Source: Company reports/Coresight Research

3Q18 Results

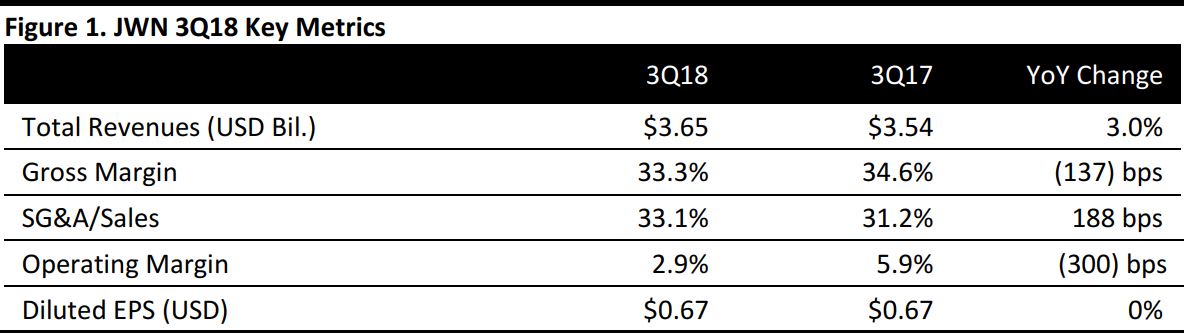

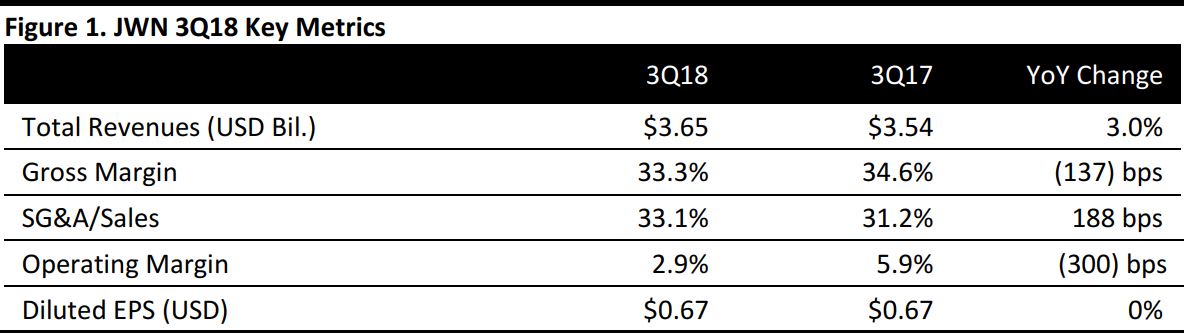

Nordstrom reported 3Q18 revenues of $3.65 billion, up 3.0% year over year and below the consensus estimate of $3.7 billion. Diluted EPS was $0.67, flat compared to the year-ago quarter and $0.01 above the consensus estimate of $0.66. The diluted EPS reflected a non-recurring estimated credit-related charge of $0.28.

Comparable sales increased 2.3% in the quarter compared with the year-ago quarter and above the consensus estimate of 2.2%. By category, full price increased by 0.4% compared to the consensus estimate of 1.6% and off price increased by 5.8% compared to the consensus estimate of 2.5%.

Nordstrom.com celebrated its 20

th anniversary in October 2018, and the company reported that its online business has grown to over 2.5 million visitors per day, ranking it one of the top e-commerce retailers in the United States. Digital sales as a percent of total net sales were 26% compared to 23% in the year ago period. Digital sales include online sales and digitally assisted store sales which include Buy Online, Pickup In Store (BOPIS), Reserve Online, Try on in Store (Store Reserve) and Style Board, a digital selling tool.

The company reported it is scaling investments in digital businesses and new markets; Nordstromrack.com and HauteLook are on track to exceed $1 billion sales this year. Nordstrom Rack has both brick and mortar stores and an e-commerce website, and offers offers branded clothing and accessories for women, men, and kids at a large discount to consumers. HauteLook is a member-only shopping website offering flash-sales and limited-time sale events featuring women's and men's fashion, jewelry and accessories, beauty products, kid's clothing and toys, and home décor. HauteLook offers discounts of 50 to 75 percent off retail prices with new sale events every morning.

Blake Nordstrom, Co-President, said that Trunk Club, a fully owned subsidiary of Nordstrom, has delivered sales growth of nearly 50% year-to-date. Trunk Club is a personalized mid-to high-end men's and women's clothing service where customers work with a specialist who chooses clothing for their box and it is shipped to their home; customers can purchase the clothes outright or send them back to Trunk Club. Blake Nordstrom reported that the women’s Trunk Club business is strong and that consumers are responding to the service. He said “We think this business represents tremendous growth and value for Nordstrom. We see in the near-term line of sight, $500 million, but long term, we think it has lots of ways to, again, service to customers and contribute.”

The company reported that its supply chain investments give it the potential to increase the number of products available same or next day by 4 to 7 times. For example, to support customers on the West Coast, the company announced it will open a new fulfillment center and a local omnichannel hub next year. The facilities are expected to enhance efficiency and improve the customer experience by getting products to them faster.

Nordstrom reported there are more than 11 million loyalty customers, contributing 56% of year-to-date sales, compared to the year ago quarter of 10 million active loyalty customers, contributing to 50% of sales, representing an increase of 10% in loyalty members.

Nordstrom ended the third quarter with 380 total stores compared to 366 stores in the quarter last year. The company currently operates 134 full-price stores and 246 off-price stores.

Outlook

Nordstrom raised its full-year earnings guidance per share and now expects adjusted EPS of $3.55–$3.65, compared to the consensus estimate of $3.61, and up from the previous guidance of $3.50–$3.65. For the full year, the company expects total net sales to be $15.5–$15.6 billion, an increase from prior guidance of $15.4–$15.5 billion. The consensus estimate is $15.91 billion. Comparable sales are expected to rise by 2%, up from the prior guidance of a 1.5%–2.0% increase.