Source: Company reports/Fung Global Retail & Technology

4Q16 Results

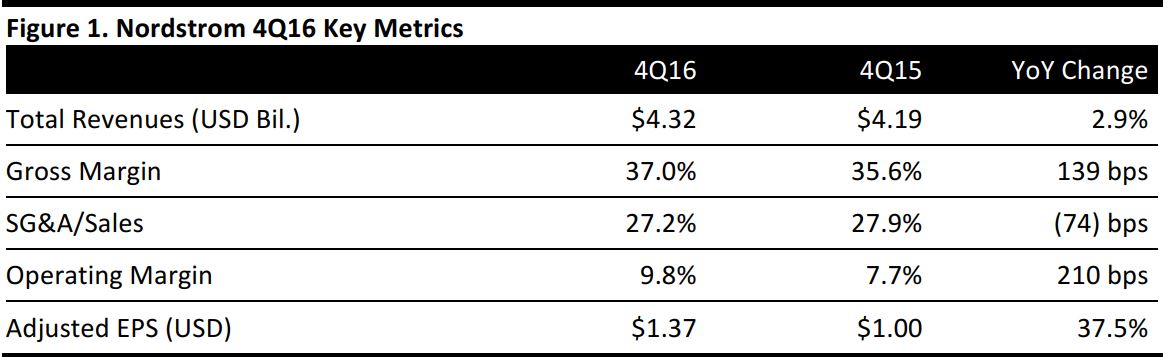

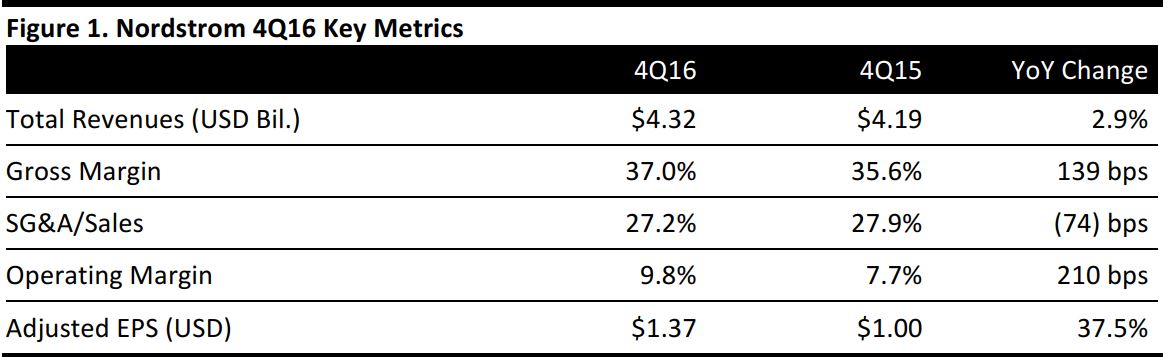

Nordstrom reported 4Q16 total revenues of $4.32 billion, up 2.9% year over year and slightly below the consensus estimate. Net sales (excluding credit card revenues) increased by 2.4%. Comps decreased by 0.9%.

Adjusted EPS was $1.37, versus $1.00 in the year-ago quarter and beating the consensus estimate of $1.15. GAAP EPS was $1.15, which includes the tax effect of the Trunk Club goodwill impairment. Both figures include a $0.10 per share nonoperational gain.

Performance by Segment

- For the Nordstrom brand, which includes sales from US and Canada full-line stores and Nordstrom.com, net sales (combined with Trunk Club) decreased by 1.1%, and comps decreased by 2.7%. Top-performing categories were women’s apparel and beauty. The women’s apparel departments focused on younger customers continued to outperform. The East was the top-performing geographic region.

- For the Nordstrom Rack brand, which consists of Nordstrom Rack stores and Nordstromrack.com/HauteLook.com, net sales increased by 10.7% and comps increased by 4.3%. As with the Nordstrom brand, the East was the top-performing geographic region in the quarter.

FY16 Results

Full-year 2016 total revenues were $14.76 billion, up 2.2% from the prior year. Net sales of $14.5 billion were up 2.9% compared with the prior year. Total comps for the fiscal year decreased by 0.4%.

Excluding the Trunk Club impairment charge, adjusted EPS was $3.14, above guidance of $2.85–$2.95. GAAP EPS was $2.02, compared with $3.15 the prior year.

Management cited several accomplishments in the fiscal year, including:

- Continued expansion into Canada, for a total of five full-line stores, including two Toronto stores that opened in fall 2016 and contributed $300 million in total sales.

- com hitting more than $2.5 billion in sales, representing approximately 25% of full-price sales.

- Nordstrom Rack sales growing by 11%, to $4.5 billion, driven by 21 new store openings and 32% online growth. Nordstromrack.com/HauteLook.com revenue reached $700 million, representing more than 15% percent of off-price sales.

- The number of active Nordstrom Rewards customers increased by 56%, to 7.8 million, and Nordstrom Rewards customer purchases represented 44% of sales.

Outlook

For FY17, the company expects the following:

- A 3%–4% increase in net sales (the consensus estimate of $14.79 billion calls for 4.4% growth).

- Flat comps.

- EPS of $2.75–$3.00, below the $3.07 consensus estimate.

Nordstrom plans to open one new full-line store and 15 new Nordstrom Rack stores, and to relocate two full-line stores and one Nordstrom Rack store in FY17.