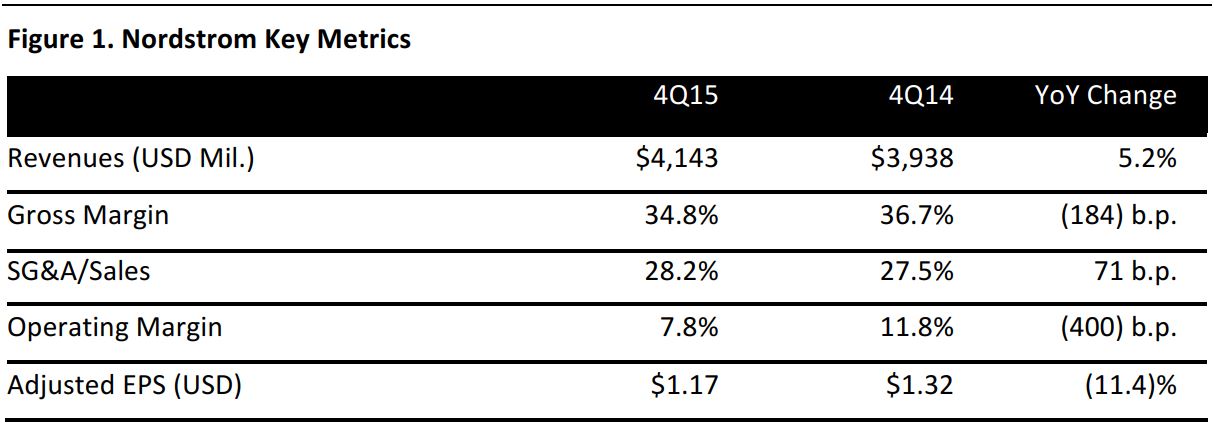

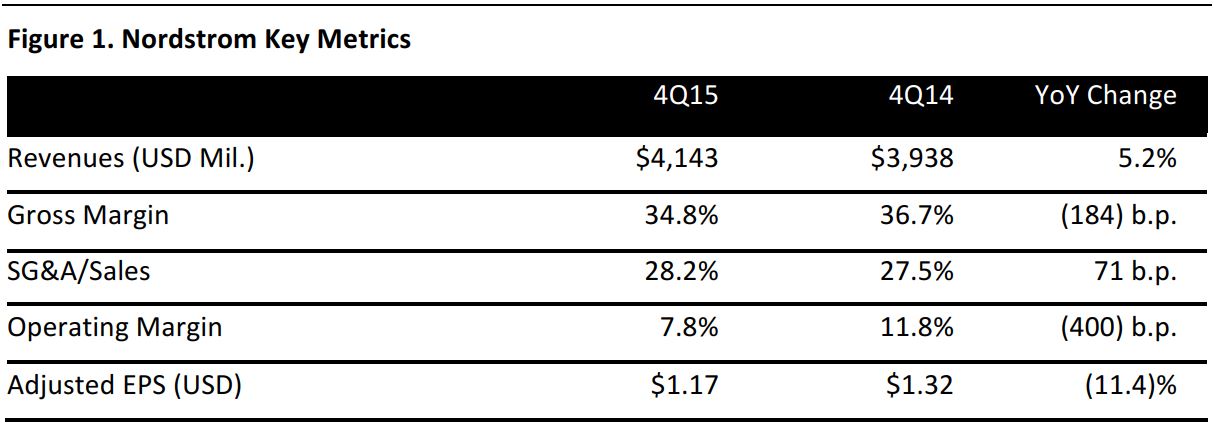

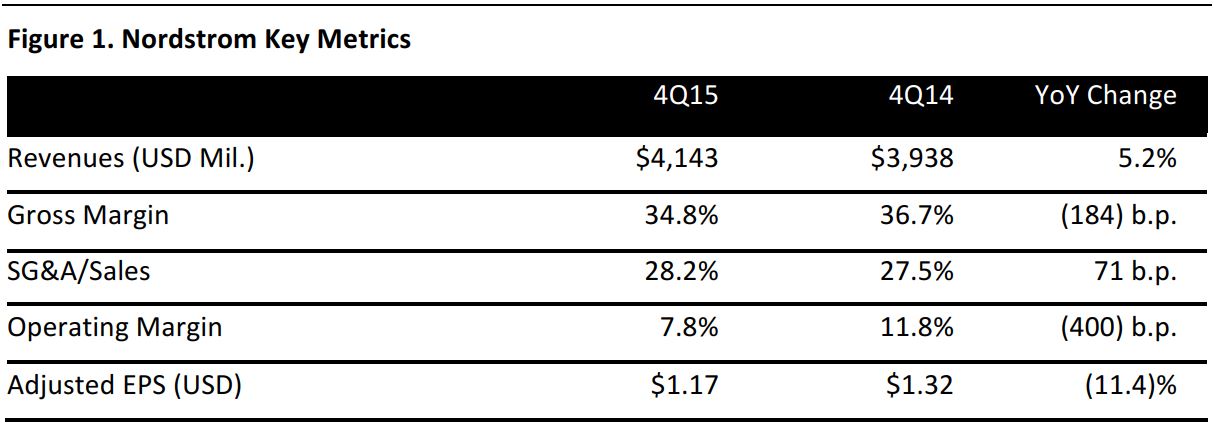

Source: Company reports

Nordstrom reported 4Q15 EPS of $1.17, excluding items, versus the consensus estimate of $1.22.

Total revenues were $4.19 billion versus consensus of $4.22 billion. Comps were up 1.0% versus consensus of 0.6%. Full-line comps were down 3.2%, while Nordstrom.com was up 11%, Nordstrom Rack down 3.0% and Nordstromrack.com/HauteLookup 50%. Top-performing categories included beauty and shoes. In women’s apparel, coats, younger-customer-focused departments, denim, and dresses continued to reflect strength. The Midwest and West were the top-performing geographic regions for the full-price business.

The company ended the period with inventories of $1.95 billion, up 12% year over year versus a 5% increase in sales during the quarter.

Full-year 2016 guidance calls for EPS of $3.10–$3.35 versus consensus of $3.54. Net sales are expected to be up 3.5%–5.5% based on comps that are expected to be flat–2%. Retail EBIT is expected to increase by 3%–10% and credit EBIT is expected to be $70–$80 million. In the first half of the year, EPS is expected to decline by 30% due to three factors: the impact of the sale of credit receivables in October 2015; the impact of growth initiatives, including an East Coast fulfillment center that opened in August 2015, and related new store pre-opening expenses; and a shift of the Anniversary Sale from the second quarter in 2015 to the second and third quarters in 2016.