Source: Company reports/FGRT

3Q17 Results

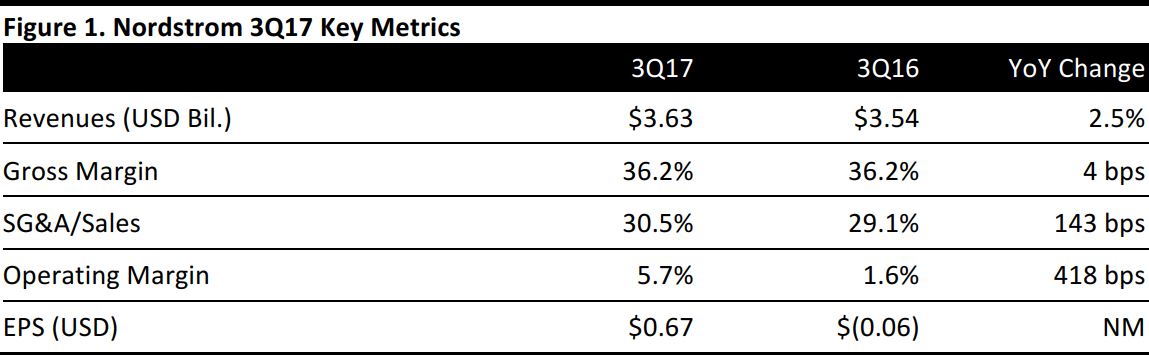

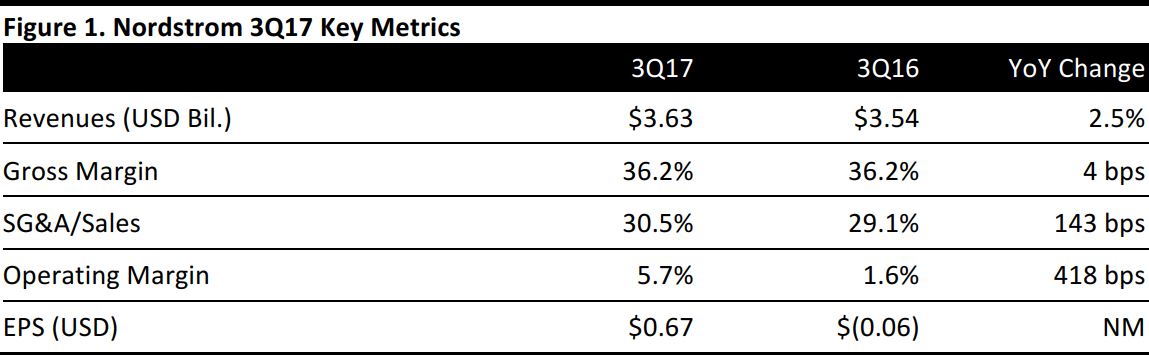

Nordstrom reported 3Q17 revenues of $3.63 billion, up 2.5% year over year and slightly above the $3.58 billion consensus estimate. The hurricanes in Texas, Florida and Puerto Rico reduced sales by $20 million, or 60 basis points, and reduced EPS by $0.04.

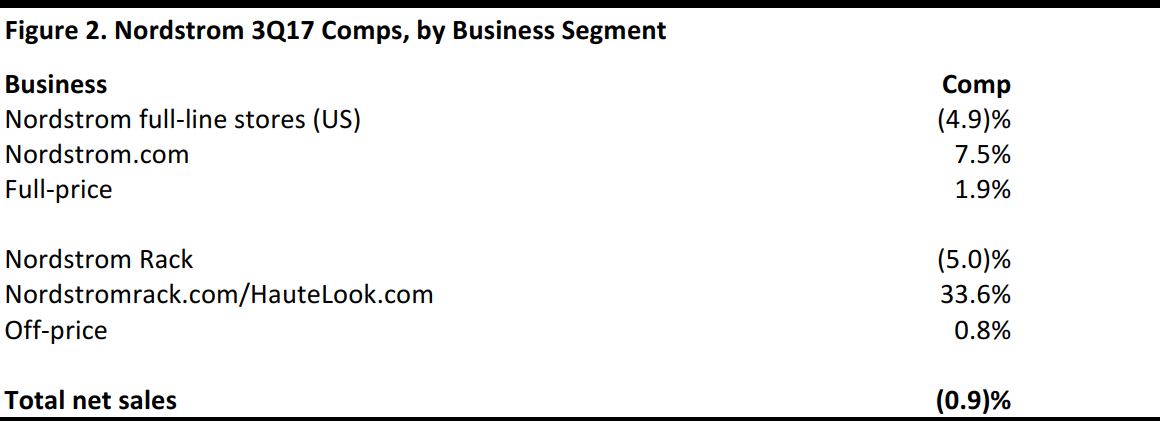

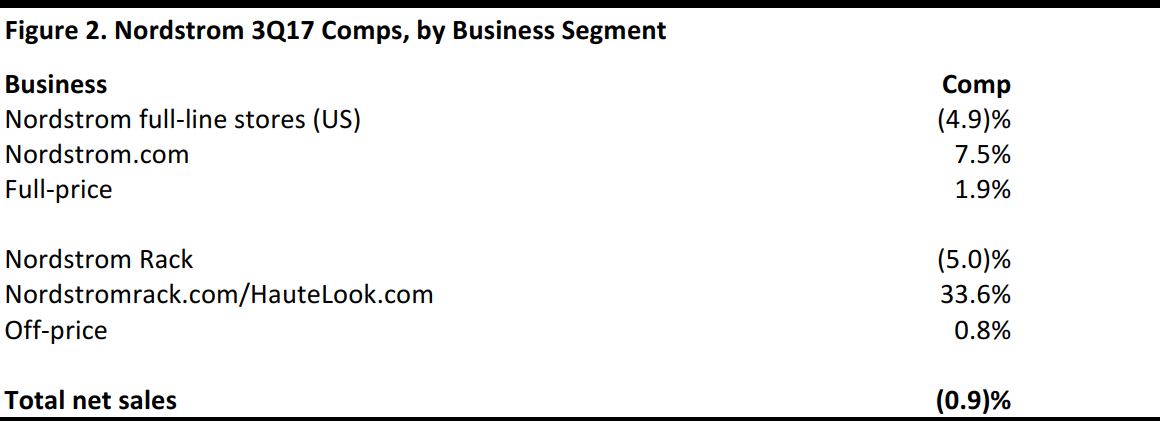

Comps declined by 0.9%, missing the consensus estimate of a 0.3% decline. The table below shows comps by business segment.

Source: Company reports

The company saw a year-over-year increase in SG&A that primarily reflected higher technology and supply chain expenses associated with growth initiatives. The GAAP operating margin included a $197 million goodwill impairment posted in the year-ago quarter.

EPS was $0.67, ahead of the $0.63 consensus estimate and compared with a loss of $0.06 in the year-ago period.

Details from the Quarter

- The company launched Nordstrom Local, its latest retail concept, which enables customers to shop and access services in a convenient, central location.

- Online sales growth year to date is 14% at Nordstrom.com and 26% at Nordstromrack.com/HauteLook.com.

- Nordstrom’s proprietary labels continued to outperform the company average.

- The company had 9.9 million active Nordstrom Rewards customers in the US and Canada, up 39%, from 7.1 million in the year-ago quarter. Sales from Nordstrom Rewards customers represented 51% of quarterly sales, compared with 45% in 3Q16.

- Nordstrom relocated two full-line stores in Southern California and opened one new full-line store in Toronto, Canada. The company also relocated one Nordstrom Rack store and opened 11 new ones.

Year to date, Nordstrom has opened 19 stores, relocated three stores and closed two stores.

Outlook

Nordstrom updated its FY17 guidance. The company now expects:

- Net sales growth of 4% (unchanged from previous guidance).

- Comparable sales to be flat (unchanged).

- Retail EBIT of $755–$785 million, down from $790–$840 million previously.

- Credit EBIT of $165 million, up from $145 million previously.

- EPS of $2.85–$2.95, narrowed downward from $2.85–$3.00 previously.