’s strategy centers around three objectives: continuing market share gain, improving profitability and returns and maintaining disciplined capital allocation. The company lowered its guidance for FY19 and now projects:

*Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net sales

*Net sales, excluding credit card revenues, as the company presents its profitability metrics as a % of net salesSource: Company reports/Coresight Research[/caption] 1Q19 Results Nordstrom’s fiscal 1Q19 net sales declined 3.5% year over year to $3.3 billion, below the consensus estimate of $3.5 billion. EPS of $0.23 substantially missed the consensus estimate of $0.43. The softer top and bottom line performances were due mainly to three company-specific factors: misexecution in the rollout of the new “Nordy Club” loyalty program; a reduction in digital marketing spend (on expectation that the loyalty program would offset it); and, merchandise assortment issues, especially related to women’s apparel, such as fashion and beauty. By category, full-price business sales declined 5.1% year over year versus the market expectation of a 2.2% decrease, reflecting broad-based declines across most categories. Off-price business sales decreased 0.6%, missing the consensus estimate of a 3.4% increase. Digital sales grew 7% year over year in the quarter, and accounted for 31% of sales, compared to 28% for the same period last year. Nordstrom reported robust growth in digital sales and store traffic in the Los Angeles market. Gross margin was 33.5%, down 60 bps year-over-year as the company took higher markdowns to realign inventory to sales trends and deleverage on occupancy expense. Ending inventory declined 5.3% year over year. SG&A as a percent of net sales increased 170 bps to 34.0% owing to deleveraging of fixed expenses on lower sales volume. Operating margin declined 210 bps to 2.3%, reflecting the gross margin contraction and rise in SG&A expense. Nordstrom ended the first quarter with 380 total stores compared to 373 stores in the same quarter last year. The company currently operates 137 full-price stores and 243 off-price stores. Year to date, the company opened three stores, closed two stores and relocated one. The company remained on track to expand its presence in New York City with the opening of its first department store for women in October 2019. Nordstrom also plans to open two Nordstrom Local neighborhood hubs this fall. Management said the company is approaching the end of its heavy generational investment cycle in fiscal 2019 and expects its Nordstromrack.com/HauteLook, Trunk Club, Canada and New York City businesses to expand scale and contribute to top-line and bottom-line growth this year. Over the past couple of years, Nordstrom has been focusing on cost-containment efforts and is on track to achieve savings of $150 to $200 million in fiscal 2019. Outlook Nordstrom’s strategy centers around three objectives: continuing market share gain, improving profitability and returns and maintaining disciplined capital allocation. The company lowered its guidance for FY19 and now projects:

- Net sales decline of 2% to flat versus prior guidance of an increase of 1–2%.

- Credit card revenues growth of low to mid-single-digit versus prior mid to high single-digit growth guidance.

- EBIT margin between 5.3% and 5.8% versus the previous guidance of 5.9–6.1%.

- EPS of $3.25–3.65 compared to previous guidance of $3.65–3.90.